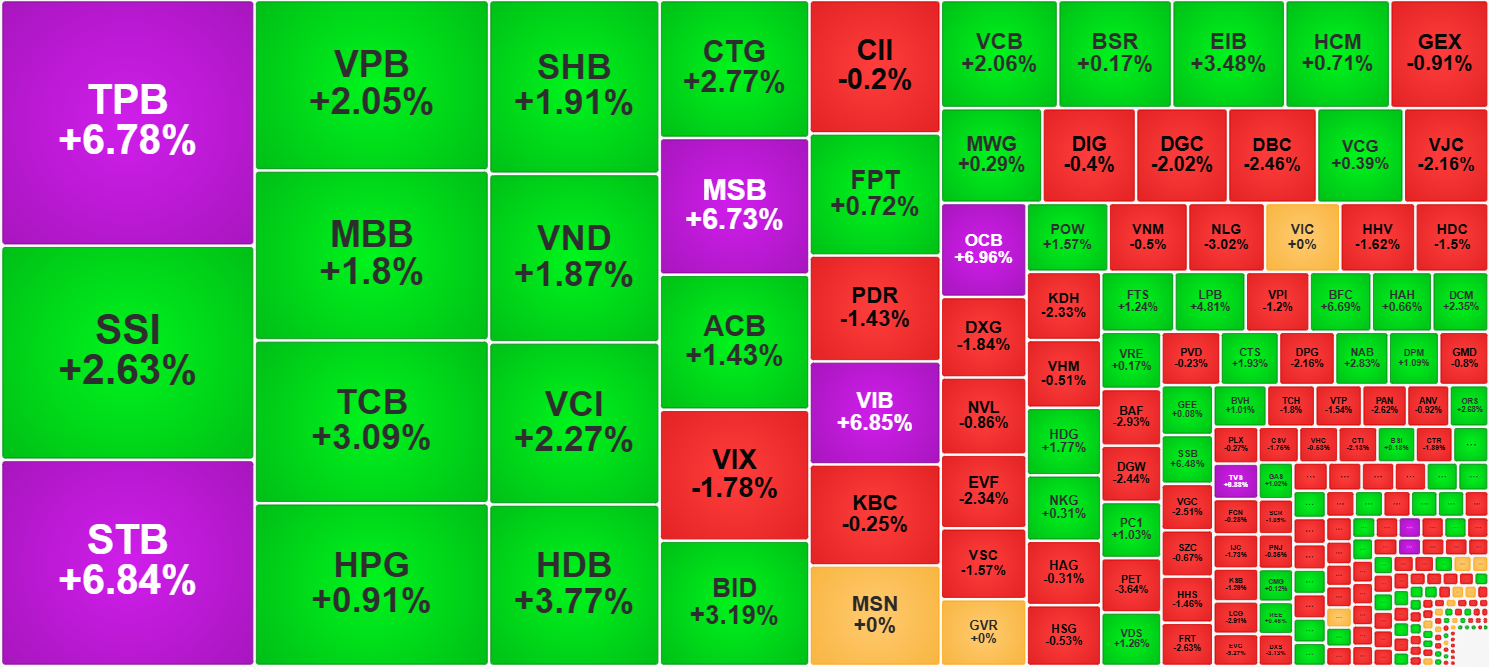

The market continues to weaken in most stocks, but the VN-Index rises strongly. The banking stock group's explosion today is an absolute guarantee of points despite VIC and VHM weakening. The 10 stocks that pulled the index most strongly are all banks, bringing in 16.2 points out of the VN-Index's total increase of 18.86 points.

All 27 banking stocks on the exchanges increased, with the lowest being ACB at +1.43%. Up to 24 stocks in this group increased by over 2%, with 5 stocks hitting the ceiling price: OCB, STB, TPB, VIB, and MSB.

In the blue-chips banking group, HDB increased by 3.77%, BID by 3.19%, TCB by 3.09%, CTG by 2.77%, VCB by 2.06%, and VPB by 2.05%. All 6 stocks among the top 10 capital stocks of the VN-Index increased very strongly (including MBB increasing by 1.8%). Therefore, VIC's reference and VHM's 0.51% decrease hardly had any significant impact.

Regarding liquidation, the banking group on the HoSE exchange accounted for up to 43.3% of the total matching order value of the exchange, which is a record-high proportion. Even during the recent "super liquidation" sessions, banks only accounted for over 30%. The banking group in the VN30 basket even accounted for 65.4% of the basket's transactions. TPB, STB, VPB, and MBB are the 4 banking stocks that matched orders exceeding the billion-dong threshold.

Along with the banking group, securities stocks were also extremely impressive this morning. Over 20 stocks in this group increased by more than 1%, with AAS, VUA, and TVS hitting the ceiling price. Large stocks in the group were also very strong: SSI increased by 2.63%, VCI by 2.27%. In terms of liquidation, SSI also entered the billion-dong trading group and ranked second in the market after TPB.

In the top 20 largest trading stocks this morning, 26 stocks belonged to the banking and securities groups. Except for VIX, which decreased by 1.78%, all the rest increased very well. The VNFin index on the HoSE exchange, which gathers stocks from these two groups, closed the morning session with a 3.11% increase, significantly outperforming other sector indices. Out of the 41 stocks in this basket, only 5 were red (DSC, EVF, VIX, DSE, BMI), but 30 stocks increased by more than 1%. The total liquidation of the VNFin group accounted for 60.3% of the HoSE exchange.

Despite strong liquidation support from banking and securities stocks, the matching order value of the HoSE exchange this morning still dropped sharply by 40% compared to yesterday morning. Transactions in the VN30 basket also decreased by about 35%. This means that cash flow has contracted in many stocks outside these two groups.

The rest of the market was not positive either. Although the VN-Index closed the morning session with a 1.13% increase, the breadth was only 119 stocks rising/194 stocks declining. Among the rising stocks, apart from banking and securities stocks, not many were truly strong. POW increased by 1.57% with a liquidation of 143.4 billion; HDG increased by 1.77% with 127.7 billion, BFC increased by 6.69% with 94.3 billion; DCM increased by 2.35% with 87.2 billion; PC1 increased by 1.03% with 85.8 billion; DPM increased by 1.09% with 68.2 billion were the most notable.

Conversely, the number of declining stocks continued to show selling pressure similar to yesterday's session. Among the 194 red stocks, up to 100 stocks decreased by more than 1%. The good point is that most of these stocks were midcap or penny stocks with not too large liquidation. Only 12 of these stocks traded over a hundred billion dong. Besides VIX, there were PDR, DGC, DBC, VJC, DXG, EVF, VSC, NLG, HHV, HDC, KDH. Overall, real estate stocks made up a significant portion. The total transaction of the 100 worst-performing stocks only accounted for 15.5% of the total HoSE exchange liquidation.

However, the large number of declining stocks and deep declines indicate investment portfolio damage risks emerging on a broad scale. The strong pull of the financial group without creating a positive spreading influence shows that sentiment is strongly differentiated. Although the VN-Index was pushed higher, investors are still acting individually based on specific stocks.

Foreign investors also significantly reduced buying this morning, pushing up the net selling scale. Specifically, this group only disbursed 1,922.8 billion dong on the HoSE exchange, a 49% decrease compared to yesterday morning, while sales decreased by about 34%, resulting in a net selling amount of 1,140 billion dong. Considering HNX and UpCOM together, the total net selling value for the morning session across the market reached 1,233 billion dong.

Notable stocks with net selling were VPB -4,212 billion, CTG -115.6 billion, HPG -113.8 billion, GEX -84.4 billion, VIX -79.9 billion, KBC -65.9 billion, VNM -54.8 billion. Net buying stocks included SSI +213.5 billion, VND +53.4 billion, BID +54.1 billion, VCI +45.2 billion, HDB +44.8 billion, MSB +41.8 billion.