Prologue: Hunting Grounds

The darkness before dawn is always the purest hunting ground.

On August 27, 2025, at 5:50 AM, while most crypto traders were still asleep, a carefully orchestrated "hunt" quietly unfolded on the decentralized derivatives platform Hyperliquid. The prey were hedgers who naively believed that "1x leverage" equaled "absolute safety." The hunters were two long-lurking, mysterious addresses poised to leverage over $15 million in capital to unleash a perfect storm worth $27.5 million.

This wasn't an unpredictable "Black Swan" incident, but rather an extreme exploitation of systemic rules. It was a bloody lesson about trust and risk, written with real money in the digital wilderness.

Chapter 1: Five-Minute Storm

The attack signal didn't come out of nowhere. Like an experienced beast, the hunters had quietly entered the "hunting ground" called Hyperliquid two days ago.

The protagonists are two addresses with clear division of labor: 0xe417..., which we call the "lurker"; and 0xb9c..., which we call the "blaster".

Starting on August 24th, the "lurker" began its operations. Like a patient angler, within three days, at an average price of $0.56, it quietly amassed a long position in XPL worth $9.5 million, totaling 21.1 million tokens. Its actions were gentle and stealthy, designed to avoid disturbing the surface and lay the groundwork for its eventual reel.

Meanwhile, the "Demolition Man" was preparing ammunition for the impending thunderbolt. Over $15.9 million in USDC flowed silently through the Arbitrum network into his Hyperliquid account, like streams.

Everything is ready.

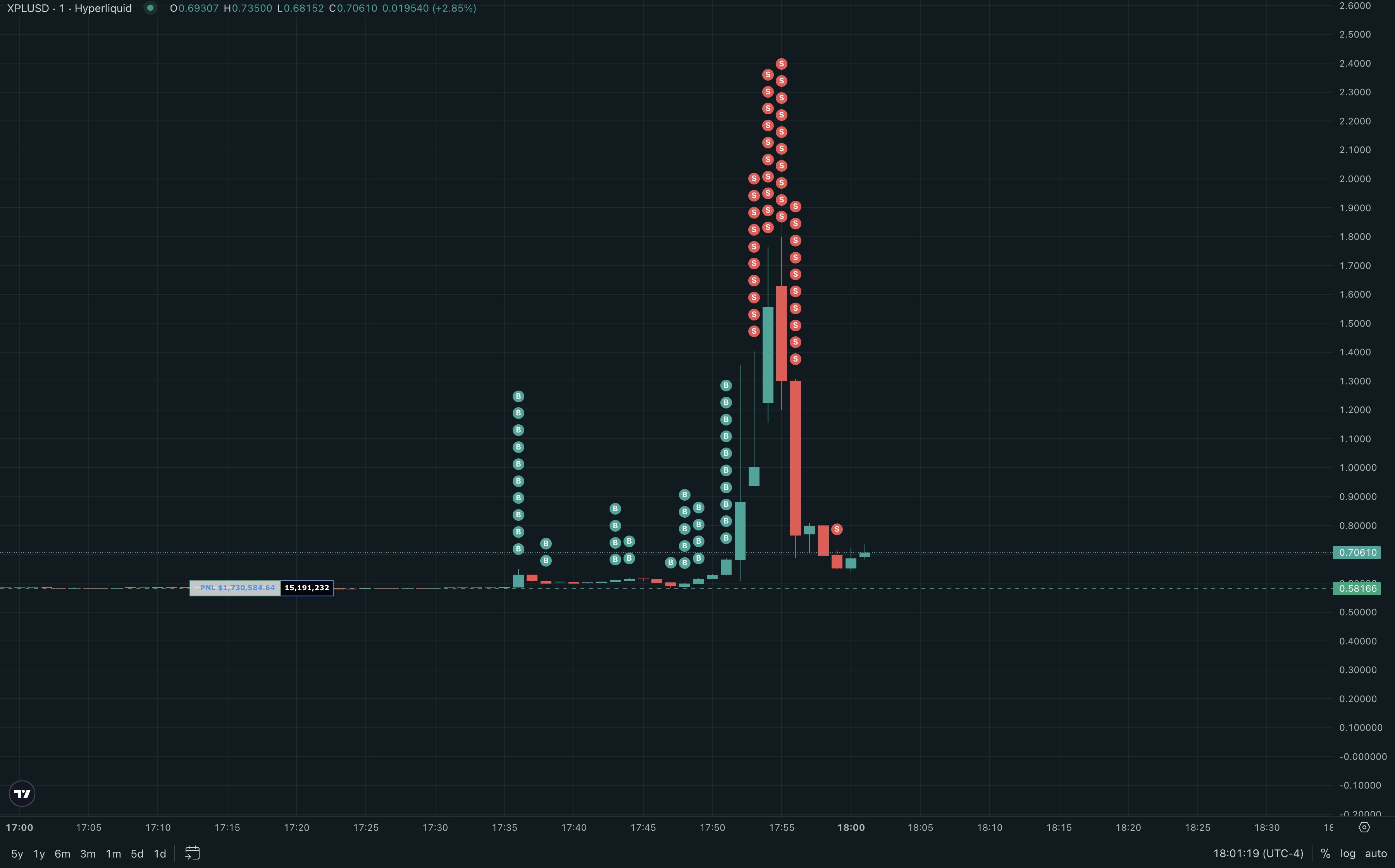

At 5:50 AM, when the market was at its quietest and liquidity was at its thinnest, the "fuse" of the attack was lit. The "Demoman" launched a full-scale assault. A series of massive market buy orders, like a heavily armored force, instantly overwhelmed the thin defenses of the XPL/USD order book. On the screen, the XPL price chart, like a wild beast awakened, broke free from all technical indicators and tore upward at an incredible vertical angle.

$0.6... $0.9... $1.5... and reached a high of $1.8.

This wasn't the market's natural breathing; it was a precise, efficient, and ruthless "targeted blast." The price surge was merely a means to an end; the real goal was to trigger a "digital avalanche." As prices broke through one round number after another, those 1x short hedge positions, considered "safe havens," saw their liquidation levels instantly pierced.

The system began automatically executing liquidations. However, liquidating short positions involved submitting market buy orders. This involuntary, system-generated torrent of buy orders, like the first boulder rolling down a hillside, triggered the roar and collapse of the entire mountain. More shorts were liquidated, more buy orders were passively generated, and prices were driven to even more insane heights.

A deadly "liquidation spiral" unfolded. In a matter of minutes, $17.67 million worth of short positions were reduced to ashes in the flames. At the height of the chaos, the hunters began to reap the rewards. The buying frenzy they had engineered served as the perfect cover for their exit. The "lurkers" closed their positions at an average price of approximately $1.15, generating a profit of $12.5 million. The "exploders" pocketed $16 million.

Five minutes, $27.5 million. After the attack, they left in style, leaving behind a devastated battlefield.

Chapter 2: Weaponized Rules

This perfect ambush didn't exploit a bug in the code, but rather the very rules themselves. The hunters found the perfect weapon: Hyperliquid's unique oracle mechanism, called "Hyperp," designed for pre-launch tokens.

In a typical derivatives market, contract prices are anchored to an external, fair spot price. But what happens when there's no spot market for pre-launch tokens like XPL? Hyperp's design is that its oracle price doesn't rely on any external data source, but rather on the exponentially weighted moving average (EWMA) of its own markdown price over the past eight hours.

This is equivalent to a thermometer in a closed room showing a "standard temperature" based on its own readings over the past eight hours. This self-referential design creates a fatal positive feedback loop when faced with an attacker with sufficient capital.

The logic of the attack is simple and elegant:

- Impacting the mark price : "Bombers" use huge amounts of money to violently raise the real-time price of the contract.

- Historical pollution data : This new, artificially inflated price is input into the EWMA calculation formula as the latest data point.

- Dragging the Oracle Price : Due to the nature of the EWMA, this internal “Oracle Price” (i.e., the 8-hour average price) begins to slowly but surely move upwards.

- Creating a price deviation and triggering liquidations : The attacker created a large price deviation—the spot price was significantly higher than the slow-moving oracle price. This deviation caused short positions to lose value drastically, triggering the fatal liquidation avalanche.

The hunters did not cheat the system; they simply used overwhelming force to make the system "believe" the price they wanted. This weapon is hidden in the instruction manual of the agreement, waiting for the first person who understands it and has the ability to pull the trigger.

Chapter 3: The Illusion of a Safe Hedge

The most devastating characters in this storm are undoubtedly the "1x leverage hedgers" who were liquidated. They thought they had found a "safety rope" to hedge their risks, but they didn't know that the rope was tied to a house of cards.

Their fundamental fallacy lies in applying the hedging logic of mature markets to an isolated "island market." A true hedging tool must have a strong convergence mechanism with the spot price of the hedged asset, which is usually an arbitrage mechanism .

However, the XPL market on Hyperliquid is a de facto “island.” It does not track any external spot price, so its price does not reflect the “fair” value of XPL, but only reflects the balance of forces between bulls and bears on the Hyperliquid platform.

Therefore, short XPL contracts by 1x isn't actually a hedge against the future value of XPL tokens, but rather a speculative short buy pressure on the Hyperliquid platform . When an attacker with overwhelming capital advantage creates buy pressure, this "hedging" strategy inevitably fails. Cbb0fe, the user who angrily exited the platform after losing $2.5 million, experienced this the hard way.

Chapter 4: Silent Night Watchman

What is most thought-provoking is that in the face of this blatant hunt, Hyperliquid's governance - the "night watchmen" who are supposed to maintain market order - chose to remain completely silent.

This wasn’t their first encounter with market manipulation. Just a few months ago, in another “JELLYJELLY” incident, when attackers targeted the platform’s own liquidity vault (HLP), threatening the very existence of the “casino” itself, the “night watchmen” decisively “pulled the plug” – they paused the market, forced liquidations, and retroactively modified settlement prices, depriving the attackers of their profits.

That time, they were forceful interveners, but this time, when the victims were ordinary users on the platform, they became indifferent bystanders.

The platform's inaction in the XPL incident appears to have been interpreted by the attacker as tacit approval. Approximately half an hour after the XPL incident (6:25-6:30 UTC+8), the same short squeeze strategy was attempted on another pre-market contract, WLFI. WLFI's price surged from approximately $0.28 to $0.43, while Binance's pre-market market remained largely unchanged during the same period. This clearly indicates that the attacker was attempting to replicate the same strategy on another contract with similar characteristics (large amounts of uncirculated tokens and short hedging).

However, this attempt didn't result in the significant cascading liquidations seen with XPL. Perhaps the XPL tragedy alerted short sellers, prompting them to reduce their risk exposure in advance; or perhaps WLFI's market liquidity structure differs from XPL's. Regardless, this failed "copycat" attack further confirmed the pattern of attacks and highlighted the lack of platform governance— the vulnerability remains, but the prey has become more vigilant.

Why did the same platform react so differently to two similar instances of market manipulation? The answer may lie in the different identities of the victims in each incident. The JELLYJELLY attack threatened the survival of the protocol itself, while the losses from the XPL attack were primarily borne by users.

This kind of selective enforcement is even more chilling than the attack itself. It shatters the market's illusion of a fair, neutral platform and reveals the looming specter of centralized power behind the so-called "decentralization." The platform's threshold for intervention appears to be based on its own financial risk, rather than on general market fairness.

Chapter 5: Investor's Survival Rules

While it's unrealistic for the average investor to completely avoid all risks, they can identify and avoid these "traps" through more prudent pre-investment due diligence. The key is not just analyzing the asset itself, but also the "market microstructure" in which it exists . Before entering any DeFi derivatives market, at least three reconnaissance steps must be completed:

- Identify "Isolated Markets" : Before trading a derivative, ask yourself: What is its price anchored to? XPL and WLFI are both typical "islands" on Hyperliquid. Their prices reflect only the internal market dynamics of long and short positions within the platform, with no external spot market to arbitrage and correct their prices. For such isolated markets, any so-called "hedging" strategy is a false proposition, as you're not hedging the fair value of the asset, but rather a gamble with the funds of all counterparties on the platform.

- Examine oracle mechanisms : These are the core of DeFi derivatives. Be wary of self-referential oracles. Mechanisms like Hyperp, where prices are determined by their own historical prices, are like using past temperatures to define the current standard temperature in a closed room. This makes it susceptible to manipulation by large capital. A healthy oracle must rely on multiple, independent, and in-depth external data sources (e.g., Chainlink aggregates spot prices from multiple major exchanges).

- Find the platform's "safety cushion" : A responsible platform will set clear risk parameters for low-liquidity, high-risk assets. Investors should proactively find and confirm:

- Are there any open interest caps? This can fundamentally limit the amount of risk that can be accumulated in a single market.

- Are there any position limits for individual accounts? This can prevent whale from controlling the market.

- Is the liquidation mechanism smooth? Is it a one-time market crash (which can easily lead to a chain reaction of liquidations) or is it handled smoothly through methods such as TWAP/VWAP (time/volume weighted average price)?

If a platform does not set up any of the above risk control measures for a brand new asset without an external price anchor, then for ordinary investors, it is not a fair casino, but a carefully designed "hunting ground".

Epilogue: The Path to a Resilient Market

The Hyperliquid XPL incident should ultimately be characterized as a foreseeable exploitation of a flawed market design. It served as a stress test, and the Hyperp mechanism failed miserably. However, the costly "tuition" of this incident must be transformed into a stepping stone towards a more robust protocol.

The loopholes in platform rules are entirely possible to fix, and the technical complexity is not significant. This exposes not unsolvable technical challenges, but rather the trade-offs platforms must make between pursuing trading volume and attention-grabbing strategies and managing risk . The future development of DeFi requires combining cutting-edge financial innovation with a sophisticated risk management philosophy.

Patching vulnerabilities can be done at the following levels:

- Abandoning purely internal oracles : For pre-launch tokens, a hybrid oracle can be introduced. This can integrate prices from other platforms (such as Aevo and Binance's pre-market). Even if used only as a reference, it can break the internal closed loop and provide arbitrageurs with the possibility of price correction. At the same time, an automated circuit breaker mechanism can be hard-coded into the protocol. For example, if a contract price deviates by more than 50% from its one-hour average within five minutes, trading will be automatically suspended for 15 minutes, giving the market a cooling-off period and effectively preventing the formation of a "liquidation spiral."

- Implement dynamic, on-chain risk management : This is the core improvement. Introduce position concentration margin . When an account's holdings account for an excessively high proportion of the total market, its margin requirements should increase exponentially. This will make the cost of capital for "controlling the market" extremely high, thus acting as a deterrent.

- Optimize the liquidation engine : Abandon crude market liquidation and force all large liquidations to be executed smoothly over a period of time using the TWAP/VWAP algorithm to minimize the impact on the market.

These measures are standard practices in mature financial markets and some robust DeFi protocols. Hyperliquid is not unaware of this; more likely, it selectively relaxed these safety measures to seize an early advantage in the high-risk, high-reward market of pre-launch token trading.

The future of true decentralized finance lies not in creating more unregulated casinos, but in building a resilient market that is trustless, rules-based, and has a strong immune system built in . Only in this way can it ultimately fulfill its promise of fairness to all participants.