BTC and Ethereum have been lackluster lately, with the market showing signs of stagnation . However, the altcoin market has been quite lively. SOL has once again taken the lead in the altcoin market, driving a bullish structural rally.

Follow us on WeChat: Crypto Xiao Miaoy. Last night was another historic moment—the Ministry of Commerce proactively embraced Trump's crypto strategy, putting GDP data directly on-chain! The first nine chains included: BTC, ETH, SOL, TRON, XLM, AVAX, ARB, MATIC, and OP. Regarding oracles, LINK and PYTH were officially announced. The market had long anticipated #LINK , so there was little movement. However, #PYTH doubled in value, firmly securing its spot as the "second-largest oracle." Currently, FDV is only 2.2 billion, compared to LINK's 24 billion, the gap is stark. This overt move by the Ministry of Commerce not only boosted PYTH but also essentially locked in the future of the public blockchain landscape.

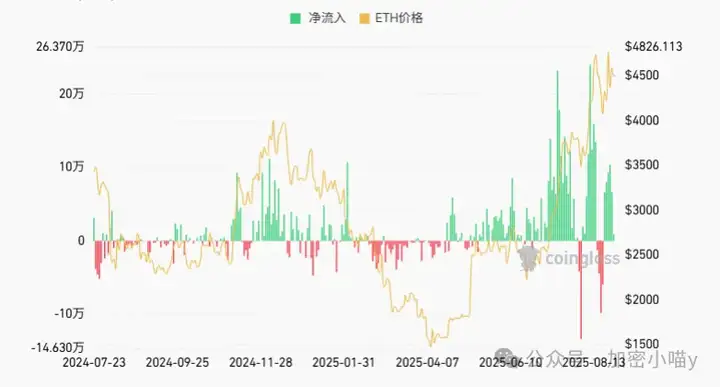

Chat + Q: 3806326575. Don't forget, his son also launched a fund, Twenty One, with plans to raise 3.9 billion yuan to invest in Bitcoin, backed by Tether, Bitfinex, and SoftBank. From this perspective, the Ministry of Commerce is giving a second shot in the arm. As long as Trump remains in office, positive news is likely to continue to emerge. Is ETH preparing a big move? Institutional buying has been frantic. ETH has been flat in recent days, but on-chain funds have continued to flow. #BMNR recently bought another 100,000 ETH, bringing its total holdings to 1.8 million, maintaining a monthly purchasing power of 300,000 for three consecutive weeks. The gap between withdrawals and new staking data is narrowing, currently at just 300,000, and is expected to reach equilibrium within a week or two. This indicates that institutions are completing their turnover, raising the overall cost of holding the token, which is a strong positive for a potential breakout above 10,000 points. The only concern is that ETF inflows plummeted to 39 million last night, an order of magnitude lower than in previous days.

Add a caption for the image, no more than 140 characters (optional). However, in the long run, it is only a matter of time before ETH is tied to the Stablecoin Act and RWA.

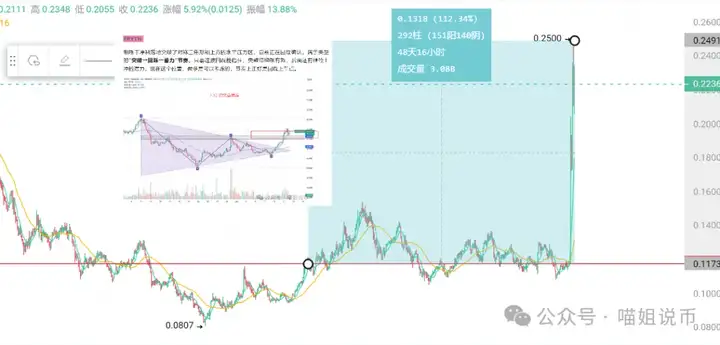

In the altcoin sector: WFLI & XPL are the leading new coins taking off

- #WFLI: Last night, it broke 0.3 again, putting it within striking distance of a token launch. I personally believe 0.3-0.4 is a reasonable range, and long-term stability above 0.4 is not a problem. The reason is simple—while USD1 doesn't have a first-mover advantage, it does have resource advantages for the next four years. The most important thing in the financial sector is a license. Considering past practices, a 40 billion FDV isn't a high figure.

- #XPL: Its growth has been even more dramatic, with BN exceeding 0.8 and FDV reaching 8 billion. With the backing of Peter Thiel, USDT, and PayUSD, this sector is poised for a strong narrative in the coming years. At this rate, it's likely to achieve TRX-like success, with a market cap of tens of billions a reasonable expectation. However, with at least a month until the TGE, there will undoubtedly be some movement, offering ample opportunities for bargain hunting, so don't rush in blindly.

The primary market remains hot:

- Creditlink IDO : attracted $80 million in one night, with 28,000 participants and FDV reaching 500 million, a definitely popular project.

- Tether & RGB : Preparing to issue stablecoins on Taproot Assets, worth paying attention to.

- Buidlpad & Lombard Finance : FDV 450 million, great potential.

- Binance Wallet MITO : TGE is approaching, the points threshold is 248 points, and Binance has obvious advantages.

A word of caution: don't blindly follow small-platform IDOs; beware of potential pitfalls. The cryptocurrency market is currently experiencing a lull in the market, with BTC taking a break, altcoins enjoying a frenzy, policy support, and capital volatility. There are still plenty of opportunities for short-term trading.

This is the end of the article! If you are still confused about the direction in the crypto, why not join me in making plans and wait for you to come, otherwise, in the next wave of market, you may be the one standing on the other side.

V: c13298103401 or Q: 3806326575