After months of controversy and waiting, WLFI finally reached its defining moment.

On August 26th, the Trump family's crypto project, WLFI, announced the launch of its Lockbox page, allowing holders to transfer their tokens and begin the unlocking process. At 8:00 AM EST on September 1st, WLFI will complete its first token release, officially releasing 20% of the initial allocation into circulation.

For this governance token, which was once stated in the white paper as "probably never tradable", this step almost symbolizes a turning point in the project narrative: from concept and voting to actual realization, WLFI is completing the transformation from "political symbol" to "tradable asset".

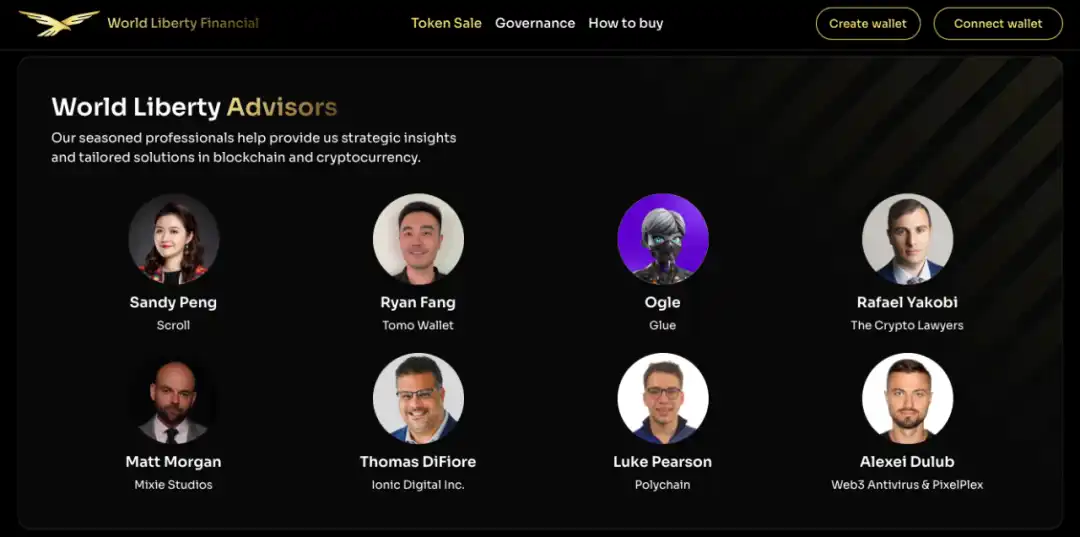

The designers behind WLFI

World Liberty Financial (WLFI) was established on September 16 last year and was guided by real estate tycoon Steve Witkoff and his son Zach. Co-founders also include crypto KOL Chase Herro and Zak Folkman.

The Trump family also features prominently, with Trump listed as the "Chief Cryptocurrency Advocate" and his sons Eric, Donald Jr., and Barron as "Web3 Ambassadors."

In addition, WLFI has three technical leaders.

1. Rich Teo: Head of Stablecoins and Payments. He previously founded the itBit exchange and the stablecoin company Paxos, and currently serves as CEO of Paxos Asia. Rich also serves as an advisor to SocialFi's project, Republic.

2. Corey Caplan: Head of technical strategy, co-founder of DeFi platform Dolomite, responsible for integrating lending and trading functions.

3. Bogdan Purnavel: Lead developer, formerly the developer of Dough Finance.

One of World Liberty Financial's first moves was to sell its own tokens. The ICO began on October 15, 2024, selling 20 billion $WLFI at a price of $0.015, earning the company approximately $300 million.

On January 20, 2025, the day of Trump's inauguration, WLFI announced a second token sale, citing "huge demand and strong interest." An additional 5 billion tokens were issued at a price of $0.05, a 230% increase from the initial sale. The second sale was completed nearly two months later, on March 14, having raised its full $250 million goal.

According to WLFI's "Gold Paper," WLFI tokens will grant holders voting rights on important matters affecting the protocol, such as upgrades. The expected token distribution includes 33.893% through the token sale, 32.6% for incentives and community development, 30% for "initial supporters," and 3.5% for "core team and advisors."

The project white paper also states, "$WLFI tokens will be issued to raise funds to purchase tokens of mainstream projects with growth potential. $WLFI token holders will share in the appreciation of the asset portfolio." The white paper explicitly states that the $WLFI users purchase is only a governance token, and that the $550 million already belongs to the project.

However, the Trump family's repeated crypto investments seem to indicate that WLFI will be more than just a non-transferable token for identity verification. Now, with the opening of the Lockbox feature, WLFI's token issuance process has officially entered the "cash-out phase," with the previously sold 55 billion tokens set to be gradually released under the community governance framework.

What is the valuation of WLFI token?

On August 23rd, WLFI announced its initial unlocking rules, stating that only the token shares of early pre-sale users will be unlocked upon the initial launch of WLFI. Specifically, 20% of the WLFI purchased by each address in the $0.015 and $0.05 rounds will be unlocked, while the unlocking schedule for the remaining 80% will be determined by the community through a governance vote. The token shares of founders, team members, advisors, and partners remain locked and will not be included in the initial unlocking.

The market generally believes that the launch of WLFI's circulation marks a potential moment of "price repricing." The initial 20% unlocking and release is both a test of investor attention and a potential turning point in whether WLFI's market capitalization can reach a higher range.

Based on the first round of financing valuation of US$1.5 billion (corresponding to US$0.015 per coin) and the second round valuation of US$5 billion (US$0.05 per coin), the current over-the-counter price of US$0.24 means that WLFI's valuation has increased more than 16 times in the past 8 months.

From a horizontal comparison, the market generally views WLFI as a heavyweight project that rivals the Trump Token. The latter reached a market capitalization of $80 billion in its early days, while WLFI's current preliminary market capitalization forecast is close to $30 billion, leaving the market with considerable room for speculation.

Which big investors bought it?

According to a joint disclosure by Accountable.US and Bloomberg, among the top 50 WLFI addresses, at least 14 users hold coins through trading platforms restricted by the United States, holding a total of more than 6.7 billion WLFI tokens (market value of approximately US$335 million), and the most eye-catching coin holder is undoubtedly Justin Sun.

In November 2024, Justin Sun's TRON DAO became the largest independent investor in World Liberty Financial (WLFI), subscribing to 3 billion WLFI tokens for $30 million. According to sources familiar with the matter, the transaction price was significantly lower than the market's expected offering price of $0.015 at the time, with the actual transaction price reaching $0.01. This meant that Justin Sun invested at a discount of approximately 64%. This price not only earned him an early investment bonus but also established his core position in the WLFI project.

Subsequently, WLFI officially announced on November 27, 2024 that Justin Sun had joined the project as an advisor, but there was no introduction of Justin on the WLFI official website.

Aqua1 Fund

However, a new fund recently dethroned Sun Ge from the top spot. On June 26th, Web3 native fund Aqua 1 announced a strategic purchase of $100 million in WLFI, the governance token of World Liberty Financial, the Trump family's crypto project. The purchase aims to participate in the governance of the decentralized financial platform and accelerate the development of the blockchain financial ecosystem. According to on-chain information, Aqua 1 Fund holds 800,000,000 WLFI.

In addition, Aqua 1 also plans to establish Aqua Fund in the Middle East and jointly incubate the RWA tokenization platform BlockRock with WLFI.

DWF Labs

In April 2025, Abu Dhabi crypto investment and market making agency DWF Labs announced that it had spent $25 million to purchase tokens issued by World Liberty Financial (WLFI), a crypto project controlled by the Trump family.

Mike Dudas

Mike Dudas, founder of 6th Man Ventures and The Block, purchased more than $145,000 worth of WLFI tokens on the eve of Trump's inauguration on January 20, 2025. That's approximately 970,000 WLFI tokens.

Troy Murray

BarnBridge DAO member Troy Murray purchased approximately 666,000 WLFI tokens.

Sigil Fund (alias Fiskantes)

The Gibraltar-based fund’s chief investment officer, known only as “Fiskantes,” spent 40 Ethereum (approximately $130,000) to purchase WLFI tokens, which, based on the WLFI IPO price, translates to approximately 400,000 WLFI tokens.

From an untradable governance token to a lockbox-unlocked asset circulation; from a "presidential ambassador" to on-chain holdings; from a stablecoin financing tool to an international investment matching platform, WLFI presents an unusual narrative: the convergence of political and capital forces through cryptocurrency. The initial unlock on September 1st will mark the starting point for WLFI's entry into the real market, and a critical moment to test whether the triple narrative of "politics, finance, and cryptocurrencies" can be fulfilled.

Click here to learn about BlockBeats' BlockBeats job openings

Welcome to join the BlockBeats official community:

Telegram group: https://t.me/theblockbeats

Telegram group: https://t.me/BlockBeats_App

Official Twitter account: https://twitter.com/BlockBeatsAsia