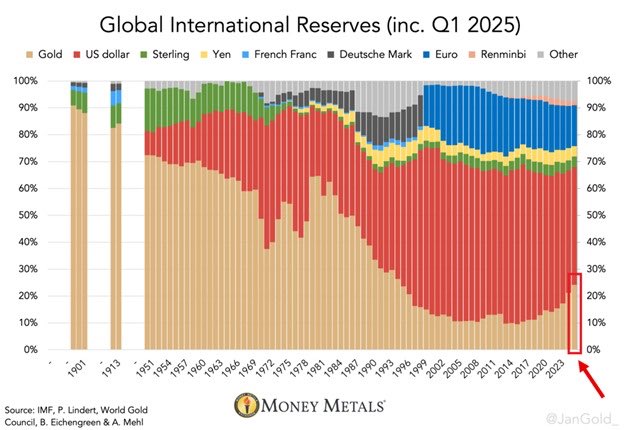

The dollar is losing reserve currency status. It’s down to 42% of global reserves, and gold is rapidly rising.

Digital gold is becoming the reserve currency of the individual.

Gold is returning as the reserve currency of the state.

Original post below.

The Kobeissi Letter

@KobeissiLetter

09-01

Gold is replacing fiat currencies as a reserve currency:

Gold's share of global international reserves rose 3 percentage points in Q1 2025, to 24%, the highest in 30 years.

This marks the 3rd consecutive annual increase.

Meanwhile, the US Dollar's share declined ~2 percentage

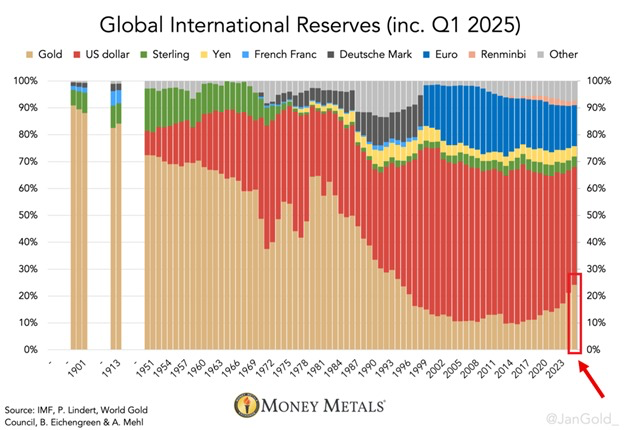

Recall the Fed admitted that a “small number” of countries were switching to gold.

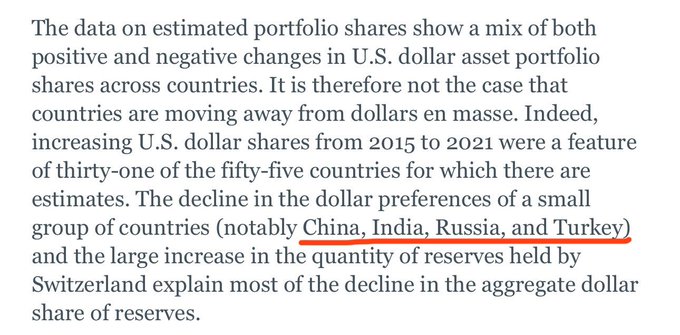

But that small number actually included Russia, India, and China: the RIC of BRICS.

Balaji

@balajis

05-30

The Fed now admits some countries are moving to gold. But says it’s a small group.

🇨🇳 China: 1.4B

🇮🇳 India: 1.4B

🇷🇺 Russia: 144M

🇹🇷 Turkey: 85M

That “small group” represents 3B people. So 37.5% of the world is moving away from dollars towards gold. x.com/NewYorkFed/sta…

But why are gold prices rising? Because BRICS is stacking gold bricks, and the Russian sanctions eroded the store-of-value function of the dollar.

And why did the Fed hike rates and devalue Treasuries? Because inflation was eroding the purchasing power of the dollar.

Daniel Di Martino

@DanielDiMartino

09-01

This is just the mechanical effect of rising gold prices and reduced US treasury value amid higher interest rates... not that gold holdings and treasury holdings changed much

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content