This article is machine translated

Show original

Does a rate cut necessarily mean an immediate flood of money and a surge in prices?

History has already provided the answer: not necessarily.

The current timing is actually very similar to 2019, when the market also pre-priced in the expected rate cut.

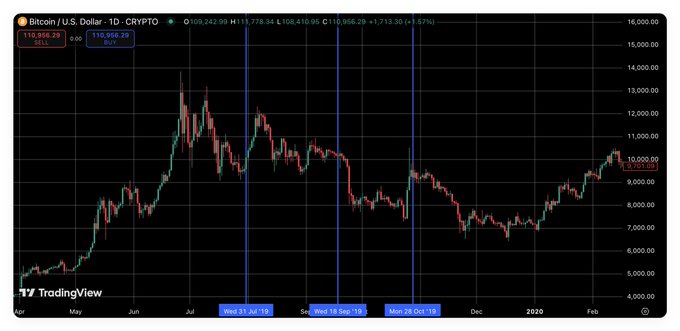

In 2019, the Federal Reserve cut interest rates three times:

- July 31: 25 basis points, the first rate cut since the 2008 financial crisis.

- September 18: Another 25 basis points cut.

- October 30: A third 25 basis points cut.

As the saying goes, good news begets bad news. After three rate cuts, BTC experienced short-term declines twice.

Now, at a similar point again, with BTC trading above the daily MA120, the bull-bear boundary, it's time to be more vigilant and reduce risk exposure, rather than blindly optimism.

Interest rates themselves are a tool with a time lag. In comparison, QE is actually more straightforward.

Yes, Brother Feng, you're the expert on this.

Actually, I didn't post anything today 😂 Rub it out in five minutes and it'll be all wet.

Yes, great teacher 😋

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share