The deal could be a springboard for Sonic to penetrate deeper into the US market.

Sonic Labs invests $40 million in SonicStrategy, aiming to expand to the US. Photo: Blockworks

Sonic Labs invests $40 million in SonicStrategy, aiming to expand to the US. Photo: Blockworks

Spetz (SPTZ) , operating under the name SonicStrategy , has just announced receiving a $40 million transformational funding from Sonic Labs , the organization that operates the blockchain of the same name.

SonicStrategy Secures $40 Million USD ($55M CAD) Investment From @SonicLabs $S

— SonicStrategy (CSE: $SPTZ | OTC: $DBKSF) (@sonic_strategy) September 2, 2025

"We view SonicStrategy as the natural bridge between the Sonic Network and traditional finance," said @michaelfkong , CEO of Sonic Labs.

🇺🇸$DBKSF 🇨🇦 $SPTZ https://t.co/85fC2OFm9i

Why is this news important?

- The $40 million deal between Sonic Labs and SonicStrategy is not just a simple Capital injection, but a strategic move that opens the door for Sonic to enter the US market . The special terms allow for conversion into common stock on Nasdaq if SonicStrategy raises additional Capital, which is clearly a "reservation" step for its ambition to list in the US.

- More importantly, Sonic does not hide its ambition to build an institutional-grade infrastructure to become a bridge between blockchain and traditional finance . The $150 million expansion plan (99.99% community support) includes launching an ETF, pursuing PIPE, partnering with BitGo, and improving tokenomics in a deflationary direction.

Deal Details

- Investment: $40 million in the form of 6-month convertible bonds , 0% interest rate, issued in Sonic's S Token .

- Key terms: If SonicStrategy moves its listing from the Canadian stock exchange to Nasdaq or a similar exchange in the U.S., and raises at least $40 million in outside Capital , the debt will convert into common stock at $4.50 per share .

- Lock conditions: The convertible shares are locked for 3 years, while the S Token that Sonic Labs contributed are locked for 4 years.

- Capital preservation: The investment is unsecured , but Sonic Labs has a call option to recover a portion of the Capital if SonicStrategy raises additional capital from a third party.

- Purpose of Capital use:

Treasury replenishment

Support validator operation

Investing in strategic blockchain projects

- Progress: The transaction is expected to be completed within 5 working days according to CSE regulations.

$150 million expansion plan in the US

- This is part of a $150 million expansion plan that was approved by the Sonic community with a 99.99% approval rate. Specifically:

$50 million allocated to ETF implementation;

$100 million to pursue the PIPE model (Private Investment in Public Equity).

- In addition, Sonic also aims to optimize tokenomics in a deflationary direction, including improving the Gas Price mechanism and increasing the Token burn rate. In particular, Sonic is cooperating with BitGo to act as a Custodian for these new financial structures, creating trust for institutional investors.

- Michael Kong, CEO of Sonic Labs, said that SonicStrategy plays a Vai in bridging the gap between blockchain and traditional finance. He emphasized: “This investment represents our confidence in our ability to deploy and provide institutional-grade infrastructure for the Sonic ecosystem.”

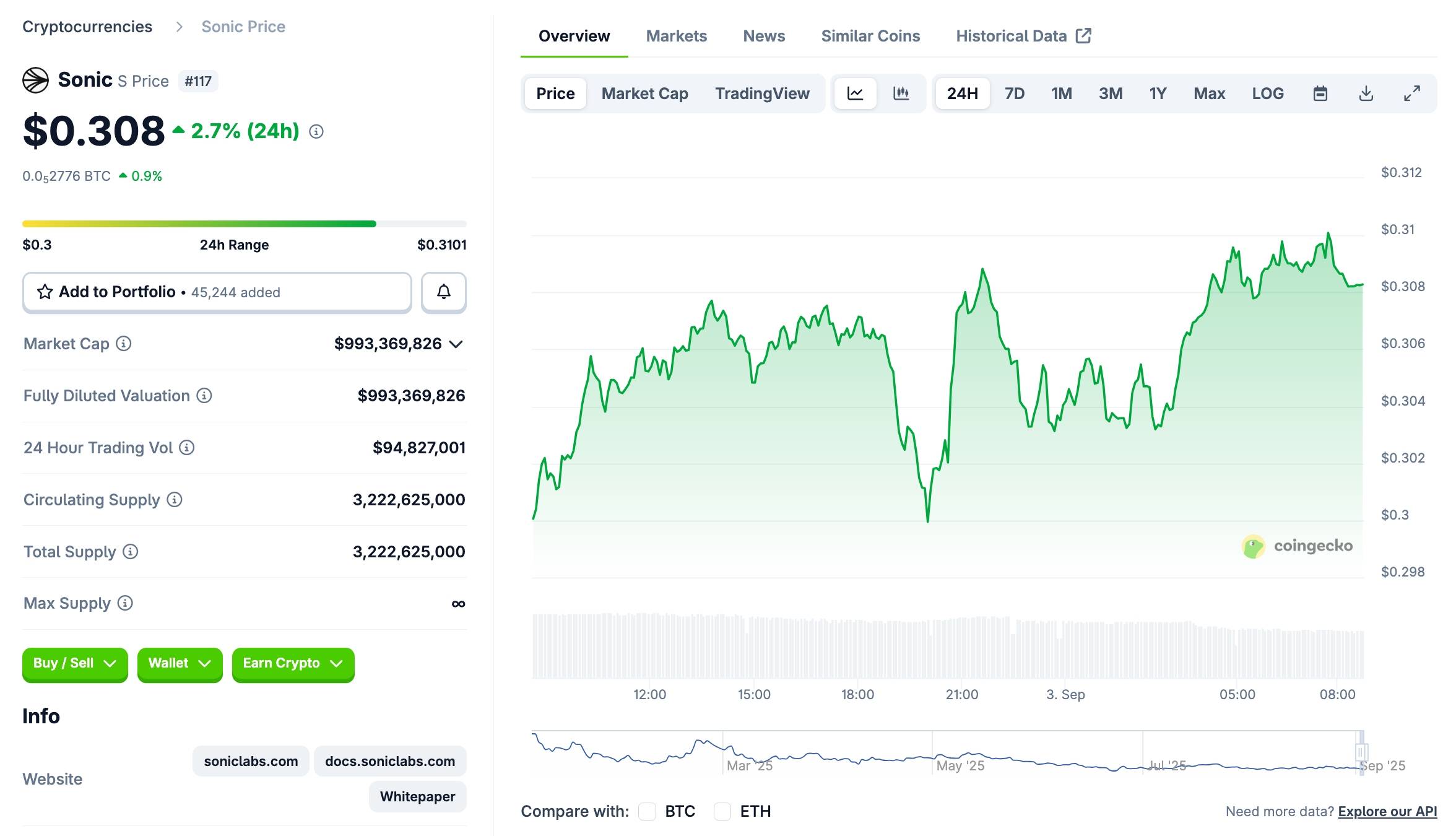

- In the past 24 hours, the price of S coin increased by 2.7% and is trading around 0.3 USD, while the entire crypto market moved up by 1.3%.

S price movement in the last 24 hours, CoinGecko screenshot at 08:30 AM on 03/09/2025

S price movement in the last 24 hours, CoinGecko screenshot at 08:30 AM on 03/09/2025

Coin68 synthesis