CryptoOnchain released its latest analysis report today (3rd) through CryptoQuant, pointing out that the trading volume of the US dollar stablecoin USDT has increased significantly recently, indicating that the market may be about to experience severe fluctuations.

USDT trading volume surges, investors eager to invest

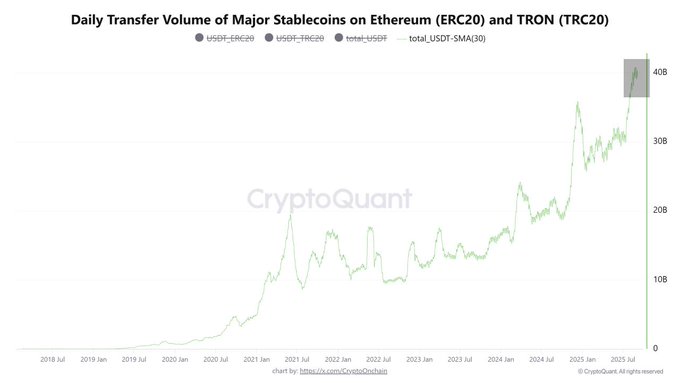

A CryptoOnchain report provides a detailed analysis of USDT on-chain activity on Ethereum and TRON, revealing significant shifts in stablecoin liquidity. The report first notes that the 30-day Simple Moving Average (SMA-30) of USDT trading volume has reached a record high, reflecting strong demand for liquidity among market participants. Secondly, on August 22nd, USDT's daily trading volume surged to $77.8 billion, the highest level since the LUNA crisis on May 12th, 2022. However, unlike the market environment then driven by panic and capital flight, the current market is relatively stable, and this trading volume spike is more likely a result of strategic accumulation by "smart money" rather than a FUD-driven sell-off.

Combining the data, the CryptoOnchain report believes that USDT's on-chain status may suggest a variety of scenarios: large investors are preparing to "buy on the dip", and global demand for USDT (especially on the low-cost Tron network) is growing, suggesting that the market is preparing for an upcoming period of high volatility:

These signals suggest that the market may be on the verge of severe volatility.

Investors focus on U.S. macroeconomic events

Investors focus on U.S. macroeconomic events

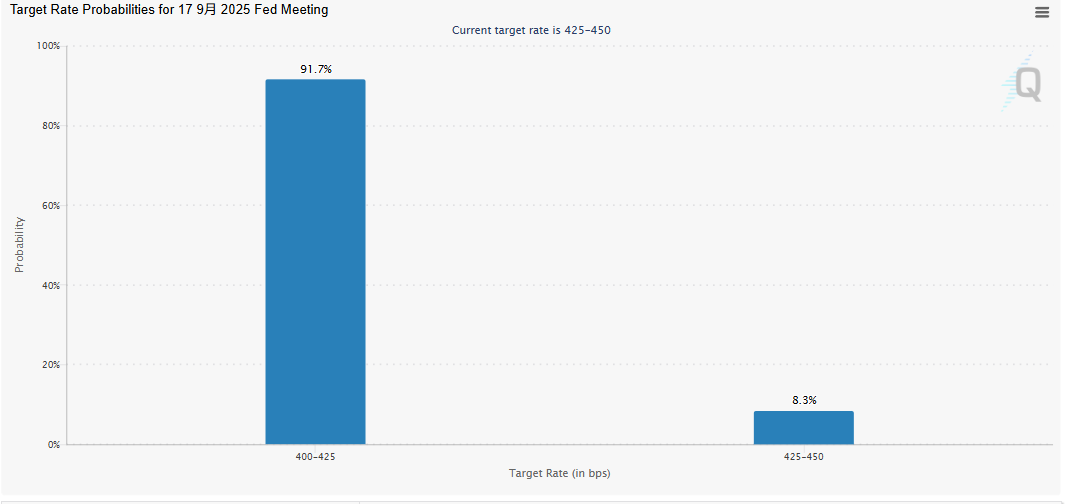

Echoing the CryptoOnchain report, the market generally believes that this month's cryptocurrency market will be influenced by the Federal Reserve's upcoming interest rate decision in September. The Fed will then decide whether to resume rate cuts in September and by how much. According to the CME FedWatch tool, the market currently places a 91.7% probability on the Fed resuming rate cuts this month, while the probability of maintaining interest rates is only 8.3%.

It's worth noting that, prior to the FOMC meeting, the U.S. Bureau of Labor Statistics (BLS) will release its August non-farm payroll report this Friday, September 5th. This report will reveal non-farm sector job growth, the unemployment rate, and other key labor market indicators. Analysts believe that if the non-farm payroll report reveals a weakening labor market, expectations of a Federal Reserve rate cut will intensify. Conversely, if the labor market remains strong, the Fed's path to rate cuts may face further obstacles and uncertainties.

Currently, the market is holding its breath in anticipation of potential volatility.