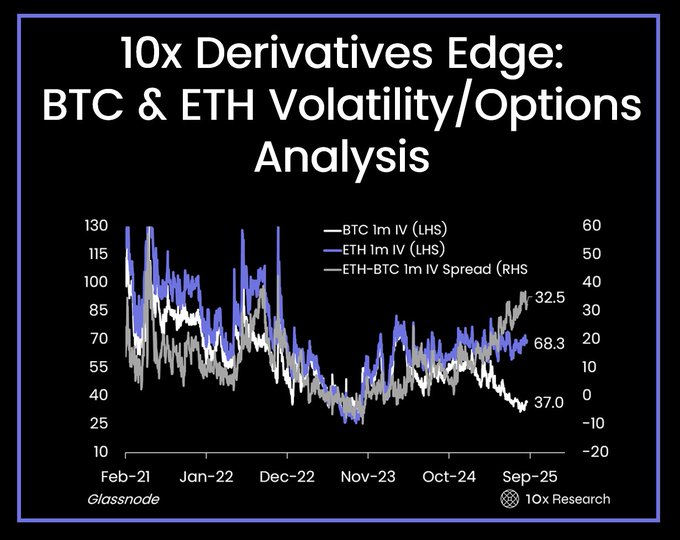

10x Derivatives Edge: BTC & ETH Volatility/Options Analysis Signals That Move Markets We’ve split our weekly volatility analysis into two parts to make it easier to digest. This report provides the full market context and color, while the earlier Smart Options Plays report zeroes in exclusively on actionable trade ideas. This week’s 10x Derivatives Edge breaks down the signals you can’t afford to miss. We analyze the latest shifts in Bitcoin’s implied volatility, risk reversals, and term structure—showing what traders are really pricing in ahead of September’s market catalysts. Ethereum’s volatility premium is dissected, along with strategies to capture mispricings in the ETH/BTC spread. We highlight where dealer positioning could accelerate moves, and why certain “gravity dates” in September matter for both BTC and ETH. Finally, we outline two actionable trade ideas designed for very different market views—one for holders seeking protection, and one for buyers who want upside with a buffer. The setups are clear, the risks are defined, and the timing could not be more critical. Let's dive right in: signal.10xresearch.com/p/10x-d...…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content