World Liberty Financial’s WLFI, a Token linked to Donald Trump, has dropped nearly 10% in the past 24 hours, raising concerns of deeper losses ahead.

On- chain metrics show persistent weakness, suggesting that the altcoin could face more downside in the coming sessions if demand fails to recover.

WLFI under pressure as traders exit positions and bet on new lows

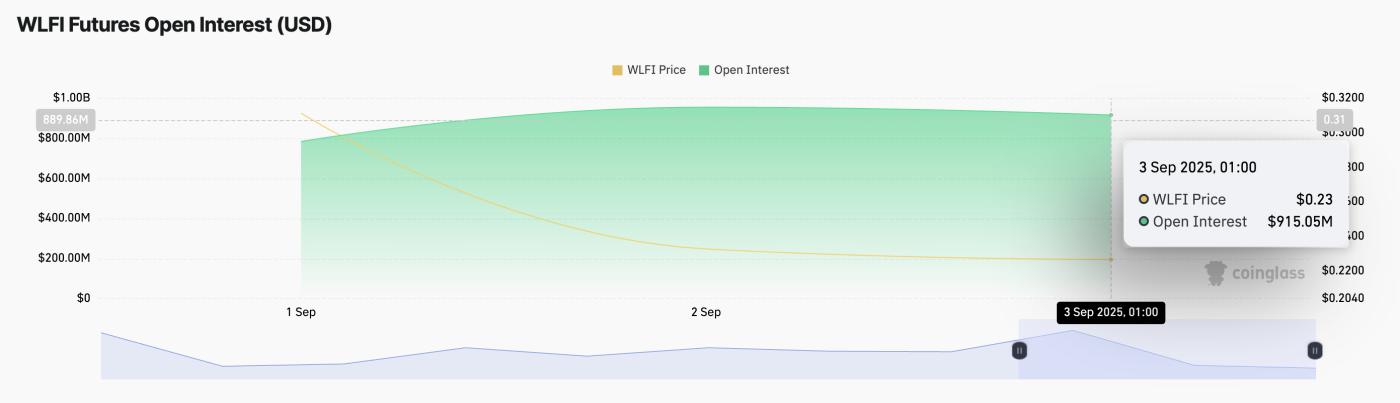

The decline in WLFI’s price over the past day has been accompanied by a decline in Futures Contract open interest, confirming a pullback in market participation. Currently at $915.05 million, the figure has dropped 4% over the past 24 hours, according to data from Coinglass.

To stay updated on TA and the Token market: Want more Token insights like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

WLFI Futures Contract open interest. Source: Coinglass

WLFI Futures Contract open interest. Source: CoinglassOpen interest refers to the total number of Futures Contract that are outstanding. It is used to measure market participation and Capital flow into an asset.

As the price of an asset falls along with a decline in Futures Contract open interest, traders are closing their positions rather than opening new ones. This trend reflects a decline in confidence in WLFI and suggests that the current sell-off is being driven more by investors leaving the market.

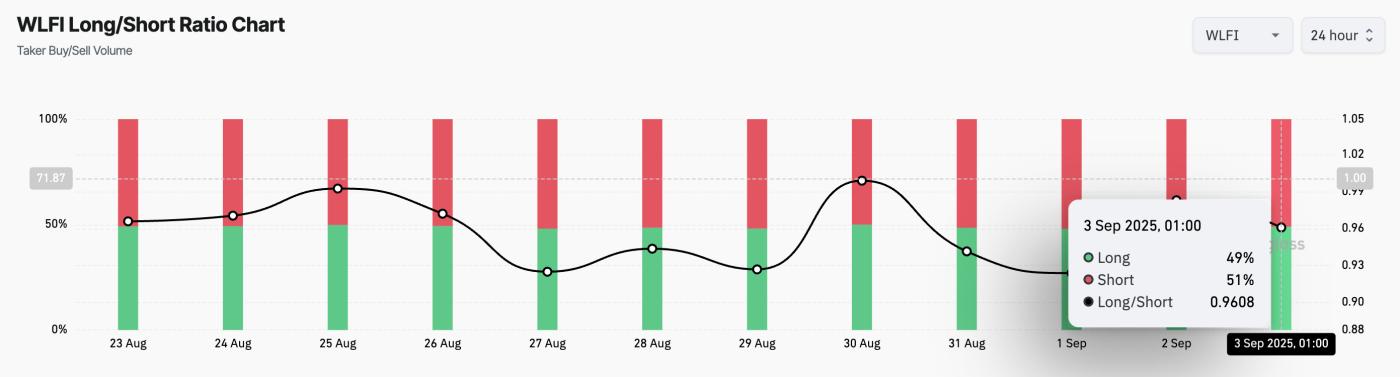

Additionally, on chain data shows that WLFI’s Longing/ Short ratio is heavily skewed towards the Short, suggesting that traders are increasingly betting against the Token . At the time of writing, the index stands at 0.96.

WLFI Longing/ Short Ratio. Source: Coinglass

WLFI Longing/ Short Ratio. Source: CoinglassThe Longing/ Short ratio measures the ratio of Longing to Short positions in the Futures Contract market for an asset. A ratio above one indicates that there are more Longing positions than Short positions. This indicates bullish sentiment, as most traders expect the value of the asset to increase.

However, as with the WLFI, a ratio below one means there are more Short positions than Longing in the market. This reflects the prevailing negative sentiment towards the WLFI, with Futures Contract traders largely betting on the asset's price falling rather than rising.

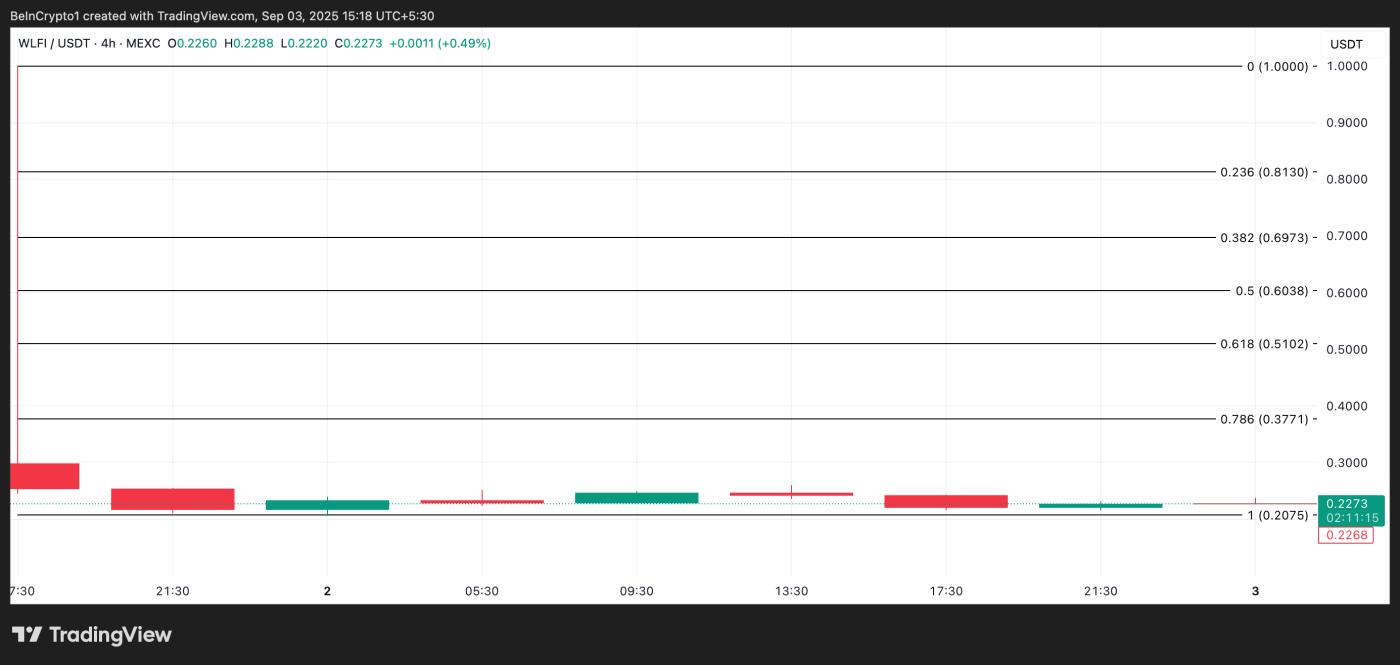

WLFI's next target could be $0.2075 or $0.3771

Without fresh interest from buyers, WLFI is at risk of further price decline. If demand continues to decline, its price could fall to $0.2075.

WLFI Price Analysis. Source: TradingView

WLFI Price Analysis. Source: TradingViewOn the other hand, if buying pressure increases, this could be stopped. If new buyers enter the market, they could trigger a recovery towards $0.3771.