Pyth Network Phase 2: Financializing Off-Chain Data

Pyth Network Phase 2: Financializing Off-Chain Data

Since its inception in 2021, Pyth has been a leader in building data infrastructure and distributing financial information. The goal has always been to be the most accurate source of information in the financial sector, and now Pyth is moving to the next stage of development with the proposal to deploy an institutional-grade product, expand the use case for Token, and further integrate with the TradFi platform.

Pyth is designed to deliver price data for any asset to anywhere—a concept that sounds simple but has yet to be fully implemented. While the Internet has found a way to replace CDs with data streams and music players with multimedia apps, the same has yet to happen with financial data infrastructure.

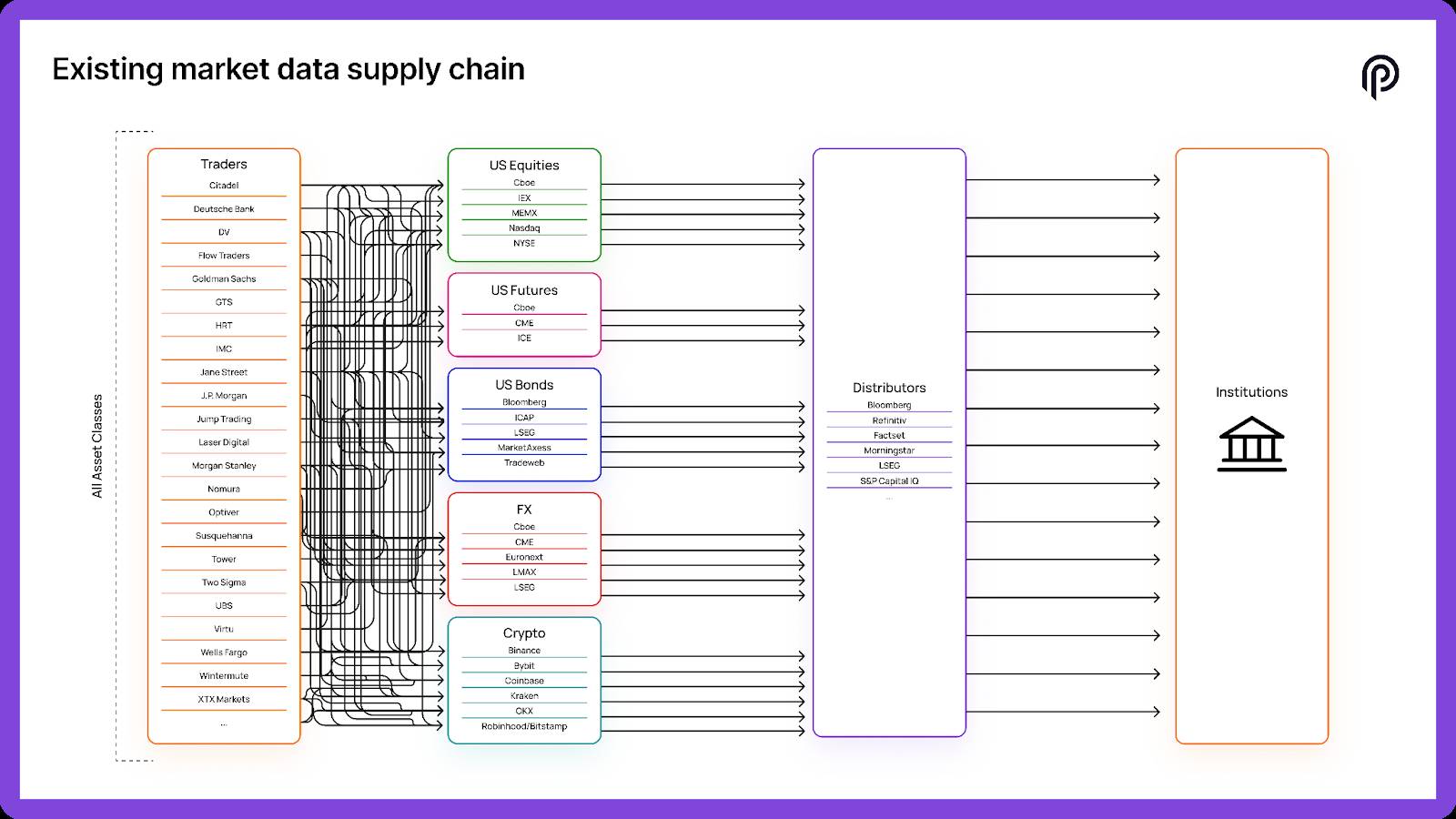

Financial institutions today are still constrained by legacy systems that cost them millions of dollars each year in fees to intermediaries like Bloomberg and Refinitiv. These aggregators also source their data from exchanges that share the same technical framework and are limited by geography, asset class, and data type. The result is that financial information remains largely undigitalized and Shard , despite efforts to transform elsewhere.

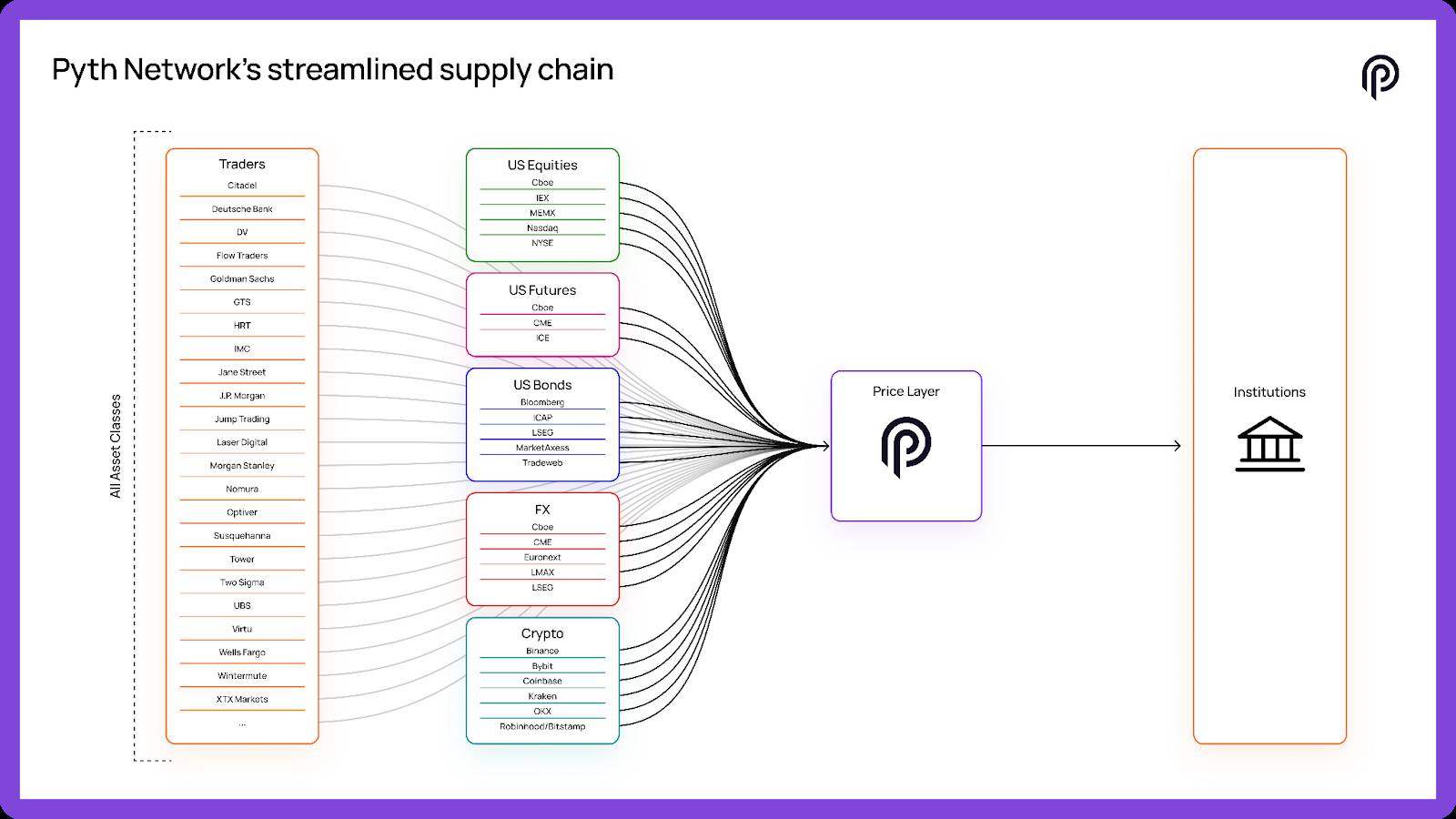

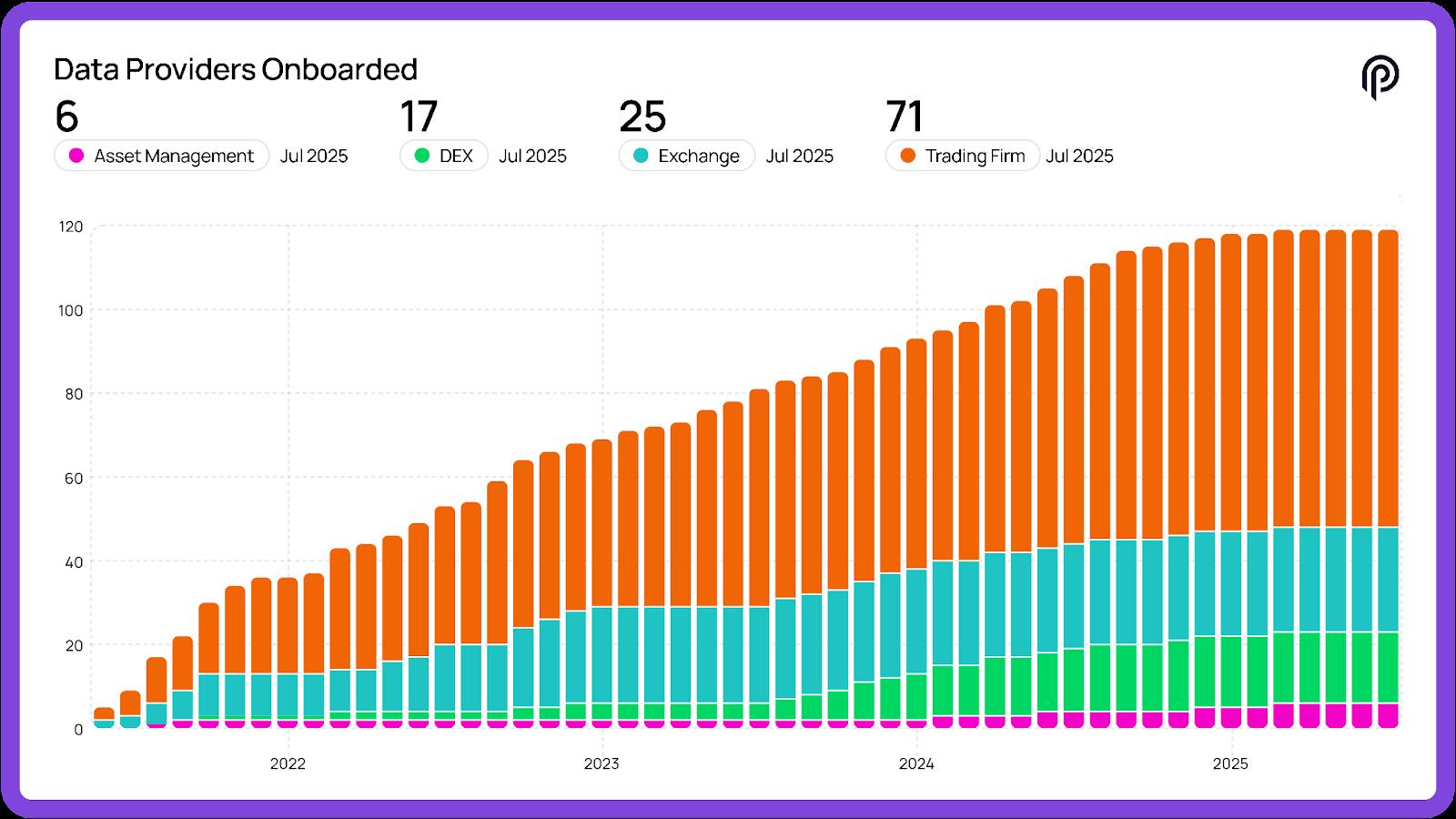

Pyth solves this problem by using blockchain technology to establish a source of accurate information, while current systems cannot do this in a decentralized and intermediary-free way. From a platform that centralized data between exchanges and organizations participating in transactions, Pyth's network now includes hundreds of financial institutions providing standardized data according to a common framework. With a total volume of over $1.6 trillion, accounting for over 60% of the DeFi market share, and even becoming a partner with the US Department of Commerce, Pyth has achieved a level of popular application similar to the leading protocols in the market.

More importantly, Pyth has emerged as the most valuable and in-depth repository of institutional-level financial data.

The first phase of development saw Pyth build a product that meets DeFi needs and lay the foundation for Phase 2, which will form the model for a market data economy. This phase will focus on increasing revenue for the DAO, expanding into new markets, and increasing the cumulative value of the entire Pyth ecosystem. The most visible evidence of this growth is the long list of on-chain and off-chain applications that are using Pyth as the primary price feed for the global information supply chain .

More importantly, more and more organizations are using data for aggregated Pyth, and the project is in the final stages of development to launch a game-changing product for institutional-level financial data on a global scale.

Financial institutions spend up to $50 billion a year accessing the information they want. From setting prices for billion-dollar trades to displaying quotes on exchanges, financial data is the fuel that powers the entire financial market. But the data model that institutions currently use is slow, expensive, and fragmented. If Pyth can capture just 1% of that market, the protocol could Chia $500 million in annual revenue. But Pyth’s ambitions go much further than that; the project is here to capture the entire market and return sustainable value to the network.

Phase 1: Build infrastructure, expand into DeFi , and establish the most reputable price feeds

The first chapter of Pyth's journey focuses on a single goal: building and scaling the infrastructure needed to validate and distribute institutional-grade data on-chain.

Pyth’s network participants are making this vision a reality, with tangible results for all to see. With over 60% market share in the DeFi space and $1.6 trillion in volume processed, Pyth is perfectly positioned for an explosive growth cycle and value accumulation for the upcoming real world asset trend.

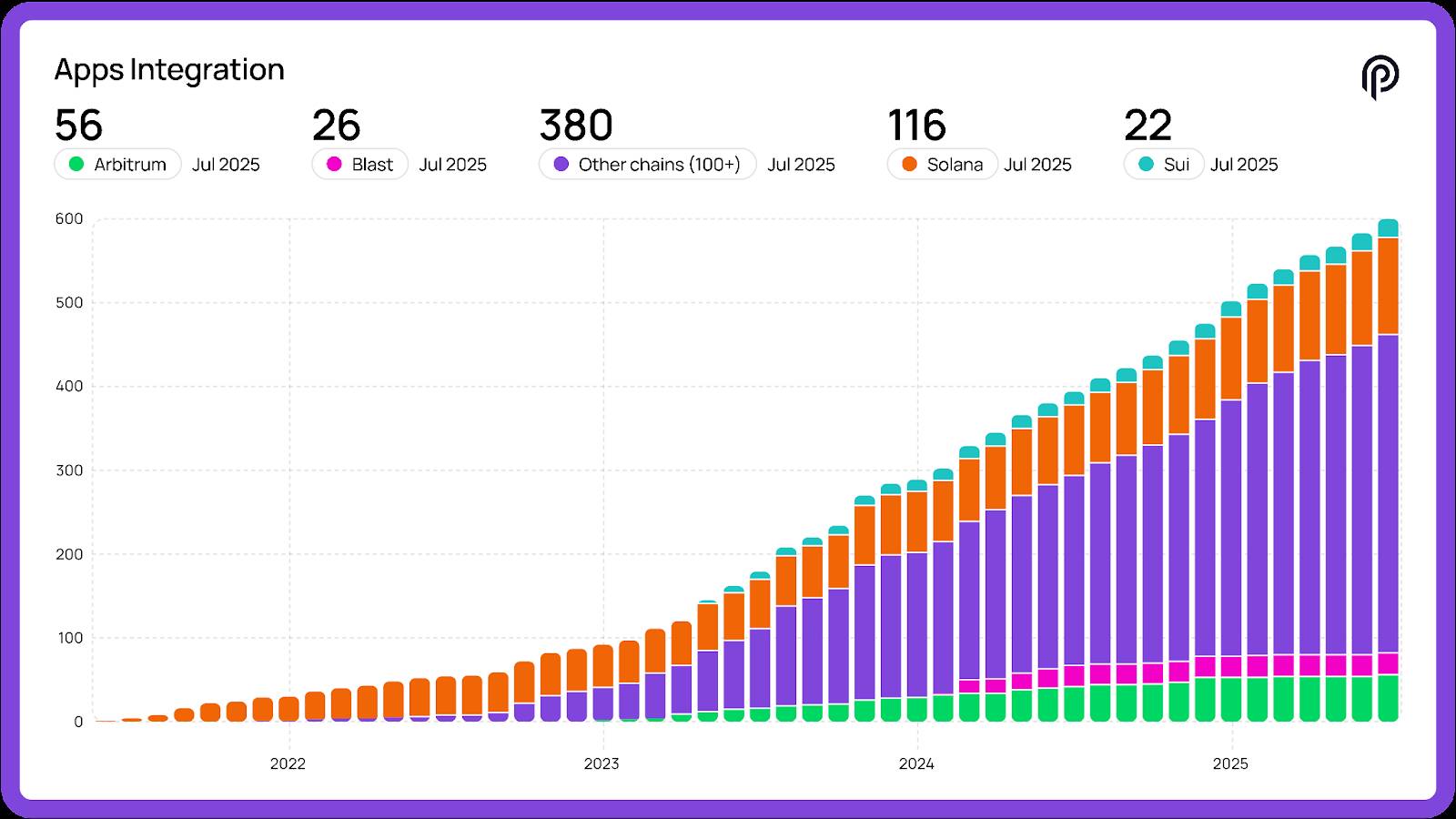

Over time, on-chain fees will increase as data is sent as secure, attested messages to smart contracts everywhere. Earlier this year, Pyth DAO approved incremental validation fee increases across dozens of blockchains, and this will continue to roll out as more data becomes available. Pyth Network adoption will continue to accelerate through connectivity to more blockchains, access to new markets, improved trust metrics, and the upcoming wave of Tokenize . The project expects more data to be brought onto the blockchain, much of which will leverage Pyth for validation and distribution.

To date, Pyth Network has achieved the following:

- Integrates over 600 protocols on over 100 blockchains

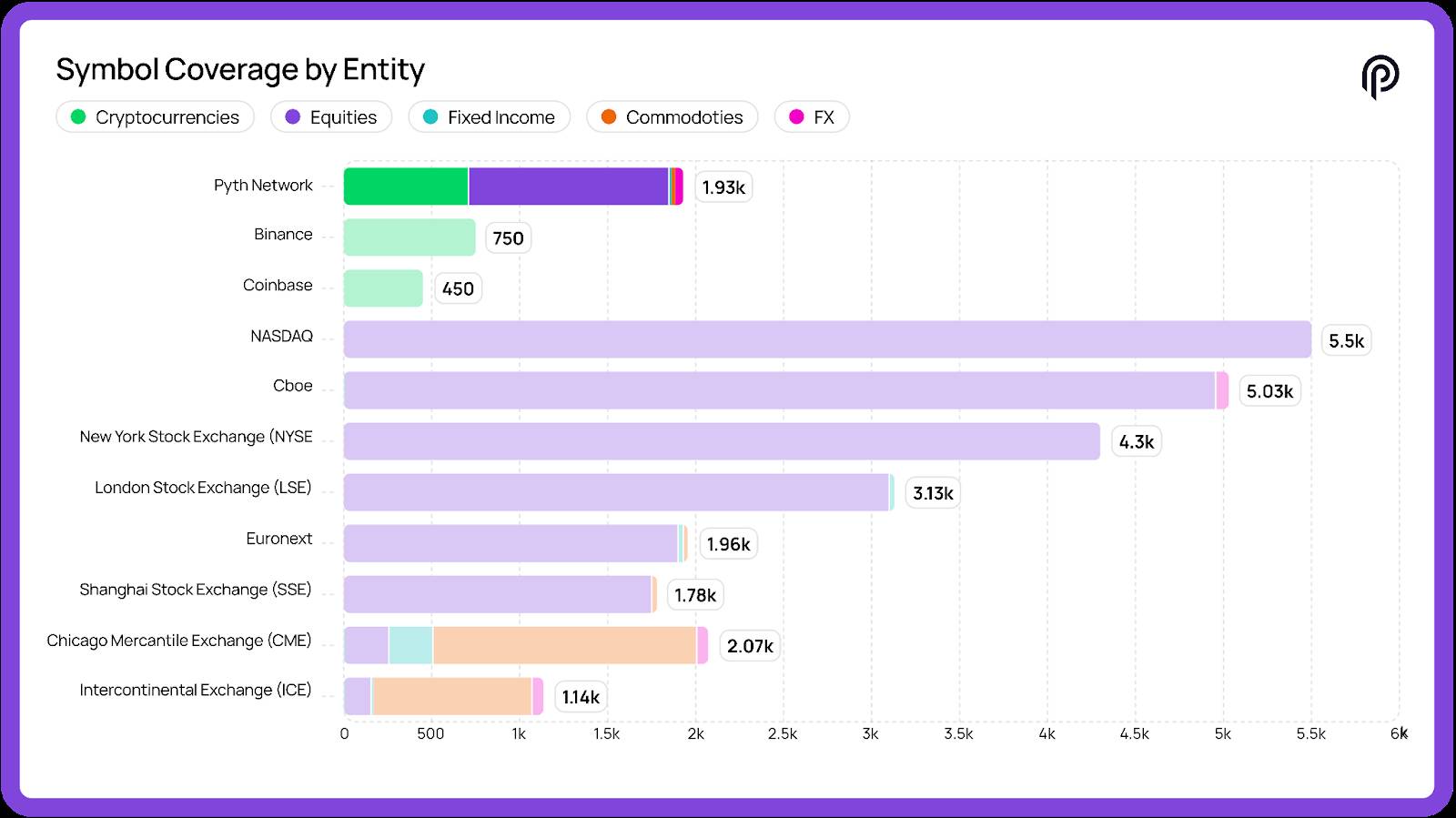

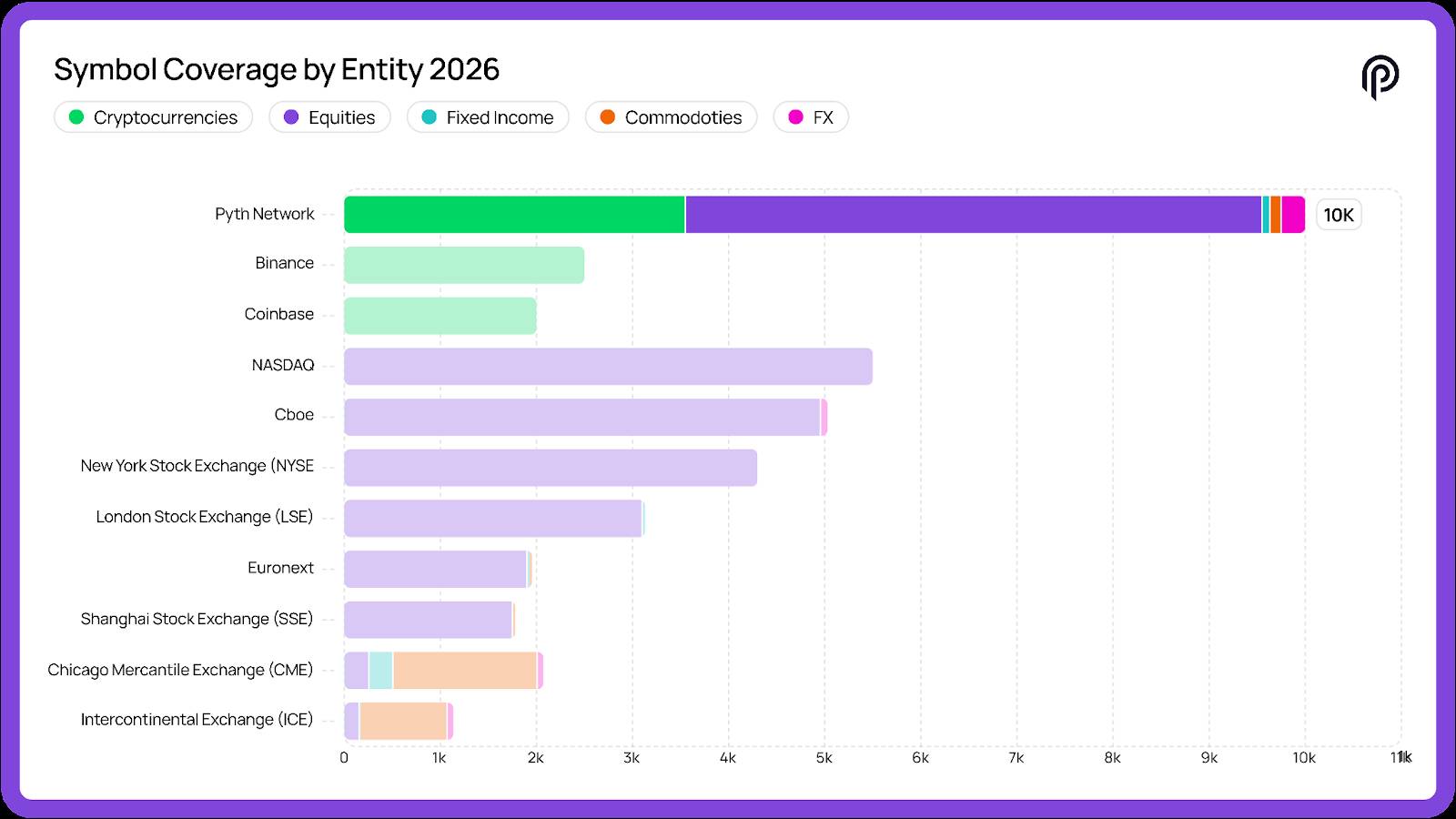

- Provides over 1,800 price feeds, covering over 900 real assets

- Become the top oracle by volume across every major blockchain ecosystem

Here are the differences of Pyth:

- Exclusive data from the world's leading trading firms and exchanges — including DRW, Jump, Jane Street, Optiver, HRT, SIG, IMC, Virtu, GTS, Flow, Cboe, LMAX, MEMX, MIAX, IEX, and more

- Multi-asset coverage across crypto, stocks, forex, commodities, interest rates — all in one network

- Global market perspective, breaking down regional barriers and unifying data across geographies

- Millisecond level updates for high performance trading environment

- Selected by the Department of Commerce to authenticate and distribute US economic data on chain

Phase 1 has proven the product works at scale. Now it’s time for Phase 2: redefining the market data economy and becoming the go-to source of information across the entire financial industry.

Phase 2: Unlocking the $50 Billion Potential

Pyth is now ready to move into Phase 2, which begins with monetizing the first market data network built by and for institutions.

The global market data industry is worth more than $50 billion a year, but is dominated by just a few established companies. They have:

- Price increase of more than 50% in the last 3 years

- Charging some customers 5 times more than others for the same product

- Shard access across multiple geographies and asset types

- Imposing barriers to entry for new entrants into the professional financial services sector

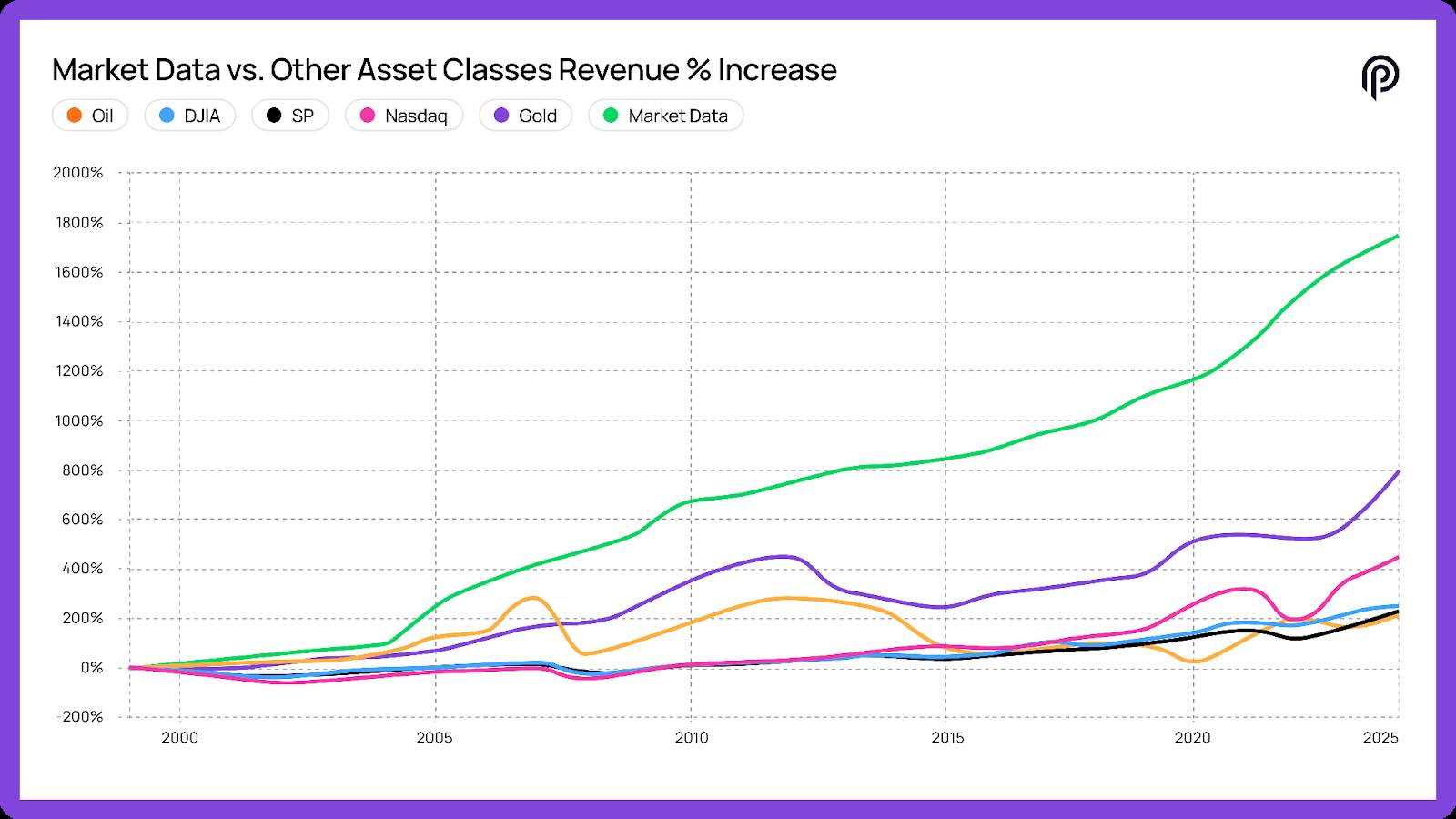

The cost of market data has increased so much over the past 25 years that its value has outpaced other major asset classes.

The market is facing a challenge, and price-setting and market-impacting companies around the world have been working to build a solution with Pyth. Here are some of their weaknesses:

- Exchanges only see their own Order Book – only a small portion of the market – often limited to a single region or asset class.

- Each exchange sells proprietary data feeds, missing out on trades happening anywhere else, creating blind spots.

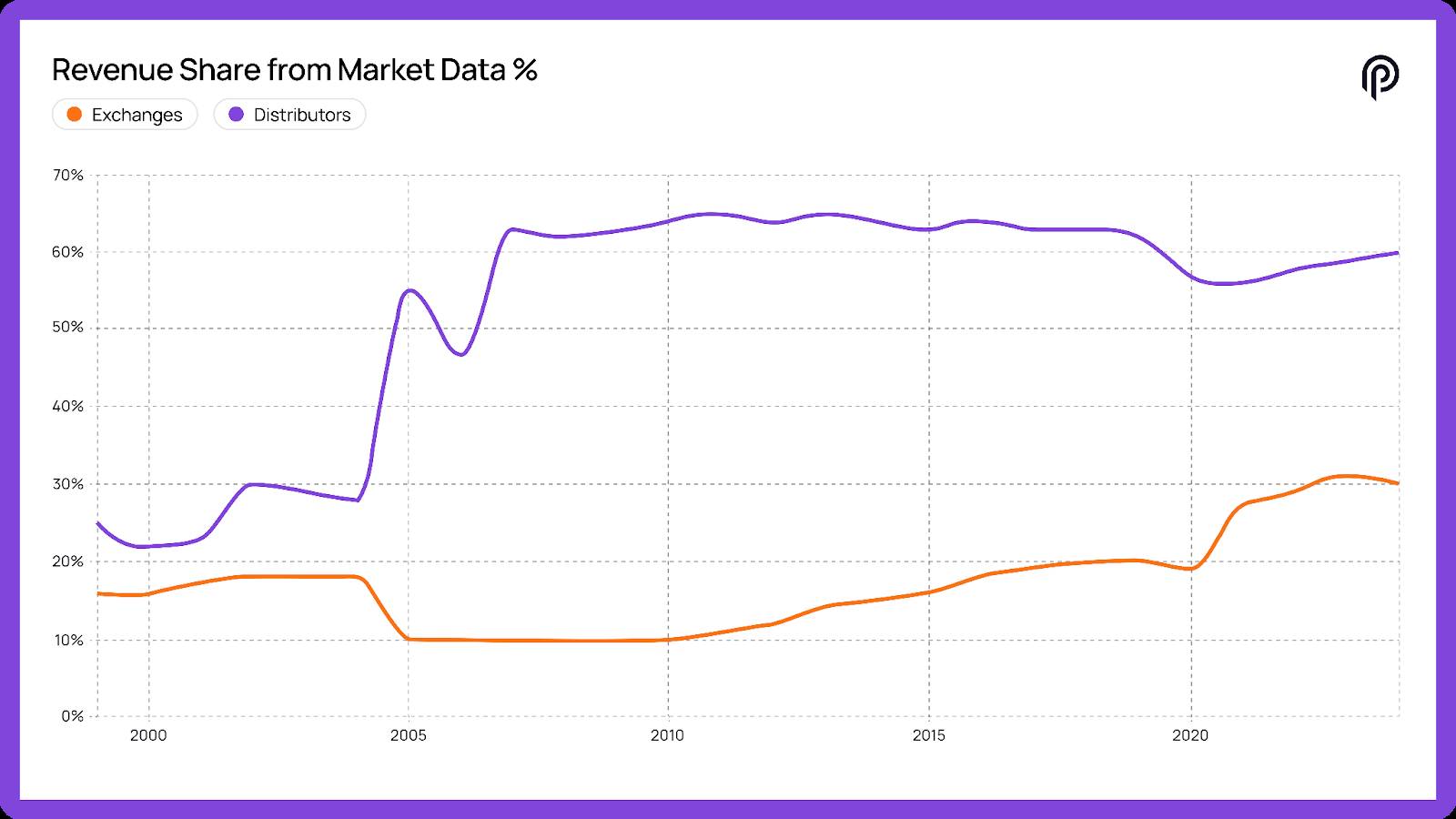

- Data giants like Bloomberg and Refinitiv patch together these incomplete feeds and resell them as expensive, take-it-or-leave-it packages.

- The trading firms that generate the fastest and most accurate prices do not receive any revenue from their data.

And here is the core structural flaw of the problem:

- The most valuable price data is generated at the early stages, before it reaches the exchanges, but the majority of revenue flows to intermediaries and dealers at the later stages.

Pyth's new product has the potential to simplify access to global markets, empower organizations with specialized data, and reshape the market data economy.

The product is built on Pyth’s cutting-edge model, which captures institutional-grade data directly from the source, while incorporating improvements in performance, accessibility, and asset coverage. This upstream approach overcomes the core shortcomings of traditional market data, capturing the most valuable prices before they become Shard, inflated, and delayed, and then transferring value back to the institutions that create them.

The proposed subscription product for Pyth is designed to deliver pure market data directly into existing workflows outside of the blockchain environment for:

- Risk modeling & analysis

- Clearing & Payment System

- Government compliance and regulatory workflows

- Accounting & reporting tools

- Display screen

- Historical research

Imagine a world where anyone, from the world’s largest institutions to individual traders, can purchase comprehensive and specialized market data from the Pyth Network. Payments can be made in a variety of ways, including USD, stablecoins, or PYTH Token . This flexibility opens the door to millions of potential subscribers globally.

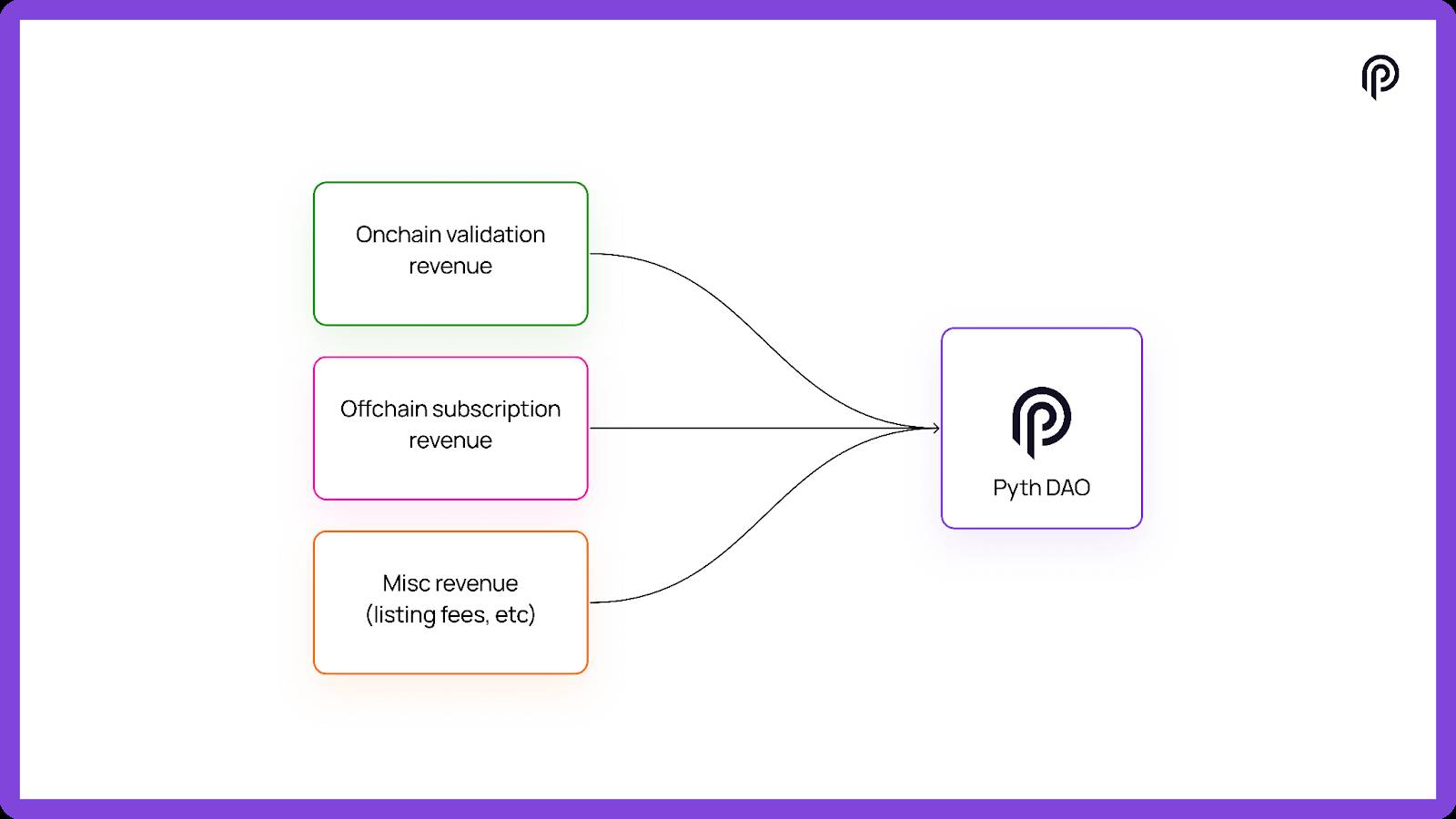

The proposal includes revenue from subscriptions flowing back to the Pyth DAO, and letting the DAO decide how best to deploy these funds to strengthen the network and align incentives for contributors. Possibilities discussed in the governance forum include Token buybacks, revenue Chia models, and other mechanisms to reward publishers, users, stakers, and holders. As adoption grows, this feedback loop could expand the reach of the network, strengthening data quality and accruing value for all participants.

Pyth has delivered the quality, speed, and reach needed to compete and win in this market. With a new product for the DAO to consider, accelerating demand, and a clear path to enter a $50 billion industry, Phase 2 lays the financial and structural foundation for Phase 3: expanding Pyth into a global price layer for any market, anywhere.

Phase 3: Expanding the network globally

With the infrastructure built and the subscription data model in place, Phase 3 will aim to achieve market-wide coverage:

- Add 200–300 new codes every month

- More than 3,000 codes by 2025

- More than 10,000 codes by 2026

- More than 50,000 codes by 2027

- Comprehensive coverage on:

- Transaction location

- Licensed DeFi

- DeFi is not licensed

- OTC market

Why this matters:

- It establishes the most complete financial data layer in the world

- It removes regional barriers, asset class gaps and vendor complexity

- Like Spotify, the product catalog continues to grow—but unlike traditional providers, contributors Chia in the profits

Here is Pyth's current position:

Here's what Pyth wants to achieve by the end of next year:

Each new data source attracts more developers and organizations, driving adoption and subscription revenue. That revenue strengthens the Pyth DAO and expands the incentives for contributors. These increasing incentives attract even more data sources, accelerating the cycle.

The path forward is clear. With its dominance in DeFi and growing adoption on TradFi, Pyth Network is in a position to capture a significant market share in the $50+ billion global data industry. But that’s not the end goal. Pyth has the potential to become the single source of truth for the entire global financial industry.

Note: This is sponsored content, Coin68 does not directly support any information from the above article and does not guarantee the truthfulness of the article. Readers should conduct their own research before making decisions that affect themselves or their businesses and are willing to take responsibility for their own choices. The above article should not be XEM as investment advice.