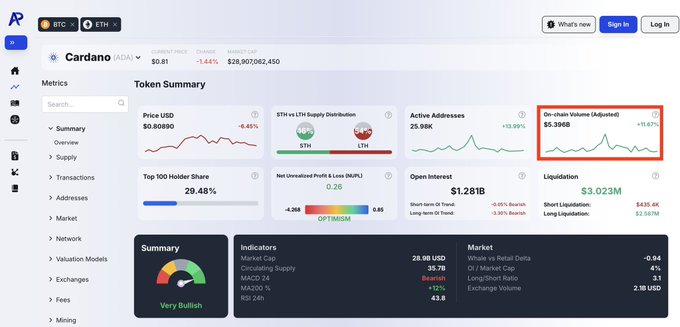

The Cardano network just had one of its strongest weeks of 2025 as on-chain volume surpassed $5.3 billion.

According to analysts, if the current support zone is held, ADA could soon approach the $1 mark.

At the moment, Cardano (ADA) has held the $0.80 support level with strong on-chain activity, following a consolidation phase.

Could this setup strengthen Cardano's short-term recovery?

ADA stabilizes at key support zone

ADA is currently trading near $0.83. This comes after a pullback from previous highs, marking a period where selling pressure appears to have eased.

Analysts say $0.68 remains a key support level . A drop below this level could weaken bullish arguments.

Market analyst Brownstone pointed out the bullish divergence on the MACD, an indicator that measures momentum changes, showing an uptrend even as the Token has pulled back. This is usually a sign of waning selling pressure, supporting a stable price scenario.

The immediate resistance zone lies at $0.85. If ADA closes above this level, the path towards $1 will be open.

ADA price action currently shows that the Token is building a solid foundation while waiting for stronger upside momentum.

Network activity reinforces the uptrend

Over the past week, Cardano has processed over $5.3 billion worth of volume .

Analysts note that this is one of the highest levels recorded in 2025. The increase indicates stronger usage from retail and institutional investors.

Analyst Mintern found that active addresses and open interest also increased. A higher number of active addresses indicates that wallets are actively trading, while an increase in open interest reflects more positions in the futures market.

Combined, these factors indicate deeper liquidation across the ecosystem, such on-chain booms often pave the way for major price rallies.

Analysts say sustained participation could lay the groundwork for a rally if technical levels are confirmed.

Liquidation and volume remain key factors and Cardano 's recent performance fits that pattern.

Whale Money Flow and Technical Structure

The technical structure reinforces the potential for further growth. ADA has maintained its price above the 55-day and 89-day exponential moving Medium (EMAs), as well as the 200-day simple moving Medium (SMA), for seven consecutive weeks.

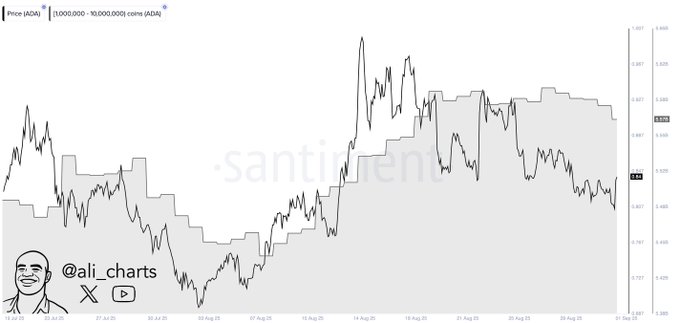

According to analyst MasterAnanda, this association suggests that the uptrend is underway. However, whale behavior has created obstacles as large holder have sold around 30 million ADA in the past week.

These sales put pressure on liquidation and contributed to the price hovering around $0.83.

Ali Martinez said the outflows do not change the long-term structure but could delay recovery efforts in the short term.

Traders also point to a retest of the recent breakout level around $0.78 – $0.80, which is currently Vai as support.

Successful retests typically mark the end of accumulation phases. CryptoGem analyst Athos said the stability suggests a potential short-term recovery to $0.95 or $1.

Analysts say the ascending channel is still intact. As long as the ADA Token holds above $0.80, the momentum is still in favor of the uptrend.

The pattern is now likely to extend towards the upper band of the channel, with long-term targets above $2.00 if volume continues to increase.

Future prospects

The current picture shows that ADA is balancing between strong buying pressure from network activity and selling pressure from whales.

If it continues to hold the $0.78 – $0.80 zone with high volume , Cardano has a chance to challenge the $1 mark again in the coming weeks.

- Charles Hoskinson Steps Up Competition With Ethereum Amid ADA Weakness

- Cardano at Risk at $0.80 as Whales Dump 30 Million Token

- Bitmine continues to accumulate ETH strongly, total holdings exceed 8.4 billion USD

Vincent