Bitcoin (BTC) and the S&P 500 are showing a growing decoupling at the time of writing. While the two assets have historically moved in tandem, the latest daily chart shows a contrasting trend.

On the chart, Bitcoin (purple) continues to surge strongly, while the S&P 500 plummets. This development reveals signs that Capital flows are gradually shifting to the cryptocurrency market.

Bitcoin’s recovery is all the more remarkable as it comes after a period of weakness that lasted for several weeks. From its historic high of $124,000, the digital coin retreated to $108,000, before attempting to regain its balance and break above the important resistance level of $110,000.

The familiar decoupled model

This isn’t the first time Bitcoin and the S&P 500 have moved in opposite directions. Bitcoin has consistently outperformed traditional stock markets over the years.

Data from Curvo shows that the S&P 500 has outperformed Bitcoin only three times between 2020 and 2024, most notably during the 2022 decoupling, when Bitcoin fell 62% while the S&P 500 lost just 13%.

Now, the liquidation flow is tilted towards Bitcoin. In 2024 alone, the cryptocurrency is up 135%, compared to 33% for the S&P 500 index.

Analysts say that if Capital continues to flow in strongly, Bitcoin can completely break through the important resistance zone. At the same time, this shift also promises to create positive momentum for many other altcoins.

BTC.D is down – Who is the beneficiary?

Altcoins appear to be benefiting from BTCD .

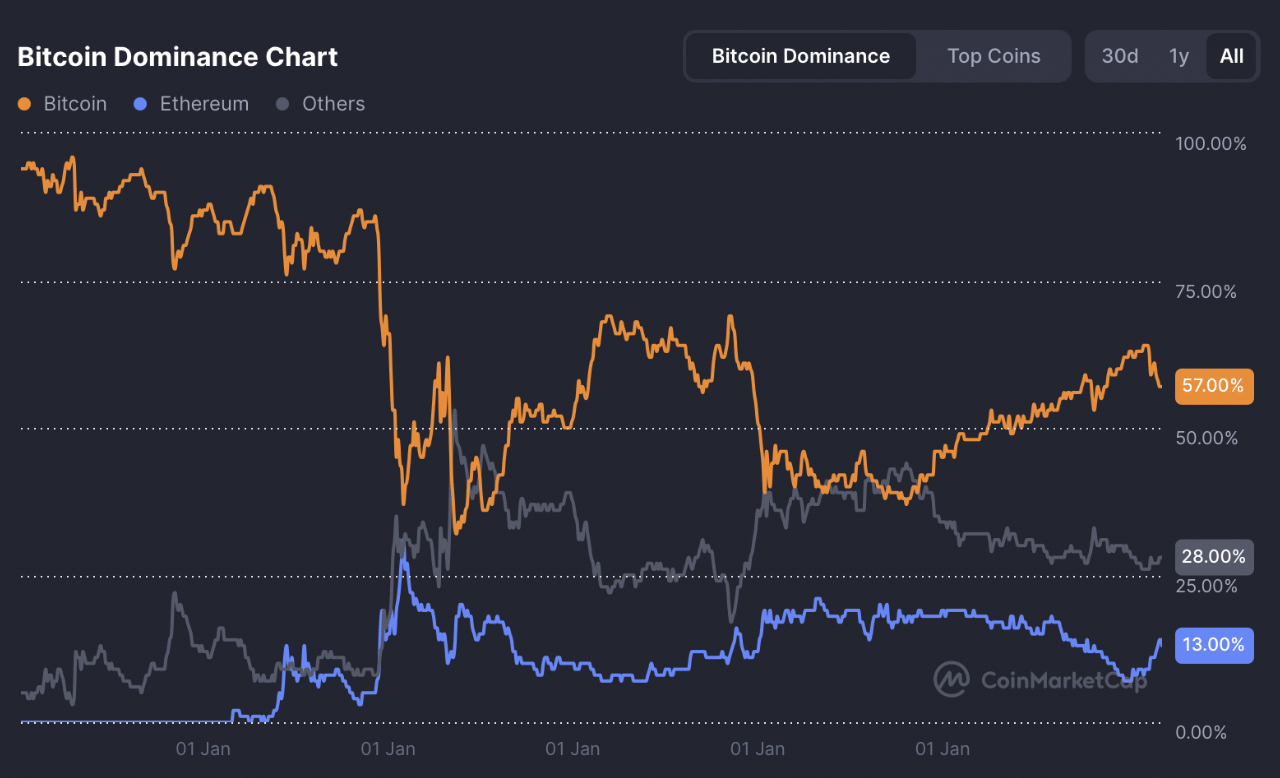

According to CoinMarketCap, Bitcoin’s (BTC.D) dominance rate — which measures Bitcoin’s share of the entire cryptocurrency market — has dropped by 3.43% over the past 24 hours. Ethereum (ETH) accounts for much of that liquidation , up 2.17%.

In the scenario where BTC.D continues to decline , altcoins may extend their gains in the coming sessions.

However, analyst Ben Cowen has a contrary view. He believes that Bitcoin dominance will soon recover, which will benefit BTC but put pressure on most altcoin pairs.

“I am bullish on ALT/ ETH pairs in September, but bearish on ALT/ BTC pairs, as BTC.D is showing resilience.”

Cowen explained that traders often mistake altcoins' gains against ETH as a sign of weakness in BTC In fact, the index could still rise, as altcoins can temporarily outperform ETH but still be weaker than BTC.

He added that ETH is likely to retest the 21-week EMA , giving the altcoin a short-term advantage. However, this momentum will be difficult to sustain once ETH /USD hits that level.

Prominent names still keep the fire burning

At the time of writing, the 90-day altcoin season index shows that the market is still seeing bright spots, although most large Capital Token are only slightly up. Notably, memecoins and mid-cap projects are becoming the main drivers of the recovery.

Standing out in this group are Pudgy Penguins (PENGU), Ethena (ENA), Conflux (CFX), Story (IP), and Chainlink (LINK) – names that continue to maintain their bullish momentum thanks to solid fundamentals.

However, in the context of constantly shifting Capital flows, large- Capital altcoins can still become attractive destinations, as investors look for safer options.

- Bulls Remain in Control as Bitcoin Price Surpasses $112,000

- Is September the Start of the Real Altcoin Season?

- ETH breakout or fakeout? Traders debate whether $4.5K can hold

SN_Nour