#ETH

- ETH trades below 20-day MA at $4,311.45 but shows bullish MACD momentum divergence

- Exchange reserves at 3-year low and institutional adoption growing with $40M funding round

- Technical resistance at $4,430 needs breakthrough for confirmed upward trajectory

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Below Key Moving Average

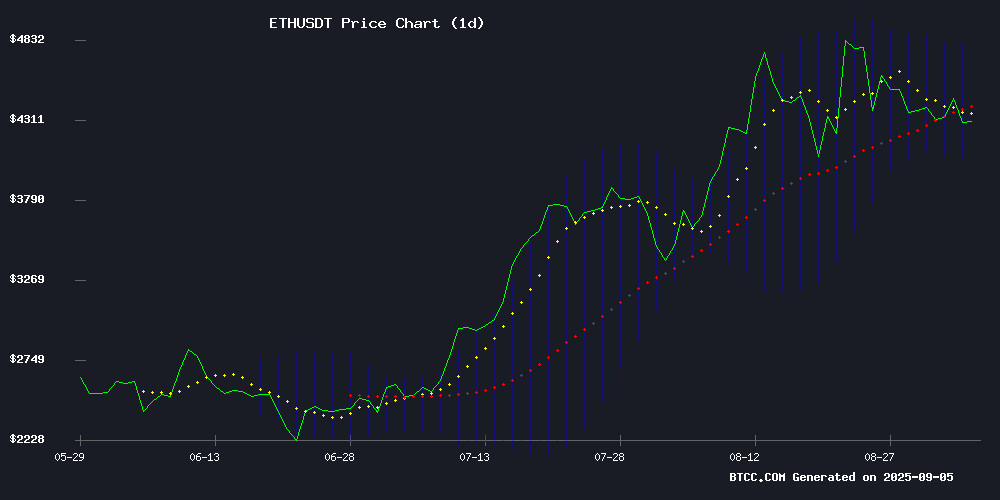

ETH is currently trading at $4,311.45, sitting below its 20-day moving average of $4,431.69, which suggests some near-term bearish pressure. However, the MACD indicator shows a positive histogram of 94.15, indicating potential bullish momentum building. The Bollinger Bands reveal price action NEAR the middle band with room to test resistance at $4,807.85. According to BTCC financial analyst Michael, 'The technical picture presents a consolidation phase with the MACD divergence hinting at possible upward movement if ETH can reclaim the $4,430 level.'

Market Sentiment: Institutional Adoption Grows Amid Supply Constraints

Positive fundamental developments are supporting ETH's long-term outlook. Exchange reserves have hit a 3-year low indicating reduced selling pressure, while institutional adoption receives a significant boost with Etherealize's $40M funding round. Staking yields continue to outperform traditional finance, attracting yield-seeking investors. BTCC financial analyst Michael notes, 'The combination of supply scarcity through staking and growing institutional infrastructure creates a fundamentally bullish backdrop, though technical resistance levels need to be monitored closely.'

Factors Influencing ETH's Price

9 Best Crypto Coins with 100x Potential: BullZilla, Peanut the Squirrel, Fartcoin, and More Set for Growth in 2025

Meme coins continue to dominate cryptocurrency discussions as high-risk, high-reward investments. Following the explosive growth of Dogecoin and Shiba Inu, investors are now eyeing BullZilla, Peanut the Squirrel, and Fartcoin as potential candidates for 100x returns by 2025.

BullZilla ($BZIL), built on the Ethereum blockchain, has emerged as a standout contender. Its innovative presale system and next-generation features are attracting early investors seeking maximum upside. The project is currently in Stage 1-C of its presale phase.

The broader meme coin market shows no signs of slowing down, with numerous projects positioning themselves as the next breakout stars. Market participants are particularly focused on presale opportunities, where early entry could yield significant advantages.

Cloud Mining Platform AIXA Miner Promises Daily Ethereum Profits Up to $2,700

Ethereum continues to solidify its position as a cornerstone of decentralized finance (DeFi) and smart contracts, with its value surpassing $6,500 per ETH in 2025. As institutional and retail interest grows, cloud mining has emerged as a viable alternative to traditional mining, which remains cost-prohibitive for most investors due to hardware and energy expenses.

AIXA Miner's platform claims to democratize Ethereum mining by eliminating physical hardware requirements. The service reportedly enables users to generate up to $2,700 in daily profits through energy-efficient smart contracts and heavyweight mining machinery. This approach lowers barriers to entry, allowing participants with minimal technical knowledge to engage in cryptocurrency mining.

The Ethereum network's expanding utility beyond simple transactions—particularly in DeFi applications—makes cloud mining an increasingly attractive option for investors seeking exposure to crypto's growth potential without operational complexities.

Ether Exchange Reserves Hit 3-Year Low as Traders Shift to DeepSnitch AI Presale

Ethereum reserves on centralized exchanges have plummeted to their lowest level in three years, with just 17.4 million ETH remaining—a 38% drop from September 2022's peak. Institutional demand, driven by spot ETH ETF inflows and corporate treasury purchases, is locking up supply. ETFs alone attracted $13 billion since July 2024, including $5.4 billion in their launch month.

Retail traders, meanwhile, are pivoting to presales for higher upside. DeepSnitch AI emerges as a standout candidate, alongside speculative plays like Sui and Pump.fun. The divergence highlights a market split: institutions accumulate ETH while retail seeks alpha in early-stage projects.

Ethereum Staking Yields Outpace Traditional Finance, Analysts Bullish on ETH

Ethereum staking yields are capturing significant attention as they consistently outperform traditional financial instruments. With returns surpassing those of bonds and bank deposits, ETH staking has emerged as a compelling strategy for yield-seeking investors. Joseph Lubin, Consensys co-founder, suggests Wall Street's growing interest in Ethereum could further propel prices, positioning staking as a cornerstone of institutional adoption.

Analysts highlight Ethereum's validator network expansion and robust staking rewards as key factors in its dominance as a passive income vehicle. The network's long-term potential is drawing comparisons to traditional finance, with some projecting ETH as a 15x ROI opportunity. Meanwhile, newer entrants like MAGACOIN FINANCE are gaining traction, adding depth to the crypto yield conversation.

Cloud Mining Investors Favor AIXA Miner for Ethereum Profits Amid Market Volatility

Ethereum's ascent toward $4,000 projections for 2025 has intensified interest in passive income streams like cloud mining. AIXA Miner dominates this niche by offering non-technical investors daily ETH yields up to $2,000 through transparent contracts, distinguishing itself from fraudulent competitors that plague the sector.

The platform's operational integrity—evidenced by precise 24-hour payouts and fully disclosed contract terms—addresses cloud mining's chronic trust deficit. As Ethereum solidifies its position as the second-largest cryptocurrency, demand grows for turnkey solutions that bypass hardware complexities while maintaining profitability.

Ethereum NFT and DeFi Trading Surge as Investors Seek Stable Returns

Ethereum's price stability above $1,800 has reignited activity across DeFi protocols, with TVL rebounding to $90 billion. Established platforms like Aave, Curve, and MakerDAO are witnessing renewed engagement, while on-chain traders position for the next wave of high returns.

For retail investors, the complexity and volatility of DeFi remain barriers. Many are turning to contract-based solutions like ProfitableMining, which promises transparent yields without active management. The platform's Avalon Miner A1466 contract reportedly delivers $239.19 net profit on a $1,300 investment, while a $100 beginner contract offers risk-free testing.

Hackers Leverage Ethereum Smart Contracts to Conceal Malware in npm Packages

Cybercriminals are deploying Ethereum smart contracts as a novel vector to hide malicious code within widely used npm packages. The tactic, uncovered by ReversingLabs, exploits blockchain's immutability to evade traditional security measures.

Two packages—'colortoolsv2' and 'mimelib2'—were found retrieving command-and-control instructions from Ethereum contracts rather than hardcoded URLs. This approach renders detection and takedowns significantly more challenging, as the malicious payloads remain decentralized.

The campaign employs sophisticated social engineering, including fake GitHub repositories targeting developers. Lucija Valentic of ReversingLabs notes the method represents a paradigm shift in malware distribution, leveraging blockchain's legitimate infrastructure for illicit purposes.

Etherscan Launches Seiscan for Sei Network

Etherscan, the premier block explorer for Ethereum and EVM-compatible chains, has introduced Seiscan—a dedicated analytics platform for the Sei Network. The toolset empowers developers with real-time transaction tracking, smart contract auditing, and wallet monitoring on Sei's high-throughput Layer 1 blockchain.

This strategic expansion underscores Etherscan's commitment to infrastructure support for emerging ecosystems. Sei's focus on optimized trading infrastructure gains credibility through enhanced transparency tools, potentially accelerating adoption among institutional builders.

Etherealize Secures $40M to Boost Institutional Ethereum Adoption

Etherealize has raised $40 million in a funding round led by Electric Capital and Paradigm, aiming to accelerate Ethereum's integration into traditional finance. The firm focuses on bridging the gap between Ethereum's ecosystem and institutional needs, with plans to develop private trading and settlement platforms for tokenized assets.

Institutional interest in Ethereum is surging, evidenced by public firms purchasing over $1.2 billion worth of Ether this week alone. Launched in January 2025, Etherealize seeks to provide clarity, tools, and regulatory-compliant infrastructure to institutions still grappling with Ethereum's complexities.

Is ETH a good investment?

Based on current technical and fundamental analysis, ETH presents a compelling investment opportunity with some near-term caution advised. The cryptocurrency is trading below its 20-day moving average at $4,311.45, indicating potential resistance around $4,430. However, several positive factors support long-term growth:

| Metric | Current Value | Implication |

|---|---|---|

| Price | $4,311.45 | Below 20-day MA, needs breakout |

| MACD Histogram | +94.15 | Bullish momentum building |

| Bollinger Position | Middle Band | Neutral territory |

| Exchange Reserves | 3-Year Low | Reduced selling pressure |

| Institutional Funding | $40M Recent Raise | Growing adoption |

BTCC financial analyst Michael suggests that while short-term volatility may persist, the fundamental case for ETH remains strong due to staking yields, institutional adoption, and supply constraints. Investors should consider dollar-cost averaging and monitor the $4,430 resistance level for breakout confirmation.