#TRX

- Technical indicators show TRX testing critical support with bullish MACD crossover suggesting potential upward momentum

- Fundamental developments including NEAR collaboration and institutional demand creating positive market sentiment

- Price targets indicate potential movement toward $0.42 based on combined technical and fundamental analysis

TRX Price Prediction

Technical Analysis: TRX at Critical Juncture

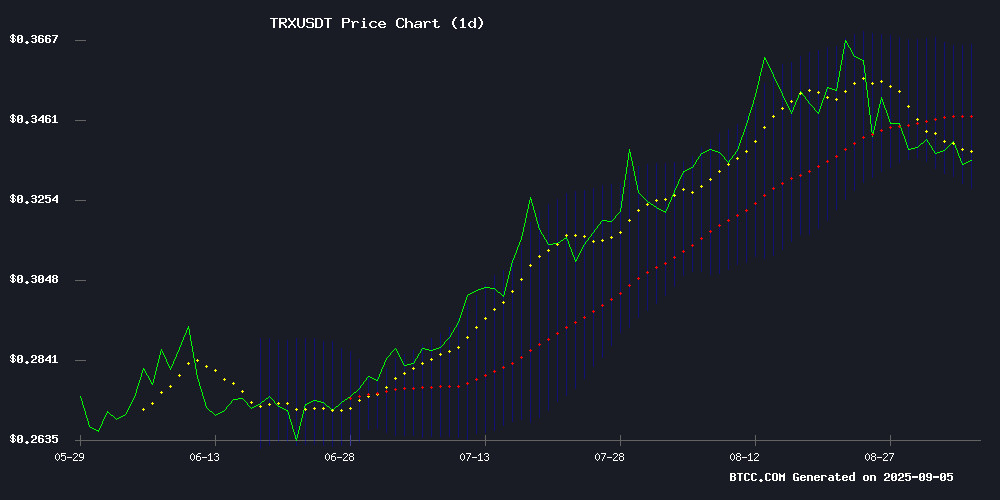

TRX is currently trading at $0.3357, below its 20-day moving average of $0.3469, indicating short-term bearish pressure. However, the MACD shows a bullish crossover with the histogram at 0.006636, suggesting potential upward momentum. The Bollinger Bands reveal price action NEAR the lower band at $0.3284, which often serves as support. According to BTCC financial analyst William, 'The technical setup suggests TRX is testing crucial support levels. A bounce from current levels could target the middle Bollinger Band around $0.347, with a breakthrough potentially reaching $0.365.'

Market Sentiment: Bullish Catalysts Emerging

Recent developments including the NEAR and TRON collaboration for cross-chain stablecoin transfers and institutional demand are creating positive momentum. Justin Sun's announcements regarding HTX's yield products and removal of limits are generating additional market optimism. BTCC financial analyst William notes, 'The fundamental news flow aligns with technical indicators suggesting TRX may lead the next altcoin recovery wave. Institutional interest and on-chain strength could propel TRX toward the $0.42 target mentioned in recent predictions.'

Factors Influencing TRX's Price

NEAR and TRON Collaborate to Enable Frictionless Cross-Chain Stablecoin Transfers

TRON DAO has announced a strategic partnership with NEAR Protocol to integrate NEAR Intents into the TRON blockchain. This integration simplifies cross-chain transactions by eliminating the need for wallet setups, bridging, or chain-specific knowledge—marking a significant leap in blockchain usability.

NEAR Intents operates as a multichain transaction protocol, allowing users to issue requests while third parties compete to fulfill them optimally. The technology abstracts away blockchain complexity, creating a unified interface for both crypto and traditional services. Its integration with TRON, one of the most active blockchains by user base, could accelerate mainstream adoption of decentralized applications.

The collaboration underscores a broader industry shift toward chain abstraction, where AI and users interact with multi-chain ecosystems as if they were a single network. TRON’s vast community combined with NEAR’s intent-centric architecture positions this partnership as a potential catalyst for cross-chain liquidity and DeFi innovation.

TRON (TRX) Price Prediction: Institutional Demand and On-Chain Strength Fuel Targets Towards $0.42

TRX price has begun to regain momentum as institutional and retail interest converges. Nasdaq-listed TRON Inc. has doubled its TRX holdings, injecting $110 million to elevate its treasury above $220 million—a clear signal of institutional confidence.

The accumulation creates a demand floor, absorbing sell-side pressure and reinforcing TRX's price stability. Trading near $0.33, TRX has broken out of a long-term weekly channel, with sustained positioning above this level potentially accelerating upward trajectories.

Justin Sun Addresses HTX’s High-Yield Products Amid User Scrutiny

Justin Sun, founder of TRON and adviser to HTX, has publicly responded to concerns surrounding the exchange's high-interest financial products. The executive framed the offerings as a strategic play for user acquisition, comparing the subsidies to retail marketing tactics.

Sun emphasized full transparency in funding these yields, stating they are entirely platform-subsidized. "This is standard competition among trading platforms," he noted via social media, inviting users to deposit without restrictions. The approach aligns with HTX's growth-phase strategy of prioritizing market share over immediate profitability.

HTX to Boost Yields and Remove Limits, Says Justin Sun

Justin Sun, founder of TRON and HTX, unveiled plans to enhance stablecoin yields on the HTX platform while eliminating deposit restrictions. The exchange will fully subsidize these elevated returns, offering users a seamless path to higher earnings through stablecoin staking.

The strategic move targets broader participation in crypto finance by simplifying yield generation. HTX's subsidy-backed approach removes traditional barriers, positioning the exchange as a competitive player in the incentivized DeFi landscape.

Tron (TRX) May Lead Next Altcoin Bullish Recovery Wave

Tron network emerges as a potential bellwether for altcoin market momentum, with recent data revealing heightened activity. The network saw a surge in daily deposit transactions over the past four weeks, particularly in USDT deposits, signaling smart money positioning.

Whale activity on the Tron network has spiked, with addresses holding over $100 million moving $3.8 billion in a single day—a multi-month high. This level of institutional engagement mirrors patterns observed in June, suggesting renewed confidence in the altcoin sector.

Contrary to typical bear market behavior, rising liquidity indicates traders are preparing for increased activity. The trend, which began in August, extended into September with sustained deposit momentum.

TRON (TRX) Tests Critical Support at $0.34 Amid Mixed Technical Signals

TRX price holds steady at $0.34 despite bearish MACD indicators, buoyed by a $110 million institutional investment from Bravemorning Limited. The injection elevates the firm's total TRX holdings to $220 million, underscoring long-term confidence in the protocol.

Technical signals remain neutral with an RSI of 46.17, suggesting potential upside. However, profit-taking has emerged after a 26% quarterly rally, resulting in $2.95 million in net outflows as TRX approached overbought territory at $0.35 last week.

How High Will TRX Price Go?

Based on current technical indicators and fundamental developments, TRX shows potential for significant upward movement. The current price of $0.3357 is testing critical support, with technical analysis suggesting a bounce could target $0.347 initially, followed by $0.365. Fundamental catalysts including the NEAR partnership and institutional demand could drive prices toward the $0.42 target. However, traders should monitor the $0.328 support level closely, as a break below could signal further downside.

| Target Level | Price | Probability |

|---|---|---|

| Initial Resistance | $0.347 | High |

| Upper Bollinger | $0.365 | Medium |

| Bullish Target | $0.42 | Medium |