#TRX

- Technical indicators show bullish MACD momentum with price holding above key support levels

- Mixed news sentiment with negative headlines offset by strong USDT liquidity growth fundamentals

- Potential price targets range from $0.365 to $0.42 depending on resolution of current market controversies

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Indicators

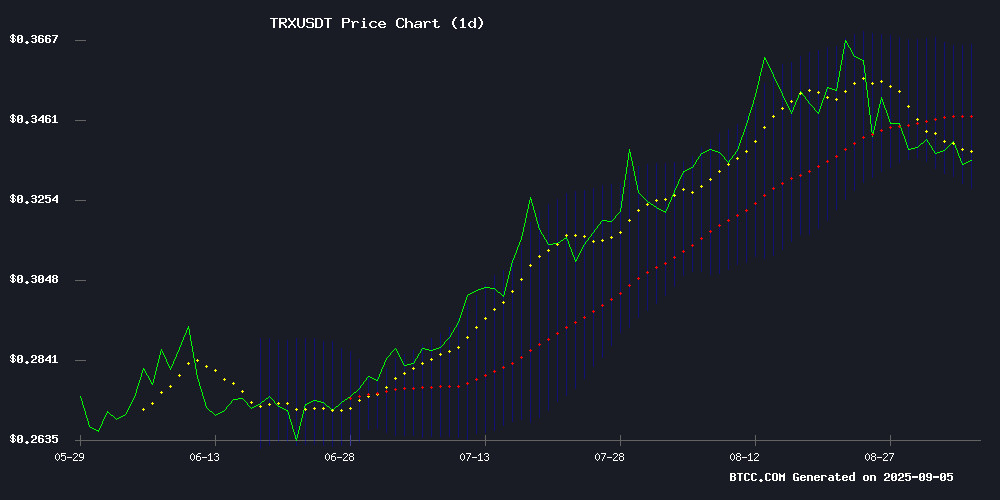

TRX is currently trading at $0.3373, slightly below its 20-day moving average of $0.3470, indicating potential consolidation. The MACD reading of 0.009965 with a positive histogram of 0.006542 suggests building bullish momentum. According to BTCC financial analyst William, 'The price holding above the Bollinger Lower Band at $0.3287 while MACD remains positive indicates underlying strength. A break above the middle band could target the upper band resistance at $0.3653.'

Market Sentiment: Mixed News Flow Creates Uncertainty

Recent developments present a complex picture for TRX. Justin Sun's involvement in the WLFI token controversy and blacklisting incidents create short-term headwinds, while TRON's USDT liquidity surge signals strong fundamental growth. BTCC financial analyst William notes, 'The negative news creates temporary pressure, but the underlying USDT adoption story remains compelling. Market sentiment appears cautiously optimistic despite the headline risks.'

Factors Influencing TRX's Price

Justin Sun Demands Unfreezing of WLFI Tokens, Cites Investor Rights

Tron founder Justin Sun has publicly challenged World Liberty Financial's decision to freeze 540 million WLFI tokens tied to his wallet. The move followed several outbound transactions from a Sun-linked ethereum address.

"These unreasonable freezes violate legitimate investor rights," SUN declared on X, urging the project to "respect these principles" and release his holdings. The blockchain entrepreneur positioned himself as an early supporter who contributed both capital and trust to the WLFI project.

Sun claims the flagged transactions were merely "generic exchange deposit tests," arguing that true financial innovation requires fairness and transparency. The dispute emerges as TRON-based assets continue gaining institutional attention.

World Liberty Financial Accuses Exchange of Token Manipulation, Justin Sun Blacklisted

World Liberty Financial (WLFI), a new DeFi platform backed by the TRUMP family, has accused an unnamed cryptocurrency exchange of manipulating its WLFI token to drive down prices. The token debuted at $0.47 on September 1 but plummeted 61% to $0.18 within days. WLFI claims the exchange engaged in market manipulation, alongside suspicious activity from Tron founder Justin Sun's wallet.

The platform has blacklisted Sun's wallet, freezing $540 million in unlocked WLFI tokens and locking 2.4 billion more. Sun denies the allegations, stating his address only conducted minor exchange deposit tests. The controversy highlights the volatility and risks in DeFi markets, particularly for newly launched tokens.

TRON's USDT Liquidity Surge Signals Potential Breakout Toward $0.42

Orca wallets now dominate 52% of TRON's USDT flows, a record high that historically precedes market expansions. This liquidity shift mirrors August's pattern, which catalyzed an 8% Bitcoin rally. TRX's price consolidation at $0.338 sets the stage for a potential breakout, with technical indicators suggesting bullish momentum.

The emergence of a cup-and-handle pattern on TRX's daily chart points to continuation potential, with critical resistance between $0.356-$0.37. A successful breach could propel the token toward Fibonacci targets at $0.39 and ultimately $0.42. Market dynamics reflect preparation for volatility—spot outflows and negative funding rates create conditions for a short squeeze.

TRON's deep integration with USDT amplifies the significance of these liquidity movements. Mid-tier wallets are driving the activity, indicating strategic positioning by informed market participants rather than retail speculation alone.

Justin Sun's Wallet Blacklisted Amid WLFI Token Controversy

World Liberty Financial has blacklisted TRON founder Justin Sun's wallet following allegations of market manipulation involving the WLFI token. The move comes just days after WLFI began trading on major exchanges, with trading volume exceeding $1 billion in its first hour.

Sun, WLFI's largest outside investor with a $75 million stake, saw 600 million of his tokens unlocked at launch. Despite public assurances he wouldn't sell, $9 million worth of WLFI was transferred from his address. The token's price volatility has raised concerns, swinging between $0.40 and $0.20 during its debut.

The controversy extends beyond Sun. The TRUMP family's 22.5 billion WLFI tokens briefly reached a $5 billion paper valuation. Regulatory scrutiny appears likely given Sun's ongoing legal issues and WLFI's connections to U.S. political figures.

How High Will TRX Price Go?

Based on current technical indicators and market developments, TRX shows potential for upward movement toward $0.42. The combination of positive MACD momentum, support above the Bollinger lower band, and growing USDT liquidity creates favorable conditions. However, investors should monitor the resolution of the WLFI token controversy and any developments regarding Justin Sun's blacklisting status.

| Target Level | Probability | Key Drivers |

|---|---|---|

| $0.365 (Upper Bollinger) | High | Technical breakout, MACD momentum |

| $0.42 | Medium | USDT adoption growth, market sentiment improvement |

| $0.38-0.40 | Medium-High | Resolution of current controversies |