#LTC

- Technical Consolidation: LTC trades near its 20-day moving average with mixed momentum indicators suggesting short-term uncertainty

- Market Sentiment Shift: Investor attention is rotating toward newer blockchain projects, creating headwinds for established assets like Litecoin

- Key Levels to Watch: $114 resistance break could trigger momentum toward $122, while failure may test $106 support

LTC Price Prediction

Technical Analysis: LTC Shows Mixed Signals Near Key Moving Average

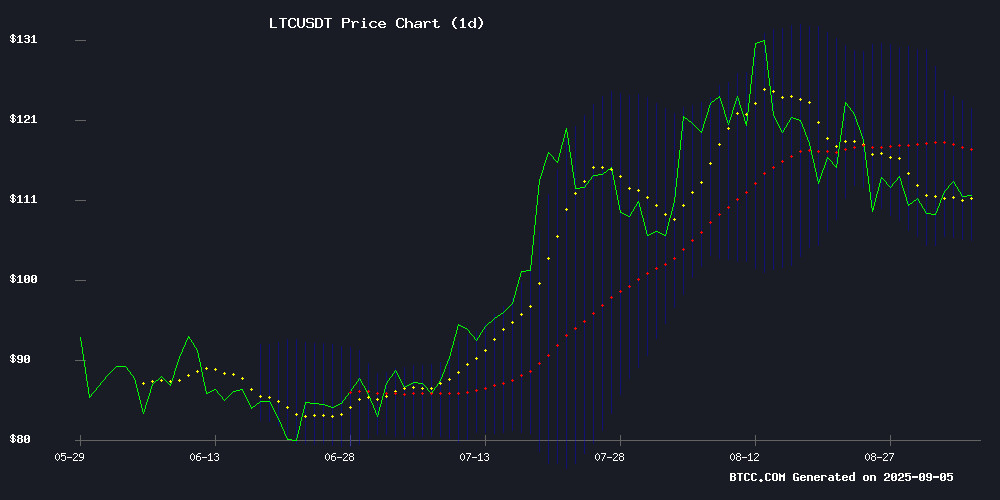

Litecoin is currently trading at $112.22, slightly below its 20-day moving average of $113.97, indicating potential resistance at this level. The MACD reading of 5.3549 versus its signal line at 4.7844 shows bullish momentum remains intact with a positive histogram of 0.5705. Bollinger Bands positioning between $122.28 (upper) and $105.66 (lower) suggests the cryptocurrency is trading within a normal volatility range, though approaching the middle band may indicate consolidation.

According to BTCC financial analyst Robert, 'LTC's technical setup shows it's testing important support-resistance conversion around the 20-day MA. A sustained break above $114 could trigger momentum toward the upper Bollinger Band around $122.'

Market Sentiment: Litecoin Faces Mixed Fundamentals Amid Sector Rotation

Recent news flow presents a nuanced picture for Litecoin. While the broader crypto bull run continues, LTC appears to be experiencing some stagnation as investors rotate toward emerging Layer 2 solutions and new mining concepts. The cryptocurrency's recent commentary toward XRP has generated additional market discussion, though the fundamental remittance use case remains intact.

BTCC financial analyst Robert notes, 'Litecoin's current sentiment reflects a market that's diversifying into newer narratives. While not facing direct negative news, LTC needs stronger catalysts to break out from its current consolidation phase as attention shifts to newer projects offering potentially higher growth multiples.'

Factors Influencing LTC's Price

Layer Brett Emerges as a High-Potential Ethereum Layer 2 Contender Amidst Crypto Bull Run

Market analysts are eyeing Layer Brett, a new ethereum Layer 2 solution, as a standout performer with predictions of a 60x surge within the next 90 days. Unlike established cryptocurrencies such as HBAR, Litecoin, and Cardano, Layer Brett combines meme-driven virality with robust blockchain utility, targeting Ethereum's scalability challenges.

The project distinguishes itself by addressing high gas fees and slow transaction speeds on Ethereum's LAYER 1, offering a cost-effective and efficient alternative. This positions Layer Brett as a revolutionary player in the meme token space, contrasting with the slower growth trajectories of assets like Cardano.

While HBAR, Litecoin, and Cardano continue to attract mainstream attention, Layer Brett's presale momentum and technological edge suggest it could outpace its competitors in the current bull market.

Cardano and Litecoin Stagnate as Remittix Emerges for Potential 40x Growth

Cardano (ADA) and Litecoin (LTC), once hailed as market leaders, are struggling to break out of their current trading ranges. ADA trades flat near $0.83, with resistance at $1 proving formidable despite ecosystem upgrades. Litecoin mirrors this stagnation, failing to capitalize on its earlier promise.

Meanwhile, analysts spotlight Remittix (RTX) as a dark horse for 2025. Its rapid growth trajectory and scalable infrastructure position it as one of the few projects capable of delivering 40x returns. Market participants are shifting focus from legacy tokens to emerging opportunities like RTX, seeking the explosive growth that ADA and LTC currently lack.

Elon Musk's Dogecoin Influence Fuels Cloud Mining Interest as DNSBTC Gains Traction

Elon Musk's latest Dogecoin (DOGE) reference has reignited meme coin enthusiasm, but the ripple effects extend beyond speculative trading. Cloud mining platforms like DNSBTC are capitalizing on the heightened interest, offering users streamlined access to Bitcoin (BTC), Litecoin (LTC), and Dogecoin (DOGE) mining rewards without hardware overhead.

DNSBTC's $60 sign-up bonus and eco-friendly data centers in the U.S., Canada, and Iceland position it as a turnkey solution for passive crypto income. While Musk's tweets historically buoy DOGE prices, infrastructure providers now convert viral moments into sustainable participation.

Litecoin's 'Unwanted' Jab at XRP Sparks Market Cap Debate

Litecoin's official X account ignited a crypto community clash by labeling Ripple's XRP as 'unwanted,' drawing sharp rebukes from analysts and traders. The remark, framed as a judicial verdict with a gavel emoji, backfired as market participants highlighted XRP's $168.4 billion market cap—20 times larger than LTC's $8.6 billion valuation.

CrediBULL Crypto dismissed the criticism as baseless, noting XRP's enduring top-three market position reflects organic demand. 'Assets don’t maintain $170 billion valuations without utility,' he argued. The exchange underscores persistent tribalism in crypto, where protocol loyalty often overrides objective metrics.

Fleet Miner Expands Multichain Strategy with USD1 Launch on Coinbase and Solana

Fleet Miner's parent company, FLAMGP, has announced the availability of USD1 on Coinbase, marking a significant step in its compliant on-ramp strategy. The stablecoin also went live on solana with a $100M pre-mint to bolster DeFi integrations, including Raydium. Meanwhile, WLFI, the ecosystem token, has begun trading on multiple exchanges, drawing market attention to USD1's liquidity and reserve disclosures.

FLAMGP emphasized its commitment to stablecoin innovation and multichain infrastructure. Fleet Miner, its mobile cloud-mining platform, will enhance contract pacing, risk prompts, and mobile UX to offer a low-barrier entry for users. The platform abstracts mining complexities into a one-tap hashrate subscription, leveraging AI-driven efficiency and clean-energy solutions.

Users can activate cloud hashrate using assets like BTC, ETH, XRP, or USDT, with USD-denominated contracts settled daily. The platform aims to set new benchmarks in cloud mining service quality and risk control.

Is LTC a good investment?

Based on current technical and fundamental analysis, LTC presents a mixed investment case. The cryptocurrency trades near key technical levels with bullish MACD momentum but faces resistance at the 20-day moving average. Fundamentally, while Litecoin's established position in payments provides stability, it's currently overshadowed by newer blockchain narratives.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $112.22 | Neutral |

| 20-Day MA | $113.97 | Resistance |

| MACD | Bullish (0.5705) | Positive |

| Bollinger Position | Middle Band | Consolidation |

For investors with medium-term horizons, LTC could offer value if it breaks above $114 resistance, targeting the $122 upper Bollinger Band. However, those seeking explosive growth might find better opportunities in emerging sectors while using LTC as a portfolio stabilizer.