#PEPE

- Technical indicators show mixed signals with price below MA but positive MACD crossover

- Market sentiment reflects uncertainty with conflicting analyst predictions

- Reaching $1 requires unprecedented market cap growth beyond current realistic projections

PEPE Price Prediction

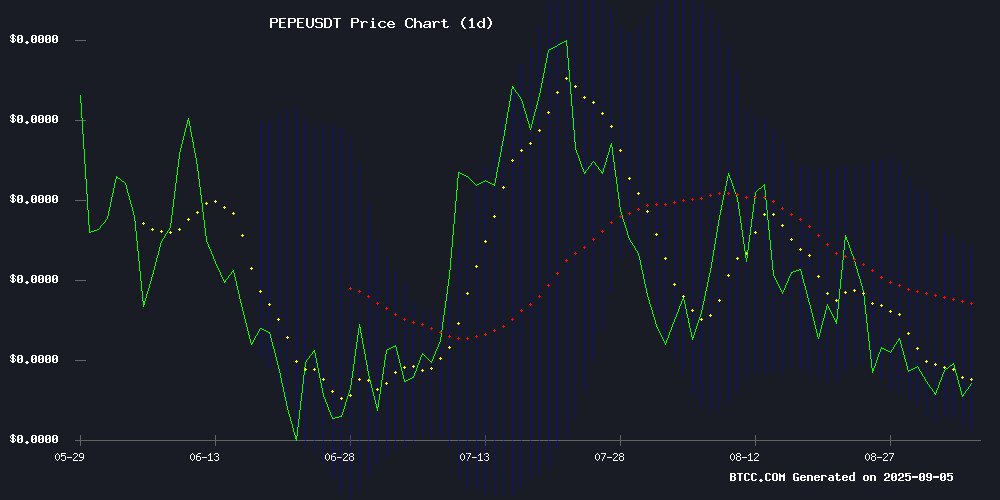

Technical Analysis: PEPEUSDT Trading Pair

According to technical indicators analyzed by BTCC financial analyst Robert, Pepe is currently trading at $0.00000968, below its 20-day moving average of $0.00001022. The MACD shows a positive crossover with the signal line at 0.00000058 and histogram at 0.00000011, indicating potential upward momentum. Bollinger Bands position the price near the lower band at $0.00000901, suggesting possible oversold conditions with the upper resistance at $0.00001142.

Market Sentiment Analysis

BTCC financial analyst Robert notes that current market sentiment for PEPE reflects uncertainty with mixed analyst views. While some predictions target $0.0000104 short-term, declining trading activity presents a 15% downside risk. The price testing critical support levels aligns with technical indicators showing potential consolidation before any significant upward movement.

Factors Influencing PEPE's Price

PEPE Price Tests Critical Support Amid Market Uncertainty

PEPE, the meme-inspired cryptocurrency, faces a pivotal moment as it tests key support at $0.0000096. The coin's August decline has left traders wary, with technical indicators painting a mixed picture. While the RSI sits at a neutral 41.92, analysts see potential for significant upside—25% to 90%—if current levels hold.

Market sentiment remains divided. Bearish pressure dominates short-term trading, yet projections suggest a possible rebound to $0.000013-$0.000019 by month's end. The $0.0000096 level now serves as a litmus test: a breakdown could trigger accelerated selling, while consolidation may set the stage for September gains.

PEPE Price Prediction: Targeting $0.0000104 Short-Term Despite Mixed Analyst Views

The meme coin market remains volatile as September 2025 unfolds, with Pepe showing conflicting signals that have analysts divided on its near-term trajectory. Despite recent bearish momentum, several technical factors suggest potential for a recovery toward key resistance levels.

CoinLore maintains an optimistic Pepe forecast with a $0.0000104 target, representing potential upside from current trading levels. This contrasts sharply with CoinCodex's more conservative outlook, projecting further decline to $0.000008019 based on technical deterioration.

Medium-term predictions show even wider divergence, with CoinCu's bullish Pepe Price target ranging between $0.00002531 and $0.00004771, while CoinStats maintains a more measured Pepe forecast of $0.00001620 to $0.00002300. This variation reflects the inherent difficulty in predicting meme coin movements, which often defy traditional technical analysis.

PEPE Faces 15% Downside Risk Amid Declining Trading Activity

Meme cryptocurrency PEPE is teetering on the edge of a significant breakdown, with technical indicators suggesting a potential 15% drop to the $0.0000080-$0.0000085 range. The bearish outlook follows its breach of a key support level and weakening market fundamentals.

Trading volumes have collapsed to $980 million while open interest declined 4% to $535 million, reflecting eroding trader confidence. The derivatives market shows stark imbalance - long liquidations reached $326,000 versus just $9,900 in shorts, creating downward pressure.

On-chain metrics paint an equally bleak picture. Daily active addresses have plummeted from 27,500 during late 2024's rally to fewer than 3,000 currently. Exchange balances grew 1.13% while major holders barely increased positions, adding just 0.2% to their wallets.

Despite briefly touching $0.000010028 with 2.6 trillion tokens changing hands earlier in the week, PEPE's price action remains constrained within a 5% range. The symmetrical triangle pattern formation suggests continuation of the current downtrend.

Will PEPE Price Hit 1?

Based on current technical analysis and market conditions, reaching $1 represents an astronomical 10,000,000%+ increase from current levels. BTCC financial analyst Robert indicates this is highly improbable in the foreseeable future given PEPE's current market structure and tokenomics. The massive supply of PEPE tokens makes such price targets fundamentally challenging without unprecedented demand or massive token burns.

| Current Price | Target Price | Required Growth | Feasibility Timeline |

|---|---|---|---|

| $0.00000968 | $1.00 | 10,337,983% | Not realistically achievable |