This is DeFi’s FOMC moment.

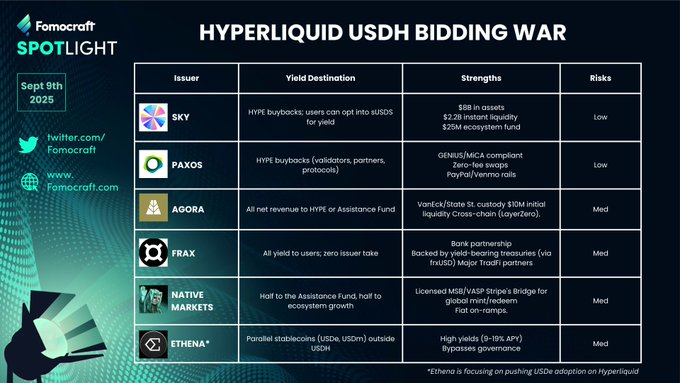

On Sept 14, @HyperliquidX validators will pick the issuer of $USDH, the chain’s first native stablecoin.

At stake are $5.7B in USDC generating ~$220M in annual yield.

Who captures the yield and who sets Hyperliquid’s monetary policy?

(a thread)

The stakes are high.

$5.7B in USDC generates ~$220M in annual yield.

Losing Hyperliquid could wipe ~10% of Circle’s revenue overnight.

Circle planned to launch native USDC and CCTP, but delays opened the door for USDH to take momentum.

Which brings us here.

This isn’t just another stablecoin auction.

It’s the first time validators get to choose their own central bank.

They’ll decide where the yield flows, who captures the benefits, and what becomes Hyperliquid’s monetary policy.

Who would you pick?

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share