OpenSea is heating up the Non-Fungible Token market with the launch of the multi-million dollar Flagship Collection. They are also allocating 50% of their revenue to a vault and preparing for the launch of the OpenSea SEA Token .

Is this a golden opportunity for investors and collectors to get ahead of the next wave?

The Most Optimistic Announcements in OpenSea History

OpenSea , one of the best Non-Fungible Token exchanges , just announced a series of major updates. The platform will launch a mobile version (OpenSea Mobile). They will also establish the Flagship Collection — a seven-figure Non-Fungible Token “treasure trove” to celebrate Web3 cultural heritage. Finally, they will launch the final phase of their pre-TGE rewards program, where a large portion of transaction fees will flow into a reward pool.

“Now we can accelerate. We are entering the most exciting phase in the company's history, as we evolve OpenSea into the best place to trade anything on chain.” OpenSea co-founder & CEO Chia on X.

OpenSea announced that it will allocate up to 50% of its platform fees to collect millions of Token and Non-Fungible Token into a prize pool. The project team estimates that the initial fund will hold around $1 million in OP and ARB Token . This is a marketing strategy and a way to “showcase” assets to enable the chest/reward experience for users. This is done before the official launch of the OpenSea SEA Token .

While the launch of the OpenSea SEA Token is a positive sign in this announcement, it is not new. OpenSea has been hinting at the Token for months , and the community has long speculated and debated a potential Airdrop .

Some community members noted that the SEA Token was hinted at eight months ago, making this latest announcement a strong indication that the Token Generation Event (TGE) is approaching. However, OpenSea stressed that the TGE will only take place once the core features are fully prepared.

Community reaction is Chia . The optimistic group sees this as a big boost to liquidation and engagement. They also XEM it as an indirect “buyback loop” for the Non Fungible Tokens that OpenSea collects into its vault.

The skeptics warn of short-term hype cycles and the risk of asset concentration in the platform’s vault. They also highlight potential selling pressure after the TGE if the Token is not designed with strong safeguards.

Some users have purchased Non-Fungible Token with the hope of reselling them to OpenSea or profiting from chest rewards. This clearly reflects a story-driven game rather than a bet on pure artistic value.

Benefits and risks

Strategically, a curated Non-Fungible Token inventory (Flagship Collection) could reinforce brand value and provide tangible PR content for the OpenSea SEA Token . Allocating a large portion of platform fees back into the ecosystem — in theory — like Token buyback/treasury mechanisms, could support a floor price for select collectibles.

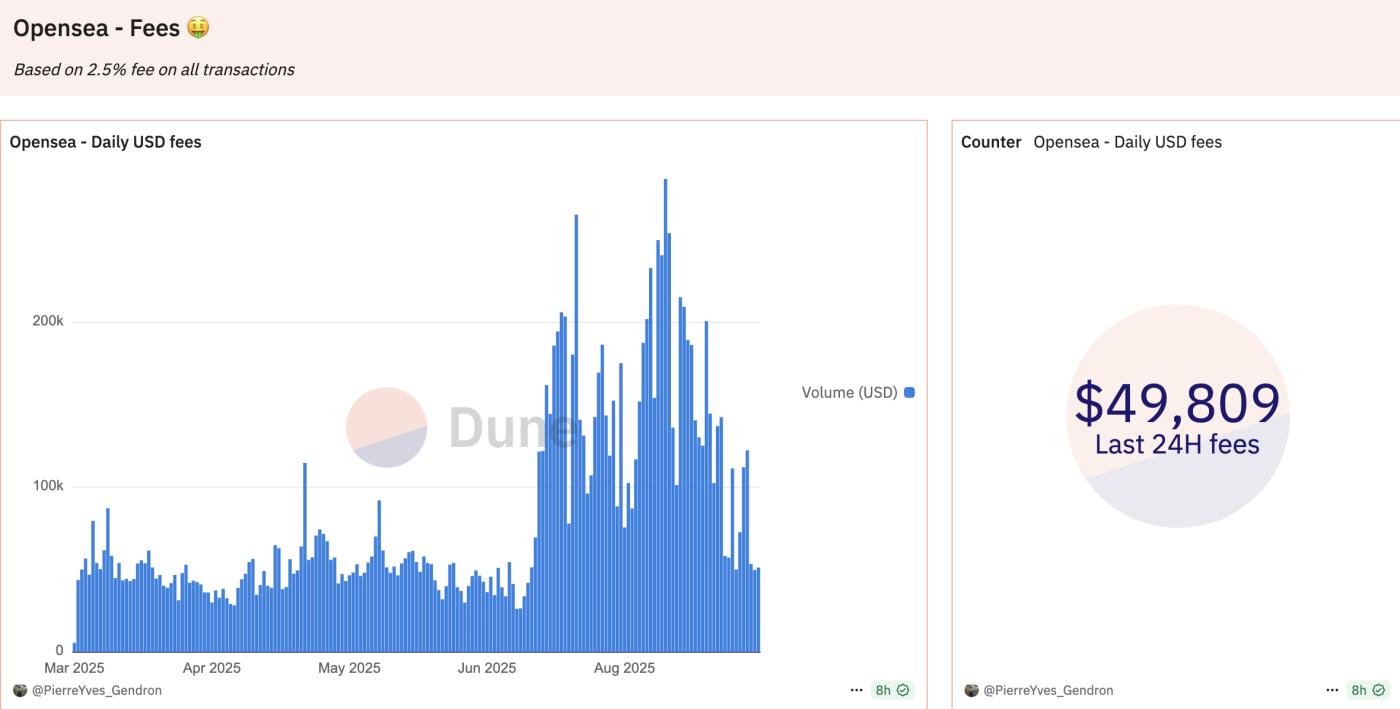

OpenSea Fees. Source: Dune

OpenSea Fees. Source: DuneHowever, the impact depends directly on the size of OpenSea’s revenue. Even a 50% fee allocation may not yield significant results if volume are low. Furthermore, if chest/reward mechanisms are lacking transparency, the result could be extreme volatility post-TGE. Or, if the tokenomics involved in the Airdrop distribution are too broad, the result could be extreme volatility post-TGE.

The legal and ethical risks should not be overlooked. Allocating 50% of the fee to a repository raises questions about its commitment to creators (royalties) and the balance of interests between the platform and the artist. It also raises questions about how OpenSea will manage this repository in the long term.