After a week-long fundraising process from many participating units, Hyperliquid validators decided to choose the “domestic” project Native Markets to take on the responsibility of developing the USDH stablecoin.

Native Markets wins bid for stablecoin USDH on Hyperliquid. Photo: The Block

Native Markets wins bid for stablecoin USDH on Hyperliquid. Photo: The Block

Why is this news important?

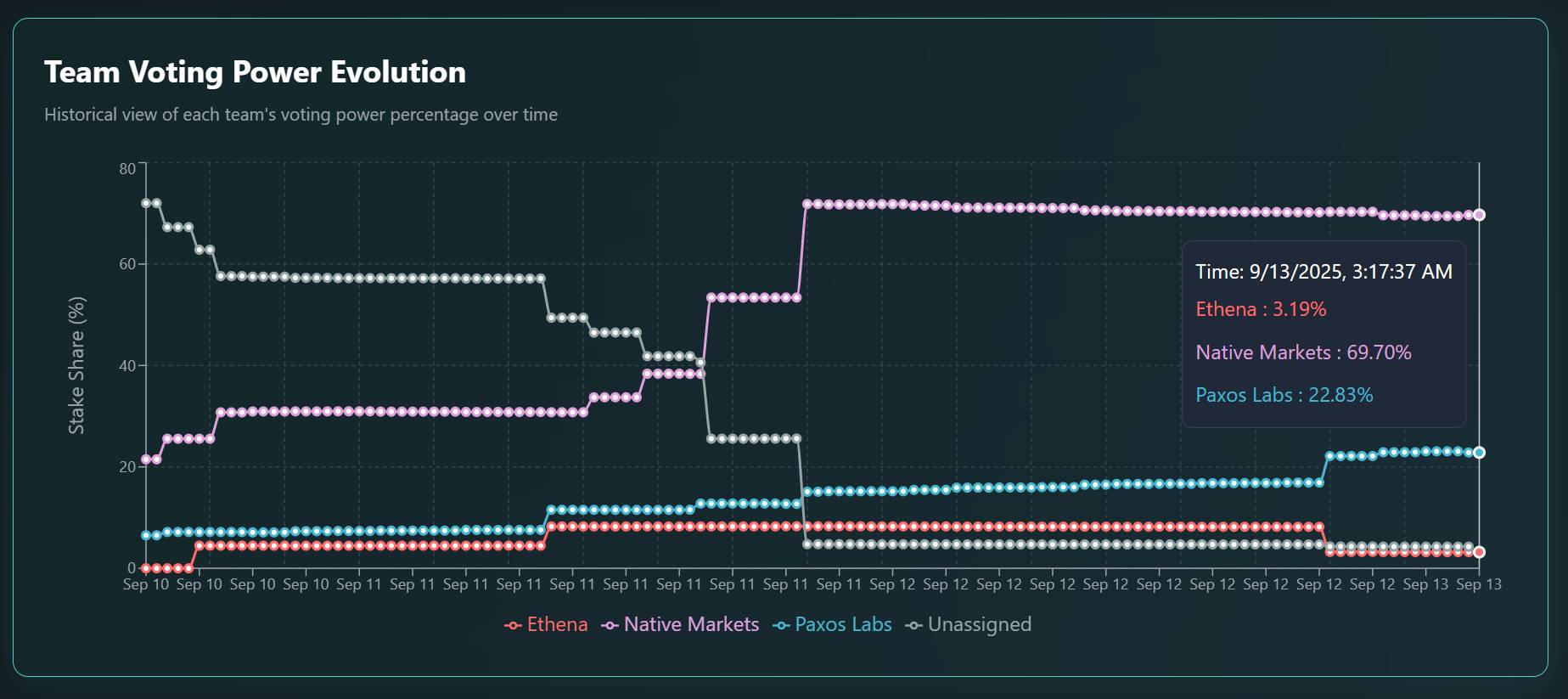

- Native Markets received an overwhelming support of nearly 70% from validators on Hyperliquid to win the bid to deploy the USDH stablecoin.

- This is the only project that originates from the Hyperliquid ecosystem itself, which is also the reason why validators support it because it will ensure benefits are tied to this blockchain, instead of choosing to trade off with private businesses like the other bidders.

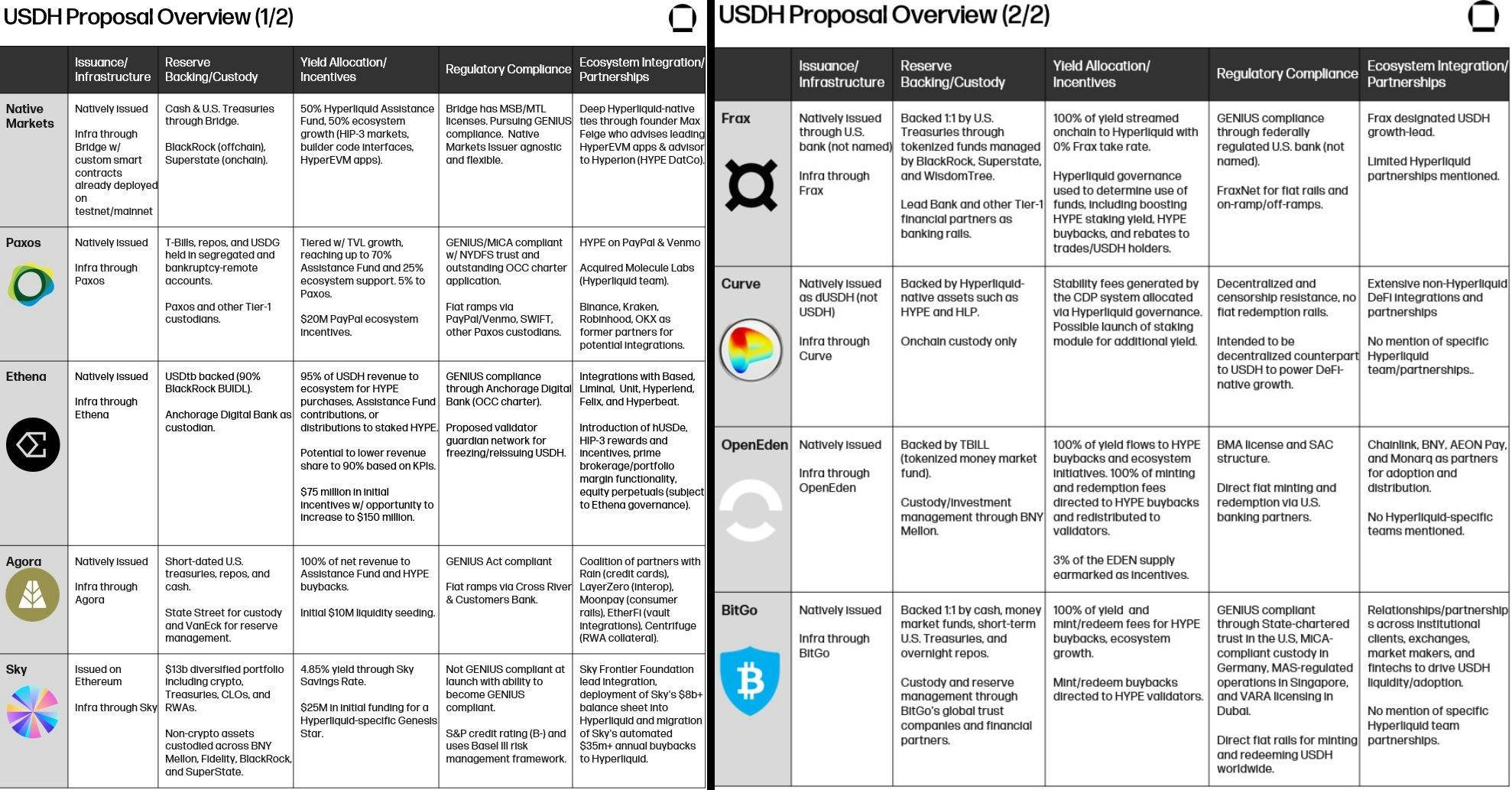

- The auction attracted participation from many big names in the cryptocurrency industry, including centralized stablecoin issuers (Paxos, Agora, BitGo) to decentralized (Frax, Sky, Ethena , Curve).

- Native Markets plans to test USDH in the next few days.

- USDH will be the second stablecoin supported on Hyperliquid, after USDC - a stablecoin that was promoted from the beginning with a supply on Hyperliquid of more than 6 billion USD but was considered to not bring any additional benefits to the ecosystem.

- The fact that the stablecoin USDH is being contested by many parties and even "rolled out the red carpet" with many attractive offers is proof of the heat of Hyperliquid - an ecosystem that has been growing significantly in recent times with stable functions and revenue - as well as the need to deploy stablecoins in the context of the US having just issued a law to manage this field, as well as this is the function of crypto that attracts more and more attention from large financial institutions.

Native Markets Wins Overwhelmingly in Auction for Hyperliquid’s USDH Stablecoin

According to the voting results on September 14, 2025, the validators of the Hyperliquid blockchain network have reached a majority consensus to select Native Markets as the issuer for the stablecoin USDH - the second stablecoin supported on this Derivative DEX after Circle 's USDC .

Accordingly, 10 out of 19 eligible validators participated in the vote to select Native Markets, with the HYPE Staking rate accounting for 69% - completely overwhelming the remaining proposals from big names such as Paxos, Agora, Sky, Ethena, ...

USDH winning bid vote results. Source: usdhtracker.xyz

USDH winning bid vote results. Source: usdhtracker.xyz

Native Markets co-founder @fiege_max – one of the early contributors to Hyperliquid and recognized by the community – issued a statement outlining the testing roadmap for USDH in the coming time.

USDH will soon be released for testing on both Hyperliquid as a HIP-1 Token and on Ethereum as an ERC-20 Token in the coming days. The project will then allow a limited number of users to test the issuance and conversion of stablecoins with a maximum value of $800 per transaction. If all goes well, Native Markets will join Hyperliquid in opening a USDH/ USDC trading pair to facilitate the transition, while also removing the cap on issuance and conversion of stablecoins.

The other two founders of Native Markets are Anish Agnihotri, a blockchain researcher, and MC Lader, former President and COO of Uniswap Labs.

We will be deploying both the USDH HIP-1 and corresponding ERC-20 within days.

— max.hl (@fiege_max) September 14, 2025

We will then start with a testing phase for mints and redemptions of up to $800/tx with an initial group, to be followed by the opening of the USDH/ USDC spot order book as well as uncapped mints &…

In its proposal, Native Markets claims to back USDH with cash and assets including US Treasury bills, with off-chain assets held by BlackRock and on-chain assets managed by Bridge, a stablecoin company acquired by payment processing giant Stripe in 2024. The project also pledges to use profits from the collateral assets to buy back HYPE and increase the supply of USDH.

Real voting or just administrative drama?

Summary of Hyperliquid's USDH stablecoin bid proposals. Source: Galaxy Research

Summary of Hyperliquid's USDH stablecoin bid proposals. Source: Galaxy Research

However, the vote also caused a lot of controversy in the community of people interested in the matter, with accusations such as:

- Validators colluded to choose Native Markets, despite the fact that this was a new project, had no successful product implementation, did not have extensive legal experience like other parties or connections to the traditional financial industry to promote acceptance, but was the first party to announce the bidding proposal as soon as Hyperliquid Chia information about its intention to find a USDH partner. Other units, because they were completely unaware of this news in advance, took 1-2 days or more to prepare the bidding package.

- The only advantage that Native Markets has over other famous stablecoin issuers is that this is a project that is completely originated from Hyperliquid, thus ensuring that the interests are tied to the blockchain and this perp DEX, unlike other parties who all have their own businesses and the risk of conflicts of interest.

- One validator even had a conspiracy theory accusing other bidders of “bribing” the validator to steer public opinion, but ultimately provided no evidence.

- All of which suggests that the USDH vote may be just a governance “drama” staged to maintain the decentralized facade of the project, while the winner was clearly determined from the beginning.

Putting aside the criticism, many people in the crypto community believe that Paxos, Agora or Ethena should continue with their plans to deploy their own stablecoins on Hyperliquid as proposed in the old proposal, because the vote is essentially just about the code name “USDH”, and if their stablecoin product is really good, let the community decide through the usage process and choose the name that really wins in the end.

The criteria for issuing stablecoins on Hyperliquid and using them as a value currency on the DEX include holding and Staking 200,000 HYPE (more than 10 million USD), ensuring the maintenance of the 1 USD value mark and having deep enough liquidation to serve transactions with USDC and HYPE.

In a statement released a few days ago, Ethena Labs founder Guy Young “hinted” that he had already purchased some tickers on Hyperliquid, suggesting that the stablecoin unit was about to deploy assets there.

Agreed, already bought our tickers weeks / months ago

— G | Ethena (@gdog97_)September 11, 2025

Coin68 synthesis