2025 has been a turning point for crypto tokenomics — with buyback booms and record-breaking token burns dominating the market. These strategies are reshaping how projects manage supply, create scarcity, and build investor confidence.

This guide breaks down what buybacks and burns mean, why they’re important, and which projects led the way in 2025 — with data-packed examples and key takeaways for traders and investors.

What is a Token Buyback?

A crypto buyback is when a project repurchases its own tokens from the open market — similar to a stock buyback in traditional finance.

Goals of Token Buybacks:

- ✅ Increase Token Value: Fewer tokens available can mean higher prices if demand stays steady.

- 💧 Improve Liquidity: Projects can stabilize the market and reduce volatility.

- ♻️ Support the Ecosystem: Funds are often used strategically (e.g., to create protocol-owned liquidity).

- 🔥 Buy-and-Burn: Some projects destroy repurchased tokens, making the event deflationary.

What is Token Burning?

Token burning is the permanent removal of tokens from circulation — usually by sending them to a “burn address” that no one controls.

Key Effect: Once burned, the tokens are gone forever, reducing supply and (potentially) increasing scarcity.

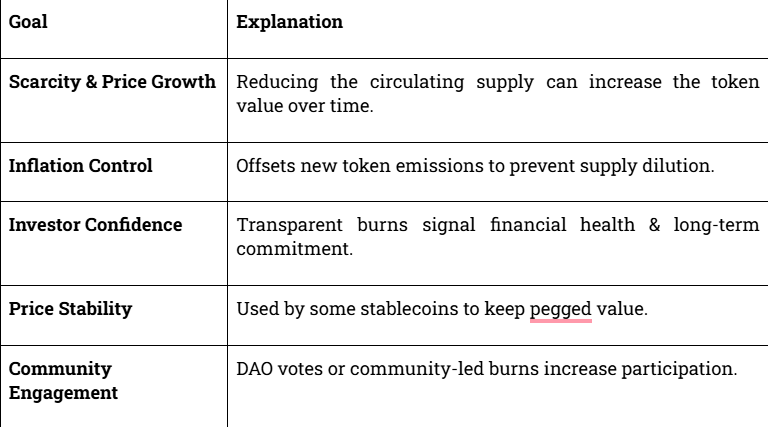

Why Crypto Projects Use Buybacks & Burns

Press enter or click to view image in full size

How Crypto Buybacks & Burns Work

- Crypto Buyback: Project uses revenue/treasury funds to purchase tokens from the market.

- Crypto Burn: Purchased tokens are sent to an inaccessible address, permanently removing them.

Implementation Types:

- 🗓 Scheduled: Predictable burns (e.g., Binance burns BNB quarterly).

- 🏛 Governance-Driven: DAO votes decide when and how much to burn.

- 🤖 Automated: Smart contracts execute burns based on revenue or fees (e.g., Ethereum’s EIP-1559).

- 👥 Community-Driven: Holders voluntarily burn tokens.

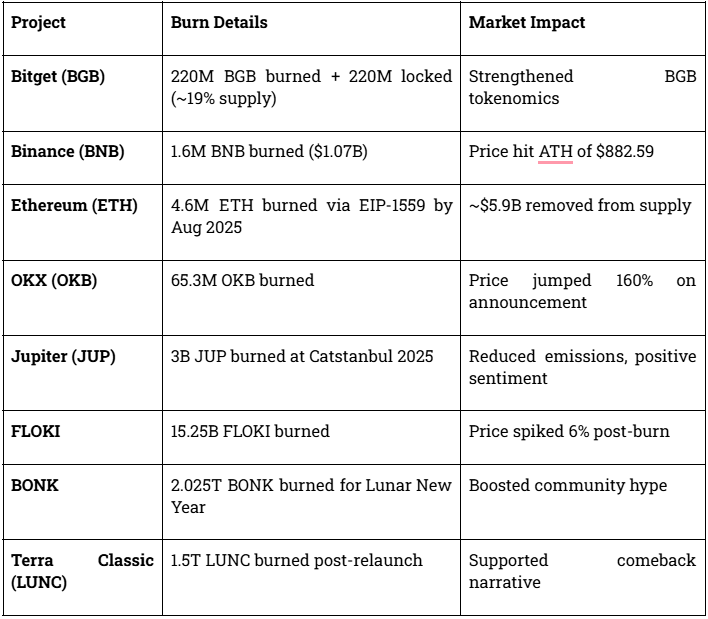

Biggest Token Burns of 2025

Press enter or click to view image in full size

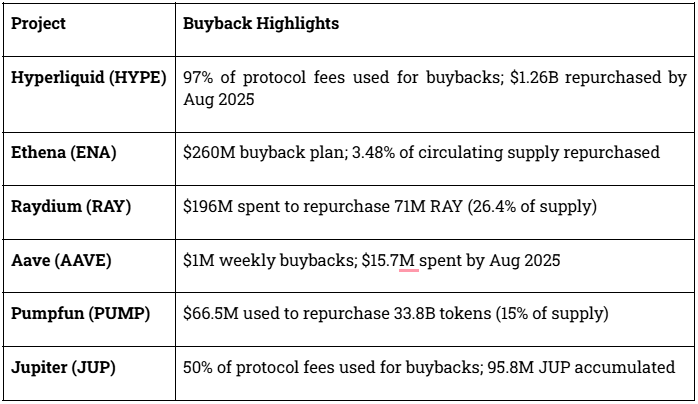

Biggest Token Buybacks of 2025

Impact on Token Prices

- Scarcity Effect: Burns can drive prices up (e.g., OKB +160%, Orca +76%).

- Short-Term Volatility: Prices can spike or dip temporarily post-burn.

- No Guaranteed Growth: About 30% of projects saw <10% price change despite burns.

- Deflationary Support: Regular burns (e.g., Ethereum) provide ongoing price support.

Impact on Traders & Investors

- 🔑 Confidence Booster: Transparent burns show project commitment.

- 🚀 FOMO Triggers: Scarcity narratives attract buyers.

- 📉 Liquidity Risk: Too many burns can hurt market liquidity.

- ⚠️ Potential Manipulation: Large buybacks may create short-lived price pumps.

- 🏛 Regulatory Scrutiny: Some jurisdictions may view buybacks as price manipulation.

Conclusion

Buybacks and burns are now core tokenomics strategies — but they are not magic bullets.

They work best when:

- 🔍 Backed by real revenue and strong fundamentals

- 📊 Executed transparently and consistently

- 🤝 Aligned with community and regulatory expectations

As crypto matures, expect more automated, data-driven, and governance-led buybacks/burns, shaping a more predictable and investor-friendly market.