Compiled by: Zhou, ChainCatcher

Important Information:

- Fed dot plot: overall more accommodative, one official expects a 150 basis point rate cut this year

- Bullish, a crypto exchage, reported a return to profitability in its first quarterly report after its IPO, with net profit reaching $108.3 million.

- BNB's market capitalization exceeded $133 billion, setting a new record, surpassing UBS and ranking 166th in global asset market capitalization.

- CZ: We have contacted about 50 potential DAT teams and will only support a few strong companies

- Lee Ka-chiu: Hong Kong is implementing a stablecoin issuer regime to promote tokenized asset trading

- Tether CEO: The company's profit margin is as high as 99%, and it made $13.7 billion in profit last year

- Binance is in talks with the U.S. Department of Justice to remove key oversight requirements from its $4.3 billion settlement.

What important things happened in the past 24 hours?

According to ChainCatcher and The Block, DeFi Development Corp. (ticker symbol DFDV) has purchased an additional 62,745 Sol tokens, valued at approximately $14.6 million. This brings the company's total Sol token holdings to over 2 million, valued at nearly $500 million. With approximately 25 million shares outstanding, the company's Sol token value per share is approximately $19.44.

According to ChainCatcher, the cryptocurrency exchange Bullish released its first quarterly financial report after its listing, achieving quarterly profitability. In the quarter ending June 30, the company's net profit reached US$108.3 million (US$0.93 per share), a significant turnaround from the net loss of US$116.4 million (US$1.03 per share) in the same period last year.

Powell: This rate cut is a risk management cut

ChainCatcher reported that the Federal Reserve cut interest rates by 25 basis points in September, a move supported by most Trump-appointed Fed officials, with only new Governor Milan dissenting, preferring a 50 basis point cut. At a press conference, Fed Chairman Powell stated that Wednesday's rate cut was a risk management decision, adding that he did not see a need for a rapid adjustment in interest rates.

Fed dot plot: overall more accommodative, one official expects a 150 basis point rate cut this year

ChainCatcher reports that according to Jinshi, the Federal Reserve's dot plot shows that among the 19 officials, one believes there will be no interest rate cuts in 2025, six believe a cumulative 25 basis point cut should be made, two believe a 50 basis point cut should be made, and nine believe a 75 basis point cut should be made. An official, most likely from Milan, predicts a significant 150 basis point cut in 2025 and believes there will be at least two more significant cuts this year.

Defi Dev Corp increased its holdings by 62,745 SOL, bringing its total holdings to 2.095 million.

According to ChainCatcher, according to official news, Nasdaq-listed company DeFi Dev Corp (DFDV) announced that it had increased its holdings of 62,745 SOL, bringing its total treasury SOL holdings to 2,095,748, which is worth approximately US$499 million as of September 16, 2025.

According to ChainCatcher, Caixin reported that Lu Lei, deputy governor of the People's Bank of China, revealed at the 14th China Payment and Clearing Forum that cross-border QR code payment interoperability has made significant progress. Alipay and Ant International, subsidiaries of Ant Group, have become the first institutions to participate in the cross-border QR code unified gateway business pilot.

According to ChainCatcher, Crypto in America reported that the U.S. Congress held a meeting on September 17 to promote legislation for a strategic Bitcoin reserve. Several Republican lawmakers, including Senators Ted Cruz and Marsha Blackburn, and industry representatives, including MicroStrategy founder Michael Saylor, attended the meeting.

The BITCOIN Act was reintroduced by Senator Cynthia Lummis in March of this year. The bill aims to include Bitcoin in the national strategic reserve assets on an equal footing with gold, and requires the US government to purchase 1 million Bitcoins in the next five years.

Yunfeng Financial's wholly-owned subsidiary completes RWA tokenization of FOF fund investment shares

According to ChainCatcher, Yunfeng Financial Group announced that its blockchain technology team has successfully tokenized the real-world assets (RWA) of FOF (fund of funds) shares invested by its wholly-owned subsidiary, and issued the first RWA project independently completed by Yunfeng Financial, further promoting the deep integration of traditional finance and blockchain technology.

Bullish Obtains New York BitLicense, Set to Expand into the US Market

According to ChainCatcher, CoinDesk reported that the New York Department of Financial Services has issued a virtual currency business activity license to Bullish US Operations LLC, enabling it to provide spot trading and custody services to New York institutions and advanced traders.

According to ChainCatcher, in the federal funds futures market of the Chicago Mercantile Exchange (CME), a "mysterious trader" is currently guarding against a super dovish surprise in the Federal Reserve's decision this week.

According to researcher Ed Bolingbroke, Monday's front-end-of-the-curve flows saw the largest block trade in Fed Funds futures ever, with the Chicago Mercantile Exchange confirming the trade on its X platform.

It is reported that the price and timing of the block transaction are consistent with the buyer's characteristics. Given that the current swap market has fully digested the expectation of a 25 basis point rate cut, this move may suggest that the mysterious trader is hedging the risk of a 50 basis point cut in the Federal Reserve's decision on Wednesday.

H100 Group increased its holdings by 21 BTC, bringing its total holdings to 1,046.

According to ChainCatcher, H100 Group has officially announced that it has increased its holdings of Bitcoin by 21 at an average price of approximately SEK 1,087,500 per Bitcoin. Currently, the company holds a total of 1,046 Bitcoins.

Binance Wallet and Aspecta Partner to Launch BuildKey TGE Model

According to ChainCatcher, Binance Wallet and Aspecta have partnered to launch the BuildKey Time-Generating (TGE) model. Participants depositing BNB will receive BuildKeys, a certificate representing their token allocation. BuildKeys can be traded in the Bond Curve liquidity pool or held until the TGE to redeem tokens. The first project to utilize this new Aspecta BuildKey TGE model will be announced on September 18th.

Forward Industries Launches $4 Billion ATM Program to Support Solana Treasury Strategy

According to ChainCatcher, Forward Industries (FORD), the largest Solana treasury company, announced today that it has submitted a $4 billion ATM plan to the U.S. SEC to provide financial support for its Solana financial strategy.

The fund will be used for general corporate purposes, including the continued execution of Solana's strategy, acquisitions of revenue-generating assets, and other capital expenditures. Previously, Forward Industries completed a $1.65 billion PIPE private placement led by Galaxy Digital, Jump Crypto, and Multicoin Capital, and purchased over 6.8 million SOL tokens, becoming the world's largest publicly traded Solana financial company.

Metaplanet plans to invest $1.25 billion to increase its Bitcoin holdings

According to ChainCatcher, Cointelegraph reported that Metaplanet announced plans to invest $1.25 billion to increase its Bitcoin holdings by October and invest $139 million in its Bitcoin revenue generation department.

Binance Completes Maker (MKR) Token Swap, Increment, and Rebrand to Sky (SKY)

According to ChainCatcher, Binance completed the Maker (MKR) token swap, token increment, and rebranding to Sky (SKY) on September 17, 2025, and opened deposits and withdrawals for the new SKY token. Binance also launched spot trading for SKY/BTC, SKY/TRY, SKY/USDC, and SKY/USDT at 4:00 PM on the same day. Users can enable the new trading pairs through spot copy trading settings.

Economist: Japan's debt crisis risk may drive up demand for cryptocurrencies

According to ChainCatcher, economist Robin Brooks analyzed that Japan is facing a potential debt crisis, with its debt-to-GDP ratio reaching approximately 240%, further exacerbated by inflation and rising bond yields. However, a US recession could provide a brief window of relief for Japan, lowering global bond yields and easing fiscal pressure.

Brooks pointed out that Japan is currently caught in a dilemma: if it maintains low interest rates, it may cause the yen to depreciate further and trigger runaway inflation; if it allows yields to rise further to stabilize the yen, it may jeopardize debt sustainability. This dilemma may prompt investors to turn to alternative financial instruments such as cryptocurrencies and stablecoins.

Lee Ka-chiu: Hong Kong is implementing a stablecoin issuer regime to promote tokenized asset trading

ChainCatcher reports that according to Jinshi, Hong Kong Chief Executive John Lee stated in his fourth policy address that the Hong Kong Monetary Authority will encourage commercial banks to launch tokenized deposits and promote the trading of real tokenized assets. Lee also noted that Hong Kong is implementing a stablecoin issuer regime and developing legislative proposals for a licensing system for digital asset trading and custody services. He also emphasized that Hong Kong is strengthening international tax cooperation to combat cross-border tax evasion.

CZ: We have contacted about 50 potential DAT teams and will only support a few strong companies

According to ChainCatcher, B Strategy, the BNB treasury company, released a video on the X platform featuring a conversation between its founders, Leon Lu, and CZ Zhao. In the video, CZ stated that BNB is a utility token and a native currency on multiple blockchains. BNB is also one of the few tokens with numerous use cases on CEXs, including trading discounts, yield generation, Launchpad, Launchpool, and Alpha. It is also used for payments in some countries.

Regarding the BNB digital asset treasury (DAT), CZ said that he has contacted about 50 potential DAT teams, but cannot provide support to all BNB DAT companies and will only support a few strong companies.

According to ChainCatcher, crypto influencer AB Kuai.Dong (@_FORAB), Vitalik attended the Japan Developer Conference. At the conference, Vitalik stated that Ethereum's short-term goal is to expand capacity by increasing the gas limit of Ethereum's L1 while maintaining decentralization.

According to ChainCatcher, Bitwise Chief Investment Officer Matt Hougan warned that the U.S. Securities and Exchange Commission (SEC)'s simplification of the cryptocurrency ETP approval process may trigger the emergence of a new batch of products, but this does not guarantee their success.

Coinbase data breach suspect's phone contained over 10,000 customer details

ChainCatcher reported that according to Fortune magazine, the amended indictment filed by the class action law firm Greenbaum Olbrantz on Tuesday showed that Ashita Mishra, the core suspect in the Coinbase data leak and a former employee of the outsourcing company TaskUs, stored sensitive information of more than 10,000 customers on her mobile phone.

According to ChainCatcher, BNB briefly surpassed $960, possibly due to CZ's changes to his social media profiles and Binance's negotiation with the US Department of Justice to remove key oversight requirements. According to the latest data from Coingecko, BNB's market capitalization has exceeded $133 billion, setting a new all-time high. Furthermore, according to 8 MarketCap, BNB's current market capitalization has surpassed UBS, ranking it 166th globally by asset value.

According to ChainCatcher, Jia Yueting posted on social media that the signal sent by the Federal Reserve's interest rate cut is more important than the cut itself. This means that investors' cash will continue to lose purchasing power. Therefore, allocating part of your wealth to a basket of transparent, decentralized digital assets that grow in tandem with global technology and the economy is no longer just speculation. I would call it "smart financial planning." This is not financial advice, so please research it yourself.

According to ChainCatcher, Web3 smartphone maker Nothing, which previously partnered with Polygon to launch the blockchain-powered Nothing Phone, has announced the completion of a $200 million Series C funding round at a $1.3 billion valuation. Tiger Global led the round, with participation from existing investors including GV, Highland Europe, EQT, Latitude, I2BF, and Tapestry. This new round brings Nothing's total funding to over $450 million.

According to ChainCatcher, Globenewswire reported that the stablecoin protocol STBL launched by Tether co-founder Reeve Collins disclosed its next project plan after its launch on Binance Alpha and Kraken. It includes the introduction of a governance framework to enable token holders to directly participate in the formulation of the protocol. Governance integration will enable the community to influence key decisions such as upgrades, parameters and fund management.

YZi Labs Promotes Alex Odagiu to Venture Partner, Strengthening Token and Equity Investments

According to ChainCatcher, YZi Labs announced on X that Alex Odagiu has been promoted from Investment Director to Investment Partner, with responsibilities covering token, equity, and strategic investments. Alex Odagiu served as a judge/mentor for the BNB Chain MVB program for 10 consecutive seasons and participated in investments in Avalon and Aspecta. More recently, he has been deeply involved in the EASY Residency program. Odagiu stated that he has witnessed half of YZi Labs' lifecycle and three crypto cycles.

According to ChainCatcher, Tether CEO Paolo Ardoino posted on the X platform that "Tether's profit margin is as high as 99%."

According to market news, Tether previously announced plans for a new token, USAT, led by Hines and launched in partnership with Cantor Fitzgerald LP and others. The token aims to provide instant settlement, reduce costs, and be tailored specifically for the US market. Tether CEO Paolo Ardoino stated that the company's advantage lies in the distribution network it has built over the past 11 years, while competitor Circle has expanded its business through revenue sharing with companies like Coinbase.

Ardoino stated that Tether does not need to rent distribution channels; it owns its own. Despite Circle's high-profile IPO announcement, Tether has no intention of following suit. The company generated $13.7 billion in profits last year and does not need to raise capital. Instead, it plans to grow through investments, such as building new distribution channels. It has already invested $5 billion in the United States, including a $775 million investment in Rumble Inc.

According to ChainCatcher, Bloomberg reports that Binance is in talks with the US Department of Justice (DOJ) regarding the potential removal of a key monitoring requirement from its $4.3 billion settlement. Sources familiar with the matter revealed that federal prosecutors are in discussions with Binance regarding the requirement to maintain an external compliance monitor. Binance previously faced charges for allegedly failing to prevent money laundering. The DOJ has previously eliminated monitoring arrangements for several companies due to their high costs and operational impact.

Meme Hot List

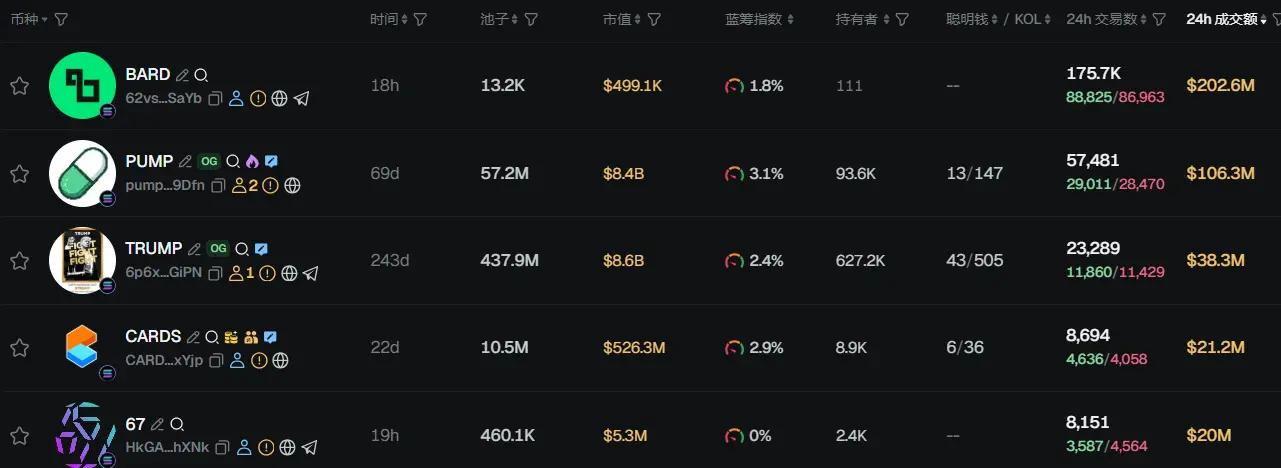

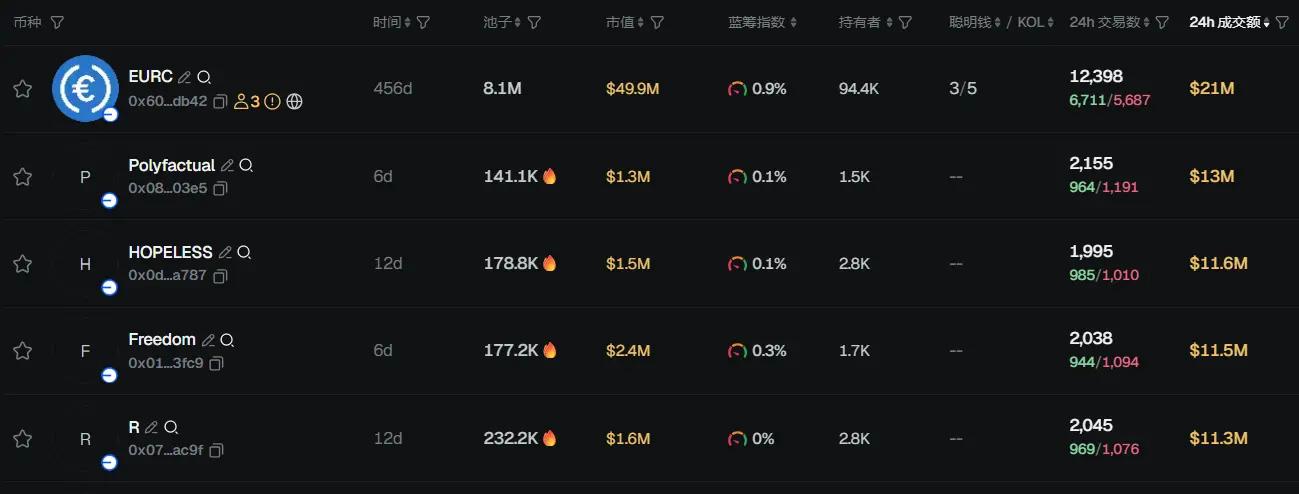

According to the market data of GMGN, a Meme token tracking and analysis platform, as of 09:00 on September 18,

The top five ETH popular tokens in the past 24 hours are: PEPE, USDe, SΞR , USPEPE, UNI

The top five Solana tokens in the past 24 hours are: BARD, PUMP, TRUMP, CARDS, 67

The top five popular tokens in the past 24 hours are: EURC, Polyfactual, HOPELESS, Freedom, R

What are some great articles worth reading in the past 24 hours?

On Thursday, September 18, the Federal Reserve announced a 25 basis point interest rate cut, lowering the target range for the federal funds rate to 4%-4.25%, resuming the pace of rate cuts that had been paused since December of last year. Newly elected Federal Reserve Board member Milan dissented, having supported a 50 basis point rate cut.

The dot plot showed that nine of the 19 officials expected two more rate cuts in 2025, two expected one cut, and six expected no further rate cuts.

On September 17th, Binance announced the completion of the Maker (MKR) token swap, token increment, and rebranding to Sky (SKY), and opened deposit and withdrawal services for the new SKY token. As of press time, SKY was trading at 0.07414 USDT, with a circulating market capitalization of approximately $1.72 billion and a 24-hour trading volume of approximately 21.49 million USDT.

According to public information, the MKR to SKY migration will enter a delayed upgrade penalty process. After governance confirmation, a 1% deduction will be made starting on September 22nd, with an additional 1% added every three months thereafter. Currently, the MKR to SKY migration is approximately 78.2% complete, and the DAI to DSDS migration is approximately 53.6%.

At this point in time of currency swaps, it is time for the market to re-examine the narrative and future of DeFi giant Sky.

Tether co-founder re-employed to create the "second-generation stablecoin" STBL. What exactly is it?

Last night, following the official announcement of Binance Alpha, the price of STBL, a "second-generation stablecoin and Tether-linked innovative project," skyrocketed, reaching a peak of around $0.22. This afternoon, it briefly surged over $0.30 on-chain before falling back to around $0.17. Meanwhile, Tether CEO Paolo Ardoino has recently stated, "USDT has nearly 500 million users, an average daily trading volume of approximately $45 billion, 17 million daily traders, and a 99% profit margin."

Who exactly is SBTL? Is it related to Tether's stablecoin blockchain, Stablecoin? Is Tether's co-founder true? What is the background of STBL? Odaily Odaily will provide a detailed introduction and brief analysis of these questions in this article.

Interest rate cuts are a foregone conclusion, but three major questions remain to be answered

The Federal Open Market Committee (FOMC) meeting held by the Federal Reserve (Fed) on Tuesday and Wednesday this week was called one of the most "strange" meetings in the history of the institution by well-known financial commentator Nick Timiraos.

Markets are almost unanimously expecting the Fed to announce its first interest rate cut in nine months on Wednesday following its two-day policy meeting. According to the CME's FedWatch tool, the probability of a 25 basis point cut to a range of 4.25% to 4.50% is as high as 96%, making it virtually certain.

Pump.fun's return to the throne

In the crypto world, the life cycle of a project is often as short as a meteor, and it seems to fall from the peak to the abyss in just a moment.

In July 2025, Pump.fun, once the absolute overlord of the Solana meme ecosystem, was on the brink of such a cliff. The token price plummeted by more than 80%, it was plagued by legal proceedings, surrounded by competitors, and market confidence almost collapsed.

However, just two months later, Pump.fun not only miraculously "resurrected," but also returned to the throne with unprecedented strength. This was not a fluke, but the result of a carefully planned, interlocking strategic counterattack.

Through aggressive repurchases of nearly 100 million US dollars, Project Ascend that reshapes the creator economy, and the milestone breakthrough of listing on Binance, Pump.fun staged a textbook-level self-rescue.

Data Insights: Status of Local Stablecoins in Southeast Asia in Q2 2025

Southeast Asia (SEA) has a combined GDP of US$3.8 trillion and a population of 671 million. As the world's fifth largest economy, it competes with other economies and has 440 million internet users, driving digital transformation.

Against this backdrop of economic dynamism, non-US dollar stablecoins and digital currencies pegged to regional currencies or baskets of currencies offer transformative tools for Southeast Asia's financial ecosystem. By reducing reliance on the US dollar, these stablecoins can improve cross-border trade efficiency, stabilize intraregional transactions, and promote financial inclusion across diverse economies.

This article explores why non-USD stablecoins are crucial for Southeast Asian financial institutions and policymakers aiming to shape a resilient, integrated economic future.

Click here to learn about ChainCatcher's current job openings