Deng Tong, Golden Finance

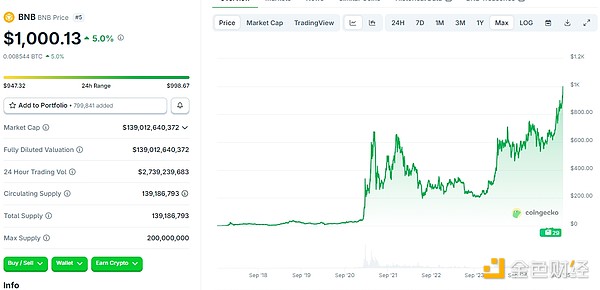

On September 18, 2025, BNB surpassed the $1,000 mark, bringing its market capitalization to $139.78 billion. This surpasses companies like BHP Billiton ($136.91 billion), Pfizer ($115.09 billion), and BYD ($138.15 billion), ranking 155th in global asset market capitalization. As of press time, the price was $1,000.13, a 24-hour increase of 5%.

In 2017, BNB was issued at a price of 2,700 BNB per 1 ETH or 20,000 BNB per 1 BTC, equivalent to approximately $0.11 USD at the time. Eight years later, BNB has finally surpassed $1,000 USD, a complete transformation and a significant departure from its competitors.

1. From ICO to IEO: A 400x debut with $0.1

Binance was officially established in January 2017; from June 26 to July 3, Binance issued 200 million BNB tokens at a price of US$0.1; on July 14, Binance officially launched its cryptocurrency trading platform.

Since then, Binance has capitalized on favorable policies in the international market. In April 2017, Japan implemented an amendment to its Funds Settlement Act, recognizing Bitcoin as a means of payment, making it the most dynamic region in the global crypto financial sector at the time. Binance quickly relocated its operations to Japan, a move that paved the way for its internationalization. Binance began to focus on the global market, and the price of BNB continued to rise. Fueled by the 2017 bull market, BNB surpassed $20 in January 2018, representing a more than 200-fold increase from its IPO price six months prior.

In 2018, Binance launched its global expansion plan, expanding to Malta, Bermuda, Uganda, and Singapore. Since then, BNB's price has stabilized in the double digits. In January 2019, BNB reached a high of $37.

In January 2019, Binance officially embarked on its Initial Exchange Offering (IEO) journey, relaunching its asset issuance platform, Launchpad. This marked the official launch of the IEO model on the Binance platform. BitTorrent (BTT) was the first IEO project after the relaunch of Binance Launchpad. It launched at an initial price of $0.00012, and within just 15 minutes, 60 billion BTT were sold out. BTT's price saw a nearly fivefold increase after trading began on Binance, bolstering market confidence in IEO projects. For a time, IEOs became a hot topic in the cryptocurrency market and a key fundraising method.

In February 2019, the Binance Chain testnet launched. In April, Binance Chain and its decentralized exchange, Binance DEX, officially launched, with BNB becoming its native asset. BNB's application cases expanded from 42 at the beginning to over 180, and the number of BNB holders exceeded one million. That year, a total of 5,321,482 BNB were burned, equivalent to approximately $207 million.

In March 2020, BNB experienced its first price crisis. The rapid global spread of COVID-19 triggered concerns about a global recession, sending risk assets, including cryptocurrencies, plummeting. By March 12th, major cryptocurrencies like BTC had experienced a precipitous decline, a phenomenon industry insiders dubbed the "March 12th Crash" or "Black Thursday." BNB also plummeted to $9.75.

After the plunge, the crypto market gradually recovered and BNB returned to double digits.

2. DeFi Summer + Crypto Bull Market: Reaching $660 Twice

In June 2020, DeFi reached a fever pitch on Ethereum, but the network faced severe congestion and high gas fees, hindering user and developer engagement. In September, Binance launched Binance Smart Chain (BSC), building on the Binance Chain. Its high performance and low gas fees made it the world's second-largest public blockchain. Binance Smart Chain's compatibility with the Ethereum EVM (Electronic Virtual Machine) enabled the migration of Ethereum projects, attracting numerous DeFi developers and fueling the continued growth of the DeFi summer. Since then, BNB has steadily risen, gradually breaking through the $30 and $40 levels after September, reaching around $40 by the end of 2020.

In January 2021, BNB kicked off its year-long surge at $40. Just five months later, in May, BNB surpassed $660, and in November, it soared again above $650.

BNB's surge this year is closely tied to the rapid development of Binance Smart Chain, whose growing number of projects has fostered a coexisting ecosystem encompassing DeFi, NFTs, gaming, and infrastructure. As the native token of Binance Smart Chain, BNB plays a crucial role in this ecosystem. As the ecosystem flourishes, demand for BNB has surged, driving its price sharply higher. Furthermore, BNB's deflationary mechanism has contributed to this surge. From January to March 2021, Binance conducted its 15th quarterly BNB burn, destroying a total of 1,099,888 BNB tokens, valued at approximately $595 million, a record high. This reduction in BNB's market supply is bound to benefit its price.

From a macro perspective, the overall cryptocurrency market was positive at the time. In 2021, the total market capitalization of the cryptocurrency market exceeded $3 trillion, a more than threefold increase from approximately $750 billion at the end of 2020. BTC reached an all-time peak of approximately $69,000 in November 2021, and ETH also reached an all-time high of approximately $4,891 during the same period, both more than doubling from the end of 2020. This general surge in the crypto market also drove BNB's price higher.

In 2022, BNB began to decline. The year was a mixed bag for BNB. In February 2022, Binance announced that the former Binance Smart Chain (BSC) would be renamed BNB Chain and operated independently. In November, FTX collapsed, embroiling Binance in controversy. Furthermore, from a macroeconomic perspective, the Federal Reserve implemented tightening monetary policies, including interest rate hikes, to combat inflation. This tightened liquidity in global financial markets and reduced investor appetite for risky assets. Cryptocurrencies were significantly impacted, with their total market capitalization plummeting from nearly $3 trillion to below $1 trillion from the beginning of the year to the end. BNB's performance also fluctuated with the overall market.

In 2023, BNB faced its darkest hour. In March, the U.S. Commodity Futures Trading Commission (CFTC) sued Binance and its CEO, Changpeng Zhao, alleging they illegally provided cryptocurrency derivatives services to U.S. customers and facilitated illegal financial activities. BNB's price plummeted by over 5.5% on the day the case unfolded. In April, the Australian Securities and Investments Commission (ASIC) revoked Binance's Australian derivatives license. In June, the SEC sued Binance and its CEO, Changpeng Zhao, alleging multiple violations. Subsequently, BNB's price plummeted by approximately 25% to around $230. By mid-October, BNB's price had fallen to around $200, a significant drop from its previous peak of over $660.

3. Regulatory tailwinds + DAT: Reaching $1,000

A golden fish cannot be confined to a pond; once it encounters wind and clouds, it transforms into a dragon. After 2024, BNB will gradually reach its peak.

On January 10, 2024, the SEC approved the first Bitcoin spot ETFs. On July 22, the SEC approved several companies' applications for Ethereum spot ETFs. The future of mainstream cryptocurrencies like BTC and ETH is becoming increasingly clear—traditional financial institutions are entering the crypto market with unprecedented speed and enthusiasm. In November, Trump won the US presidential election and made numerous pro-cryptocurrency pronouncements, including statements about building a BTC reserve and ensuring the US becomes a Bitcoin superpower, earning him the title of "Crypto President."

Influenced by increasingly relaxed and clear regulatory policies, the crypto market has once again ushered in a new bull market. BTC has broken through the $100,000 mark, setting a new historical high, and the crypto market is booming.

With the overall market booming, many companies in traditional sectors have also seen the new opportunities presented by cryptocurrencies and have begun to build their treasury reserves. Bitcoin and Ethereum, two major mainstream currencies, have been highly favored, and BNB, as a leading currency, has benefited significantly from this. In September 2025, CEA Industries Inc., the "BNB version of MicroStrategy," increased its BNB holdings twice, bringing its holdings to 418,888 BNB, valued at approximately $368 million. In August, digital asset investment firm B Strategy announced plans to list its BNB treasury company on the Nasdaq, aiming to raise $1 billion. That same month, China Renaissance Capital announced it would invest approximately $100 million in a dedicated BNB asset allocation. In July, US-listed medical company Liminatus Pharma announced plans to raise $500 million for BNB...

Yesterday, two pieces of news about Binance sparked positive speculation for BNB. On September 17th, information on the X platform indicated that CZ changed his profile from ex-@binance to @binance, possibly hinting at resuming his position at Binance. The same day, Bloomberg News, citing sources familiar with the matter, reported that the US Department of Justice is considering removing Binance's requirement to be regulated by an independent compliance oversight body. If approved, this could ease regulatory and compliance pressures on Binance and further boost BNB's price.

In addition to major industry events that are eye-catching enough, such as treasury reserves and regulatory relaxation, the launch of the BNB staking ETF and potential listing expectations are also boosting market confidence in BNB.

On August 27, REX-Osprey Asset Management plans to apply for approval from the U.S. SEC for a BNB-collateralized ETF, which will follow the same path as the Solana fund and is expected to go online in early November. This means that the United States has taken another step towards regulating BNB investment products.

On June 5th, Circle went public on the New York Stock Exchange, with its stock price soaring over 160% on its first day. Circle's surge demonstrates the unstoppable wave of crypto IPOs. As a leading industry player, Binance's IPO is only a matter of time.

IV. Conclusion

BNB has experienced a 10,000-fold surge in value over eight years, from its initial ICO price of $0.1 to its remarkable achievement of surpassing $1,000. BNB embodies the value and influence of leading exchanges. Perhaps no one can predict the future of BNB.