FTX is expected to make another repayment this month, distributing $1.6 billion to creditors on September 30. This influx could trigger an altcoin season.

However, this round is $300 million less than originally announced in July. There is room for upside, but some caution is warranted.

Continue to refund FTX

The collapse of FTX three years ago was a pivotal moment for the crypto industry, and the process of repaying creditors is still having repercussions in 2025. As part of the now-defunct exchange's plans, the FTX Recovery Trust is aiming to make a major round of payments on September 30:

The exchange announced the plan months ago, but previous statements referred to $1.9 billion in payouts. However, FTX’s latest statement quietly lowered that payout expectation to $300 million. The company’s press release doesn’t mention this discrepancy , but it’s still informative.

Eligible FTX creditors can expect to receive their refunds within 1-3 business days starting November 30. These distributions will be made through pre-determined service providers such as Bitgo, Kraken , and Payoneer.

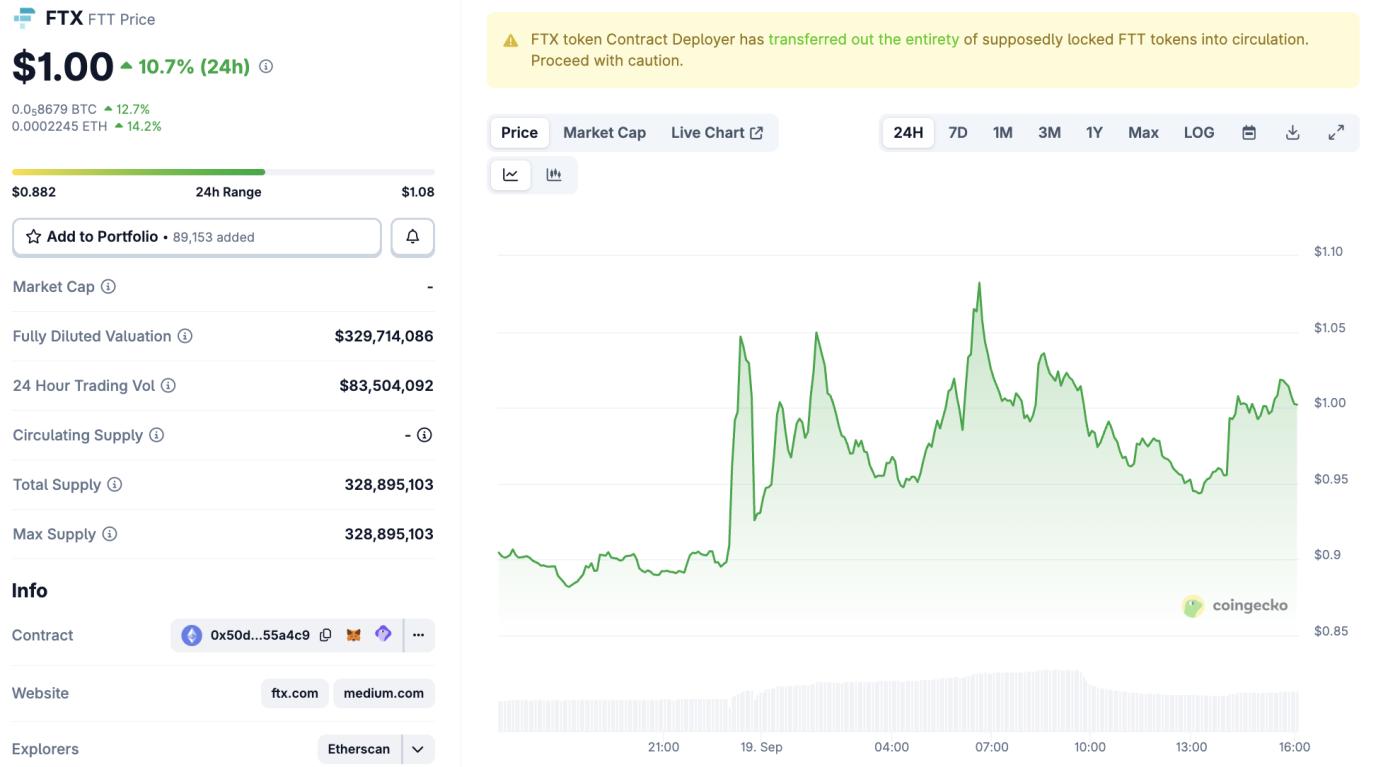

Following the announcement, the exchange's FTT Token surged in price.

Price Performance of FTX Token (FTT). Source: BeInCrypto

Price Performance of FTX Token (FTT). Source: BeInCryptoNew opportunities with altcoins?

This development could be very positive, depending on a number of factors. In the past, FTX refunds have often sparked hopes of an altcoin season . These new flows could stimulate retail investor sentiment, creating opportunities for new profits.

Currently, the Altcoin Season Index is reporting 74 out of 100, meaning we are on the verge of an altcoin season. Given the delicate state of this market , FTX's returns could be enough to spark a solid upward momentum.

However, there is no certainty at this point. These payments will be $300 million less than originally advertised, and that is no small amount. Hopefully, mitigating circumstances like these will not be enough to disrupt the current bull run.