Bitcoin has maintained a steady uptrend since the beginning of the month, raising expectations of a move towards $120,000.

This positive momentum is supported by strong investor activity, with BTC holders showing renewed confidence. This combination of technical and fundamental strength is providing the market with bullish signals.

Bitcoin investors turn to buying

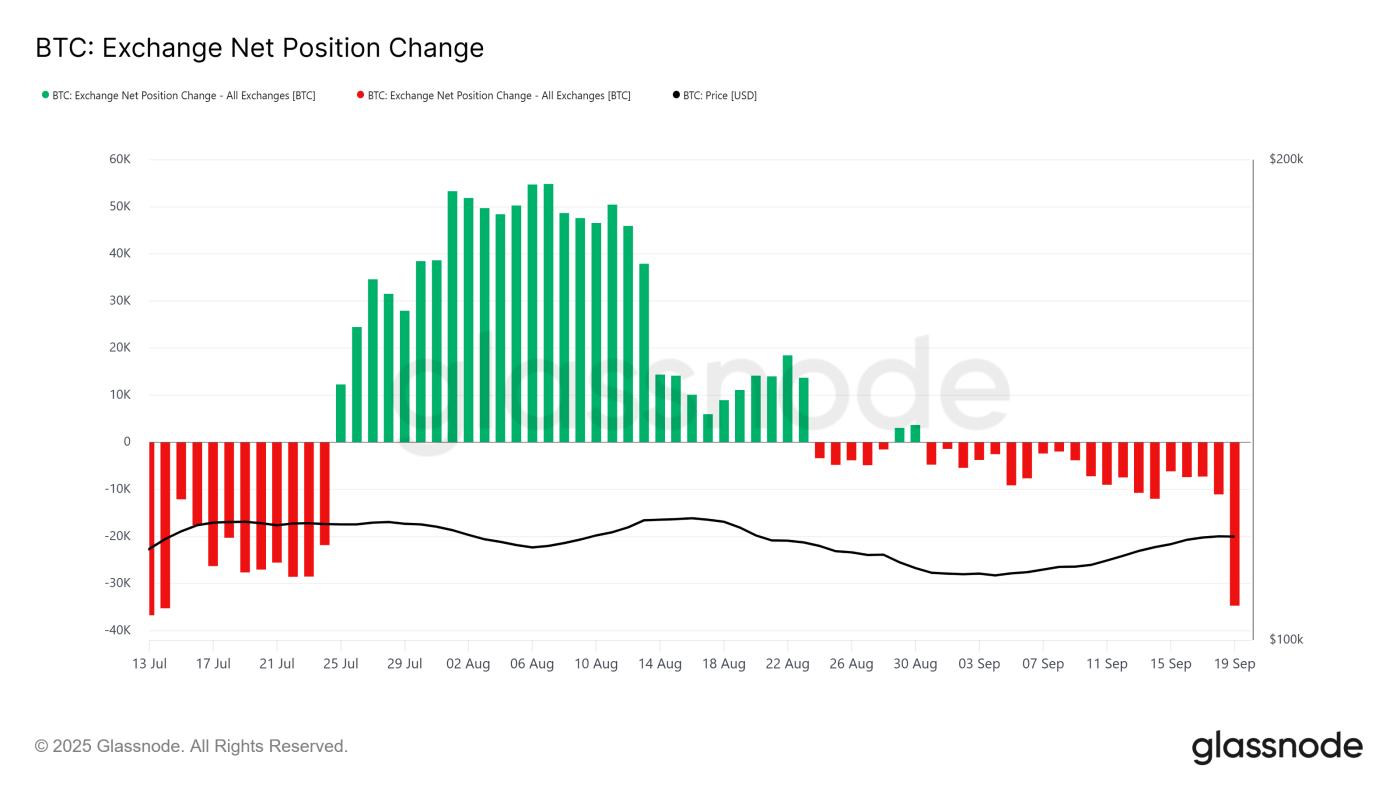

Bitcoin accumulation has reached its highest level in nearly two months, according to new data. In the past 24 hours, investors bought more than 23,000 BTC, worth more than $2.67 billion, and moved them off exchanges.

History shows that such withdrawals from exchanges indicate that investors plan to hold assets for the long term rather than looking for quick profits. The move marks a change in sentiment from earlier this quarter, when selling pressure prevailed.

Want more information on Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Bitcoin net position on exchanges. Source: Glassnode

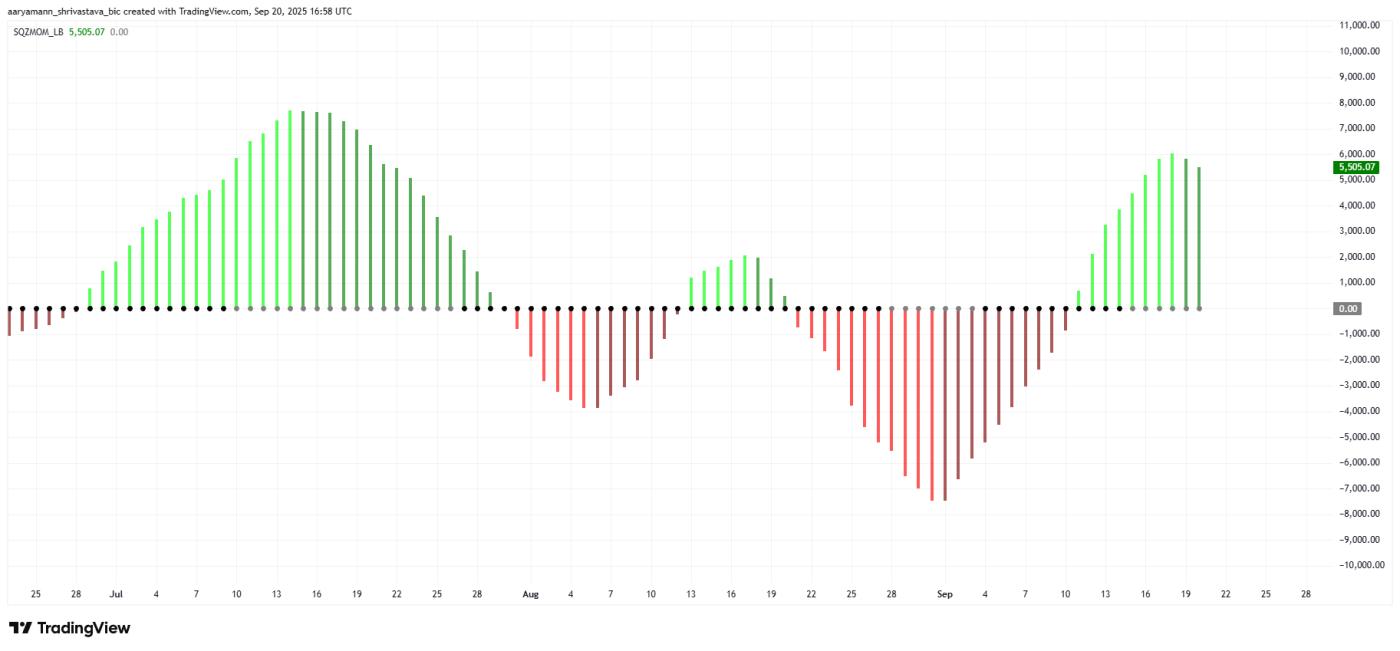

Bitcoin net position on exchanges. Source: GlassnodeFrom a technical perspective, the squeeze momentum indicator signals a bullish squeeze release for Bitcoin . An upward momentum release typically indicates that the asset is strengthening, setting the stage for further price expansion in the short term.

This development underscores Bitcoin’s resilience despite broader market volatility. The growing momentum fuels the current rally, allowing the asset to maintain its bullish stance.

Bitcoin's squeeze momentum. Source: TradingView

Bitcoin's squeeze momentum. Source: TradingViewBTC price may break through important barrier

Bitcoin is trading at $116,027, maintaining its steady gains since the start of the month. However, the king of cryptocurrencies is currently facing resistance at $117,261, a key level that has limited its upside in recent sessions. Breaking this barrier will be crucial for Bitcoin's next move.

If Bitcoin can break through and turn $117,261 into support, it could rise to $120,000 in the coming days. Strong buying pressure and favorable momentum indicators make this outcome very likely.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewHowever, the loss of momentum could bring fresh selling pressure. If BTC falls below the $115,000 support, the price risks sliding to $112,500, invalidating the optimistic outlook.