Introduction: Seeking the Essence Beneath the Noise

On September 22, 2025, the crypto market ushered in a frenzy for the Bitcoin ecosystem. With the Bitcoin price stabilizing above $114,000, a strong influx of capital poured into its emerging Layer 2 ecosystem. Among them, a protocol token called Hemi, with a 24-hour surge of 64.9%, became the dazzling star of the event. The market's clamor is always growing stronger, and for observers accustomed to the ebb and flow of the market, the real question is not "how much" but "why?"

What qualities does Hemi possess that have attracted Binance and top VCs to invest in it as Bitcoin's legitimate successor? Does its astonishing 64.9% increase indicate that the market is finally beginning to understand this grand story?

Eye of the Storm: A Carefully Prepared Value Discovery

Exploring the trajectory of Hemi's price surge reveals that it wasn't driven by a single, unexpected positive factor, but rather the inevitable result of a series of positive factors. From the overall market tailwind, to the collective surge in Bitcoin's L2 market, to Hemi's own steady progress in technology and financing, these factors all formed a solid foundation for this price surge.

First, the macro market is quietly shifting. After a long period of consolidation, the market showed positive sentiment in September, and smart investors began to seek new narrative opportunities. As the valuation of the Ethereum Layer 2 ecosystem gradually reached saturation, the long-dormant topic of "Bitcoin DeFi" was rekindled, and a capital rotation effect began to emerge. The entire Bitcoin Layer 2 sector is on the eve of an explosion.

It was precisely under this industry tailwind that Hemi's series of verifiable advances became the catalyst for igniting market sentiment. On August 28th , the company confirmed a $15 million funding round led by YZi Labs and Republic Digital. This strong backing ignited initial market enthusiasm. Subsequently, on September 5th , the $HEMI token was simultaneously listed on two major exchanges, Gate.io and KuCoin, providing a crucial boost to its liquidity. However, what truly fueled technical anticipation was a key signal revealed in the official blog post on September 11th : the team explicitly announced that their hBitVM implementation was "coming soon" to mainnet. This major announcement of a next-generation Bitcoin bridge and native programmability upgrade directly transformed future technological anticipation into immediate buying momentum, laying the foundation for the subsequent market explosion.

Therefore, the strong rally on September 22nd can be seen as a concentrated "value discovery" by the market for Hemi's long-accumulated technical strength and clear development path. It proves that in today's crypto world, the success or failure of a project ultimately comes down to its fundamentals: the strength of its team, technology, and ecosystem.

Genesis: The "orthodoxy" inherited by Bitcoin's early believers

In the chaotic world of crypto, a project's origins largely determine its potential. Hemi is most proud of its exceptional founding team, a team that can almost be considered a direct descendant of Bitcoin's "genesis."

Co-founder Jeff Garzik's name is enough to inspire awe in any early Bitcoin participant. As one of the few Bitcoin Core developers to have worked with Satoshi Nakamoto himself, Garzik's involvement imbues Hemi with unparalleled legitimacy. His deep understanding of Bitcoin's underlying protocol ensures that Hemi expands Bitcoin's functionality while maximally respecting and inheriting its core security philosophy.

Co-founder Max Sanchez is the backbone of Hemi's technical expertise. His invention of the Proof-of-Proof (PoP) consensus mechanism is key to Hemi's ability to securely inherit the security of the Bitcoin mainnet. Matthew Roszak, a renowned crypto investor and co-founder of Bloq, brings extensive industry resources and strategic vision to the project.

It is this unparalleled gene of creation and deep technical background that has attracted the world's most discerning capital. For investors, betting on Hemi is not just investing in a project, but also investing in a future with a high degree of certainty of success, led by industry founders. The existence of this "dream team" has not only attracted top technical talent, but also won the favor of capital. Hemi has completed a total of US$30 million in financing, and its list of investors includes top industry institutions such as YZi Labs (formerly Binance Incubator), Republic Digital, HyperChain Capital, and Breyer Capital. The strong team background and strong capital support have jointly built a solid moat for Hemi, giving it a reputation and resource advantage that other projects cannot match at its start-up.

Technological Singularity: Allowing Smart Contracts to “Natively” Read Bitcoin

If a strong team is the foundation of VCs' confidence in placing bets, then Hemi's radical technological solutions are the core bargaining chip that makes them willing to place a large bet. Understanding Hemi's technological singularity is the fundamental basis for understanding its investment value.

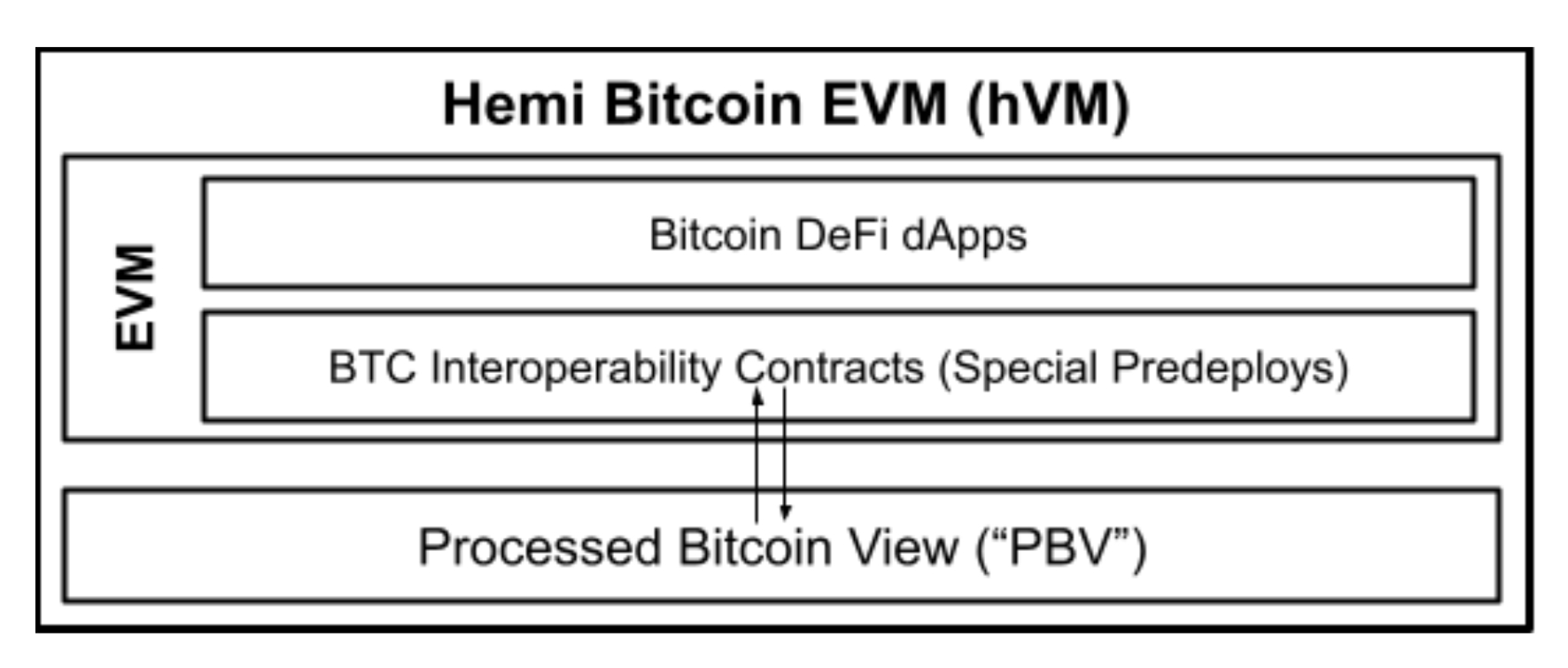

Hemi's core innovation lies in its fundamental solution to a problem that has plagued the industry for years: how can an independent smart contract platform securely and trustlessly interact with the Bitcoin mainnet? Hemi's answer is the Hemi Virtual Machine (hVM) .

The revolutionary thing about hVM is that it is not simply compatible with EVM (Ethereum Virtual Machine), but rather has a complete Bitcoin node natively embedded within the EVM.

We can use a simple metaphor to understand the ingenuity of this design: Imagine that the traditional Bitcoin L2 solution is like hiring a "Bitcoin translator" (oracle or cross-chain bridge) for the Ethereum (EVM). While this translator can transmit information, it is a centralized link that requires trust and is subject to errors and malicious behavior. Hemi's hVM, on the other hand, directly installs Bitcoin's "native language system" (a complete BTC node) into the brain of Ethereum.

As a result, smart contracts running on Hemi can directly "think" and "read" the complete state of the Bitcoin mainnet, such as querying the UTXO balance of any address. This reading process is driven by the Hemi protocol's own L2 state, ensuring that all nodes processing the same block have a completely consistent and verifiable view of the BTC state, completely eliminating the security risks and centralization issues brought about by "translators."

On top of the hVM foundation, Hemi's Proof-of-Proof (PoP) consensus mechanism further strengthens its security. It allows Hemi to anchor a "snapshot" of its network state on the Bitcoin mainnet in a lightweight and decentralized manner. This enables Hemi's transactions to ultimately achieve Bitcoin Proof-of-Work (PoW)-level finality, which Hemi officials refer to as "Bitcoin Superfinality." This means that a transaction that is sufficiently confirmed on Hemi will be as irreversible as the Bitcoin mainnet, which is crucial for L2, which supports large-scale financial applications.

The Battle for the Landscape: At the Crossroads of Bitcoin L2

The Bitcoin L2 race has never been short of participants, but the technical paths chosen by each company vary widely, reflecting the different trade-offs they make in achieving the "Blockchain Trilemma" of scalability, security, and decentralization. Hemi's entry into the market offers a new and highly competitive paradigm for this battle.

As can be seen from the table above, Hemi's greatest differentiating advantage lies in its " native integration " philosophy. Unlike Stacks' "parachain" model, RSK's "merged mining," and Merlin's "rollup" model, Hemi pursues a deep integration of the EVM's flexibility with Bitcoin's asset layer at its core. This design enables the construction of complex DeFi protocols that truly rely on Bitcoin on-chain events (for example, the confirmation of a Bitcoin transaction) to trigger, something that other solutions struggle to achieve.

For example, developers can build a decentralized Bitcoin options protocol on Hemi, whose exercise and liquidation logic can directly and automatically verify the price and transaction status on the Bitcoin mainnet without relying on any external oracles. This opens up unprecedented possibilities for "Bitcoin-native DeFi."

Ecosystem: Value Transmission from Protocol to Application

A successful public chain relies on a thriving developer and application ecosystem. Hemi understands this well and has placed ecosystem development at the core of its strategy since its launch. According to its official website, the Hemi ecosystem has attracted over 90 projects and partners, with a total locked-in value (TVL) exceeding $1.2 billion.

This burgeoning ecosystem isn't just a castle in the air, but rather demonstrates healthy diversity. Within the DeFi space, there are native lending protocols like Satoshi Protocol; at the infrastructure level, Hemi has established in-depth collaborations with leading industry projects like LayerZero and Quantstamp; and at the user portal level, it has secured support from mainstream wallets like UniSat and RainbowKit. This comprehensive approach, from the underlying layer to the application layer, lays a solid foundation for its future explosive growth.

Driving this ecosystem's flywheel is its meticulously designed token economics model. $HEMI tokens are limited to 10 billion, with the lion's share (32%) allocated to the community to incentivize early builders and participants. As the network's native token, HEMI will not only be used to pay gas fees but also serve as a core credential for participating in protocol governance and earning staking rewards. This deep connection between protocol value and token value ensures that as the Hemi ecosystem prospers, its value will be effectively transmitted to HEMI holders.

Conclusion: Beyond the noise, a new chapter for Bitcoin is opening

In summary, Binance Labs and top VCs' bet on Hemi isn't simply a financial investment; it's a deep endorsement of its technological path, its founding team, and ultimately, the future narrative of Bitcoin. Its revolutionary hVM architecture holds the true key to unlocking Bitcoin's trillions of dollars in liquidity. And that astonishing 64.9% surge may just be the beginning of the market's understanding of this "successor" story. The hype will eventually fade, but a new era of DeFi, powered by Bitcoin itself, is slowly dawning.