Written by White55, Mars Finance

Market mutation: a silent "bull-bear struggle"

On September 22, 2025, the cryptocurrency market once again experienced extreme market conditions. Bitcoin (BTC) held steady above $115,000 at the start of the Asian trading session, but within hours, it suddenly collapsed, losing key support levels and plummeting to $111,800, with a daily fluctuation exceeding 5%. Ethereum (ETH) also plummeted, falling from around $4,500 to $4,077, a single-day drop of 6.2%. Mainstream Altcoin such as Solana (SOL) also followed suit, and the market was instantly gripped by panic.

Coinglass data shows that over the past 24 hours, the total amount of liquidated positions across the entire network reached $1.7 billion, a new high for the year. Long positions accounted for over 95% of these liquidations (worth $1.617 billion), while short positions accounted for less than 5%, highlighting the precise targeting of leveraged long positions during this decline. The largest single liquidation occurred in the BTC-USDT contract on the OKX exchange, valued at $12.74 million. This could be the instantaneous collapse of a whale or institutional account, or perhaps a microcosm of the cruel nature of the market's liquidity trap.

Reasons for the decline: Good news has run out and whales are taking profits.

1. The Fed’s rate cut: The expected benefits are exhausted after the expected benefits are fulfilled

Although the Federal Reserve announced a 25 basis point interest rate cut at its September meeting, in line with market expectations, the policy did not continue the previous frenzy of risky assets.

Federal Reserve Chairman Powell made it clear that the rate cut was a "risk management" measure rather than a signal of radical easing, and stressed that subsequent decisions will be "evaluated meeting by meeting."

This cautious attitude has cooled market expectations for a series of significant interest rate cuts, weakening the momentum for traditional capital flows into the crypto market. Historical data shows that while the interest rate cut cycles in 2019 and 2020 ultimately drove crypto market gains, they were accompanied by significant short-term volatility and revised expectations.

2. Whale Selling: ETH Whales Take Profits

On-chain data reveals another pressure: the concentrated cashing out of ETH whale.

Glassnode data shows that on September 18, whales holding 1,000-10,000 ETH cashed out $1.5 billion in a single day. If the operations of larger holders are included, the total cash-out scale reached $2.15 billion.

This selling behavior is similar to the history when ETH broke through $3,500 in July. At that time, the selling pressure was offset by the active purchase of the US Treasury company. However, this time the treasury company Bitmine itself holds $9 billion in ETH (cost price of $3,949). If the price continues to fall below the cost line, its ability to increase holdings may be limited, further weakening buying support.

3. Technical resistance and overheated market sentiment

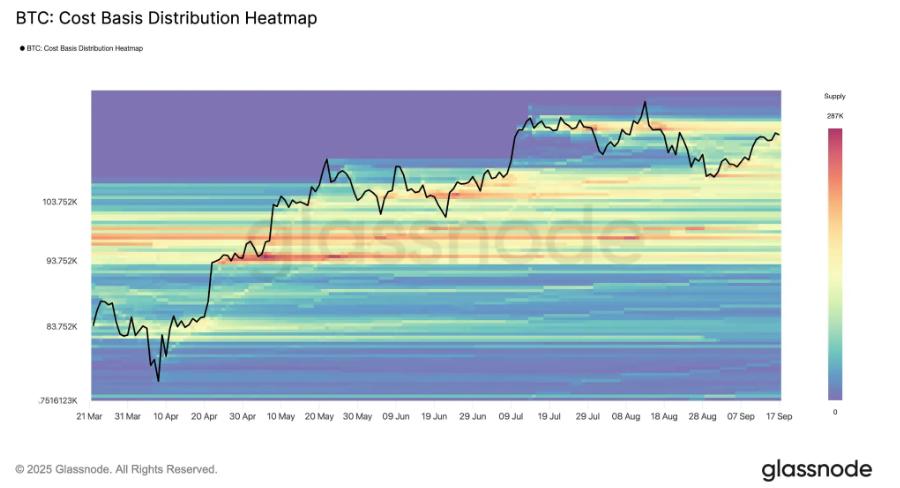

Bitcoin's CBD (Cost Basis Distribution) heat map shows a significant supply backlog around $117,000, forming a key resistance zone. Failure to effectively break through this level has dampened bullish sentiment. Meanwhile, market sentiment indicators are showing signs of overheating: the Crypto Fear and Greed Index has fallen from a high of 80 to 61, but remains in "greed" territory; the Altseason Index is approaching 65, indicating overheating. Historically, such signals have often signaled the risk of a correction.

Is the bull market over? Cycle reconstruction in the process of institutionalization

1. Institutionalization and the differentiation of historical cycles

Contrary to conventional wisdom, the core driving force of this bull market has shifted from retail investors to institutions. Asset management giants like BlackRock have continued to increase their holdings through Bitcoin spot ETFs, with net inflows reaching $246 million on September 19th alone. Ethereum ETFs saw net inflows of $478 million during the same period, with their total net asset value accounting for 5.51% of ETH's market capitalization.

This structural shift has reduced market volatility, but it has also lengthened the lifespan of the cycle. As Michael Saylor puts it, “early holders cash out, institutional funds enter the market, and market volatility decreases.”

While historical cyclical patterns (such as the four-year bull-bear cycle) suggest a potential peak in 2025, the qualitative shift in institutional participation has reduced the probability of a repeat of history. For example, Bitcoin volatility has fallen to its lowest level since 2020, attracting more conservative institutions to build positions.

2. Divergence between on-chain indicators and capital flows

Despite the sharp short-term pullback, on-chain data still shows long-term bullish signals:

Long-term holder behavior: Glassnode’s long-term holder realized profit-loss ratio indicates that profit-taking activity has retreated from its March peak, similar to the pattern of the 2021 pullback followed by the resumption of the upward trend.

Net outflow from exchanges: BTC exchange net outflow surged, reflecting a growing “hoarding” sentiment.

DeFi and the staking ecosystem: In a low-interest environment, the appeal of staking and yield-based DeFi projects has increased. The ETH beacon chain stake has exceeded 12.6 million, exemplified by a whale staking $1.25 billion in ETH in a single transaction.

3. Macroeconomic environment and policy uncertainty

A slower pace of rate cuts by the Federal Reserve (the dot plot suggests only two more rate cuts this year) could curb the performance of risky assets.

In addition, regulatory dynamics have become a potential variable: the United States and the European Union have tightened compliance requirements for stablecoins and ETFs. Grayscale has submitted an application for Dogecoin ETF. If approved, it may further broaden funding channels, but the pressure faced by non-compliant projects will also increase.

Future Outlook: Structural Opportunities Amidst Fluctuations

1. Short-term trend: bottoming out and key support testing

Technically, Bitcoin is currently trading at $110,000, a key support level that has been repeatedly validated over the past few months. A break below this level could push the price down to the $101,000-$105,000 range.

Ethereum needs to hold $4,000. If it fails, it may test the 120-day moving average and the 0.382 retracement, which is around $3,800. The sideways fluctuation may last for 30-60 days, and a clear bottom may appear in late October.

2. Medium- to long-term logic: institutional funding and ecosystem innovation

Bitcoin as "digital gold": Its anti-inflation properties remain attractive in a low-interest environment, especially when traditional asset returns decline;

If an Ethereum staking ETF is approved by the end of the year, it could bring in new capital;

Altcoin differentiation: BNB's market capitalization has exceeded $140 billion, setting a new record high, thanks to the support of the Binance ecosystem; while tokens lacking practical applications may be eliminated.

Investor Strategy: Risk Management and Value Anchoring

Warning: "The last 10% gain in a bull market may not be worth risking all your profits." The following strategies are recommended:

Reduce leverage: Avoid using high leverage during periods of heightened volatility. The painful experience of multiple position liquidations serves as a reminder to prioritize risk control.

Batch operation: Take profit on profitable positions in batches, retain cash and wait for pullback opportunities;

Focus on fundamentals: Prioritize projects with practical applications and strong regulatory compliance (such as BTC, ETH, BNB), and stay away from pure concept speculation.

Conclusion: The bull market is not over, but the rules of the game have changed

This plunge isn't the beginning of a bear market, but rather an inevitable adjustment in market structure during the process of institutionalization. The liquidity dividend from the Federal Reserve's rate cuts has yet to be fully realized, but will only truly materialize after mid-December. Whale selling and retail leveraged liquidations have accelerated short-term liquidations, laying the foundation for a healthy subsequent rally. Historical experience shows that the crypto market never rises in a straight line, but rather redistributes wealth through dramatic fluctuations.

For investors, the current period presents both risks and opportunities. If Bitcoin holds key support and institutional funds continue to flow in, the market remains poised to reach new highs by year's end. However, if the macroeconomic environment deteriorates or regulatory black swan events emerge, caution should be exercised against a deep correction. Only by maintaining rationality and abandoning the illusion of getting rich quick can one survive and profit in the new cycle of the crypto market.