Following its brand upgrade, Juchain has officially launched a token buyback and burn program. Each buyback will be fully transparent and 100% will be burned, fundamentally reducing the circulating supply and fostering long-term deflationary expectations. This not only helps strengthen the scarcity and value of $JU, but also demonstrates Juchain's commitment to sustainable growth and investor confidence. Under this mechanism, $JU's long-term value capture capabilities will be further enhanced, providing a stable financial foundation for the expansion of the platform ecosystem. This installment of our early-stage potential project discovery series will focus on Project Merlin, Avantis, and Boundless. These three projects, currently listed on Ju.com, represent financing and governance, derivatives and RWA trading, and general-purpose ZK infrastructure, respectively, providing crucial windows into the next round of ecosystem innovation.

1. Project Merlin

1.1 Project Overview

Project Merlin is a one-stop, DAO-driven ecosystem, centered around its native token, $MRLN, integrating financing, governance, community, and market into a single framework. The platform provides entrepreneurs with crowdfunding, a freelance marketplace, community governance, and IDO launch tools, creating a complete path from fundraising to launch. Users participate in governance, complete tasks, and earn incentives through the DAO and Vote2Earn mechanisms. Currently, Merlin has attracted 150,325 registered accounts and established a funding pool of $12,465,000 (248,040,000 MRLN).

With Bitcoin's upgrade from BRC20 to BRC2.0, BTC has for the first time acquired smart contract capabilities approaching those of the EVM. Merlin perfectly capitalizes on this opportunity and has become a representative application of BTC's Layer 2. It serves not only as a financing and governance infrastructure but also as a facilitator for applications in Bitcoin's evolving narrative. Merlin aims to provide a fast, transparent, and efficient platform for startups and users to collaborate, bringing Bitcoin into a truly programmable ecosystem.

Data source: projectmerlin.io

1.2 Main Highlights

Highlight 1: Combining Crowdfunding and Governance Merlin combines crowdfunding with DAO governance on BTC Layer2. After entrepreneurs submit proposals, the community votes to decide on financing. Combined with the Vote2Earn incentive mechanism, users have both rights and benefits in governance, achieving the first deep integration of financing and governance.

Highlight 2: Integration and token closed loop Merlin integrates financing, talent, and IDO into the same platform. $MRLN runs through it, serving as both a governance certificate and a payment and incentive tool. It also ensures the stability of the total amount through a cross-chain bridge, forming a complete token economic closed loop.

Merlin launched the Bitcoin Treasury plan and partnered with CIMG Inc. to expand the treasury to $1 billion by the end of the year, tapping into the narrative of "BTC strategic reserve" and providing real value support for the ecosystem and the $MRLN.

1.3 Core Products

- Crowdfunding platform: MerlinCap is the financing portal for Project Merlin. Entrepreneurs can submit their project plans through Raven Message, and the community DAO will vote to decide whether to receive financial support.

- GIG Freelance Marketplace: Merlin doesn't just fund projects; it also solves the execution problem. The GIG Marketplace allows entrepreneurs to hire developers, designers, and marketers directly on the platform, creating a decentralized talent pool.

- Community Interaction and Governance: Merlin's governance is entirely driven by a DAO. Users gain access to the governance layer by holding NFTs and participate in project screening, rule changes, and ecosystem direction voting. A unique feature of Merlin is its Vote2Earn mechanism, where every vote and interaction is converted into points and rewards.

- Avalon Launchpad: Launchpad serves as Merlin's traffic and market entry point. After completing financing and team building, startup teams can conduct an IDO (Independent Token Offering) through Avalon, quickly entering the market. Unlike traditional IDO platforms, Avalon is deeply integrated with MerlinCap, GIG, and DAO, ensuring that only projects with community funding and governance support can successfully launch.

1.4 Token Economy

- The total supply of Project Merlin's tokens $MRLN is fixed at 800,000,000, and no additional tokens will be issued in the future. The specific distribution of $MRLN is as follows:

- Seed round (5%): TGE release 10%, 3-month Cliff, 9-month linear release;

- Public offering (4%): 100% TGE release, no Cliff, no lock-up;

- Staking pool (1%): TGE release 0%, no cliff, linear release over 8 months;

- Operation (7%): TGE release 0%, 1 month Cliff, 40 months linear release;

- Market (5%): TGE release 0%, 1 month Cliff, linear release 25 months;

- Development Team (8%): TGE release 0%, 5-month Cliff, 50-month linear release;

- Grant (15%): 0% TGE release, 8-month Cliff, 30-month linear release;

- Treasury (30%): TGE release 0%, 8-month Cliff, 40-month linear release;

- Liquidity (18%): TGE release 25%, 1 month Cliff, linear release 16 months;

- Exchange community allocation (5%): 60% released by TGE, no Cliff, no lock-up;

- Airdrop (2%): TGE release 0%, 3-month Cliff, 8-month linear release.

At the functional level, $MRLN has five core uses:

- Governance participation: Holding $MRLN and using it with community NFTs unlocks full voting and governance rights.

- Financing mechanism: The startup team uses $MRLN as the main settlement currency in the DAO crowdfunding round;

- Community incentives: Voting, tasks, and project evaluations can earn rewards $MRLN to promote long-term activity;

- NFT and identity binding: The purchase and rights unlocking of community NFTs are all dependent on $MRLN;

- Cross-chain interoperability: Through Project Merlin Bridge, destruction and minting are achieved between the EVM and SVM chains, ensuring total stability and cross-ecological compatibility.

1.5 Investment Logic

As BRC2.0 ushers in the programmable era of Bitcoin, Project Merlin, as the financing and governance infrastructure for BTC's Layer 2, completes the closed loop from fundraising and issuance to governance, offering a level of scarcity rarely seen at the application layer. The platform has already attracted over 150,000 accounts and a pool of over $12.46 million. More importantly, Merlin's Bitcoin Strategic Reserve Program seeks to introduce BTC into decentralized treasury management, providing a secure boundary and credit anchor for the ecosystem. As $MRLN's multiple functions in governance, financing, incentives, and cross-chain operations are proven, its value capture logic will be deeply integrated with the evolving BTC narrative and treasury expansion, making it a key contributor to Bitcoin's application and funding layers.

2. Avantis

2.1 Project Overview

Avantis is the largest decentralized derivatives and RWA exchange on the Base chain, supporting mainstream cryptocurrencies including Bitcoin and Ethereum, as well as diversified assets such as foreign exchange, gold, crude oil, and stock indices. The platform offers up to 500x leverage and has been deeply optimized for capital efficiency and liquidity management. It aims to create a universal leverage layer, enabling global users to trade the most valuable market assets in a decentralized manner. Backed by top institutions such as Pantera and Founders Fund, Avantis has raised $12 million in two rounds of funding. Leveraging oracles such as Python and Chainlink, Avantis provides an efficient and secure trading experience.

2.2 Core Functionality

The core of Avantis lies in its high leverage and multi-asset support. The platform offers up to 50x leverage for crypto assets and up to 500x leverage for RWAs like forex, gold, and crude oil, creating a highly differentiated trading experience in the decentralized market. Unlike traditional DeFi derivatives protocols, Avantis introduces mechanisms such as loss rebates, positive slippage rewards, and zero-fee leverage. These mechanisms not only optimize traders' capital efficiency but also reduce the cost of losses in a highly leveraged environment. This model allows traders to perform high-frequency and complex operations in a decentralized environment, approaching the level of centralized exchanges.

Avantis utilizes a two-tiered LP model to enhance liquidity and security. Users can passively deposit USDC to earn stable returns, or actively engage in market making through a risk-stratified mechanism to capture higher returns. Furthermore, the platform has designed a Security Module, allowing users to stake AVNT tokens to ensure protocol stability. Stakers receive rewards, fee discounts, and XP bonuses. While there is a theoretical risk of slashing, this mechanism further enhances protocol security and LP return stability. Through these innovations, Avantis has established a unique advantage in the decentralized derivatives market in terms of leverage efficiency, risk management, and capital utilization.

2.3 Token Economy

Avantis' native token, $AVNT (2024111120239), will be officially minted on April 23, 2025, with a fixed supply of 1 billion. It will be listed on major exchanges including Coinbase, Binance, and JU.com in September 2025. It is designed to serve as the core driver of the Universal Leverage Layer, assuming multiple roles within the ecosystem, including incentives, governance, and security. Specifically, $AVNT holders can stake their tokens to secure liquidity providers and mitigate the risks of volatile markets, while also earning token rewards, bonus XP points, and reduced transaction fees.

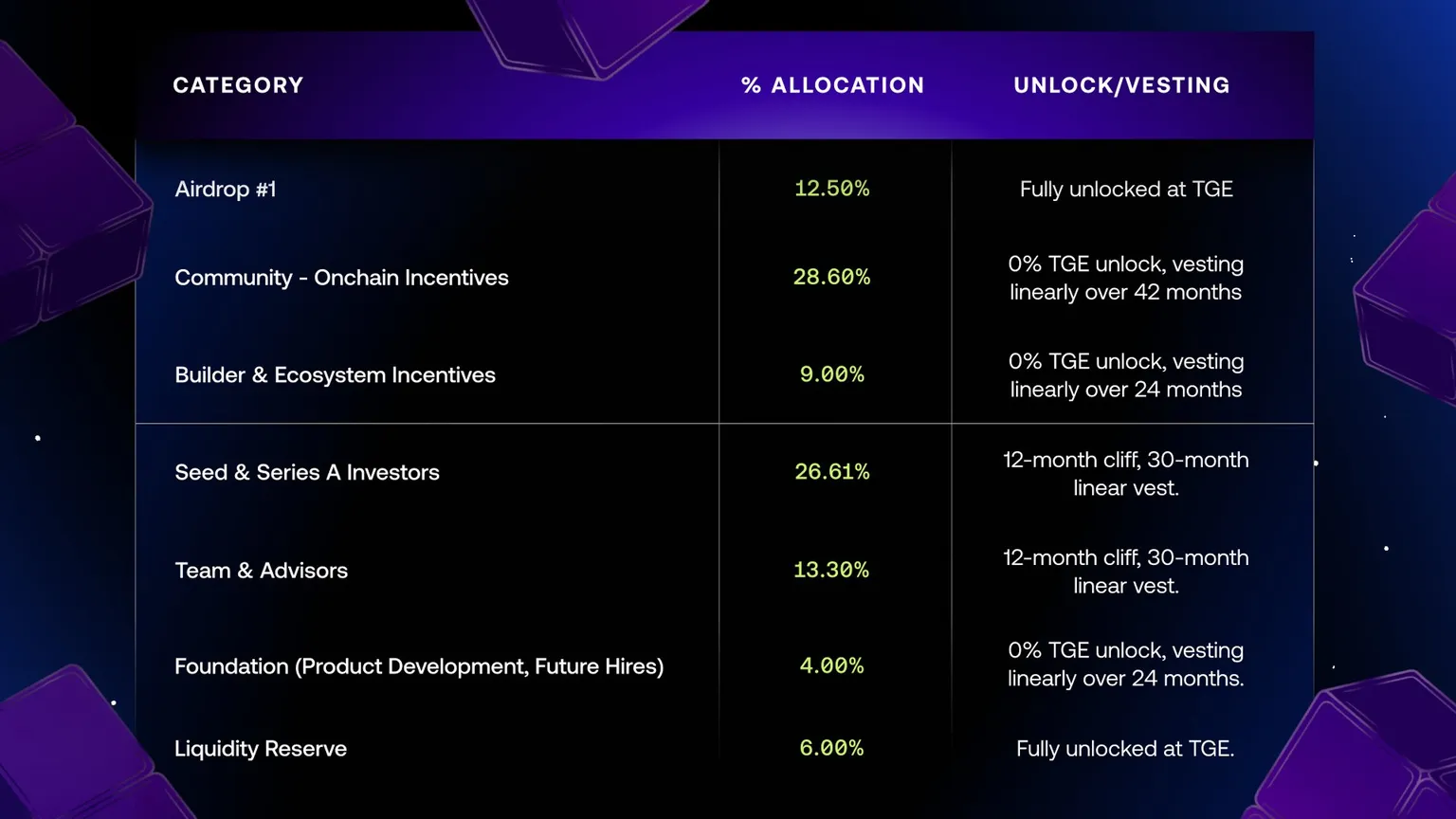

Avantis's distribution mechanism is community-oriented, with over 50% of tokens reserved for users and the ecosystem. Specifically, the distribution includes 12.5% airdrop (fully vested via the TGE), 28.6% on-chain incentives (linearly vested over 42 months), 9% ecosystem and developer grants (linearly vested over 24 months), and 6% liquidity reserves (fully vested via the TGE). The team and advisors receive 13.3% (12-month Cliff, 30-month linear vesting), investors hold 26.6% (also 12-month Cliff, 30-month linear vesting), and the foundation receives 4% (linearly vested over 24 months). This structure ensures incentives for early community and traders while limiting short-term selling pressure from investors and the team through a long-term lock-up mechanism, providing institutional guarantees for the stability of token value and the development of the protocol.

2.4 Platform Data

To date, Avantis' on-chain transaction volume has exceeded $23.6 billion, with a cumulative 2,345,664 trades brokered and 42,482 active traders. For a protocol that only launched on the Base mainnet in 2024, this growth demonstrates its rapid market presence and its status as the most deeply active and active derivatives platform in the Base ecosystem.

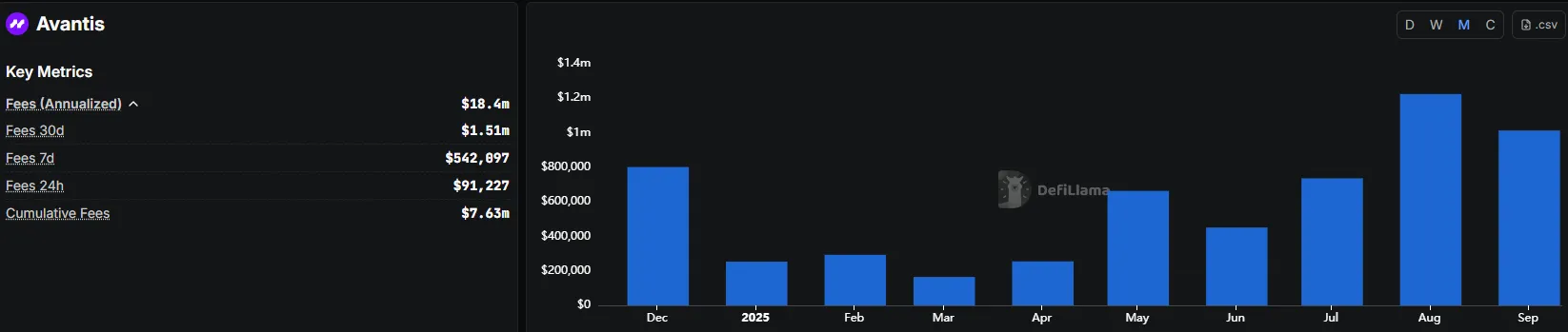

Avantis has demonstrated a steady growth in fees. Over the past 30 days, the platform incurred $1.51 million in fees, $542,000 in 7-day fees, and $91,000 in 24-hour fees, bringing the total to $7.63 million. Annualized fees have exceeded $184 million. Monthly fees have shown a significant acceleration since the beginning of 2025. This is driven by a rapid expansion in trading volume, which has driven continued fee growth. Furthermore, with the onboarding of more users and assets, the platform's advantages in liquidity and leverage efficiency have gradually become apparent.

2.5 Investment Logic

Avantis' core focus lies in its unique positioning in decentralized derivatives and RWA trading. Leveraging the high performance and low-cost environment of the Base chain, combined with high-frequency oracles like Python and Chainlink, Avantis enables on-chain mapping of traditional markets such as foreign exchange, gold, and crude oil. Its product offers a near-CEX experience with up to 500x leverage, zero fees, and a loss rebate mechanism, creating a distinct differentiation. The project has also received support from top institutions such as Pantera and Founders Fund, and has allocated over 50% of its tokens to the community, strengthening its growth and consensus. As RWA becomes a core narrative at the convergence of crypto and traditional finance, Avantis's universal leverage layer positioning is expected to penetrate a broader market space. Its rapidly growing trading volume, user base, and fee scale provide solid support for the long-term value of $AVNT.

3. Boundless

3.1 Project Overview

Boundless is a general-purpose zero-knowledge (ZK) computation network. Its core goal is to enable blockchains to cost-effectively verify complex computations, thereby achieving "internet-scale" scalability. Through zero-knowledge proofs, Boundless converts the results of computations performed by a single node into verifiable proofs, enabling other nodes to quickly confirm the results without re-execution. This mechanism not only improves network efficiency but also provides a unified verifiable computation infrastructure for L1, L2, public-chain cross-chain bridges, and DeFi applications.

Boundless also employs a PoVW (Verifiable Proof of Work) mechanism, directly tying network incentives to computational power. Nodes must run a prover to submit valid proofs and receive token rewards. This model, essentially a new "ZK Mining," ensures transparency and fairness in the proof market while attracting a large number of computing power participants, enabling Boundless to form a decentralized node ecosystem.

3.2 Main Highlights

- Cross-ecosystem deployment: Boundless does not rely on a single public chain, but is designed as a cross-chain deployable ZK computing network that can cover ecosystems such as Ethereum, Bitcoin, Solana, and adapt to scenarios such as L1, L2, cross-chain bridges, and DeFi, with the potential for horizontal expansion.

- PoVW mechanism: It uses a verifiable proof-of-work mechanism to not only verify the correctness of the results, but also measure the actual computing power, so that rewards are directly linked to computing power, achieving transparent and fair distribution. At the same time, it has built-in fraud prevention logic to reduce the risk of malicious behavior.

- Developer-friendly: Its zkVM natively supports mainstream programming languages such as Rust and C++, significantly lowering the technical threshold for ZK development and allowing Web2 engineers to directly migrate to Web3 application development.

- Large market space: The annual scale of on-chain ZKP execution and off-chain incentive fees is about US$5 billion. As mainstream public chains gradually move towards ZK, the demand for verifiable computing will continue to increase.

3.3 Token Economy

Boundless' native token is ZKC, with a genesis supply of 1 billion. It utilizes an unlimited supply model, but achieves long-term stability through a diminishing inflation mechanism, with an initial annual inflation rate of 7% that gradually decreases to 3% in the eighth year. The foundation's financial allocation of 40.03% of the core token allocation is used for long-term protocol development and ecosystem development.

The team holds 23.44% for development and governance; private investors hold 21.56%, balancing capital support with market stability through a lock-up and unlock mechanism. The remaining portion is allocated to community sales (6.57%), airdrops and marketing (1.95%), market makers (1.95%), and others (4.5%). At the time of listing, Boundless had a circulating supply of 200,937,056 ZKC, representing 20.09% of the total supply. Additionally, periodic marketing rewards have been set aside: 5 million ZKC will be released upon spot listing, and an additional 15 million will be released six months later for ongoing marketing and user incentives.

3.4 Ecosystem

Boundless currently achieves 99.9% stability and exascale computational processing, integrating with over 30 major protocols. In ecosystems like Ethereum, Bitcoin, and Solana, Boundless provides efficient and low-cost proof generation and verification, becoming a critical foundation for cross-chain bridges, ZK Rollups, oracles, and other financial infrastructure. At the collaborative level, Boundless is deeply embedded in multiple leading protocols. For example, Lido leverages Boundless to implement on-chain audits of stETH balances; Automata migrates trusted hardware verification to Ethereum; and within the Bitcoin ecosystem, projects like Bitcoin OS and LayerEdge rely on Boundless to build trusted cross-chain and application frameworks.

3.4 Investment Logic

Boundless has elevated zero-knowledge proofs from a single-chain optimization tool to cross-ecosystem infrastructure. Ethereum is bringing zero-knowledge proofs mainstream through ZK Rollup, while Solana and Bitcoin are experimenting with ZK technology in cross-chain bridges, light clients, and verification. This overall trend indicates a growing demand for verifiable computation. Against this backdrop, Boundless uses a PoVW mechanism to directly link computing power and rewards, attracting node participation and establishing a transparent proof market. Its token, ZKC, combines incentives, staking, and governance functions, with a diminishing inflation model that balances early growth with long-term stability. Overall, Boundless possesses a scarce advantage in technology patents, token design, and ecosystem implementation, making it a promising candidate to become a core pillar of the next generation of ZK infrastructure.

Summarize

Juchain's brand upgrade brings not only a refreshed image but also a comprehensive evolution of its mechanisms and ecosystem. Through transparent execution and permanent token reduction, the token repurchase and destruction plan establishes a long-term deflationary outlook for $JU, providing a solid foundation for value capture. Simultaneously, Juchain is gradually developing a diversified ecosystem, from financing and governance to derivatives and RWA, and finally to zero-knowledge computing infrastructure. Juchain is building a cross-sector, interconnected ecosystem.

This combined model, which strengthens token value through scarcity management and builds a growth engine through multi-track expansion, provides long-term resilience and potential for expansion. With the continued integration of buyback and destruction and ecosystem expansion, Juchain's positioning is gradually shifting from a single platform to a diversified ecosystem network, providing dual support for future value growth and market recognition.