- Arbitrum’s TVL surged over 60% since June 2025, reflecting stronger capital inflows into its DeFi ecosystem.

- Stablecoin liquidity, efficient revenue capture, and near-billion daily DEX volumes highlight Arbitrum’s growing on-chain activity.

Arbitrum has recorded a surprising surge in total value locked (TVL) in recent months.

On June 23, 2025, the network’s TVL hovered around $2.25 billion. Now, according to DefiLlama data, that figure has reached $3.62 billion, representing an increase of approximately 60.7% in just three months.

This surge isn’t just a number on a screen, but rather a reflection of the rapid inflow of capital into this Ethereum-based Layer-2 ecosystem.

Strong DeFi Momentum as Arbitrum Records Billions in Activity

This TVL growth also aligns with the increasing activity in DeFi. The stablecoin market cap on Arbitrum is recorded at $3.65 billion, demonstrating the dominance of stable assets in supporting the ecosystem.

In terms of fees, the network recorded $607,000 in the last 24 hours, almost entirely recorded as revenue, totaling $606,000. Interestingly, there is a slight difference when calculating the network’s overall revenue, which is $620,000.

Furthermore, applications operating on Arbitrum also contribute revenue. Data shows that daily app revenue reached $439,000, while app usage fees reached $1.28 million.

This difference occurs because not all fees go directly to the protocol treasury; some are distributed to validators and other incentives.

From a trading perspective, transaction volume on decentralized exchanges in the last 24 hours reached nearly $987 million. This figure is approaching $1 billion, indicating the intense activity in the Arbitrum on-chain market.

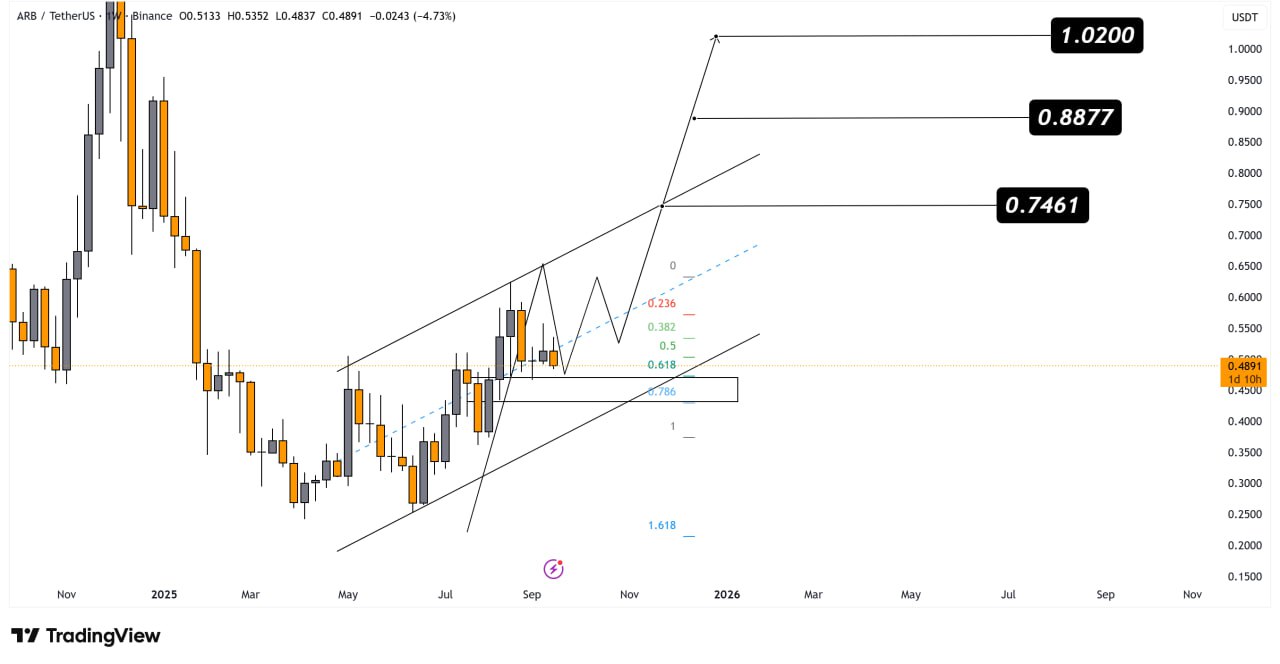

Meanwhile, analyst Rose highlighted ARB’s price movement, which has begun to recover after hitting a key demand zone. The token managed to hold within the Fibonacci golden pocket area of 0.618–0.786 and bounced off the support of its ascending channel.

According to Rose, this price structure indicates a strong continuation pattern with a trend of higher lows forming. The next price target is estimated at $0.7461, then $0.8877, and possibly extending to $1.02.

Meanwhile, at the time of writing, ARB was trading at about $0.4348, up 2.67% in the last 4 hours, with $2.3 billion in market cap.

Whale Accumulation and NodeOps Expansion Shape the Ecosystem

On the other hand, last month’s CNF also saw significant movement from whale investors. One whale was recorded as accumulating approximately 1.974 million ARB, valued at approximately $1.14 million. Interestingly, the purchase was funded by ETH exchanges, suggesting a high level of confidence in Arbitrum compared to other assets.

This type of accumulation is often considered a sign of long-term confidence, although of course, there is no guarantee that the market will move according to the whales’ expectations.

Furthermore, in early July, NodeOps officially launched its permissionless, SLA-backed compute protocol on Arbitrum after a successful testnet phase.

This move adds a new dimension to the ecosystem, especially as NodeOps is also expanding its services with staking, cross-chain integration, and AI-based orchestration to support DePIN.

The presence of this infrastructure could make Arbitrum even more attractive to developers looking to build complex projects with guaranteed more stable performance.