By Zhou, ChainCatcher

On September 24th , Bloomberg reported that Tether is in early-stage negotiations with potential investors, planning to raise $ 15 billion to $ 20 billion through a private placement in exchange for approximately 3% of its equity. Cantor Fitzgerald reportedly served as lead advisor for the transaction, which is expected to close before the end of the year.

The report also stated that this move could push Tether 's valuation to approximately $ 500 billion, making it one of the world's most valuable private companies, alongside tech giants like OpenAI and SpaceX . Currently, Tether's most direct competitor, Circle , has a public market capitalization of only approximately $ 30 billion. As for Binance, another crypto giant, estimates from various media outlets, including Bloomberg and Fortune, put the highest estimate at $ 300 billion.

Since Tether had never publicly raised funds before, this also means that Tether 's first round of financing set records for all global companies in terms of both amount and valuation. Previously, both records were held by AI company Thinking Machines Lab , which completed its first round of financing this year, raising $ 2 billion at a valuation of $ 10 billion.

Tether CEO Paolo Ardoino later posted on X that the company is evaluating financing from a group of high-profile key investors to maximize the company's strategic scale in existing and new business lines (stablecoins, distribution channels, AI , commodity trading, energy, communications, and media).

In terms of fundamentals, according to Coingecko data, the current USDT circulating market value is approximately US$ 172.875 billion, accounting for more than 57% of the total stablecoin size of approximately US$ 300 billion.

Crypto Ex-Insider , a former Binance/Bybit employee, believes that the $ 500 billion target makes Tether more like a shadow central bank, and the $ 20 billion in new capital marks its expansion from settlement to strategic layout, which may mean that stablecoins challenge sovereign influence.

Supporting confidence in this fundraising is Tether 's profitability. Officially disclosed, it achieved a net profit of $ 4.9 billion in Q2 2025 , with a profit margin of 99% . Crypto trader AT_XQ described Tether 's fundraising as "adding another printing press to the printing press." He noted that Tether's $ 4.9 billion profit last quarter came primarily from its holdings of US Treasuries and Bitcoin. If the fundraising is completed, it will boost USDT liquidity and potentially drive another wave of price increases, but the risk of regulatory intervention remains.

From the perspective of reserves and asset structure, Tether 's reserve assets include more than US$ 127 billion in U.S. Treasury bonds, approximately 100,000 bitcoins, more than US$ 20 billion in equity and US$ 7 billion in excess reserve buffer.

In addition to its core stablecoin business, Tether has expanded into a broader range of financial infrastructure, including investing $ 500 million in Bitcoin mining, AI and renewable energy projects, as well as supporting cross-border payments, DAO (decentralized autonomous organization) payroll and Web3 ecology.

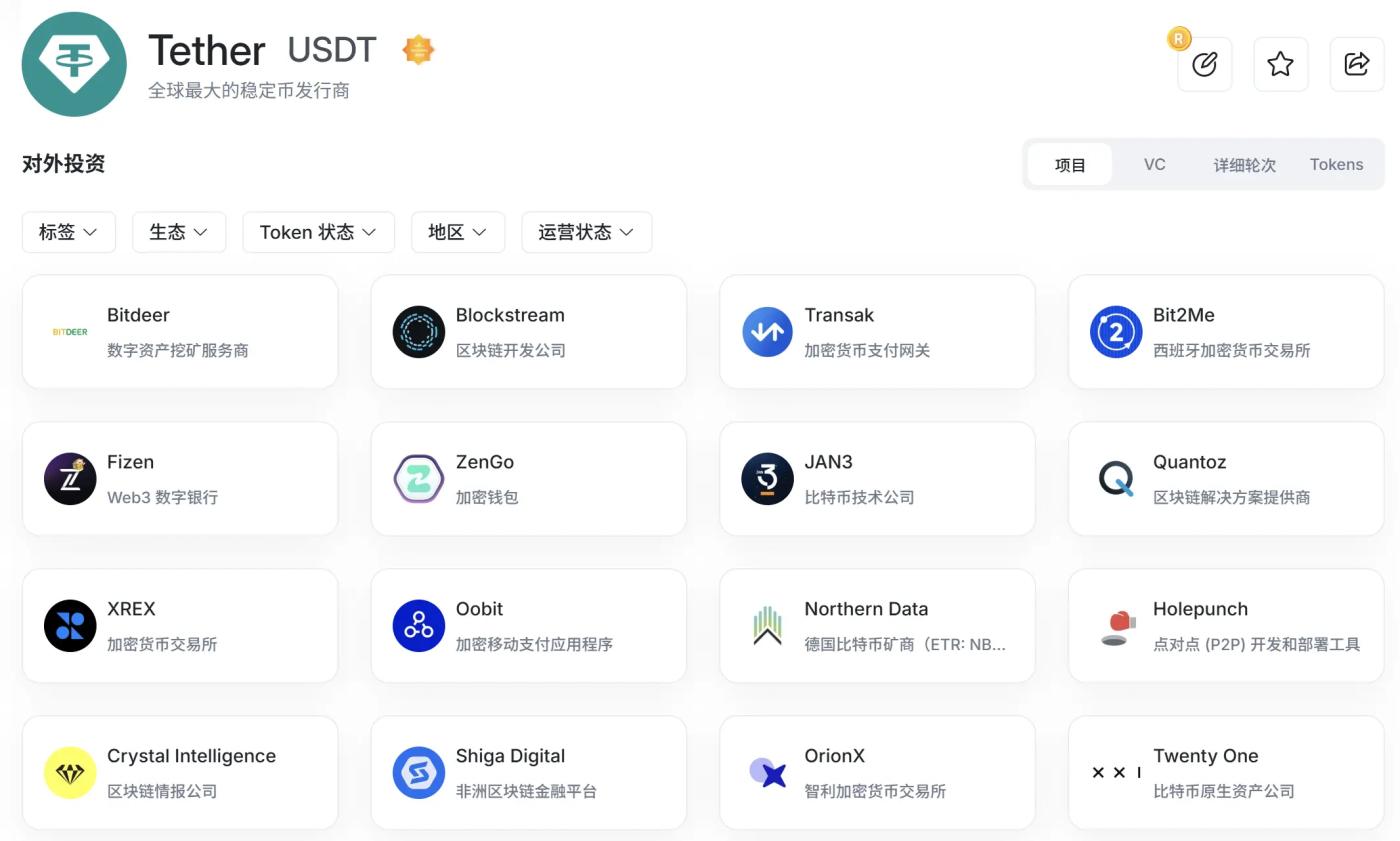

According to RootData , Tether has significantly accelerated its outbound investments since May 2024 , reaching a total of 27. Tether has also launched several new businesses, including the Hadron asset tokenization platform and the Layer1 Stable stablecoin. This massive funding round, combined with Tether's massive ambition to build a crypto empire, clearly demonstrates its vast ambitions.

Click here to learn about ChainCatcher's current job openings