#TRX

- TRX trades below key moving average with Bollinger Band squeeze indicating potential volatility expansion

- Mixed news flow creates uncertainty despite positive altcoin market sentiment

- Technical resistance at $0.354 likely caps near-term gains without significant catalyst

TRX Price Prediction

TRX Technical Analysis: Bearish Signals Dominate Short-Term Outlook

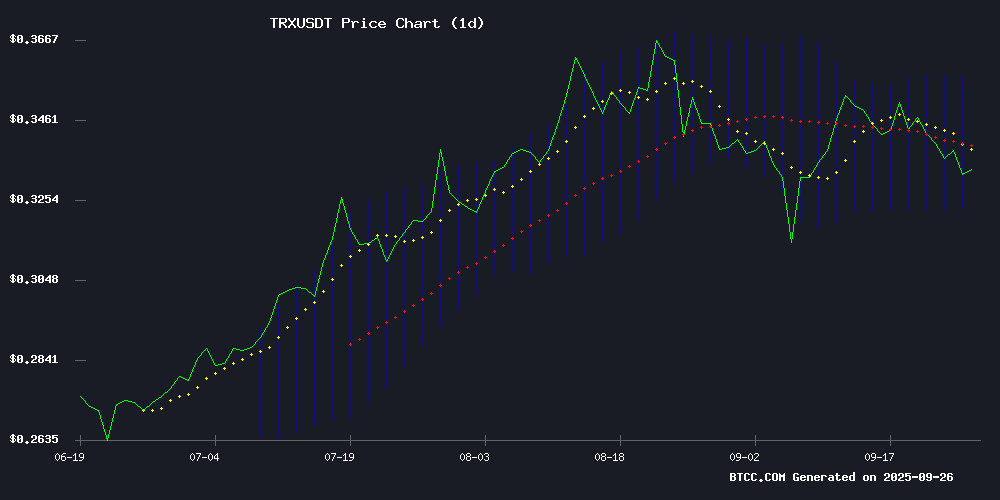

According to BTCC financial analyst William, TRX currently trades at $0.3338, below its 20-day moving average of $0.34133, indicating near-term bearish pressure. The MACD histogram shows a positive reading of 0.002114, suggesting potential momentum shift, though both MACD lines remain in negative territory. Price action NEAR the lower Bollinger Band at $0.32833 could signal oversold conditions, while resistance sits at the upper band of $0.35433.

William notes that 'TRX needs to reclaim the 20-day MA to confirm any meaningful recovery. The current technical setup favors range-bound trading between $0.328 and $0.354 in the coming sessions.'

Mixed News Flow Creates Uncertainty for TRX

BTCC financial analyst William comments that 'while positive developments around stablecoin growth and crypto legislation could benefit the broader market, TRX-specific news remains challenging. The court ruling regarding Justin Sun's portfolio disclosure adds regulatory overhang, potentially limiting upside near-term.'

William adds that 'being highlighted among altcoins with ROI potential provides some positive sentiment, but technical factors should take precedence in current market conditions. News-driven moves are likely to be contained within existing technical ranges.'

Factors Influencing TRX's Price

Stablecoin Growth and Crypto Legislation Set to Drive Fourth Quarter Returns

Regulatory clarity and institutional adoption are poised to shape the crypto market's trajectory in Q4. The CLARITY Act, a comprehensive financial services legislation, could accelerate the integration of digital assets with traditional banking, potentially unlocking deeper institutional participation.

Stablecoin expansion emerges as a critical growth vector, with Ethereum, Solana, Tron, and layer 2 networks positioned to benefit from developing payment infrastructure. Citi's bullish projection of a $4 trillion stablecoin market by 2030 underscores the sector's potential to support up to $200 trillion in transactions.

Bitcoin ETFs continue to demonstrate robust demand, acquiring 1,755 BTC daily—a trend analysts believe could propel both BTC to new highs and subsequent altcoin rallies. Revenue-generating DeFi projects and tokenized assets stand out as key growth sectors for the quarter.

5 Best Altcoins to Buy for 50x ROI Potential – Cardano, TRON and MAGACOIN FINANCE Highlighted

Investors are scouring the crypto market for tokens poised to deliver exponential gains as the 2025 bull run gains momentum. While Bitcoin anchors the sector, altcoins like Cardano (ADA), TRON (TRX), and emerging presale project MAGACOIN FINANCE are drawing attention for their growth potential.

Cardano's methodical, research-backed development has cemented its reputation for reliability, though its measured pace contrasts with faster-moving competitors. Trading near $0.94, ADA remains accessible to retail investors. Hydra and other upgrades could enhance its scalability, positioning it to rival high-performance chains. However, analysts note that achieving a 50x return would require ADA's price to surpass $47—a scenario demanding unprecedented adoption levels.

MAGACOIN FINANCE, meanwhile, has sparked excitement with its record-breaking presale performance and 19,000% ROI narrative. The project's rapid ascent underscores the market's appetite for high-risk, high-reward opportunities.

Federal Court Denies Justin Sun’s Attempt to Block Disclosure of $3B Crypto Portfolio

A U.S. federal court has rejected Tron founder Justin Sun's emergency motion to prevent Bloomberg from publishing details of his cryptocurrency holdings. The September 22 ruling from Delaware's District Court clears the way for Bloomberg to report on Sun's portfolio, which includes 60 billion TRX, 17,000 BTC, and 224,000 ETH.

Judge Colm Connolly found no evidence supporting Sun's claim of confidentiality protections for the asset information. The decision marks another legal setback for Sun, who faces ongoing scrutiny from U.S. regulators regarding his cryptocurrency activities.

The disclosed holdings reveal Sun maintains significant positions across major cryptocurrencies, with the portfolio's total value exceeding $3 billion. Market observers note the transparency ruling could impact trading dynamics for TRX and other affected tokens.

How High Will TRX Price Go?

Based on current technical and fundamental factors, TRX faces significant resistance around the $0.354 level corresponding to the upper Bollinger Band. BTCC financial analyst William suggests that 'while positive market developments could push TRX toward $0.36-$0.38 in the medium term, immediate upside appears limited to the $0.341-$0.354 range until technical resistance is broken.'

| Timeframe | Price Target | Key Levels |

|---|---|---|

| Short-term (1-2 weeks) | $0.341-$0.354 | 20-day MA resistance |

| Medium-term (1-3 months) | $0.36-$0.38 | Break above Bollinger upper band |

| Catalyst Required | Above $0.40 | Positive regulatory clarity |