This report, written by Tiger Research , analyzes potential scenarios that could unfold if Naver acquires Dunamu.

Summary of key points

- The possibility of Naver acquiring Dunamu, the operator of Upbit, has emerged and attracted industry attention. This would be a major deal on the scale of Google's acquisition of Coinbase.

- Synergy benefits are concentrated in three areas. Naver's 40 million users could simplify Upbit's registration process. Stablecoins could improve Naver Commerce's payment efficiency. Naver Webtoon's IP could create new blockchain revenue models.

- Both companies have denied the reports, but have collaborated on stablecoins and other areas. They view cryptocurrencies as core strategies, making integration a likely possibility.

1. South Korea’s crypto market is about to undergo a major transformation

On September 25, 2025, speculation arose that Dunamu, which operates South Korea's largest cryptocurrency exchange, Upbit, might join the Naver Group. Dunamu would become a wholly-owned subsidiary of Naver Financial, Naver's financial subsidiary. This would create a vertical conglomerate structure.

Source: Tiger Research

The two companies had previously announced plans to collaborate in various areas, including stablecoins. However, the news of Naver's acquisition of Dunamu, a company with a market capitalization of 12 trillion won, shocked the industry. The deal is similar to Google's acquisition of leading cryptocurrency exchange Coinbase.

Both companies have officially denied these reports, stating that "nothing has been finalized." However, the potential merger of these two giants warrants analysis. We should examine the potential changes and ripple effects of this scenario. This analysis will explore which business areas could generate synergies if a Naver-Dunamu mega-deal were to materialize.

2. What synergies can Naver and Dunamu create?

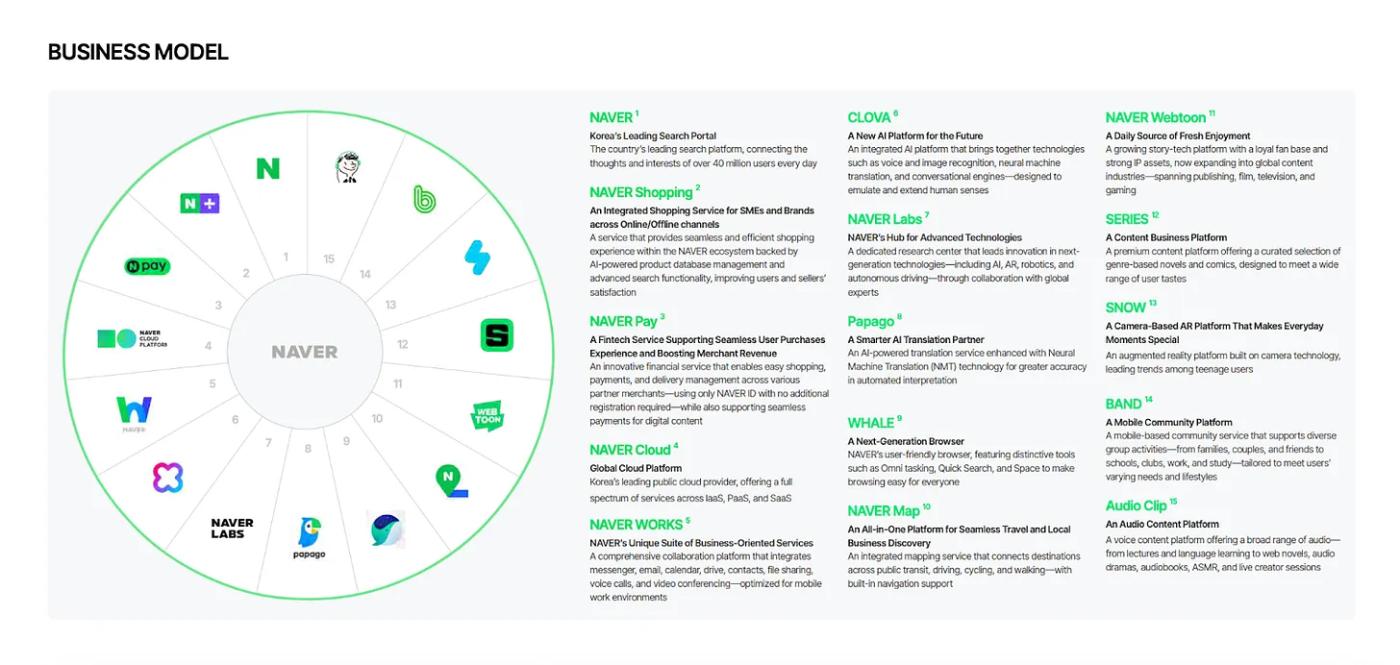

To understand the synergy between Naver and Dunamu, we first need to examine Naver's corporate identity. Naver is a leading large-scale technology company in South Korea. Initially focused on search engines, it now operates across a wide range of industries. The company has established its own ecosystem encompassing e-commerce (Naver Shopping), simple payments (Naver Pay), and a content platform (Naver Webtoon).

Source: Naver Integrated Report 2024

If Dunamu were solely a cryptocurrency exchange, the collaboration between the two companies would be limited. However, Dunamu recently launched GIWA Chain, a Layer 2 blockchain based on Optimism. This demonstrates Dunamu's transformation from a simple exchange to a blockchain infrastructure company. Blockchain infrastructure can naturally integrate with a wide range of industries.

This is where Naver's vast business scope and Dunamu's infrastructure capabilities connect. This connection explains why their combination is attracting attention.

Scenario 1: User base expansion

The most obvious synergy between the two companies is the expansion of their user base. Naver has approximately 40 million monthly active users (MAUs). The company provides digital authentication infrastructure, including easy login services within its apps and mobile ID services (such as ID cards and driver's licenses).

Source: Upbit

Currently, the registration process for cryptocurrency exchanges is quite complicated. Users must complete multiple steps: identity verification, ID photo taking, and bank account linking. These cumbersome procedures are a major barrier to new user acquisition. However, if Naver integrates with Upbit, the situation will completely change. Users can easily register and log in using their Naver ID. Companies can also significantly simplify the KYC (Know Your Customer) process by utilizing Naver's mobile ID service.

These changes will directly impact Upbit's user expansion. Upbit currently has 10 million registered users. When combined with Naver's 40 million user base and a streamlined registration process, it will be easier for potential users to join. This presents a significant opportunity for Upbit to accelerate its user growth rate.

Scenario 2: Stablecoin Payment Revolution

Source: Naver Integrated Report 2024

Source: Naver Integrated Report 2024

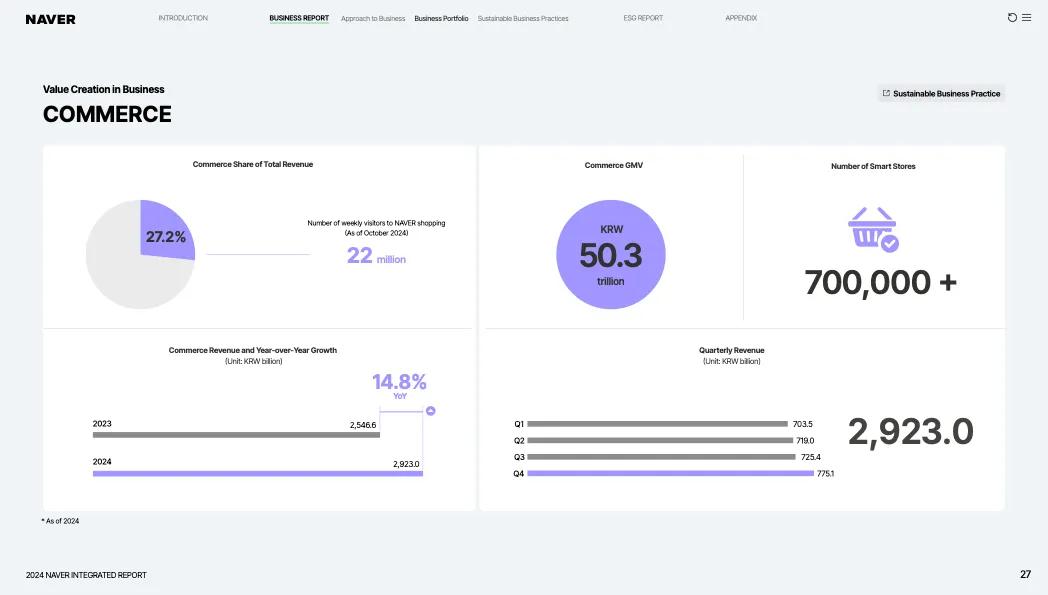

The next area to watch is stablecoins. Naver has officially announced its intention to enter the stablecoin market. The company is likely to issue a stablecoin based on the GIWA Chain. The key lies in Naver's vast payment ecosystem. Naver Pay has 30.68 million users (as of 2025), and Naver Shopping's annual transaction volume reaches approximately 50.3 trillion won (as of 2024).

By introducing a stablecoin into this large-scale payment ecosystem, both companies can expect significant synergies. Naver could reduce existing credit card processing fees and improve profitability. It could also significantly increase the efficiency of its settlement process. Furthermore, it anticipates that 10 million cryptocurrency investors will flock to Naver Pay.

Dunamu also secures lucrative revenue opportunities. The company can capture blockchain fees generated on the GIWA Chain. It can also secure transaction fees from stablecoin payment services. Stablecoins and cryptocurrencies have yet to become mainstream payment methods. Merchants need on- and off-ramps to receive stablecoins and convert them into cash. Exchange infrastructure is crucial to this process. Upbit is likely to play this role (as of 2025, the Financial Services Commission will allow the sale of cryptocurrencies on licensed exchanges).

Naver Pay Connect, Source: Naver Pay

When Naver Pay and Upbit are integrated, they will gain a completely different competitive advantage. Considering Naver's recently launched offline payment terminal, 'Naver Pay Connect,' they can build an integrated ecosystem. This ecosystem will seamlessly connect all online and offline payments through stablecoins. This will provide a significantly different competitive advantage from the existing payment ecosystem.

Scenario 3: Content IP Innovation

Source: Naver Webtoon

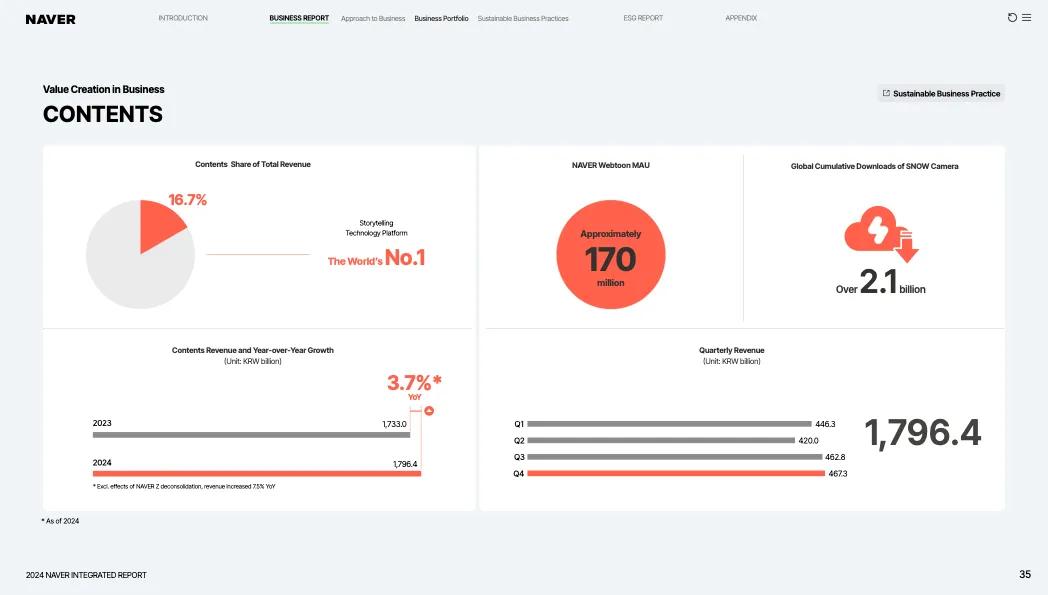

A final point of note is the potential integration of Naver's content ecosystem with blockchain. Naver Webtoon has produced numerous popular webtoons, including "Tower of God," "Sweet Home," and "Vigilante." These works have been adapted into TV series and films, garnering a global fan base. Naver Webtoon's revenue is projected to reach approximately $1.35 billion in 2024 and continues to grow.

Source: Naver Integrated Report 2024

Naver Webtoon essentially allows creators to own their IP, but the platform holds usage or exclusivity rights based on contractual terms. If Dunamu's GIWA Chain is integrated with this structure, it could enhance transparency in IP utilization and create innovative models for secondary creation and revenue distribution. Furthermore, it could enable new models, such as token economies based on fan communities and on-chain IP assets.

Source: Naver Webtoon

Naver Webtoon has also recently expanded its partnerships with global IP companies such as Disney and Marvel. Disney provides the IP, while Naver Webtoon is responsible for platform development and operation. The new platform will bring together Disney's vast collection of comic IP in one place. This means Naver Webtoon has laid the foundation for handling both its own IP and top global IP. Through this, it is expected that the monetization methods of the content industry will leap forward in conjunction with blockchain.

3. Blockchain expands Naver's business scope

Naver’s platform ecosystem extends far beyond what we’ve covered here. There are numerous scenarios where blockchain technology could be integrated with Naver’s existing value chain to add new functionality and value, or expand into entirely different areas.

For example, Poshmark, North America's largest secondhand marketplace, which Naver acquired in 2023, could leverage the programmable payment capabilities of stablecoins to implement an escrow system. Naver's search advertising business could improve transparency through blockchain-based settlement. Live streaming service Chzzk could experiment with a model that converts viewer engagement into token rewards.

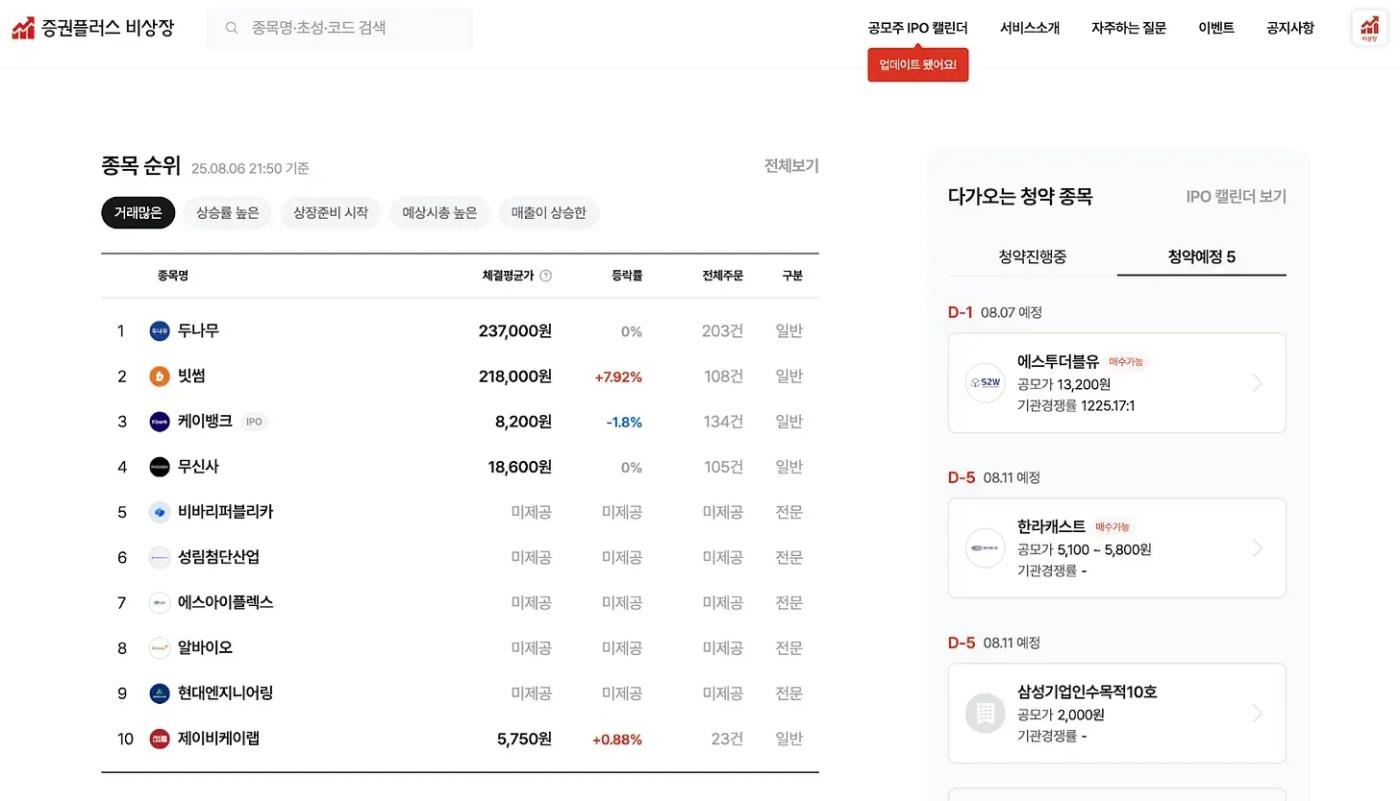

Source: Securities Plus Unlisted

One particularly noteworthy development is Naver Pay's acquisition of Securities Plus Unlisted, an unlisted stock trading platform. Combined with Dunamu's GIWA Chain, this opens up a realistic scenario for significantly improving liquidity and accessibility through tokenization of unlisted stocks.

While Naver and Dunamu have drawn a line in the sand regarding the integration of their subsidiaries, they are already collaborating in a number of areas. Importantly, both companies now view the crypto industry as a core strategic pillar and have begun fully engaging with it. The industry is closely watching how their merger will unfold and what new blockchain services will emerge in the process.