At 4:25 p.m. Eastern on Sunday, bitcoin has been tiptoeing around $110,324 to $110,595 over the last hour, acting like the cool kid at the party who won’t dance until the DJ drops a real banger.

Bitcoin’s Range Game

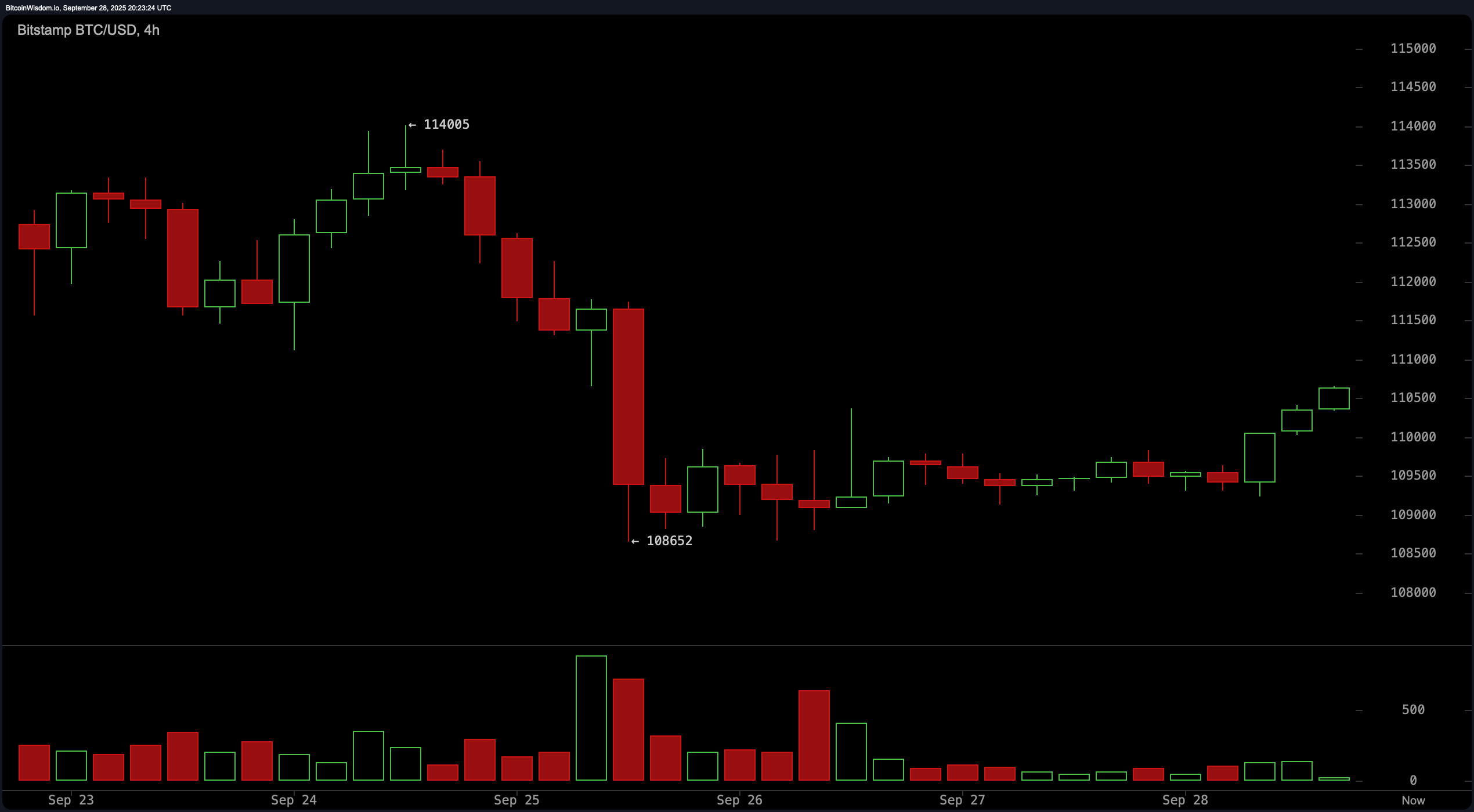

Bitcoin spent the past few days chopping inside a range, digesting a late-September shakeout and a fade from mid-month highs. The market’s vibe is consolidation: less fireworks, more side-eye. Price action hovers near familiar guardrails while traders argue over the next act.

On Sept. 28, current price figures read $110,324, up from Saturday but down roughly 4% to 5% week over week as macro jitters and exchange-traded fund (ETF) outflows pressed. The tone: cautious, not panicked—think traffic, not a pile-up.

The week’s plot twist arrived Sept. 26, when bitcoin knifed from the mid-$115Ks to test $109K after billions in leveraged longs were flushed this week. That reset wrung out froth and pinned the market near key supports. Call it a forced nap for over-caffeinated bulls.

Under the hood, technicians are circling the same signposts. First, support lives in the $107,000 to $108,700 band; lose that and $105,000 to $100,000 comes into view. On the flip side, a clean break above $112,000 to $113,000 would reopen the upside. Volume is the bouncer.

Momentum tells a mixed story. Daily relative strength index (RSI) hints at neutral-to-bullish divergence while moving average convergence divergence (MACD) leans bearish on higher time frames—classic “hurry up and wait.” The long-term channel stays intact as long as $110K holds.

Sentiment cooled without capitulating. The Fear & Greed Index crept into the “fear” zone, open interest has faded but still shows a steady boil, and social feeds skew skeptical—conditions that have a habit of setting up sneaky squeezes if resistance blinks. Traders love to be gloomy right before they’re wrong.

Flows and headlines still matter. Spot ETFs saw meaningful outflows last week, while whales shuffled coins to new wallets and exchanges and majors trimmed holdings—together, a recipe for choppy bids and quick fades. None of it breaks the story; it just makes the playlist moodier.

Macro keeps muscling onto the stage. Fed speak, PCE prints, and U.S. dollar strength have yanked bitcoin back and forth all month, correlating tightly with equities. If policy dials soften into October, the “Uptober” narrative gets air; if not, cue more meandering.

Baseline, expect chop with benefits: a range between roughly $105,000 and $113,000 until a catalyst kicks the door. The bull path is simple—hold $107,000, reclaim $112,000 to $115,000, then try for $120,000. The bear path starts with a clean break of the $107,000 floor.

Translation for traders: respect the levels, watch ETF nets, track on-chain exchange flows, and let volume confirm the move before you marry a bias. Consolidation isn’t glamorous, but it pays rent. And bitcoin still owns the lease on crypto’s penthouse.

In short, bitcoin isn’t broken—it’s traders who are bored. Bored markets don’t stay bored forever, and October has a reputation for waking sleepers. Keep risk tight, keep your jokes tighter, and keep an eye on $112,000. When the DJ finally drops it, you’ll want to be on the floor.