This article is machine translated

Show original

Last month, I reviewed @flyingtulip_'s slides and, after some reflection, decided it wasn't a good opportunity. My main concerns were redemptions and AC.

@Wuhuoqiu pretty much explained the model. I previously heard it was 500 million institutional and 500 million retail investors, but now it's 200 million institutional, suggesting large institutions aren't very interested. I don't know how much the participating institutions have invested, nor do I know if they really care about this project; perhaps it's just an investment commitment.

If we set aside AC and assume that all 200 million institutions have invested, and the public offering of 800 million is gradually raised, and 1 billion is deposited into the treasury to earn a 5% annualized return in a safe manner, the annual revenue would be 50 million. Some of this revenue would go to the team, and some would go to token repurchases, as these tokens would appreciate in value. Ideally, over 1 billion would be deposited into the treasury later, but I personally think that's unlikely.

Several possible scenarios for the public offering:

Under normal circumstances, 200 million institutions would enter the treasury, and the public offering would quickly raise 800 million. In the worst-case scenario, some institutions may forgo funding, and the public offering will have to start early before the full 800 million is raised.

In the worst-case scenario, while learning as you go, the vault/protocol is stolen, and not only the interest, but also the principal is lost.

What will the actual situation be like?

Regarding the redemption queue, referencing @zerobasezk's wave of redemptions at the end of October, if a large number of redemptions occur, will the protocol's annualized revenue fall short of the expected 50 million? How can it support the token's expectations if it falls short of 50 million?

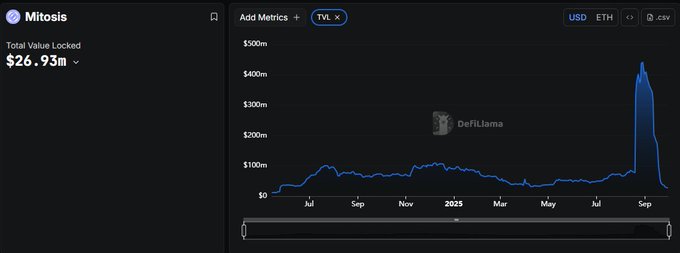

In essence, a project with a 40 million valuation is insisting on using TVL as a fundraising tool. I wonder what tricks they're playing, are they afraid that a project with a 40 million valuation won't attract that much TVL?

The remaining concern is about AC. They say this project involves so many protocols, but none of them should have a valuation of over 1 billion. Too much means it won't be polished, and wanting everything means getting nothing. Even Ethena's mechanisms were questioned and then understood only after it matured... AC is no longer the AC it once was. Flying Tulip's funds will go to Sonic. What is Sonic? Victims of the cross-chain bridge's bad debts are now unable to recover their funds; they were wiped out by the public chain's token swap.

"The Sonic cross-chain bridge's bad debts primarily stem from the Multichain protocol hack in July 2023, resulting in a total loss of $210 million, of which Sonic Labs lost approximately $122 million."

In summary, it's a staking strategy. The leader, AC, isn't very reliable. This strategy can actually be launched on any chain with Aave. I even think it would be even better on Plasma. Isn't a 15% APR better than 5%? If raising that much is difficult, then setting up a community fund with a maximum limit of 100 million, no VC, and airdropping tokens at a 10 million valuation would be faster, better, and more profitable.

The above content is solely market analysis based on personal study and research and does not constitute investment advice or the official position of the project.

Earlier example references

AC is really an old entrepreneur 😂 But the scale of entrepreneurship is relatively large

Mr. Lu's analysis is very sound! Furthermore, I remember discussing this with the team, saying that this portion of tokens should account for half, so theoretically, the true FDV of FT should be 80M. However, from another perspective, assuming there's no funds being hacked, the 80M valuation based on the Spot+Perp+Yield calculation personally created by AC seems quite reasonable, and it's worth taking a gamble.

Thanks for the correction, it is actually 80M

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content