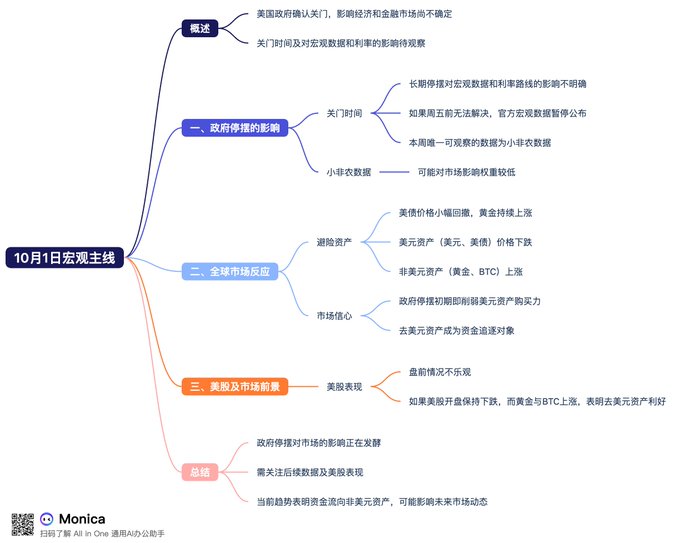

October 1st Macro Trends: US Government Shutdown, Non-Farm Payrolls May Be the Only Employment Data This Week, Will Gold/#Bitcoin Rise? The current macro narrative is that the US government shutdown is essentially confirmed, but the impact on the economy and financial markets remains uncertain. However, the duration of the shutdown and its impact on subsequent macroeconomic data and the path of macroeconomic interest rates remain uncertain. We need to wait and see how the situation unfolds in the US. Furthermore, if the government shutdown is not resolved before Friday, official macroeconomic data for this week will be suspended. The only data to watch this week will be the Non-Farm Payrolls, but this data is likely to have a lower impact on the market. In the global market, safe-haven assets saw a slight pullback in US Treasury prices, while gold continued to rise. Interestingly, US dollar assets, specifically the US dollar, saw declines in US Treasury prices, while non-US dollar assets, such as gold and Bitcoin, saw gains. If this situation persists, the situation could be more serious than I anticipated. I originally thought the US government shutdown would only weaken market confidence in the government after a period of sustained activity. However, as soon as the shutdown began, the decline in information about the US government naturally weakened the purchasing power of US dollar assets, putting pressure on them. At this point, de-dollarized assets became a target of short-term capital investment. The current pre-market outlook for US stocks is not optimistic. If US stocks continue to fall at tonight's opening, but gold and Bitcoin continue to rise, then de-dollarized assets are essentially positive.

This article is machine translated

Show original

Cato_KT

@Cato_CryptoM

10-01

美国政府正式关门/停摆,关于政府停摆三大提问,十五条解答!

这是美国七年来首次停摆,也是特朗普任期的第二次停摆,上一次持续了35天,这一次会持续多久呢?还有关于政府停摆带来的相关问题!

一,停摆持续到多久?如果美国国会想要解决政府停摆,最快需要多久解决? x.com/Cato_CryptoM/s…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content