Approximately $324.9 million worth of leveraged positions were liquidated in the cryptocurrency market over the past 24 hours.

According to currently compiled data, short positions accounted for approximately $288 million, or 88.7% of the total liquidated positions, while long positions accounted for approximately $36.9 million, or 11.3%.

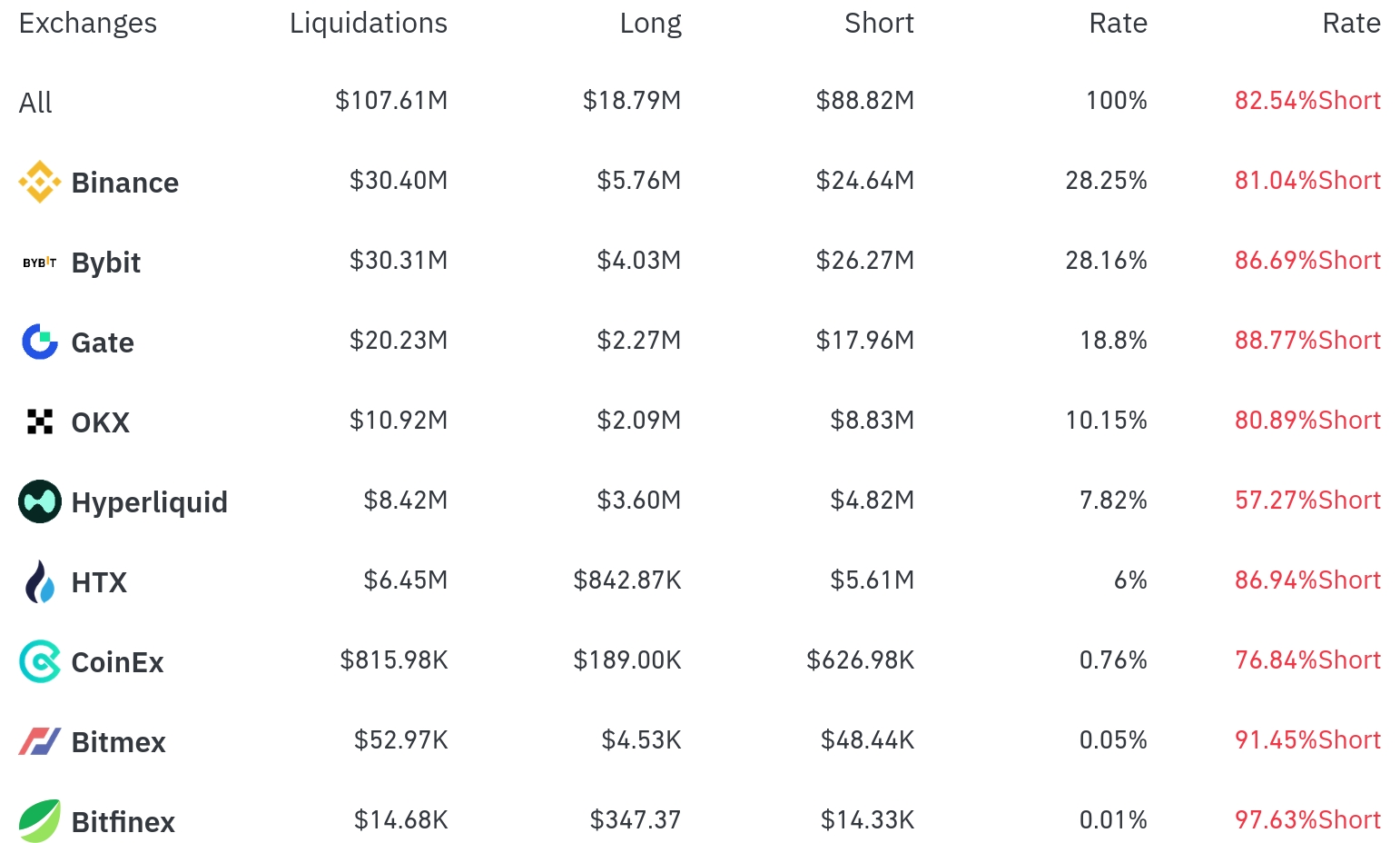

Binance saw the most liquidations over the past four hours, with a total of $30.4 million (28.25% of the total). Of this, short positions accounted for $24.64 million, or 81.04%.

The second-highest number of liquidations occurred on Bybit, with $30.31 million (28.16%) of positions liquidated, of which short positions accounted for $26.27 million (86.69%).

Gate.io saw liquidations of approximately $20.23 million (18.8%), with a very high short position ratio of 88.77%.

Notably, most exchanges showed a short position liquidation rate of over 80%, indicating that the recent cryptocurrency market rally has led to a large-scale liquidation of short positions.

By coin, Bitcoin (BTC) positions saw the most liquidations. Approximately $164.5 million worth of Bitcoin positions were liquidated over the past 24 hours, with approximately $35.92 million liquidated over the past four hours. Bitcoin is currently trading at $125,428, up 2.62% over the past 24 hours.

Ethereum (ETH) saw approximately $129.94 million in positions liquidated over the past 24 hours, with $26.47 million liquidated over the past four hours. Ethereum's price rose 3.56% to $4,487.15.

Solana (SOL) has seen approximately $26.42 million liquidated in the last 24 hours and is currently trading at $232.48, showing a strong uptrend of 5.95%.

Dogecoin (DOGE) also saw liquidations of approximately $10.92 million over the past 24 hours, with a price increase of 5.71%, and is currently trading at $0.26037.

Notable altcoins include ASTER, which saw a 9.41% increase and liquidations of approximately $3.96 million over 24 hours, and ENA, which saw a strong 11.41% increase and liquidations of approximately $1.42 million.

In particular, XPL (AMPLE estimate) rose by 6.05%, resulting in a large-scale liquidation of $10.78 million over 24 hours, which accounted for a significant portion of the total liquidation amount.

This massive liquidation demonstrates the significant impact on traders holding short positions due to the overall upward trend in the cryptocurrency market. In particular, the price rises of Bitcoin and Ethereum have had a significant impact on the overall market, with most altcoins also rallying, accelerating the liquidation of short positions.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.