A new proposal calling for a revamp of Polygon ’s tokenomics is gaining traction on governance forums and social media, as investors are frustrated by the sharp drop in POL’s price relative to the broader crypto market.

The proposal, put forward by activist investor Venturefounder, suggests removing the 2% annual inflation rate and implementing a buyback or Token burn program from the reserve fund, to reduce selling pressure and restore investor confidence.

Under the current model, around 200 million new Polygon Token are issued each year, putting constant downward pressure on the price. The venture founder proposes moving to a fixed supply (0% inflation) or a roadmap that reduces the supply by 0.5% every quarter until it reaches 0%. He cites examples like BNB, AVAX , and ETH, Token that benefit from a deflationary model or limited supply.

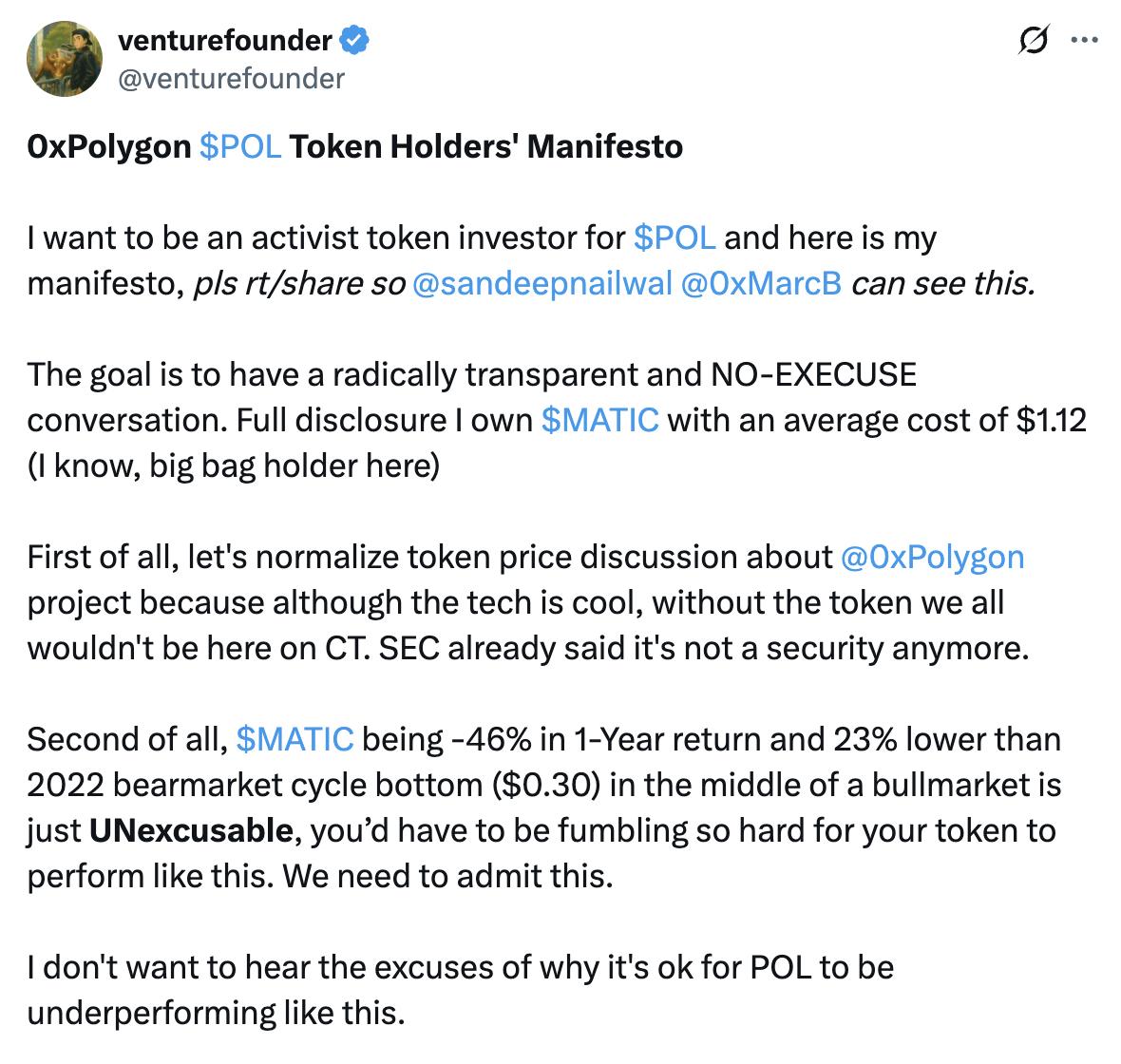

In a previous article on X (which has over 25,000 XEM ), Venturefounder criticized Polygon ’s POL Token 46% drop in price over the past year, trading below its 2022 Dip , calling it an “unacceptable result” in a market that is currently rallying with Bitcoin and Ether leading the way. He emphasized: “There’s nothing wrong with the market – the problem is POL, and it’s in free fall.”

In addition to inflation, he also criticized Polygon for its slow and lack of transparency strategy since 2022, calling on the team to quickly complete infrastructure like Agglayer.

The proposal has received positive feedback from the community, including co-founder Brendan Farmer and Polygon Labs CEO Marc Boiron. Discussions are currently open on the forum, focusing on whether validator rewards can be maintained without inflation and assessing the impact of buybacks on network security.

The article Investors call for Polygon tokenomics overhaul appeared first on CoinMoi .