Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Since late September, BTC and the wider crypto market began to recover the losses sustained in a selloff around the FOMC meeting in the middle of the month. That recovery rally quickly extended into a move to two new successive all-time highs as we entered into the month of ‘Uptober’ . On Sunday morning, and once more on Monday evening, BTC touched record highs, supported by strong Spot ETF inflows. Last week, spot products saw their second largest weekly inflow since launch. That inspired a move higher in ATM volatility levels as well as a small, yet temporary skew towards out-the-money call options for short-tenor options. Interestingly, despite a bigger rally in ETH spot, its derivatives markets have responded in a more cautious manner, with short-tenor skews trading close to neutral levels, and longer-term options commanding only a modest OTM call premium. Nonetheless, crypto asset prices have at least for now shrugged off the US federal government shutdown which has put on pause the steady flow of key macroeconomic data releases.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

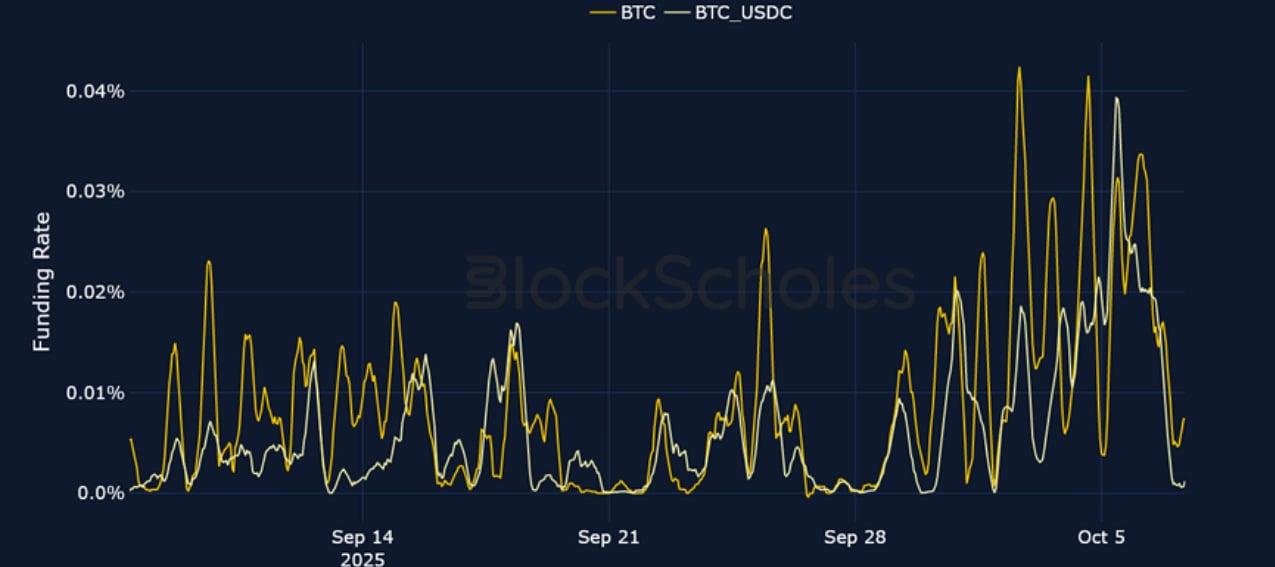

Perpetual Swap Funding Rate

BTC FUNDING RATE – The large rally over the past week in spot has inspired a whipsaw reaction in funding rates, surging up only to collapse just as fast.

ETH FUNDING RATE – Moves in ETH funding rates have been more orderly and perp traders have failed to price in the same bullish funding rates as seen in BTC perps over the past week.

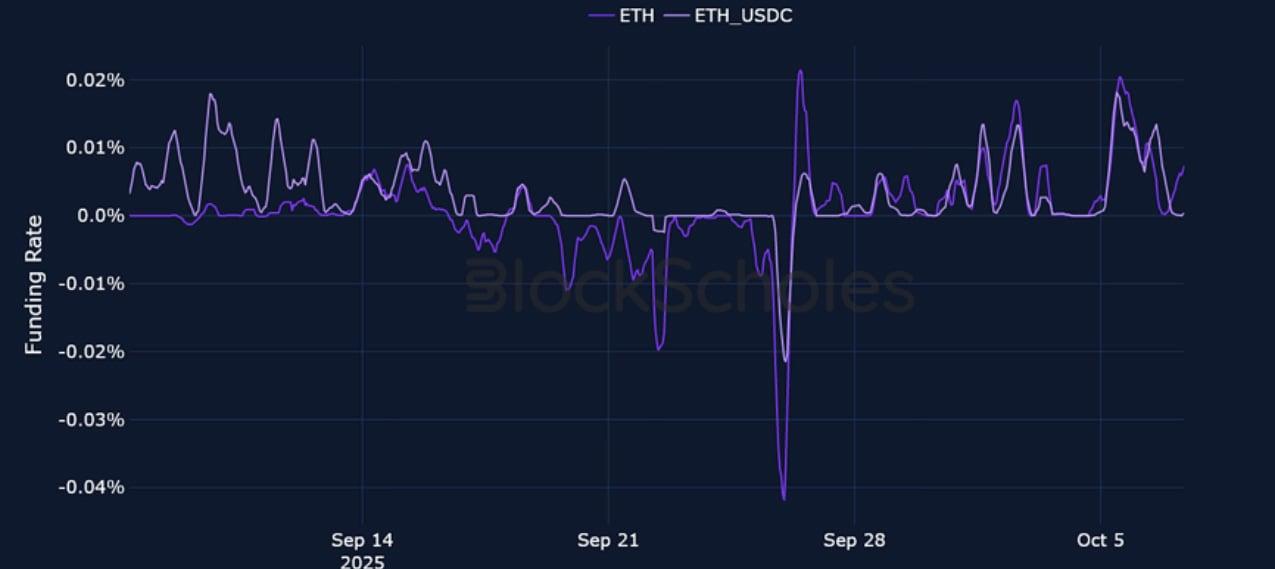

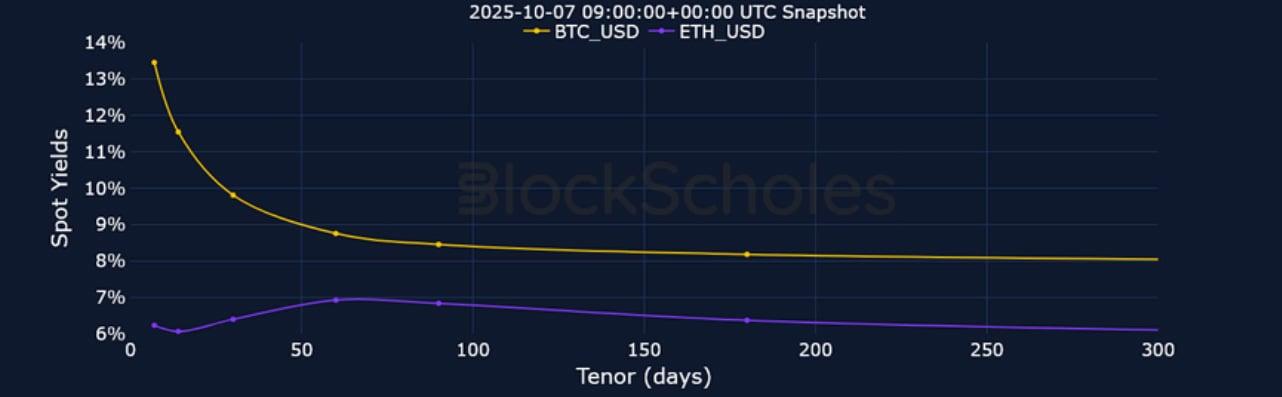

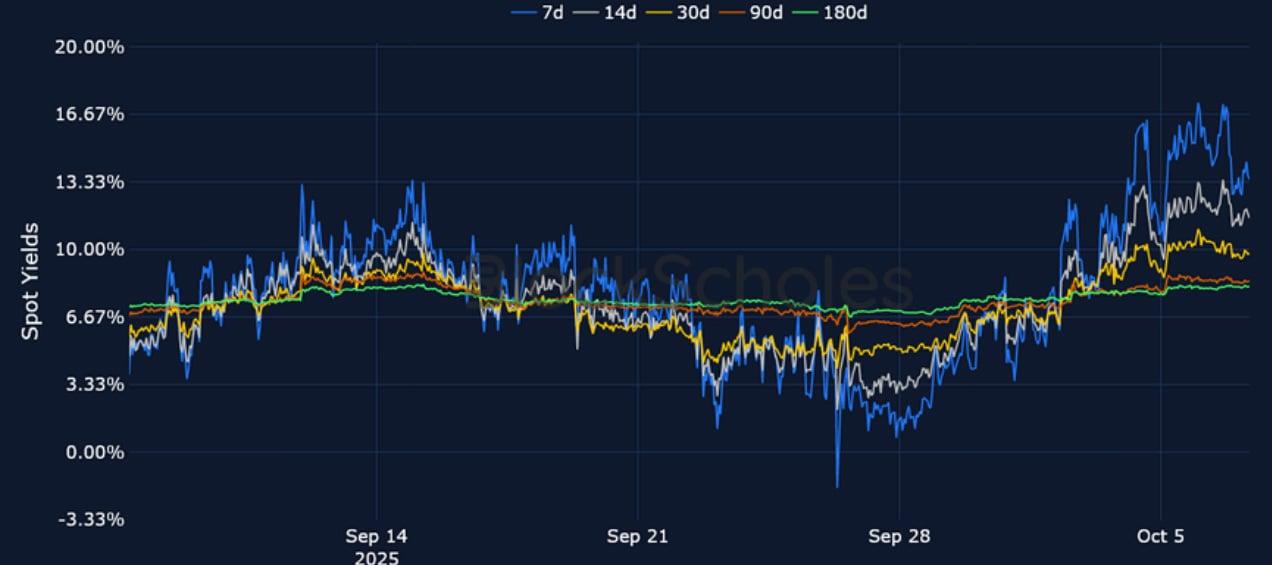

Futures Implied Yields

BTC Futures Implied Yields – Two successive ATH’s, first on Sunday morning and then on Monday evening has inverted the term structure of spot yields.

ETH Futures Implied Yields – As is the case with ETH funding rates, a more subdued reaction to the 12% rally in ETH spot price over the past 7 days is visible when looking at the flat futures term structure for Ether.

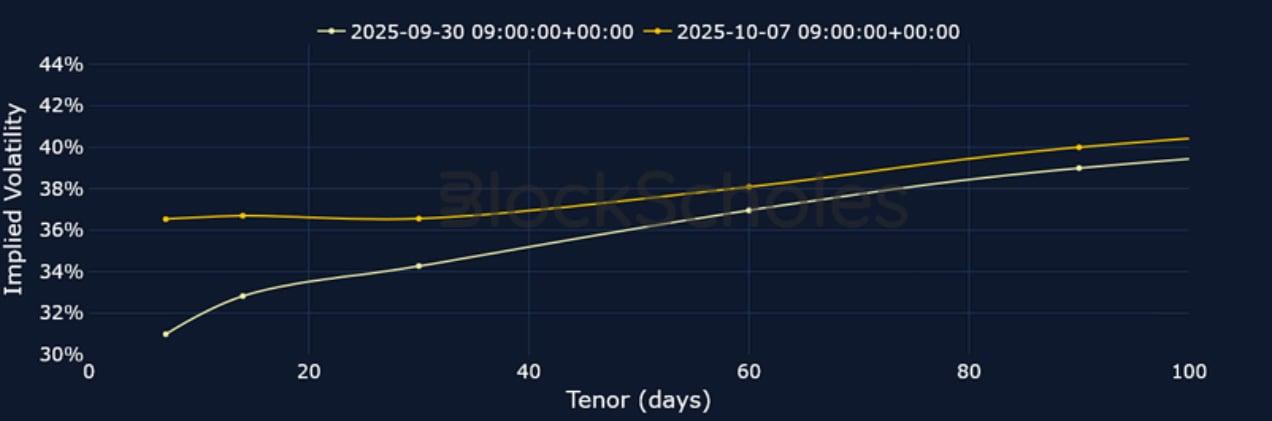

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – After trading sideways towards the tail- end of September, short-tenor vol broke out as BTC caught a bid.

BTC 25-Delta Risk Reversal – With the entry into ‘Uptober’ , short-tenor vol smiles showed traders demanding a premium for OTM calls – so far however, that has failed to hold for a material length of time.

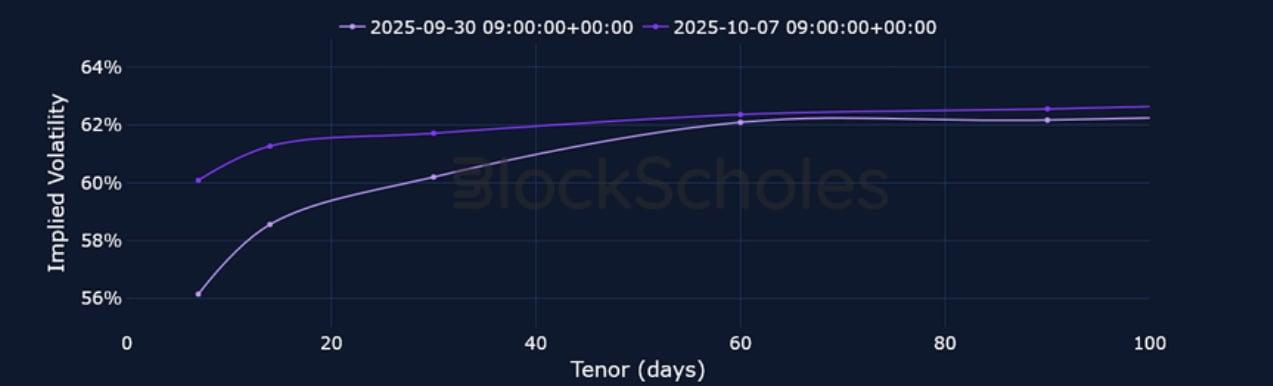

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – After bottoming out on Oct 3, 2025, 7-day ATM IV has jumped more than 10 vol points over the past few days.

ETH 25-Delta Risk Reversal – Despite reclaiming $4,700 and strong Spot ETF inflows, the skew towards calls for mid-long dated options remains modest, while shorter maturities trade close to parity.

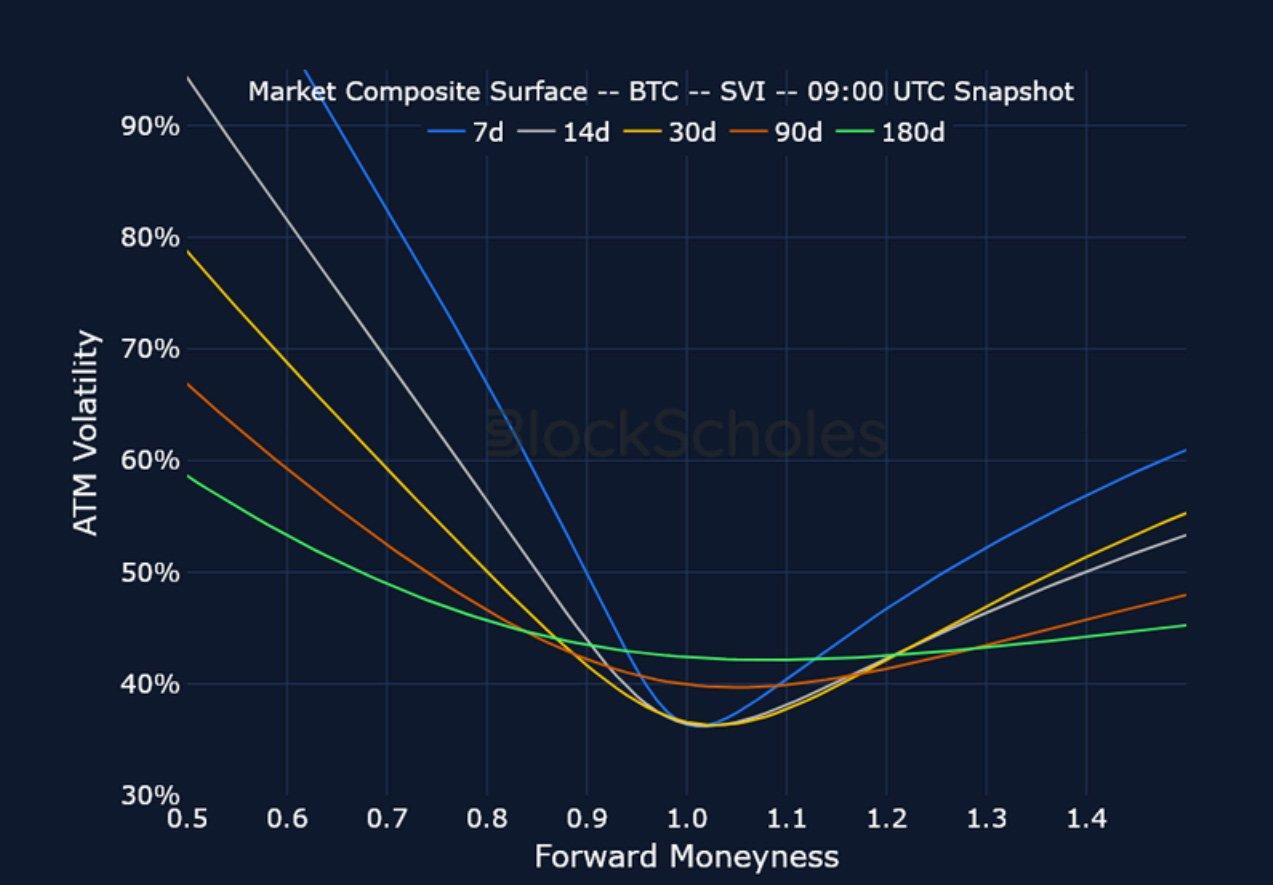

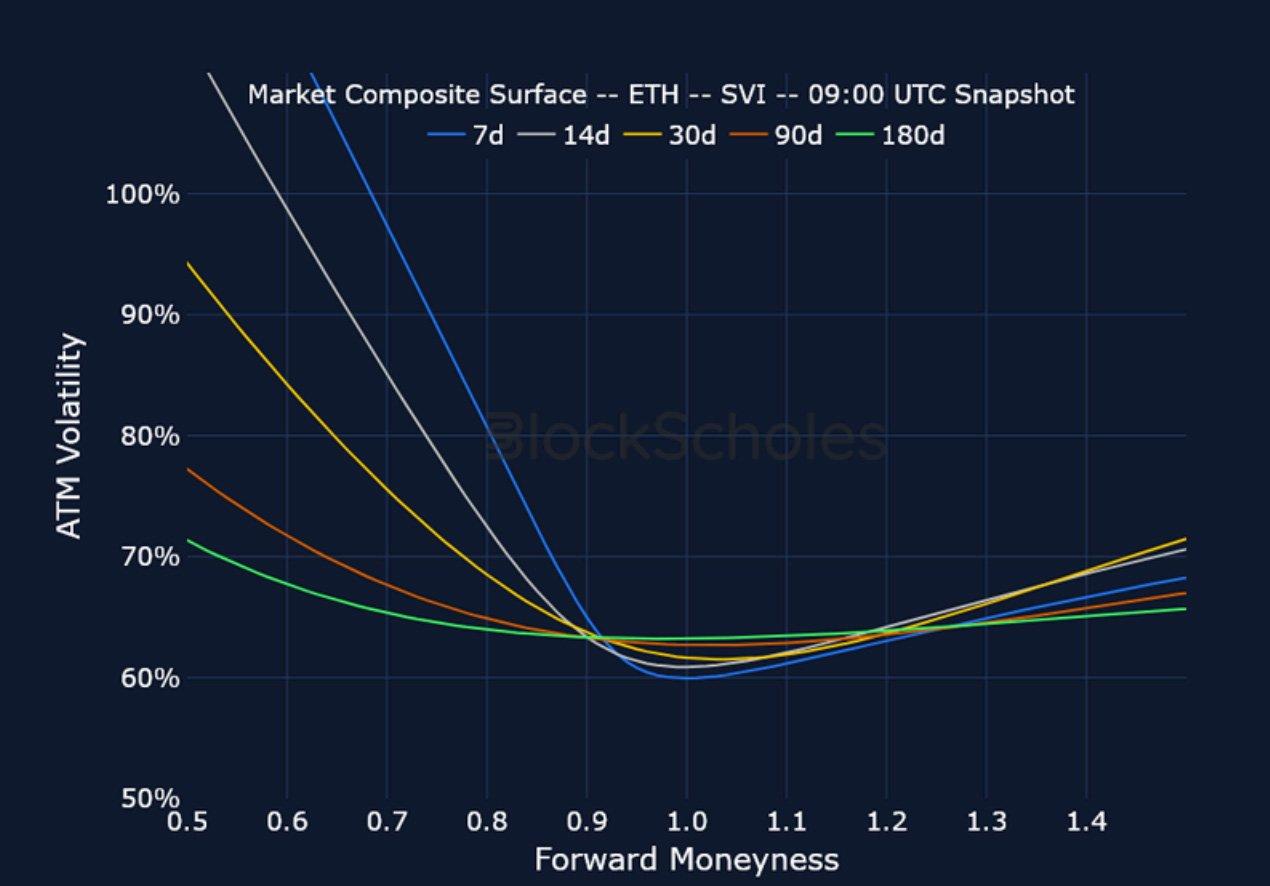

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

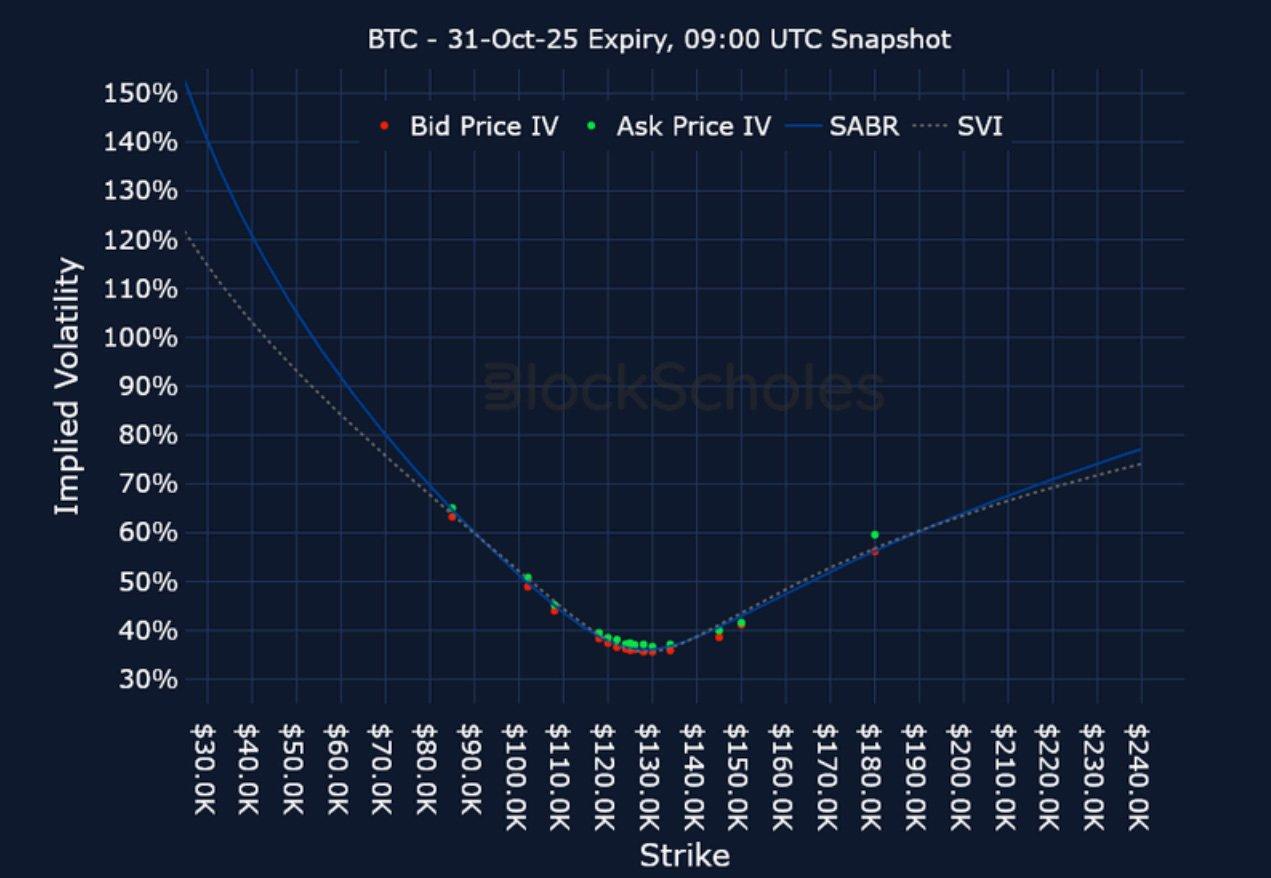

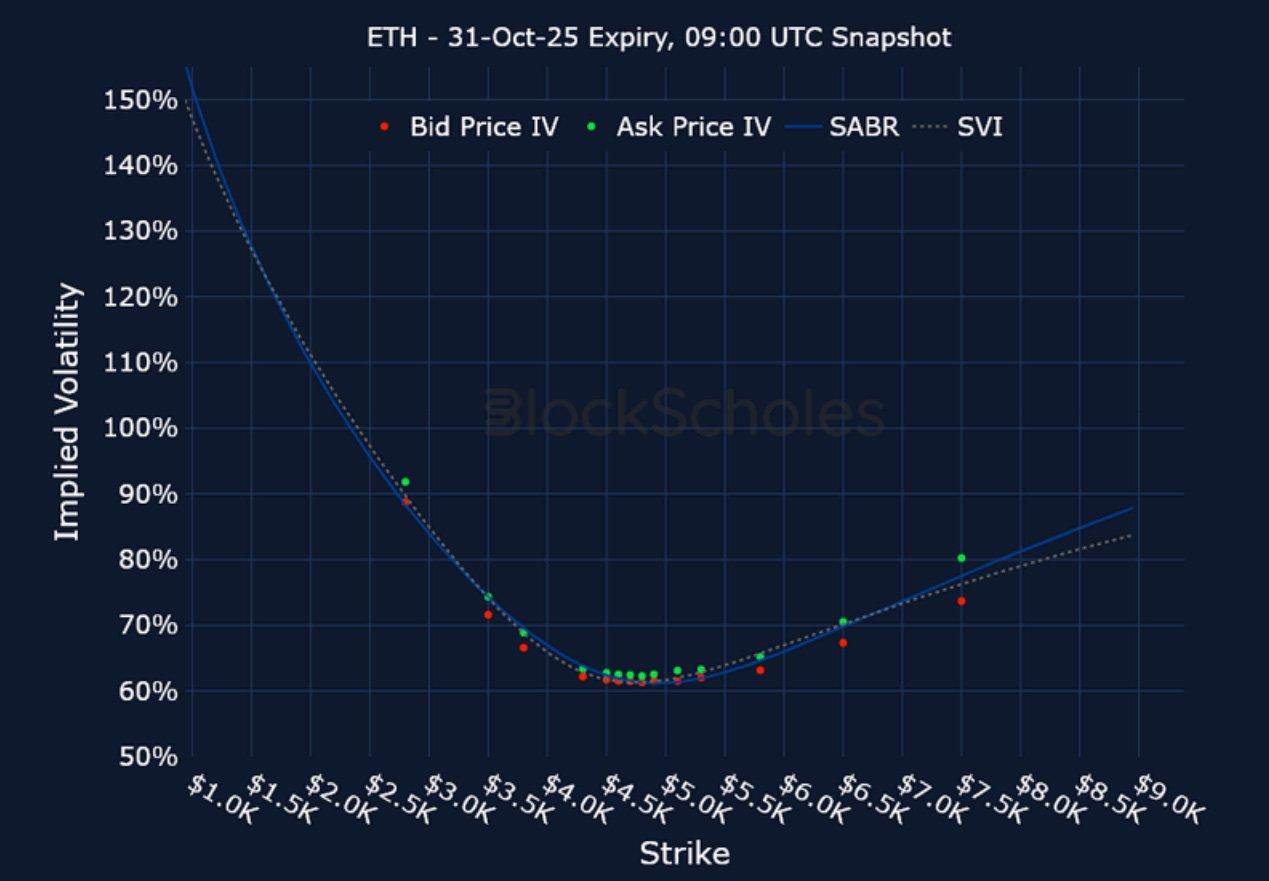

Listed Expiry Volatility Smiles

BTC 31-OCT EXPIRY – 9:00 UTC Snapshot.

ETH 31-OCT EXPIRY – 9:00 UTC Snapshot.

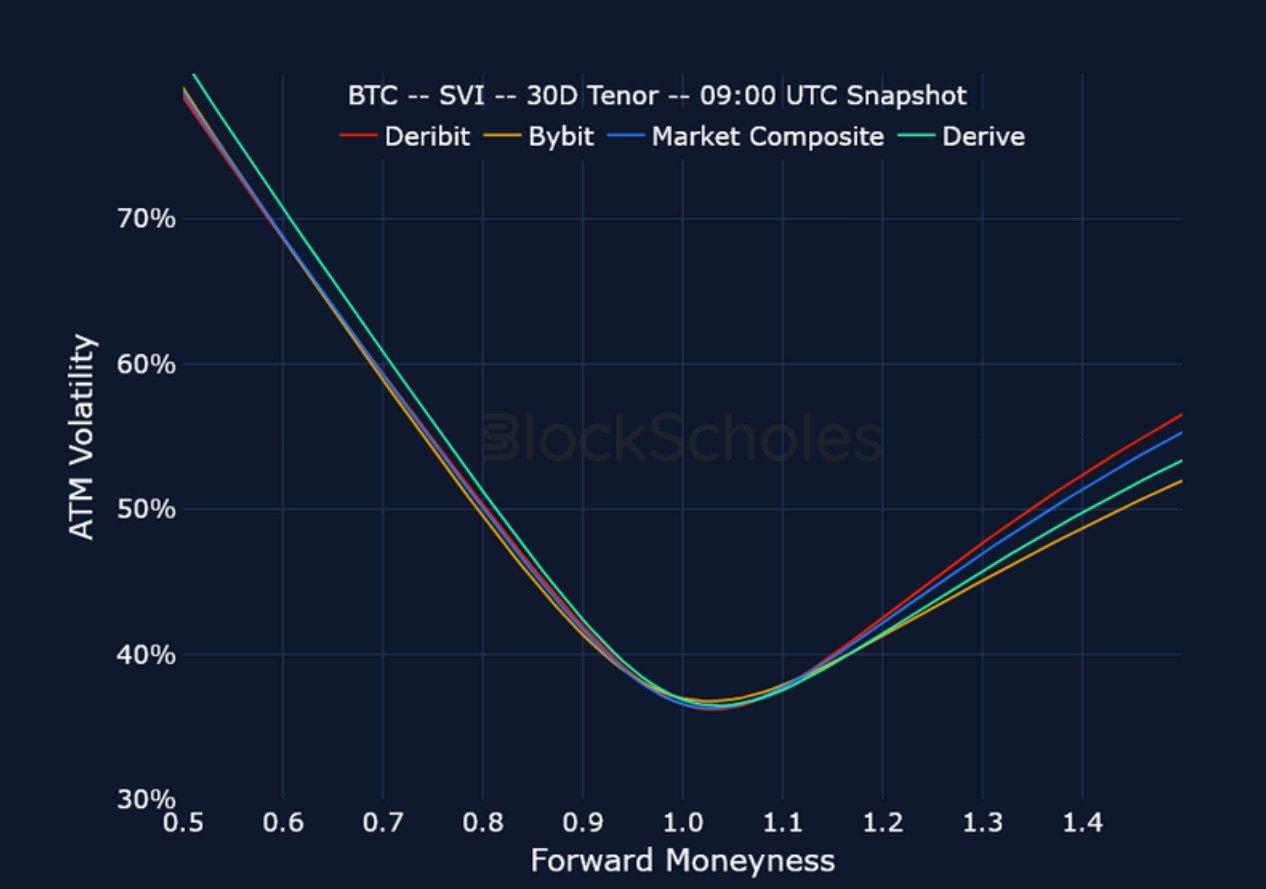

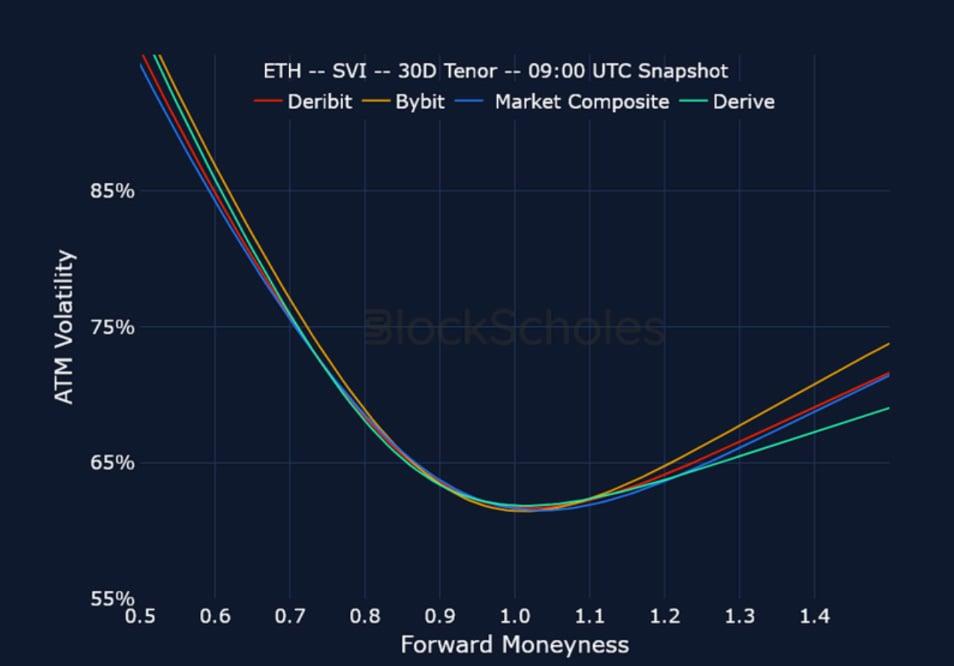

Cross-Exchange Volatility Smiles

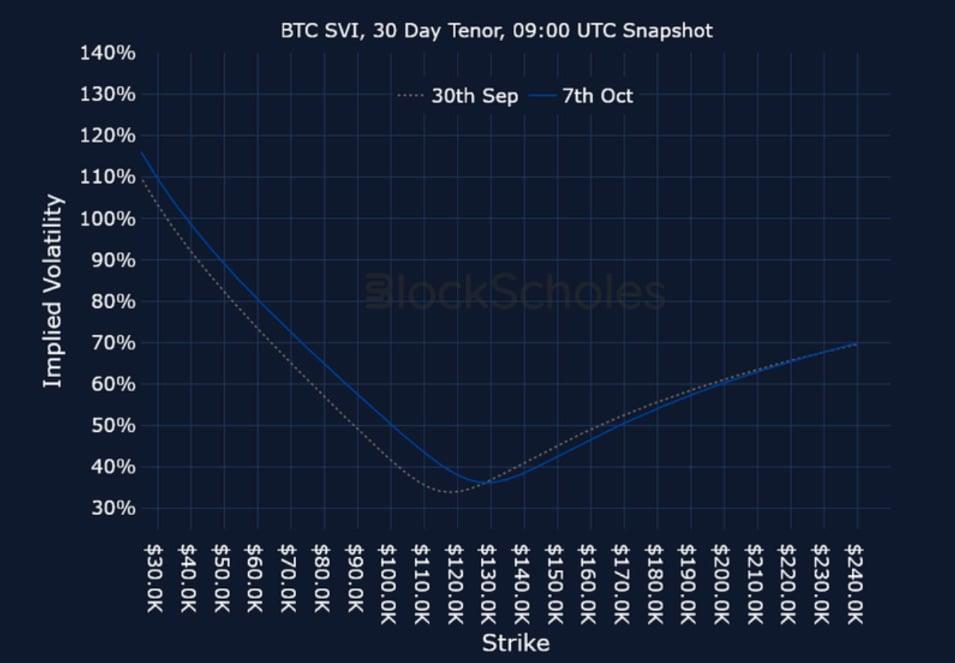

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

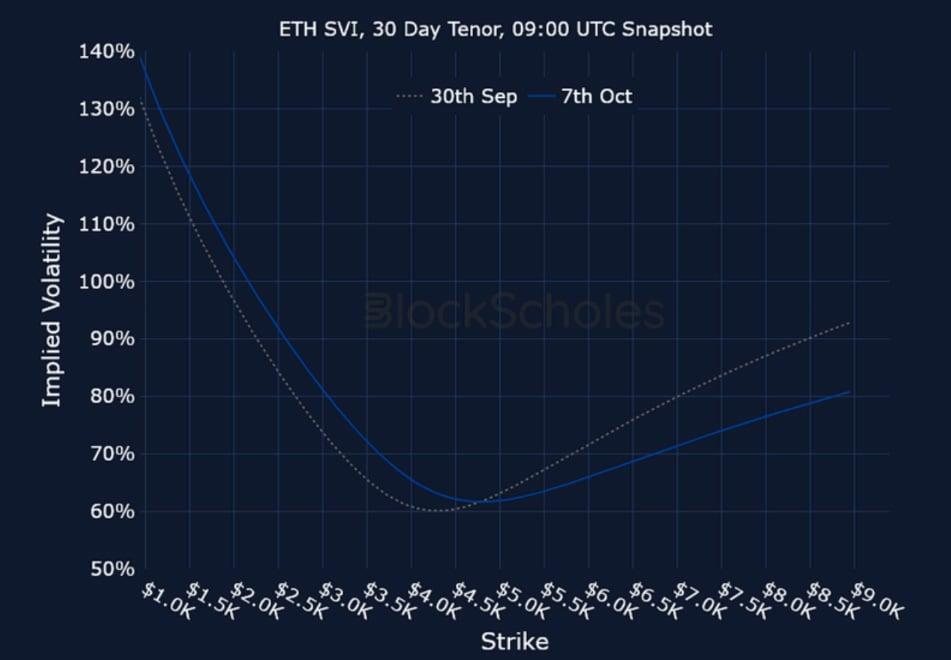

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)

Trading with a competitive edge. Providing robust quantitative modelling and pricing engines across crypto derivatives and risk metrics.

RECENT ARTICLES

Crypto Derivatives: Analytics Report – Week 41

Block Scholes2025-10-09T19:49:28+00:00October 9, 2025|Industry|

Crypto Derivatives: Analytics Report – Week 40

Block Scholes2025-10-02T08:29:38+00:00October 2, 2025|Industry|

Options Landscape Cleaner After September’s Shakeout

Imran Lakha2025-10-01T12:23:24+00:00October 1, 2025|Industry|

The post Crypto Derivatives: Analytics Report – Week 41 appeared first on Deribit Insights.