Introduction

For the second time since June, Binance's BNB Smart Chain (BSC) surpassed all other blockchains in terms of activity. This surge was primarily driven by Memecoin trading, which became a core source of volume on BSC's decentralized exchange (DEX). Simultaneously, BSC's native token, $BNB, reached a new all-time high and surpassed $XRP in market capitalization, becoming a top-three global crypto asset, behind only Ethereum and Bitcoin.

Binance founder CZ"CZ" Zhao was a key driver of this surge in on-chain activity. He frequently tweeted about various memecoins on social media, promoted Aster, the BNB perpetual contract platform, and participated in the X Spaces show "BNB Supercycle" on October 8th. The livestream attracted thousands of listeners, further reinforcing the market's narrative of a "full recovery" for the BNB ecosystem.

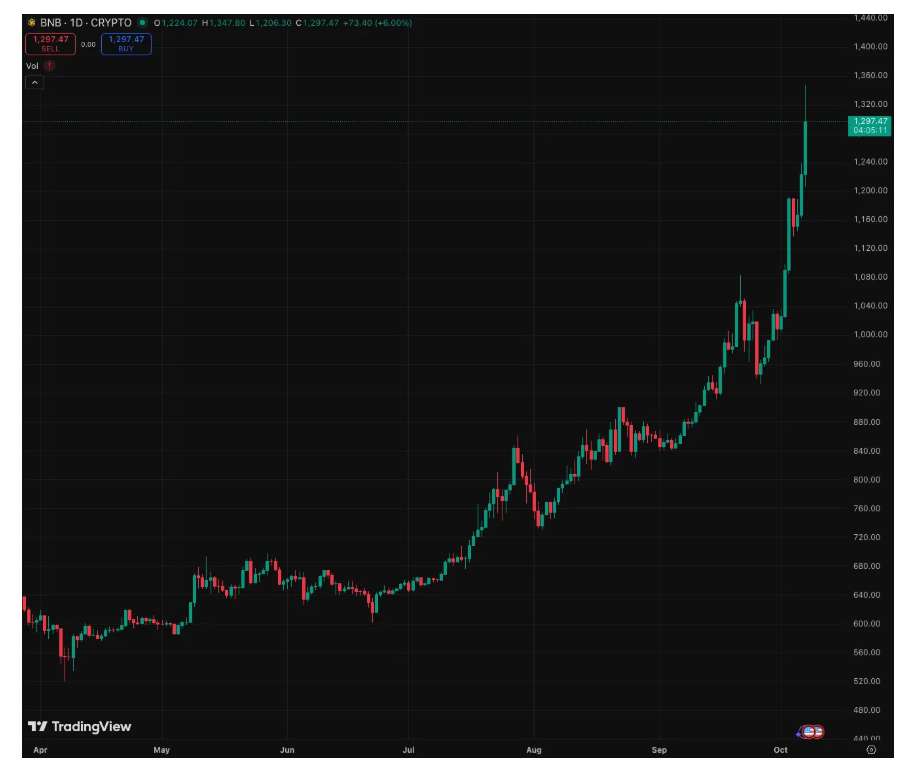

Over the past six months, BNB prices have risen by approximately 133%, significantly outperforming Bitcoin. Over the same period, CAKE has risen by approximately 146%, demonstrating that trading and on-chain activity are gradually returning to Binance's core ecosystem.

This trend also reflects the success of PancakeSwap's tokenomics model. The decentralized exchange utilizes a "buyback + burn" mechanism, aiming to achieve a net supply reduction of approximately 4% annually, with burn funds coming from platform revenue. The protocol's ultimate goal is to reduce the total CAKE supply by approximately 20% by 2030—one of the most deflationary models among major DEX tokens.

With the surge in BSC DEX trading volume and user activity, PancakeSwap’s deflationary goals are gaining strong support.

BNB price chart (as of October 7)

CAKE price trends — the native token of PancakeSwap, the leading BSC DEX (as of October 7th)

Quickly understand the architecture of BSC

BNB Smart Chain (BSC), launched by Binance in 2020, is the execution layer of the BNB Chain ecosystem.

BSC's predecessor was called Binance Smart Chain. Its original design intention was to create a high-speed, low-cost, EVM (Ethereum Virtual Machine) compatible blockchain to supplement the functions of Binance Chain - the latter only supports simple asset issuance and transfers and does not have smart contract functions.

In 2022, Binance reshaped the entire network architecture into BNB Chain and positioned it as a more decentralized ecosystem, while setting BNB (formerly known as Binance Coin, now standing for "Build and Build") as its gas fee and governance token.

The original architecture consisted of two core networks:

- BNB Beacon Chain — responsible for governance and staking;

- BNB Smart Chain (BSC) — responsible for execution and smart contract operation.

However, by 2024, Binance completed the so-called BNB Chain Fusion, officially deprecating the Beacon Chain and integrating all its governance and staking functions into the BNB Smart Chain.

Recently, BSC validators proposed a proposal to cut gas fees in half (from 0.1 gwei to 0.05 gwei) and reduce block times from 750 milliseconds to 450 milliseconds. This would reduce the average cost of a single transaction to approximately $0.005, bringing BSC’s fees closer to Solana’s.

Additionally, the recent $ASTER Token Generation Event (TGE) and market speculation about a potential AsterDEX airdrop have driven explosive growth in funding and on-chain activity.

CZ (CZ) actively promoted the ecosystem on X (formerly Twitter), even announcing the start of the "BNB meme season".

However, DefiLlama recently removed AsterDEX perpetual contract trading volume from its platform because its data team suspected wash trading and the high correlation between Binance and Aster trading volumes.

Meanwhile, Hyperliquid has proven that a successful perpetual contract DEX model can be extremely profitable in the crypto space, while Pump.fun has demonstrated the huge potential of a low-threshold issuance platform.

Now, CZ is obviously interested in entering both tracks at the same time, and with his resource advantages, he is indeed quite competitive.

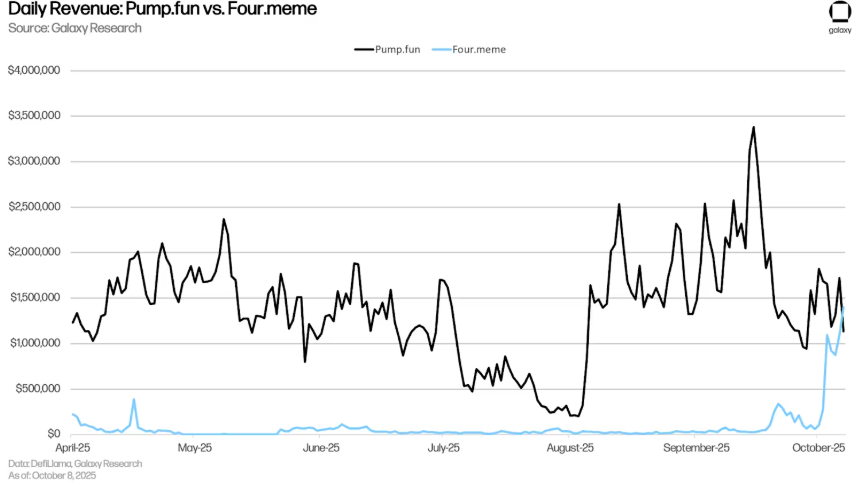

His company YZI Labs fully supports AsterDEX in an attempt to compete for Hyperliquid's market share; and another platform Four.meme - known as the "BSC version of Pump.fun" - has surpassed Pump.fun and Axiom in 24-hour revenue, user activity has soared, and more and more traders are bridging assets from Solana to BSC.

Daily Revenue Comparison: Pump.fun vs. Four.meme

As of this writing on October 8, Four.meme's 24-hour revenue has surpassed Pump.fun's, at $1.4 million to $1.14 million, respectively.

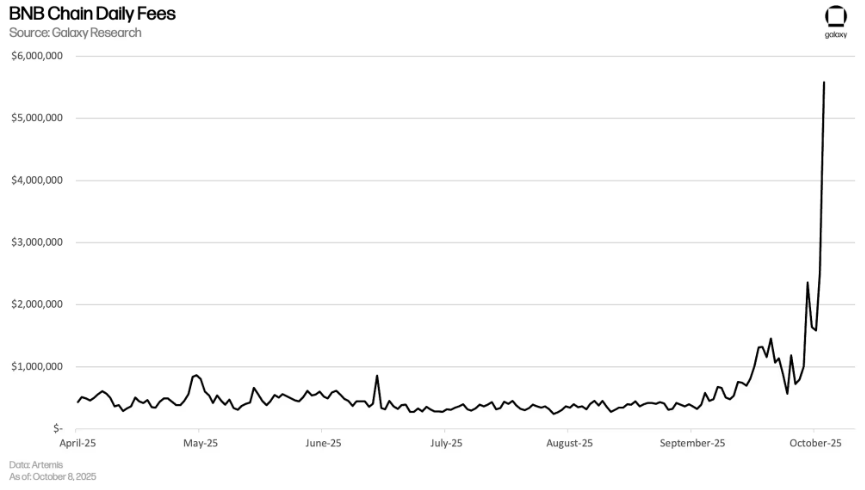

With the surge in user activity, BNB Chain’s daily transaction fees have also seen a significant increase.

From less than $500,000 in August to over $5 million as of October 8, it has increased by more than 1,000%.

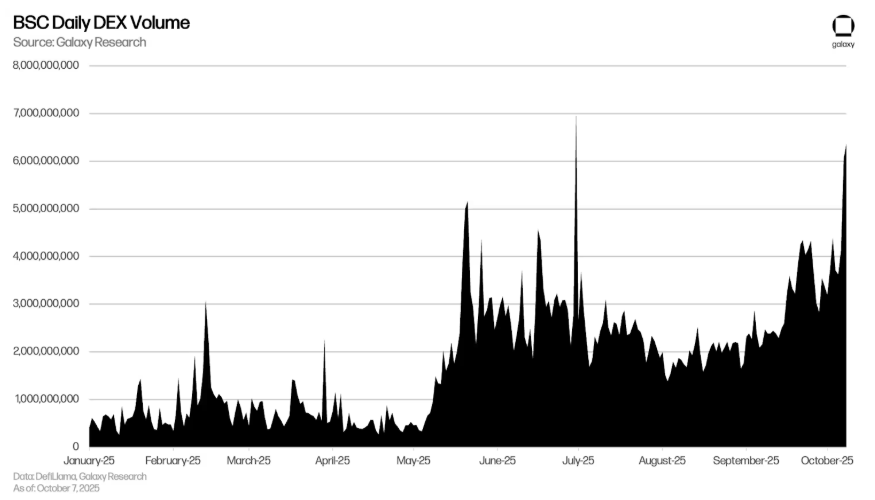

BSC’s DEX trading volume (over $6 billion) has surpassed Solana (approximately $5.5 billion).

It is worth noting that in April this year, BSC's daily trading volume was less than US$1 billion.

This suggests that aggressive marketing and incentives are having the desired effect.

Net inflow

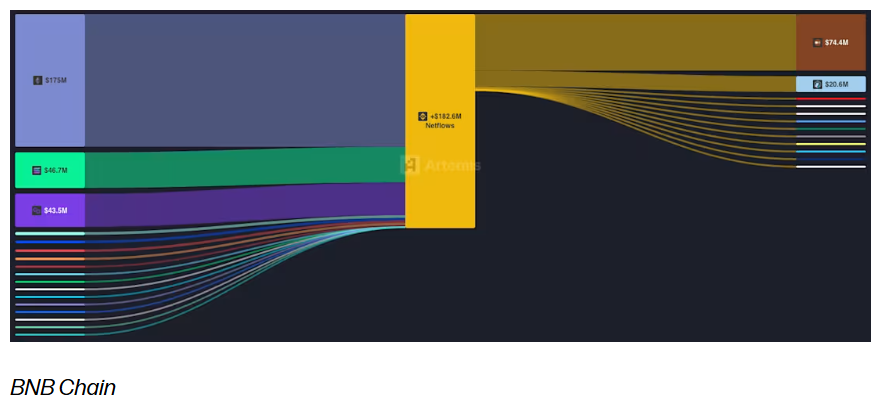

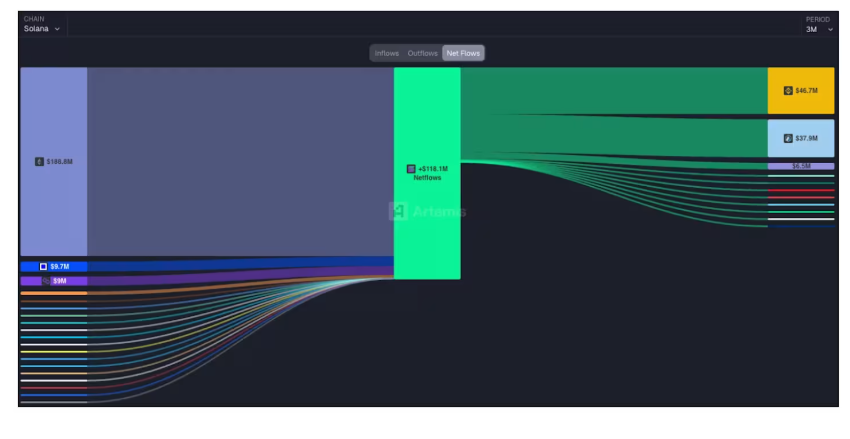

According to Artemis data (as of October 7), BNB Chain has seen a net inflow of $182.6 million over the past three months.

By comparison, Solana is at $118 million and Avalanche is at $41 million.

Solana: Notably, the largest outflow from Solana over the past three months was bridged to BNB Chain, with $46 million transferred from Solana to BNB Chain alone.

Why it matters

The market attention surrounding BSC demonstrates that, even in the short term, brand and narrative still matter above all else in the crypto world. CZ(CZ)’s renewed visibility—from announcing the “BNB Supercycle” to promoting specific memes—has transformed BSC into the most vibrant hub in the industry.

For example, the token Binance Life (literally “Binance Life” in Chinese) launched on October 4th and surpassed $450 million in market capitalization. You’re seeing little of this on Solana, where even the best-performing new Solana token currently struggles to break $20 million in market capitalization.

It's easy to forget that during the previous US administration, CZ served four months in prison and Binance paid $4 billion to settle federal charges. After his release, he laid low for a while. But in mid-September, CZ updated his X (formerly Twitter) profile, changing his description from "ex-@binance" to simply "@binance," consistent with his pre-2024 status, suggesting he may be reacting to the more relaxed regulatory environment under the Trump administration. Binance is seeking to relax its enforcement terms in the US, while YZI Labs has raised a new $1 billion fund for the BNB ecosystem to drive growth. Binance is taking a proactive stance again.

From a broader perspective, exchange-driven ecosystems are experiencing a resurgence. For example, MNT (Mantle) and Bybit are clearly emulating the BNB model. As BSC demonstrates, mastering both exchange liquidity and the execution layer can be an unbeatable combination. Coinbase's hint at the potential launch of the BASE token may also indicate that it recognizes the potential of a similar vertically integrated model to capture additional liquidity.

The next question, as with every craze, is sustainability. If Four.meme, Aster, and PancakeSwap can maintain trading volume without external incentives, the BNB supercycle may become more than just a meme phenomenon.