Author: Min| TechFlow

Following 312 and 519 , the crypto has another crash anniversary - October 11.

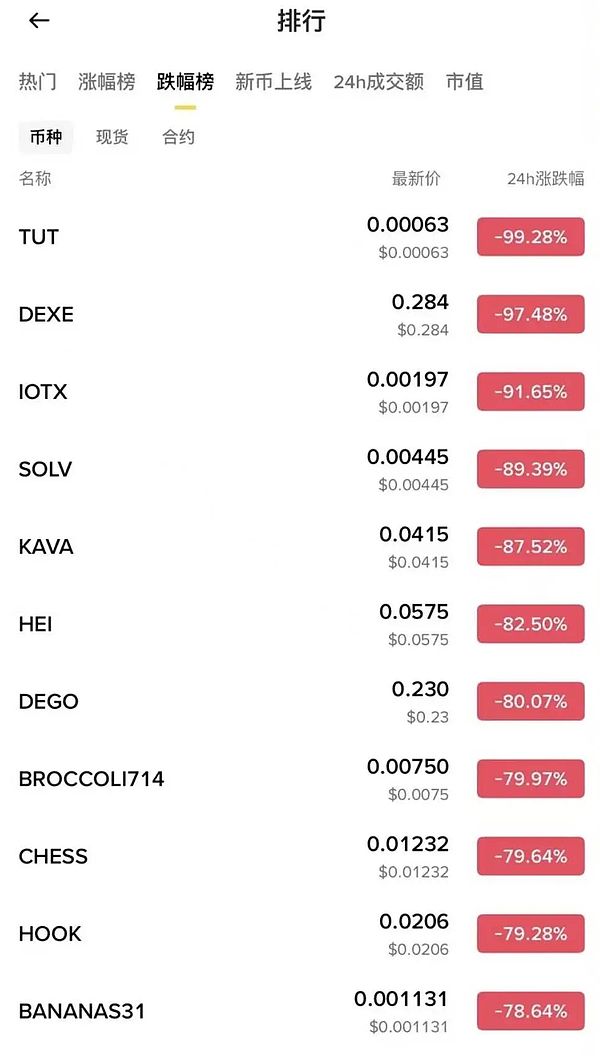

Bitcoin once fell below $110,000, the USDE decoupled, and Altcoin plummeted. The prices of many projects dropped to zero in just a few minutes. Yes, they really dropped to zero.

Coinglass data shows that as of 9:00 on the 11th, the 24-hour liquidation amount reached US$19.2 billion, the number of liquidations reached 1.64 million, and the largest single liquidation order exceeded US$200 million.

However, this data may just be the tip of the iceberg. According to relevant practitioners, the actual liquidation data is far greater than the public data. "Binance's liquidation data should be far greater than Hyperliquid and Bybit ." According to Coinglass data, Binnace's liquidation data is currently only one-fifth of Hyperliquid's.

Crypto data analyst MLM (@mlmabc) believes that the actual market liquidation data is around 30-40 billion US dollars.

In the past, we had comforted ourselves that the market is no longer what it used to be and has become more perfect, and that there would not be another turbulent market like the one on March 12. However, we were once again ruthlessly slapped in the face by reality.

On the surface, this was a sudden black swan shock, but what really caused the market to collapse was the long-term accumulated leverage prosperity and the structural defects of the market maker system.

The trigger for this plunge was Trump.

That same day, he abruptly announced a new round of tariffs on Chinese goods. The sudden escalation of Sino-US trade frictions put global risk assets under pressure. Risk aversion surged, with capital fleeing to the US dollar and US Treasuries. Cryptocurrencies, as a representative of risky assets, bore the brunt of the sell-off.

This became the first straw that broke the camel's back for the market.

However, a piece of tariff alone cannot explain why the entire crypto market suddenly collapsed. The real key is that the market's false prosperity has long been built on high leverage.

Over the past few months, Bitcoin and other mainstream assets have repeatedly reached new highs. However, the majority of the funds behind this are not long-term capital, but rather leveraged funds accumulated through contracts, lending, and liquidity mining. When negative news strikes, these highly leveraged long positions are the first to be hit. Once the support level is broken, forced liquidations are triggered one after another, and the selling pressure continues to intensify, causing the market to fall into a chain reaction of "long-killing-long" liquidations.

Perhaps the most striking example is the US Depository and Clearing (USDE). Since the official introduction of its 12% subsidy policy, a large number of users have engaged in revolving loans for arbitrage. This mechanism was extremely attractive during the bull market, attracting a large influx of capital in a short period of time and becoming a key engine driving market prosperity. However, on October 11th, when the impact of tariffs triggered a sell-off, the USDE experienced a significant decoupling, briefly falling below $0.66, becoming a landmark event in the plunge.

What is even more fatal is that the market maker mechanism completely failed in this crash.

Bugsbunny, a staff member of Greeks.live, analyzed that the funds of active market makers are currently limited, and they will concentrate their main liquidity resources on Tier 0 and Tier 1 projects, such as BTC and ETH, and only provide a little support for mid- and long-tail Altcoin"incidentally".

After the collapse of Jump, the market's liquidity supply relied more on these active MMs, but they lacked a complete tail risk hedging mechanism and could only cover daily market conditions. In extreme market conditions, the funds were simply not enough to provide a bottom line.

When Trump's tariff announcement triggered market panic, market makers were forced to prioritize the safety of major projects, withdrawing funds originally allocated to smaller cryptocurrencies. As a result, the Altcoin market was completely deprived of counterparties, leaving no one to cover the selling pressure and sending prices into a near-free fall. Tokens like IOTX plummeted to near zero, a stark reflection of the liquidity depletion.

In fact, with the emergence of a large number of new projects this year, the funds of active MM have long been overloaded, and the market lacks sufficient derivatives to hedge tail risks. This time the veil has been completely lifted.

Furthermore, Bugsbunny believes that what's even more devastating is that the plunge occurred on Friday night (early Saturday morning in the Asian session). Market makers in both Europe and the United States and Asia have clearly defined working hours. If this had occurred during the weekday session, liquidity would likely have been restored long ago.

"But today happened to be Friday. It was just a coincidence."

It is a danger, but also an opportunity. Some are happy while others are sad.

On October 10th, before Trump's announcement, an early Bitcoin investor continued to increase short positions in BTC and ETH on Hyperliquid, totaling over $1.1 billion. After the sharp drop, he profited handsomely. Others took advantage of the situation, capitalizing on the decoupling of USDE, BNSOL, and WBETH.

Overall, the October 11 crash was not caused by a single reason, but rather a conspiracy of three forces: the policy impact of macro black swans, structural fragility under leverage prosperity, and the collapse of market maker liquidity protection .

This morning, seeing the widespread grief in my circle of friends, I felt the cruelty and ruthlessness of the market.

The crypto market has never been a smooth highway; it's more like a sea dotted with hidden dangers. The prosperity of a bull market is often accompanied by the illusion of leverage, while black swans always lurk around the corner, poised to strike at any moment. For retail investors, the most important thing is not the constant pursuit of huge profits, but survival.

As long as you can survive, you will have the opportunity to stand at a new starting point in the next cycle. Once cross margin position is liquidated in extreme market conditions, you may never have the chance to return to the table.

To repeat, survival is everything.