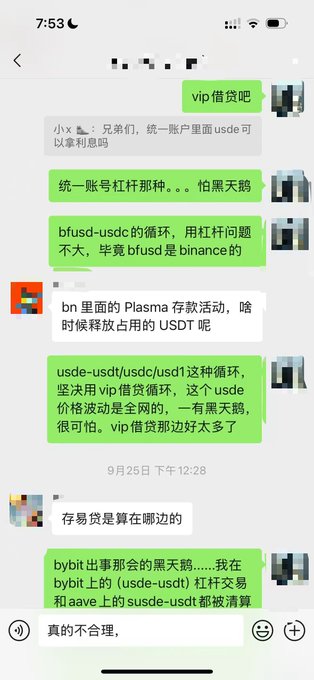

Regarding the Super Jun improvement proposals, here are a few personal opinions: From a risk management perspective, exchanges should discourage this type of circular lending arbitrage. There's currently no substantial arbitrage opportunity between the underlying yield of sUSDe and Treasury bonds. This type of arbitrage activity can easily amplify risk and be counterproductive. Furthermore, no asset should be guaranteed a floor price (0.85). A floor price guarantee is essentially a safety net, and there's no need to excessively assume third-party trust (not to mention the inherent competitor trust risk with USDe). Even if adding mint/burn within the platform or swapping through a custodian could address larger-scale liquidity decoupling, it wouldn't resolve the underlying liquidity bottleneck (and would also introduce additional mint permission risk). The core of this bottleneck lies in the USDe mechanism itself, which must implement a fixed redemption quota. This daily quota is almost 50 times the minting volume. In other words, manipulating the USDe exchange rate isn't a question of whether it can be done, but rather how much capital is required. USDe currently cannot withstand a liquidity shock of $1 billion. The larger issue is that USDe inherently carries counterparty risk from multiple exchanges. Adding circular leverage effectively means lending credit to your competing counterparties, leveraging counterparty risk. A more rational approach would be to integrate on-chain segregated pools and lending protocols within the platform, bringing lending and borrowing arbitrage directly to the chain. The platform would only provide liquidity venues and fiat currency access.

This article is machine translated

Show original

benmo.eth

@Super4DeFi

10-13

【从借贷和杠杆交易的角度来看usde脱锚事件】

首先声明,我不懂合约,只懂借贷。这篇小文是因为看到朋友在朋友圈写的一个因果链,写得非常棒,有感响应而写。错漏之处,望诸君匡正。

usde在9月上线binance,9月22日-10月22日开启apy12%的营销活动,参与这个活动有三种方式:

1. vip

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content