By Julie Goldenberg

Source: Forbes

Compiled by: Liam

A record number of publicly traded companies are adding cryptocurrencies to their balance sheets—ostensibly to diversify their holdings, hedge against inflation, and attract new investors. The undisclosed reason, of course, is management's desire to boost stock prices. In recent months, simply announcing a so-called "cryptocurrency fund management" strategy has been enough to increase trading prices at a premium.

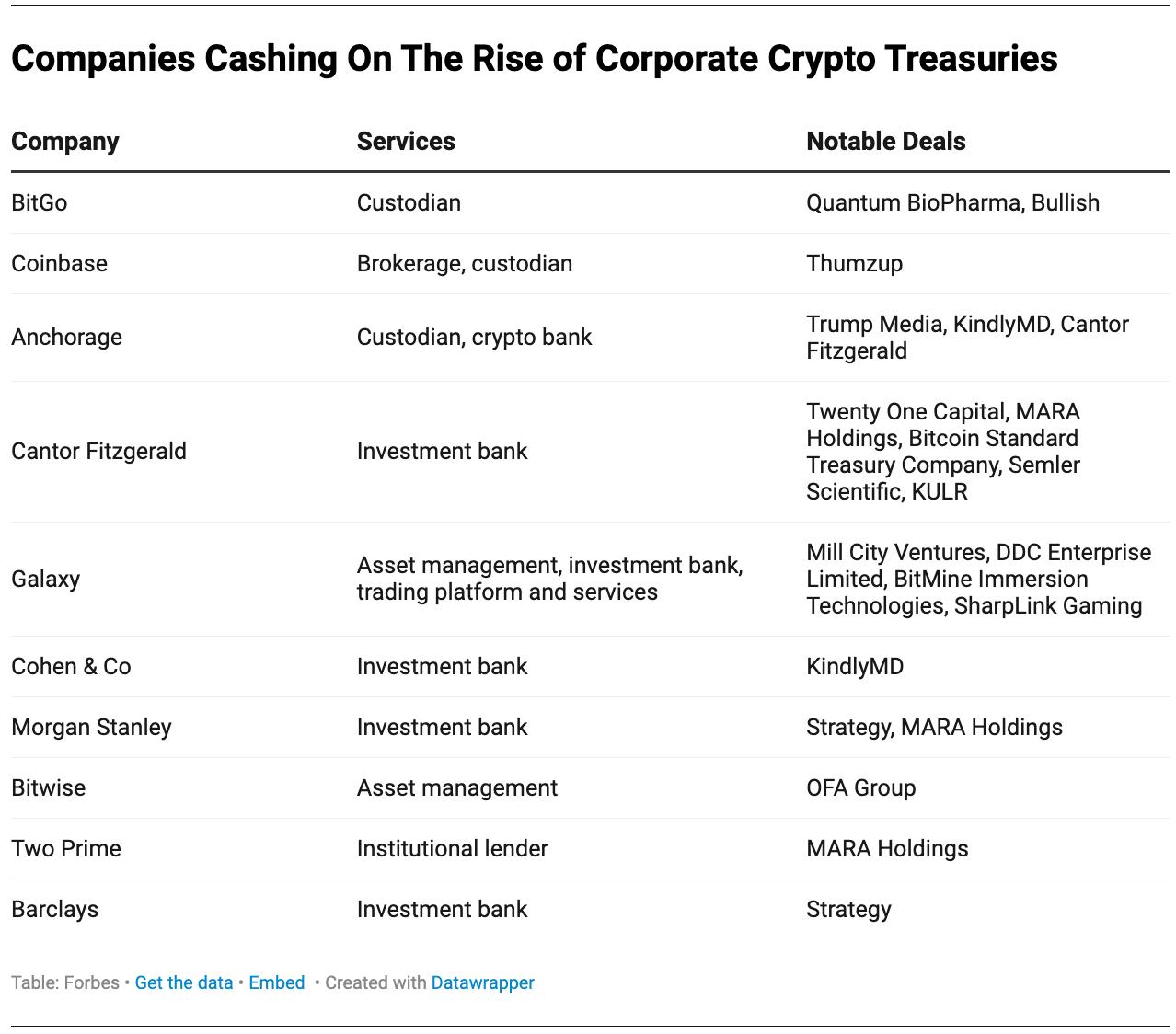

The real fortunes, however, are flowing to the merchants caught up in this latest gold rush: the custodians, brokers, asset managers and investment banks, who earn service fees on every trade, transfer and storage transaction.

Nathan McCauley, co-founder and CEO of Anchorage Digital in San Francisco, said the trend has reached "mania levels" and is "extremely contagious" over the past six months. His cryptocurrency bank has reached an agreement to manage Trump Media's $2 billion in Bitcoin reserves, as well as $760 million in assets from Bitcoin-focused Nakamoto Holdings. Nakamoto Holdings recently announced a merger with KindlyMD through a special purpose acquisition company ( SPAC ). KindlyMD is a loss-making Salt Lake City healthcare company whose stock price had been hovering below $2 per share before the news in May. Today, KindlyMD's Nakamoto is listed on the Nasdaq under the symbol NAKA. Nakamoto is named in homage to Satoshi Nakamoto , the anonymous creator of Bitcoin. The company's share price is $15, giving it a market capitalization of $114 million.

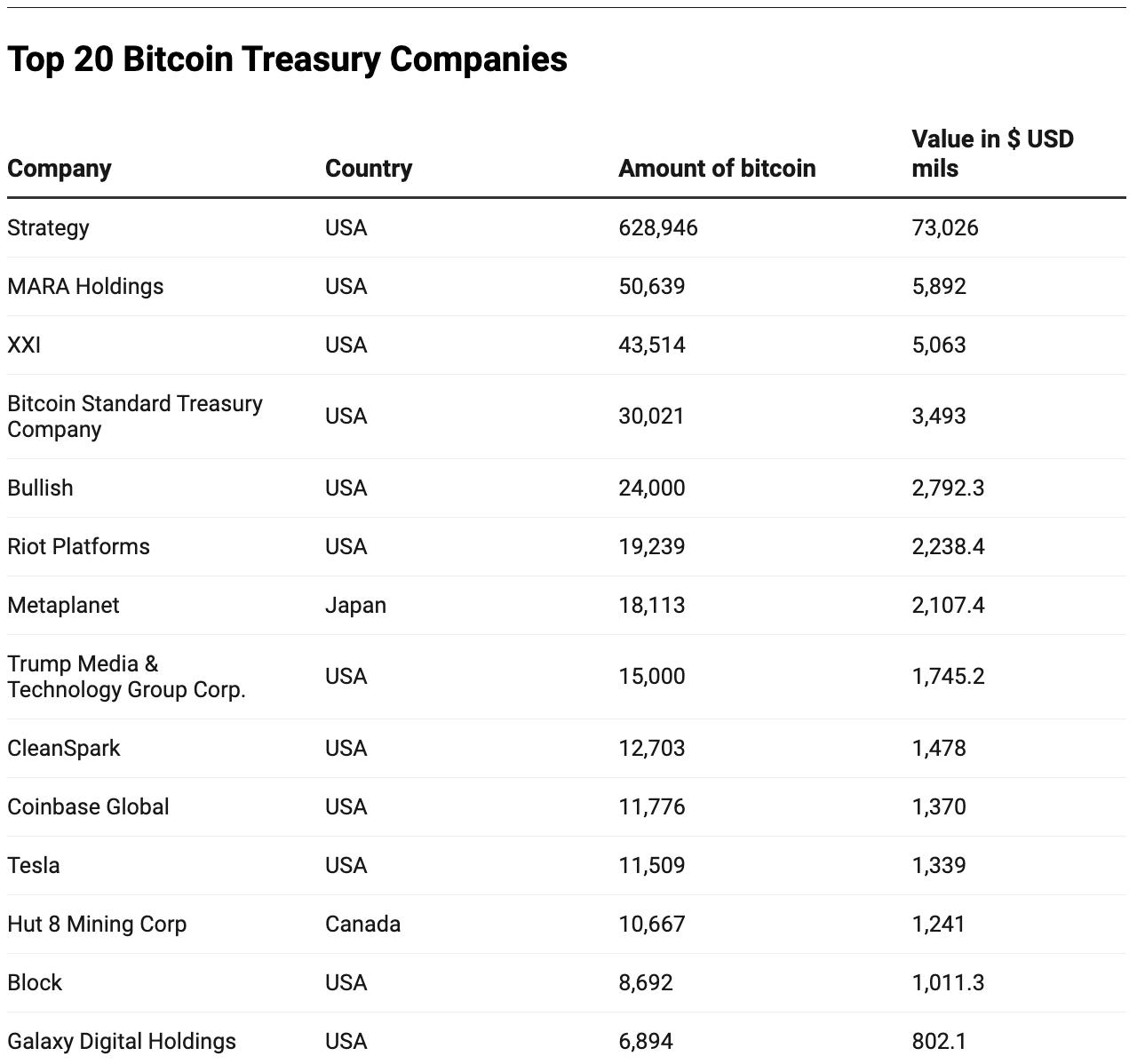

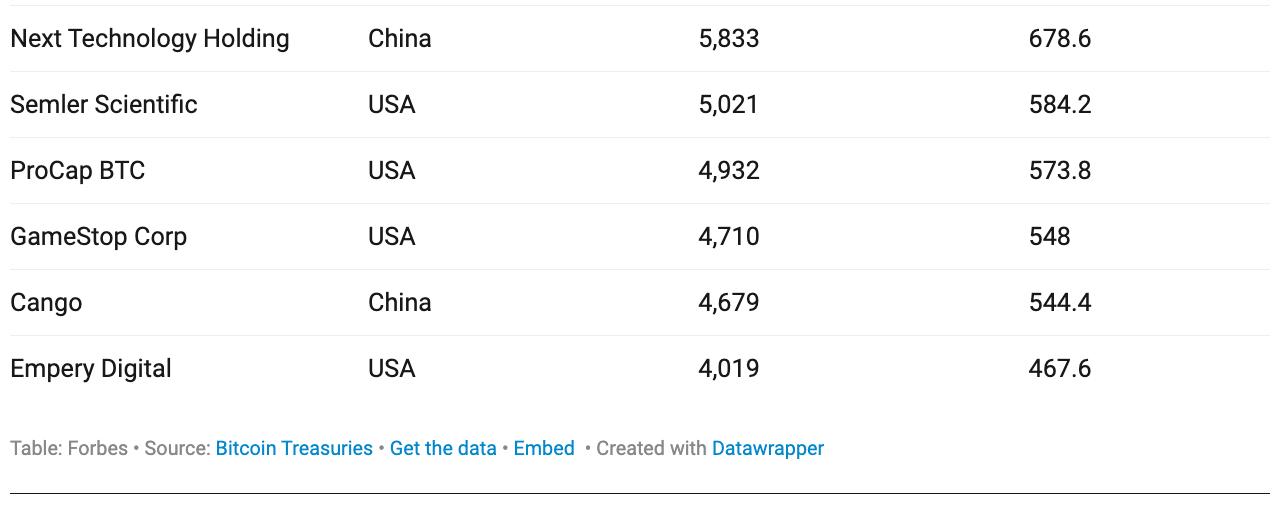

A year ago, a small group of corporate buyers collectively held just over 416,000 Bitcoins. Today, according to BitcoinTreasuries.net, at least 152 publicly traded companies control over 950,000 Bitcoins, valued at over $110 billion. The undisputed leader remains billionaire Michael Saylor's Strategy Inc., which pioneered a corporate cryptocurrency investment strategy that relies heavily on innovative financing methods, from convertible bonds to floating-rate perpetual preferred stock. Strategy Inc., originally a small software company based in Tysons Corner, Virginia, called MicroStrategy, currently owns $73 billion worth of Bitcoin, but with a market capitalization of $95 billion, it's 25% higher than its crypto holdings.

Strategy's imitators haven't stopped at Bitcoin—they're also buying into Ethereum, Solana, and a range of other digital assets. According to Architect Partners, a Palo Alto-based cryptocurrency advisory firm, companies have raised over $98 billion for such investments this year alone, with an additional 139 companies committing $59 billion since June. The latest example: World Liberty Financial, a cryptocurrency company controlled by the Trump family, recently announced the launch of a $1.5 billion "crypto treasury" backed by its own token, WLFI. Additionally, Trump Media holds a $2 billion "crypto treasury" in Bitcoin.

Elliot Chun of Architect Partners said that while the trend is still in its early stages, its wider impact is difficult to quantify, the boom has already “generated significant spending across a range of sectors”.

Underwriting commissions and other fees on preferred stock and convertible bond offerings have proven to be a lucrative business for a host of traditional investment banks and broker-dealers, including Morgan Stanley, Barclays Capital, Moelis & Company and TD Securities.

Take, for example, Strategy's recent March offering of 8.5 million shares of preferred stock, which was priced at $722 million. Morgan Stanley served as underwriter, and a dozen other firms collected approximately $10 million in fees. MARA Holdings, a Fort Lauderdale-based company that mines cryptocurrency and is currently buying and hoarding Bitcoin, issued $950 million in convertible bonds in July. Morgan Stanley and the other firms likely received $10 million in proceeds from the transaction.

Another beneficiary of the cryptocurrency fund management boom is qualified custodians, which hold digital assets on behalf of their clients. For example, BitGo, a long-established firm headquartered in Palo Alto, saw its assets under custody surpass $100 billion in the first half of 2025, thanks to the booming cryptocurrency market and the growth of corporate fund management.

“[Corporate treasury management] is a growing portion of our business,” said Adam Sporn, BitGo’s head of prime brokerage and U.S. institutional sales. “Six months ago, we didn’t see a lot of dedicated business there, but now it’s a significant portion of the new clients.” He estimates that in the past few months alone, about two dozen cryptocurrency treasury managers have announced custody agreements with BitGo. This surge in business paved the way for the company to confidentially file for an IPO in July.

Major custodians like BitGo and Coinbase charge institutional clients upfront fees, annual fees, and surcharges for holding cryptocurrencies and helping them earn a yield. The most common structure is an annualized deduction of the assets held, typically between 0.15% and 0.30%, but large clients can negotiate rates down to as little as 10 basis points, or 0.10%, according to Ravi Doshi, co-head of global markets at FalconX.

While these fees represent hundreds of millions of dollars in revenue for custodians managing tens of billions of bitcoins, margins on custodial transactions are typically slim. The demand for cryptocurrencies generated by these agencies also generates additional revenue for exchanges and prime brokers like Coinbase, FalconX, and Cumberland. Dan Dolev, senior fintech analyst at Mizuho, notes that each purchase creates a cycle: more purchases drive up prices, attracting new investors and making more tokens available for trading.

In addition to trading and custody, yield-generating services such as staking, lending, and options overlays are another lucrative area. Staking rewards users who lock up tokens to help validate blockchain transactions, while options strategies involve using financial derivatives to adjust the risk-return profile of a portfolio without changing its underlying asset allocation.

“When these companies raise money and plan to put it on their balance sheets, they’ll quickly face the question of ‘now what?’ ” said Chun of Architect Partners. “There’s over $60 billion in crypto assets that need to generate returns, and these publicly traded companies can’t do it alone.” Sidney Powell, CEO of Melbourne crypto lending firm Maple Finance, said that until now, companies have relied on the appreciation of the underlying assets to drive returns, but the rapid spread of the crypto fund management trend will force companies to differentiate by seeking yield-generating strategies or low-cost capital to buy Bitcoin.

Juan Leon, senior investment strategist at Bitwise, a crypto asset management and advisory firm, said that to build a competitive advantage, these firms may increasingly turn to lenders like Two Prime and Maple Finance, as well as asset managers like Wave Digital Assets, Arca , and Galaxy, which charge between 25 and 50 basis points for their fund management services. Earlier this month, Galaxy reported $175 million in inflows into its fund management business, part of which it used to provide fund management solutions to about 20 clients holding cryptocurrencies.

Meanwhile, Wall Street has begun financing the cryptocurrency craze. Mutual fund giant Capital Group , hedge fund D1 Capital Partners and investment bank Cantor Fitzgerald, among others, have provided funding for companies to stockpile cryptocurrencies amid a friendlier policy environment and greater regulatory clarity under President Trump.

Despite the cryptocurrency space's naysayers, the boom in digital asset treasury management is still in its early stages. "We believe that ultimately all companies will become cryptocurrency treasury managers in some capacity," Leon said, noting that global corporate cash reserves currently stand at approximately $31 trillion. "Whether 1%, 10%, or 100% of their balance sheet assets are in cryptocurrency, they're going to hold some assets. So there's a lot of room for growth."