BlackRock’s iShares Bitcoin Trust (IBIT), the largest U.S. spot Bitcoin ETF, recorded two consecutive days of redemptions this week as Bitcoin tumbled below $105,000.

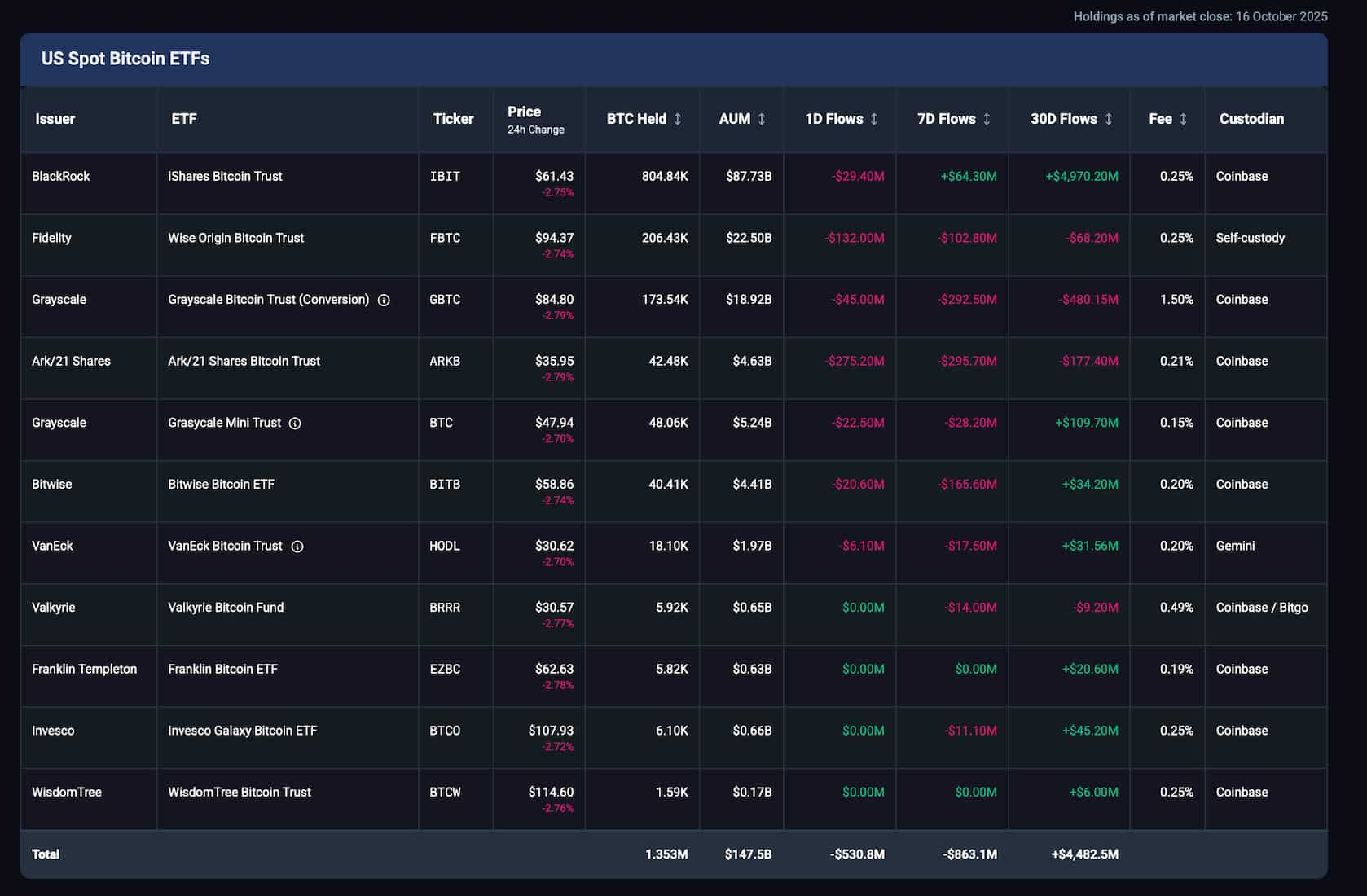

According to ETF flow tracker data shared by HeyApollo co-founder Thomas Fahrer, IBIT sold 272 BTC on October 15 and another 272 BTC on October 16, bringing its two-day outflow to 544 BTC, worth around $57 million at current prices.

The market stress coincided with geopolitical tensions after President Trump threatened 100% tariffs on Chinese imports, sparking a global risk-off move. Gold climbed above $4,330 per ounce as investors fled to safety, while Bitcoin slipped through key technical levels.

The breach of its 200-day simple moving average at $107,400 and the expanding channel floor near $99,500 further reinforced the bearish momentum.