XRP is bracing for a volatile close to October, with Finbold’s AI prediction agent projecting the token will slip significantly by Halloween.

The prediction window runs October 23–31, neatly overlapping Halloween, a fitting backdrop given the token’s recent performance. XRP has already suffered a 15.7% monthly decline, with weak inflows and ETF delays haunting traders.

In the last 24 hours the token has staged a modest recovery, rising 1.06% to $2.41, though it still underperformed the broader crypto market’s 1.26% gain.

The uptick comes after a bruising month in which XRP shed nearly 16%, a drawdown shaped by ETF speculation, macro headwinds, and technical rebounds.

XRP market dynamics

The backdrop remains uncertain. The U.S. government shutdown has delayed the Securities and Exchange Commission’s review of 155 pending crypto ETF filings, including 20 proposals tied directly to XRP.

Analysts argue that once the shutdown lifts, the SEC could approve products in batches, mirroring the rollout seen with Bitcoin and Ethereum ETFs. For XRP, which now enjoys the legal clarity of being deemed a non-security, approval could unlock institutional demand similar to Bitcoin’s $150 billion ETF inflows.

Attention now turns to October 29, the SEC’s looming deadline for Grayscale’s XRP ETF bid. With the agency offline, the timing is precarious, but the eventual post-shutdown pace of decisions could be decisive for the token’s near-term trajectory.

XRP technical analysis

On-chain signals show mixed momentum. Analyst Ali Martinez noted that XRP continues to slide toward the $2 region, a level that looms as the next downside target.

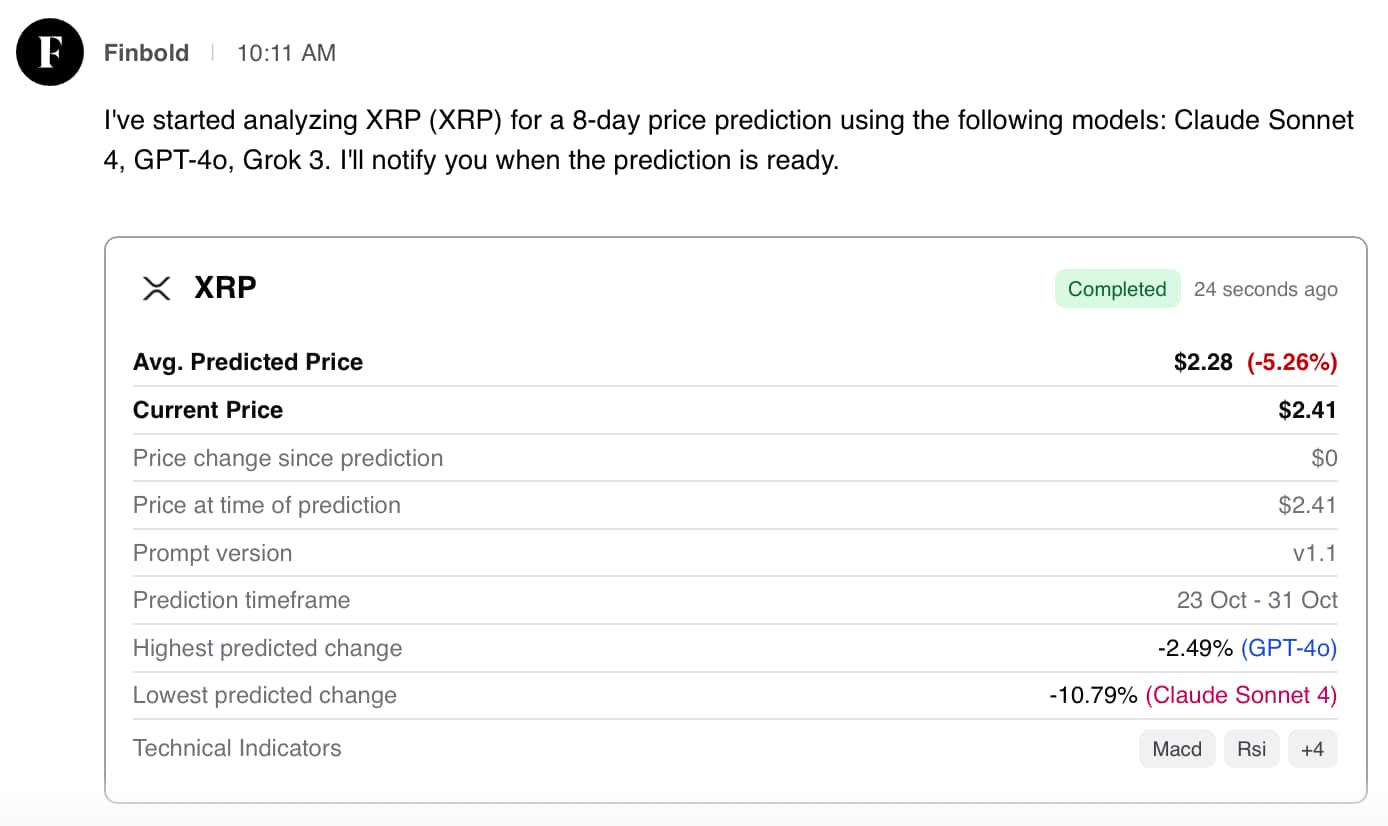

The most bearish model, Claude Sonnet 4, forecasts a slide toward $2.15 (-10.8%), while GPT-4o sees a more modest pullback to $2.35 (-2.5%) from the XRP price AI prediction.

Technical indicators confirm the caution. XRP rebounded off oversold territory (RSI at 37.8) and briefly retested its 20-day SMA near $2.38, but the MACD histogram at -0.007 shows bearish momentum is still in play. Low volume, down nearly 17% in 24 hours, points to a lack of conviction behind the latest bounce.

What this means is simple: traders face a “trick-or-treat” scenario as October closes. ETF delays, sluggish inflows, and weak technicals may keep XRP under pressure. But with a major ETF decision due just before Halloween, the possibility of a bullish surprise cannot be dismissed.