1. Bitcoin Market Review This Week (October 20-26)

• Trend: Rising and then falling → Slightly stabilizing → Unilateral rise

• Opening price: 108683 points

• Lowest price: 106101 points (Wednesday)

• Highest price: 115447 points (Sunday)

• Closing price: 114,551 points

• Change: Weekly decrease of 5.40%, maximum amplitude of 8.81%

• Trading volume: $15.151 billion

• Technical analysis: The weekly K-line closed with a big green candle, basically "swallowing" the negative line of last week

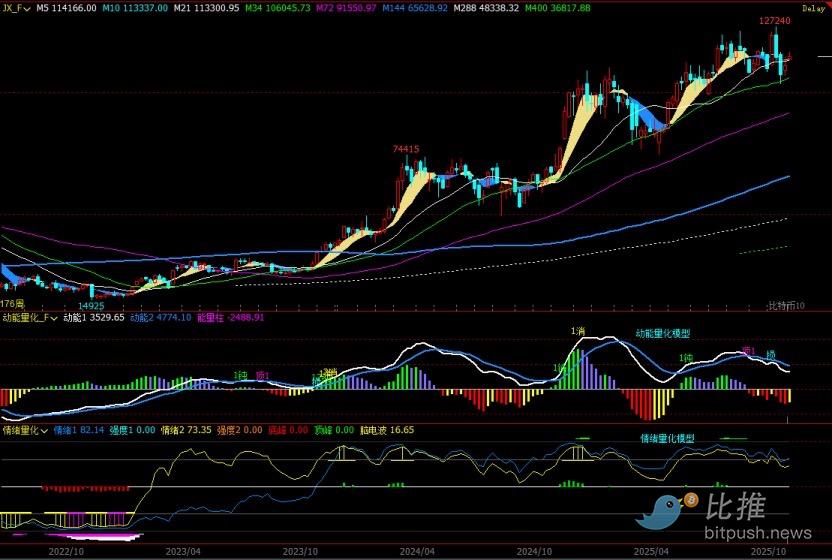

Bitcoin Weekly K-line Chart: (Momentum Quantification Model + Sentiment Quantification Model)

Figure 1

Bitcoin daily K-line chart:

Figure 2

Bitcoin 4-hour candlestick chart:

Figure 3

In my weekly review on October 19, I predicted:

1. Next week, the price of the currency will rebound to the key area of 114,000-116,000 points; if it encounters resistance and falls back, it will fall to the support of 103,000 points and maintain fluctuations in a weak range.

2. Pressure level: The first pressure range is 114,000~116,000 points, and the second pressure level is around 120,000 points.

3. Support level: The first support level is around 103,000 points, and the second support level is around 100,000 points.

The operating strategy given by the author in the weekly review on October 19 is:

1. Mid-line strategy: None.

2. Short-term strategy: Control your position, set a stop-loss point, and implement "sell high and buy low" based on resistance and support levels (using 60-minute/240-minute cycles).

• This strategy uses the price testing results of the key area of 114,000 ~ 116,000 points as the basis for decision-making;

• If the currency price shows resistance signals in this area, enter the market to short as planned, set the stop loss above 116,000 points, and the first target is around 103,000 points. Close the position if it stabilizes.

Review of actual trends this week:

This week, Bitcoin's overall trend has been one of "rising high, falling, and then stabilizing and rebounding." Specifically, the price opened flat and rose in the first three trading days, fluctuating upward to a high of 114,088 before falling under pressure. It then dipped to a low of 106,101 before finding support and gradually stabilizing. Since Thursday, it has rebounded for four consecutive trading days, with a cumulative gain of 6.33%. This week's high of 115,447 points closely matches the upper limit of the key range predicted by the author at 116,000 points, accurately confirming the validity of this resistance level. This week's overall trend generally conforms to the previous prediction of "maintaining range-bound fluctuations in weakness."

This week's operational review;

• Mid-term strategy: Based on the author’s prediction of “maintaining weak range fluctuations”, no trading was conducted this week.

• Short-term strategy: This week, I executed trades based on my established short-term strategy and successfully exited the market with a profit.

Based on this week’s market performance, the author will use a combination of multiple technical frameworks to conduct an in-depth analysis of the evolution of Bitcoin’s internal structure.

1. As shown in Figure 1, from the weekly chart:

• Momentum quantification model: After this week's adjustment, the two momentum lines continue to move downward, and the energy (negative) column grows.

The model predicts a falling price index: during the adjustment process

• Sentiment quantification model: The intensity of both sentiment indicators is 0, and the peak value is 0.

The model predicts the currency price pressure index: neutral

• Digital monitoring model: No digital signal is currently displayed.

The above data suggests that the weekly level is still in an adjustment pattern.

2. As shown in Figure 2, from the daily chart analysis:

• Momentum quantification model: After the market closed on Sunday, the two momentum lines formed a “golden cross” below the zero axis, and the energy column changed from “negative” to “positive”.

• Sentiment Quantitative Model: Both sentiment indicators were around 46 after the market closed on Sunday.

The above data suggests: oversold rebound at the daily level.

2. Market forecast for next week: (October 27th to November 2nd)

1. Currently, there is an oversold rebound demand at the daily level. The price of the currency will continue to rise next week. We will continue to observe the key area of 114,000-116,000 points . Its gains and losses will determine the future direction of the market:

• If it encounters resistance and falls back, it will fall to the support level of 106,000 points, and the trend will maintain a weak and volatile pattern.

• If it successfully holds above this area, it is expected to challenge the 120,000 point resistance level again and the trend will enter a strong and volatile pattern.

2. Pressure level: The first pressure range is 114,000 to 116,000 points, the second pressure level is around 120,000 points, and the important pressure level is around 124,000 points.

3. Support level: The first support level is around 106,000 points, and the second support level is around 103,000 points.

3. Next week's trading strategy (excluding the impact of breaking news): (October 27th to November 2nd)

1. Mid-term strategy: The market is currently in a range-bound pattern, and the trend is not yet clear. For specific position building methods, please pay attention to the link below the article.

2. Short-term strategy: Control your position, set a stop-loss, and short short at every rally based on resistance and support levels (using a 60-minute/240-minute cycle).

• This strategy uses the price testing results of the key area of 114,000 ~ 116,000 points as the basis for decision-making;

• If the currency price stabilizes above this area again, enter the market and long as planned, set the stop loss at around 114,000 points, and the first target is around 120,000 points. Close the position if there is resistance.

• If the currency price shows resistance signals in this area, enter the market to short as planned, set the stop loss around 116,000 points, and the first target is around 106,000 points. Close the position if it stabilizes.

4. Important time window next week: The Federal Reserve will announce its interest rate decision at 14:00 Eastern Time on October 29. Pay attention to market changes.

4. Special tips:

1. When opening a position: immediately set the initial stop loss level.

2. When the profit reaches 1%: move the stop loss to the cost price (break-even point) to ensure that the transaction no longer loses money.

3. When the profit reaches 2%: move the stop loss position up to the profit of 1%.

4. Tracking: Thereafter, every time the price of the currency rises by 1%, the stop loss level will move up by 1% simultaneously, dynamically protecting and locking in existing profits.

(Note: The above 1% profit trigger threshold can be flexibly adjusted by investors based on their own risk preferences and the volatility of the underlying assets.

Financial markets are constantly changing, with market fluctuations and ups and downs. I will adjust my trading strategies dynamically at any time. For investors seeking the latest trading insights, please follow the "Bitpush TG Exchange Group" below this article. You can read my daily intraday commentary and get the latest trading insights as soon as possible.

The above models are the trading rules I follow when operating and do not constitute any basis for buying or selling. They are personal opinions and are for reference only.

By Cody Feng

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush