After a quiet October for many altcoins, traders are turning to Token that can “pump” as market sentiment improves. With growing expectations of interest rate cuts and stronger liquidation in the crypto market, November could mark a month of recovery for the entire market.

Among them are three “hidden gems” that have quietly built a solid foundation despite a less positive October performance. Each shows signs of early accumulation, potential breakouts, and returning buying; signals that could fuel healthy gains throughout November 2025.

Chainlink (LINK)

Of the three “hidden gem” altcoins, Chainlink (LINK) stands out as a strong recovery candidate in November. The RWA oracle network had a weak October, down more than 15%, but its structure and whale activity now suggest it could be one of the few Token about to “pump.”

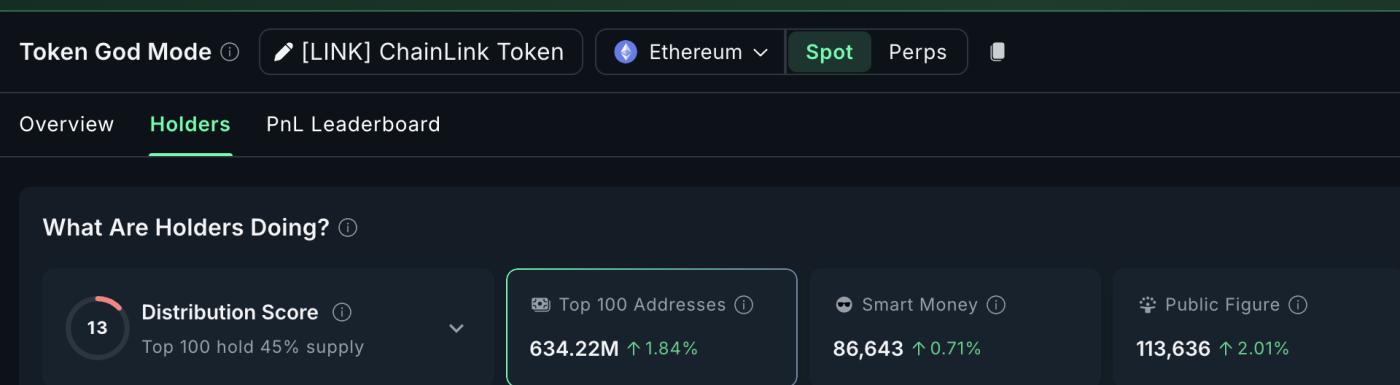

on-chain data shows that the top 100 addresses, or “mega whales,” increased their holdings by 1.84% over the past week, bringing their total balance to 634.22 million LINK. This means that whales have acquired approximately 11.46 million LINK, worth approximately $205 million.

Smart money wallets and wallets of public figures also increased their holdings slightly.

Whale LINK: Nansen

Whale LINK: NansenWant more Token analysis like this? Subscribe to Editor Harsh Notariya's daily Crypto Newsletter here .

Ray Youssef, founder and CEO of NoOnes, supports this view.

“The whale accumulation after the post-October dip is a classic sign that smart money is positioning for continued RWA expansion. The structural breakout above $18.70 and the chain of higher Dip suggest a possible bullish scenario for LINK heading into November,” Youssef told BeInCrypto.

Technically, LINK is trading within a symmetrical triangle pattern, confirming the higher Dip setup that Youssef highlighted earlier. This pattern reflects the lingering indecision between buyers and sellers. The new lower trendline has two touch points, so if strong selling pressure emerges, the invalidation scenario could increase the probability of a breakdown of the pattern to the downside.

However, if LINK closes above $18.25 and confirms the breakout, the price could head towards $20.18, and eventually $23.69, representing a gain of around 13%–30%.

Price Analysis LINK: TradingView

Price Analysis LINK: TradingViewThe Relative Strength Index (RSI), a measure of buying and selling momentum, had previously shown a hidden bearish divergence (prices making lower highs while RSI made higher highs), suggesting weakness. But the recent pullback in RSI shows that divergence is easing, a sign that whale accumulation may be restoring confidence.

If the market weakens, $17.38 and $16.98 are important supports. Losing them could open up the $15.72 zone, confirming the bearish scenario.

Litecoin (LTC)

The Litecoin ETF story has dominated the headlines this week. The newly launched Canary Litecoin ETF (LTCC) surpassed $1.1 million in organic volume in its first two hours, setting a record pace for a crypto-backed ETF.

However, despite the impressive institutional debut, LTC price is down 2.7% in the last 24 hours and nearly 8.5% in the past month, suggesting that much of the positive expectations may have already been priced in.

Still, the return of on-chain buying suggests that the “hidden gem” altcoin’s next rally could make it one of the Token that could “pump” in November.

Over the past 48 hours, two key groups of investors, “whales” holding 10,000–100,000 LTC and “dolphins” holding 1,000–10,000 LTC, have both increased their accumulation. In total, the two groups have collected nearly 110,000 LTC, worth about $10.7 million at the current LTC price. This steady inflow shows renewed confidence from Medium to large-scale holder , who can expect a post-ETF rally.

Litecoin Buyers Are Back: Santiment

Litecoin Buyers Are Back: SantimentAccording to the chart, LTC is trading within an ascending triangle, with Fibonacci levels supporting the structure. The first resistance is around $98.65, and a breakout above could open the way to $106.97 — a roughly 10% increase.

If buyers can hold above this zone, $135.98 would become the next important upside target, which would fit with ETF-driven momentum and broader market sentiment heading into November.

LTC Price Analysis : TradingView

LTC Price Analysis : TradingViewHowever, this setup is not without risk. A daily close below $94.86 would weaken the bullish case. And a loss of $93.51 could see the price retreat to deeper support zones at $89.35, or even $79.27.

Uniswap (UNI)

Uniswap (UNI) could be one of the few Token with a chance to surge in November. Despite falling more than 17% in October, the DeFi platform's native Token (UNI ) is showing early signs of recovery, closing the week in the green.

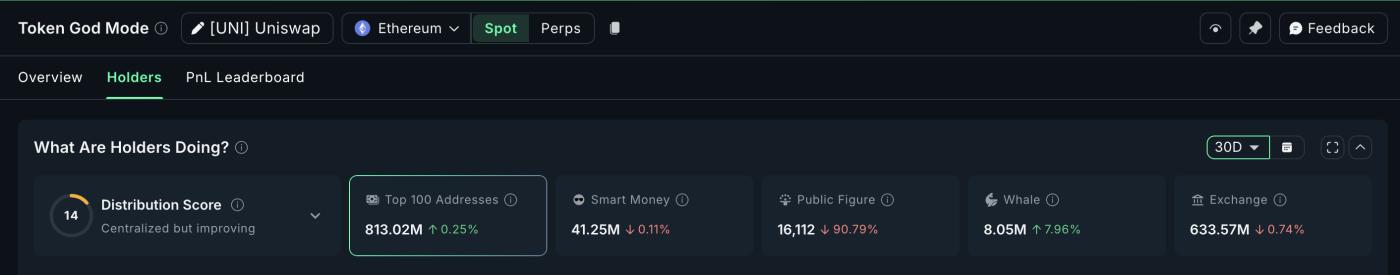

Additionally, over the past 30 days, two large groups of investors have quietly increased their positions. Whales holding between 100,000 and 1 million UNI increased their holdings by 7.96% to 8.05 million UNI. Meanwhile, the super whale group (top 100 addresses) added 0.25%, bringing their total holdings to 813.02 million UNI.

UNI Whale: Nansen

UNI Whale: NansenIn total, these two groups have collected approximately 2.62 million UNI, worth approximately $16.6 million at current prices. The steady buying during a down month suggests growing confidence that Uniswap ’s price structure could soon turn bullish.

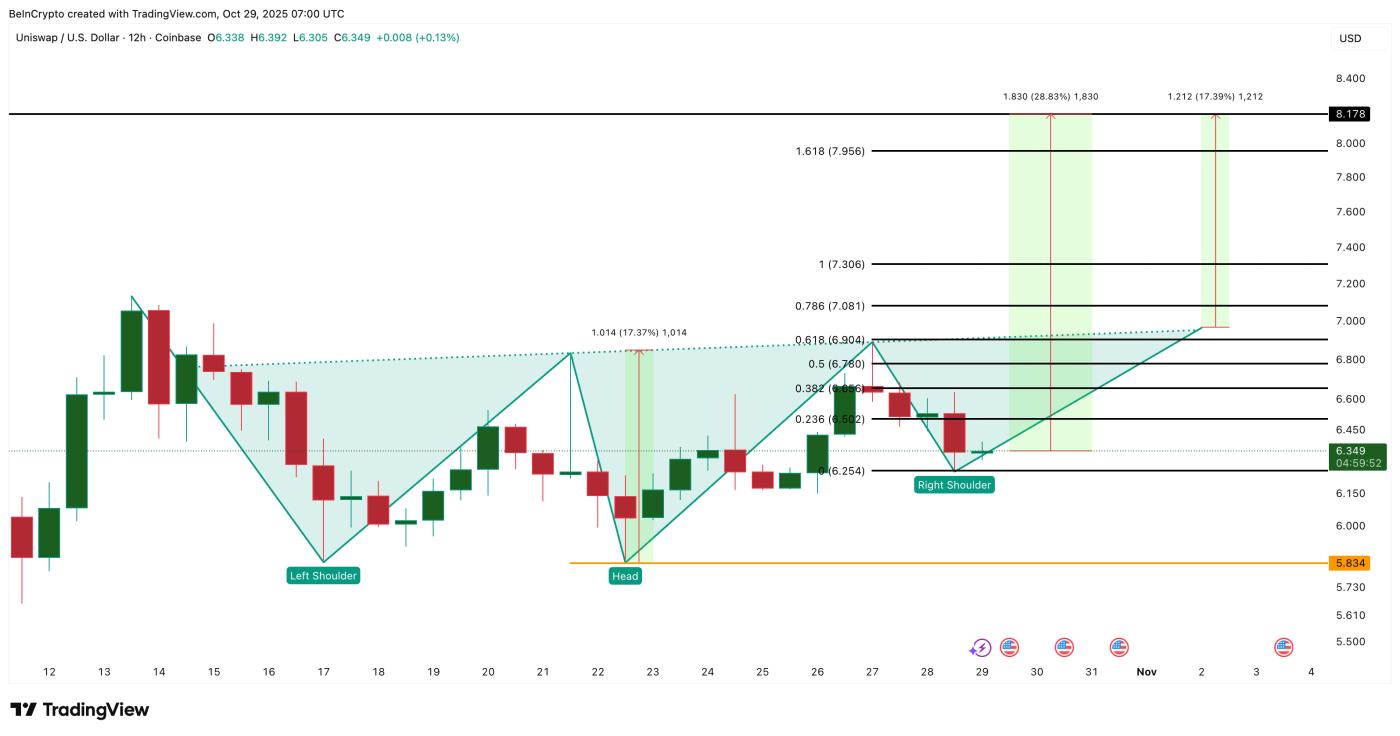

Technically, UNI ’s 12-hour chart is forming an inverse Vai-and- Vai pattern, which typically suggests a bearish-to-bullish shift. The neckline is near $6.90; a clear close above could confirm a breakout, opening the way to $8.17 — a potential upside of nearly 29% from current levels.

UNI Price Analysis : TradingView

UNI Price Analysis : TradingViewBefore reaching that zone, minor resistances at $7.08 and $7.30 could test buying power. However, the bullish thesis would weaken if UNI falls below $6.25. And a clear break below $5.83 — the Dip of the pattern — would be completely invalidated.