Article Author: Thejaswini MA Article Translation : Block unicorn

Foreword

The Facebook graph has trillions of edges.

This number is a milestone in Avery Ching's mind , a testament to what a properly designed distributed system can achieve . A trillion connections have been established between people, photos, posts, and locations. The entire analysis can be completed in four minutes using commercially available hardware from any company .

Ching knew this because he had personally built the system that made it all possible.

In 2007, Ching, fresh out of his PhD program at Northwestern University, co-founded Apache Giraph at Yahoo! What began as an experiment in distributed graph processing ultimately provided the technology for Facebook's graph search and fundamentally changed how tech companies analyze social networks on a large scale.

But Ching's shift to cryptocurrency wasn't due to the prevailing trend or the influx of venture capital. He spent a decade at Meta building the infrastructure for Diem, part of the company's ambitious global digital currency plan.

In 2021, Diem collapsed under regulatory pressure, but Ching and his team doubled down on their efforts. A few months later, they founded Aptos Labs and set a clear goal: to create a blockchain that could truly handle global institutional financing.

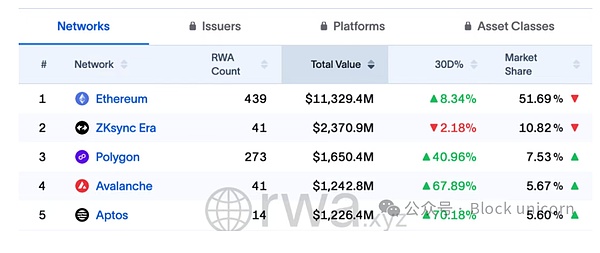

Today, Aptos processes transactions for companies such as BlackRock, Franklin Templeton, and Apollo. The blockchain currently holds over $1.2 billion in tokenized real-world assets.

Ching initially focused on building systems to analyze how billions of people connect on social media, but later shifted its focus to building systems that could change how trillions of dollars flow in the global economy.

The Road to Growth

Avery Ching grew up in Honolulu and attended Punahou School from kindergarten through high school—the same school that produced Barack Obama.

He left Hawaii for Evanston, Illinois, to study computer engineering at Northwestern University. The transition from island life to the harsh Midwestern winter may have been difficult to adjust to, but Ching found a sense of belonging in the computer science labs at Northwestern.

During his undergraduate studies, he focused on learning how to build systems capable of handling complex calculations on multiple machines simultaneously. However, what truly laid the foundation for his career was the professional knowledge he accumulated during his doctoral dissertation defense in October 2007.

His doctoral dissertation focused on supercomputing, parallel computing frameworks, and high-performance file systems. These are the foundations of every large system that underpins modern internet services.

Ching's doctoral advisor, Professor Alok Choudhary, was researching a problem that companies like Google and Facebook were beginning to face: how to process massive amounts of data when it is spread across thousands of machines?

The answer lies in designing systems that can work in coordination across distributed infrastructure, avoiding bottlenecks or single points of failure.

This insight, formed in the academic laboratory, became Ching's secret weapon after entering the industry.

Building a system to map the Facebook universe

In October 2007, the same month Ching defended his doctoral dissertation, he joined Yahoo as chief software engineer. At the time, Yahoo was still a leading technology company, struggling to handle the massive amounts of data generated by hundreds of millions of users.

Ching saw an opportunity. Social networks generate a special data structure: a graph. Each user is a node. Every friendship, every message, and every interaction is an edge connecting the nodes. The problem is, how do you analyze these graphs when they grow to billions of nodes and trillions of edges?

His answer was Apache Giraph, an open-source distributed graph processing system. The project draws inspiration from Google's Pregel paper but makes the technology available to any company that wants to analyze graph data at scale.

Instead of trying to load the entire graph into the memory of a single machine (which would be impossible at Facebook's scale), Giraph distributed the graph across multiple machines. Each machine processed its portion of the graph and then communicated with other machines to coordinate the results.

The system worked. Facebook adopted Giraph and used it to power its graph search, a feature that allows users to search the social network for things like "photos of my friend in Paris" or "the restaurants my friend likes in New York."

More importantly, Giraph is able to analyze Facebook’s entire social graph in four minutes using commercial hardware.

Diem's circuitous route

In 2011, Ching left Yahoo to join Facebook (later renamed Meta), where he spent the next decade building the underlying infrastructure that underpinned the company's analytics capabilities. His team was responsible for projects such as Apache Spark, Hadoop, distributed scheduling, and a unified programming model, technologies that enabled Meta engineers to analyze data across hundreds of thousands of machines.

Subsequently, Meta announced plans for Libra, a digital currency project (later known as Diem).

Meta's vision is to create a blockchain-based payment system serving billions of people globally, especially those without access to traditional banking services. Meta will provide distribution channels through Facebook, WhatsApp, and Instagram. Blockchain provides the infrastructure for inexpensive, fast, and global payments.

Ching has been appointed as the technical lead for the Meta crypto platform, and his team is responsible for building the blockchain itself, wallet infrastructure, and ecosystem development strategy.

Unlike Bitcoin or Ethereum, which sacrifice speed for decentralization, Diem is designed to process thousands of transactions per second while maintaining security and compliance. The team developed the Move programming language specifically for Diem, with built-in protection mechanisms designed to eliminate certain types of smart contract vulnerabilities.

However, Diem faces problems that engineering cannot solve. Regulators around the world are concerned about Facebook's power and influence. What would it mean for monetary policy if billions of people adopted a Facebook-backed currency? What would it mean for financial stability? What would it mean for privacy?

Regulatory pressures became insurmountable. By early 2022, Meta had disbanded the Diem project. With the company abandoning its cryptocurrency ambitions, years of effort had come to naught.

Ching and his core team faced a choice: return to working on Meta's traditional infrastructure or launch what they had already built independently.

They chose independence.

Building Aptos

In December 2021, Avery Ching and Mo Shaikh co-founded Aptos Labs. Mo Shaikh was previously responsible for partnerships and strategy at Diem.

Cryptocurrency prices were beginning a long decline, entering what would later become the 2022 bear market. FTX hadn't collapsed yet—nobody predicted it.

Ching and Shaikh were not concerned with market timing. They had built a blockchain that they believed was technically superior to any other existing system. With the Move programming language, a parallel execution engine called BlockSTM, and a Byzantine fault-tolerant consensus mechanism, Aptos processes transactions faster than existing proof-of-stake systems.

However, the real challenge is whether anyone will still care about the quality of technology when the entire cryptocurrency market is on the verge of collapse.

In Aptos' early days, Ching and his team had to convince skeptical investors why the world needed another Layer-1 blockchain. Ethereum already existed, along with Solana, Avalanche, Cosmos, and numerous other competitors vying for developers and users.

Ching's speech differed from that of a typical cryptocurrency founder. He didn't promise a decentralized utopia or revolutionary financial inclusion. He talked about what he understood: building scalable infrastructure.

He explained, “At Aptos, we believe that focusing on scalability is the most important thing. You can start with a journey and that journey will eventually lead to a completely different place because you can keep pushing the network forward.”

This focus on scalability stems from painful experiences at Meta. Systems that cannot adapt will eventually perish. The ability to improve infrastructure without breaking existing applications is crucial for long-term success.

Aptos launched mainnet in October 2022, at a time when the cryptocurrency bear market was deepening. The following month, FTX crashed, and the industry's reputation collapsed as a result.

As retail investors flee the cryptocurrency market, institutional investors are showing increasing interest. The FTX incident exposed the consequences of inadequate cryptocurrency infrastructure. Companies like BlackRock and Franklin Templeton are beginning to seek blockchain platforms that meet institutional standards for security, compliance, and reliability.

Aptos's corporate background suddenly became an advantage.

Tokenized stakes being cashed out

By 2023, Ching had significantly narrowed the scope of Aptos's business. He no longer tried to meet all the needs of everyone, but instead positioned blockchain as a "global transaction engine" for tokenizing real-world assets.

Traditional financial systems suffer from excessive friction. Settlement takes several days. Cross-border transactions are costly. Transaction time is limited. Custody requires multiple intermediaries.

On the other hand, blockchain can eliminate most of these frictions. By placing real-world assets on the blockchain, you can trade around the clock, settle instantly, and significantly reduce custody costs.

However, tokenization requires more than just technology; it also requires collaboration with institutions that possess assets, regulatory relationships, and capital to truly achieve tokenization.

Ching began signing these partnership agreements. BlackRock brought its BUIDL fund to Aptos, investing $500 million in tokenized assets. Franklin Templeton launched a tokenized money market fund on the platform. Apollo began exploring tokenized credit products.

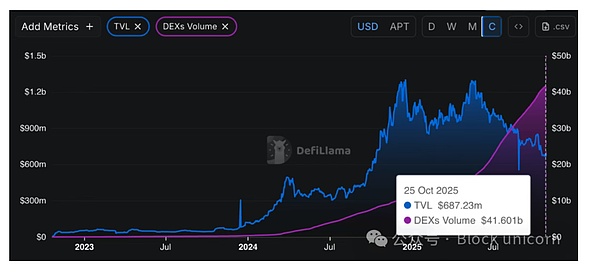

By mid-2025, Aptos will have custodied over $1.2 billion in tokenized real-world assets.

The South Korean market has emerged as another key area of focus. South Korea boasts high trading volumes, a large retail investor base, and a high level of cultural acceptance of digital assets. Ching has partnered with Lotte Group, one of South Korea's largest retailers, which uses Aptos to issue mobile vouchers.

Ching stated at the end of 2024: "As we begin to work with major retailers and engage with banks and large payment companies, we are seeing a rapid increase in interest from the South Korean side. The new government seems very supportive of cryptocurrencies. I expect cryptocurrencies to develop very quickly in South Korea."

The collaboration with South Korea validates Ching's strategy: find real-world use cases where blockchain can deliver tangible benefits, and then scale up rapidly.

In December 2024, Mo Shaikh resigned from his leadership role at Aptos. Ching, who previously served as Chief Technology Officer, succeeded him as CEO.

As Chief Technology Officer, Ching is responsible for technology development. As CEO, he will be responsible for strategic direction and partnerships, which will determine Aptos' success or failure.

During his first nine months as CEO, Ching focused primarily on enhancing Aptos' market positioning. Instead of competing with other blockchain platforms for developers and retail users, he concentrated on building Aptos into an infrastructure for institutions to tokenize and trade real-world assets.

But Ching's focus extends beyond technology development. He also actively collaborates with regulators to help develop rules governing tokenized assets.

In June 2025, he was appointed a member of the Digital Asset Markets Subcommittee of the U.S. Commodity Futures Trading Commission (CFTC). This position gives him a voice in developing U.S. digital asset regulatory rules.

When publicly announcing the appointment, Aptos Labs stated, "Avery will collaborate with other leaders from the web3 and financial services sectors to develop digital asset regulatory frameworks."

For Ching, this regulatory work is crucial. Institutional adoption of blockchain requires a clear regulatory framework. Without such a framework, institutions cannot commit significant funds.

The builder's attitude towards encryption

Ching does not see decentralization as an ultimate goal. Nor does he promise to disrupt traditional finance or create a new economic system. Instead, he focuses on solving practical problems: speeding up transactions, reducing costs, improving security, and fostering new financial products.

This pragmatism stems from his experience building infrastructure at Yahoo and Meta. These companies didn't pursue theoretical elegance, but rather focused on creating systems that could reliably run for billions of users.

Ching's focus on practical applications has attracted institutions that wouldn't normally consider more ideologically driven crypto projects. For example, BlackRock and Franklin Templeton aren't interested in disrupting central banks or creating parallel financial systems. What they need is infrastructure that can help them offer better products to their clients.

Aptos provided them with such infrastructure.

This is the engineer's belief: better tools lead to better results. Efficiency itself is ethical. Making something serve a billion people is itself a form of idealism.

He wasn't trying to change human nature, but rather to accept it and build upon it. Ultimately, this might be the most radical stance.