2025 will not be an easy year for DeFi projects, but they have learned a trick from Wall Street: use buybacks to express confidence.

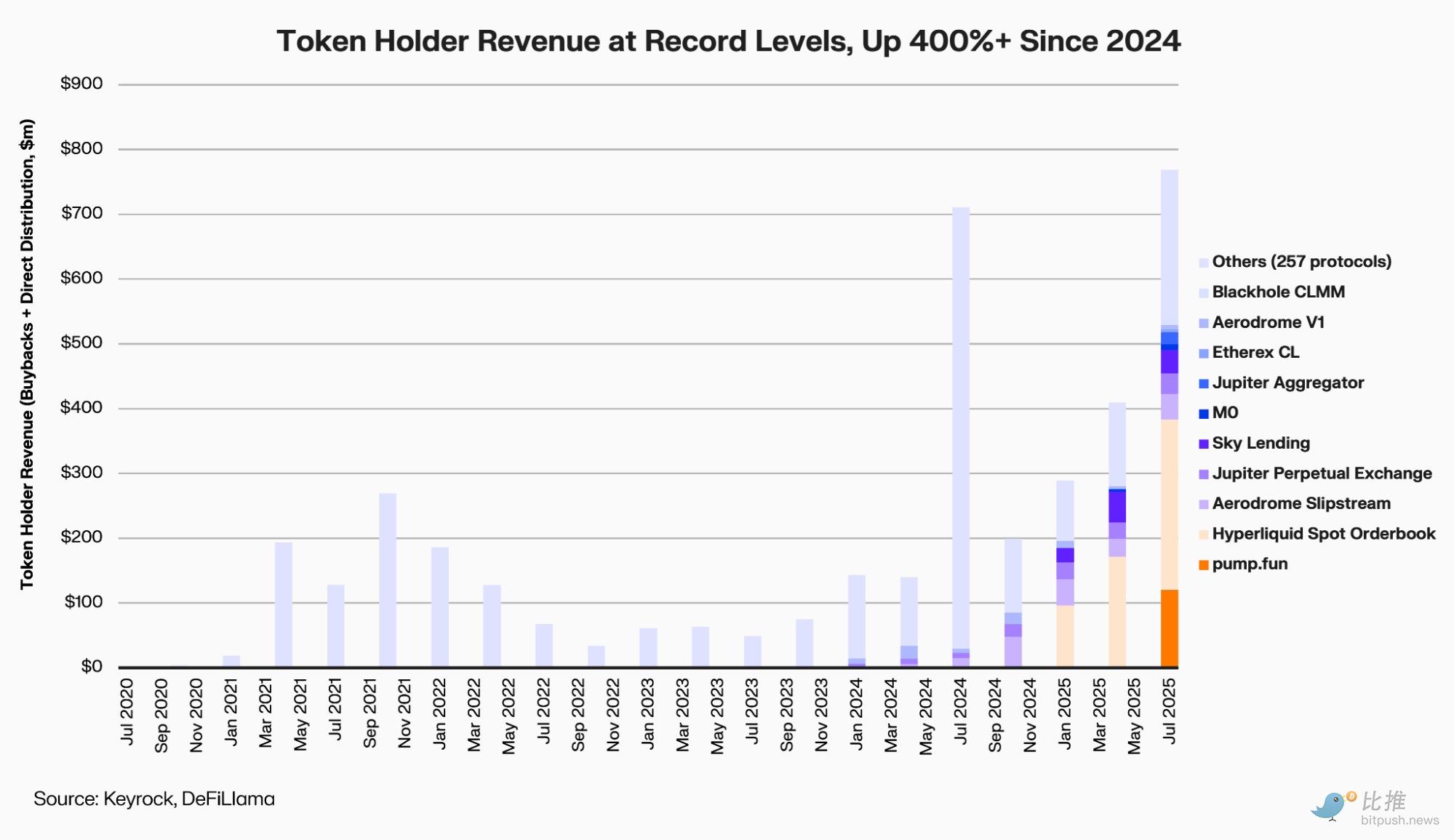

According to a report by crypto market maker Keyrock, the top 12 DeFi protocols spent approximately $800 million on buybacks and dividends in 2025, a 400% increase from the beginning of 2024.

"Just as publicly traded companies use buybacks to demonstrate their long-term commitment, DeFi teams are hoping to use this to prove that they are profitable, have cash flow, and have a future," wrote analyst Amir Hajian.

But in a market with scarce liquidity and low risk appetite, are these actions to "reward token holders" a return to value or just a waste of money?

Who's involved in this buyback frenzy?

This wave of buybacks, starting with Aave and MakerDAO at the beginning of the year and continuing with PancakeSwap , Synthetix , Hyperliquid , and Ether.fi , covers almost all the major tracks in DeFi.

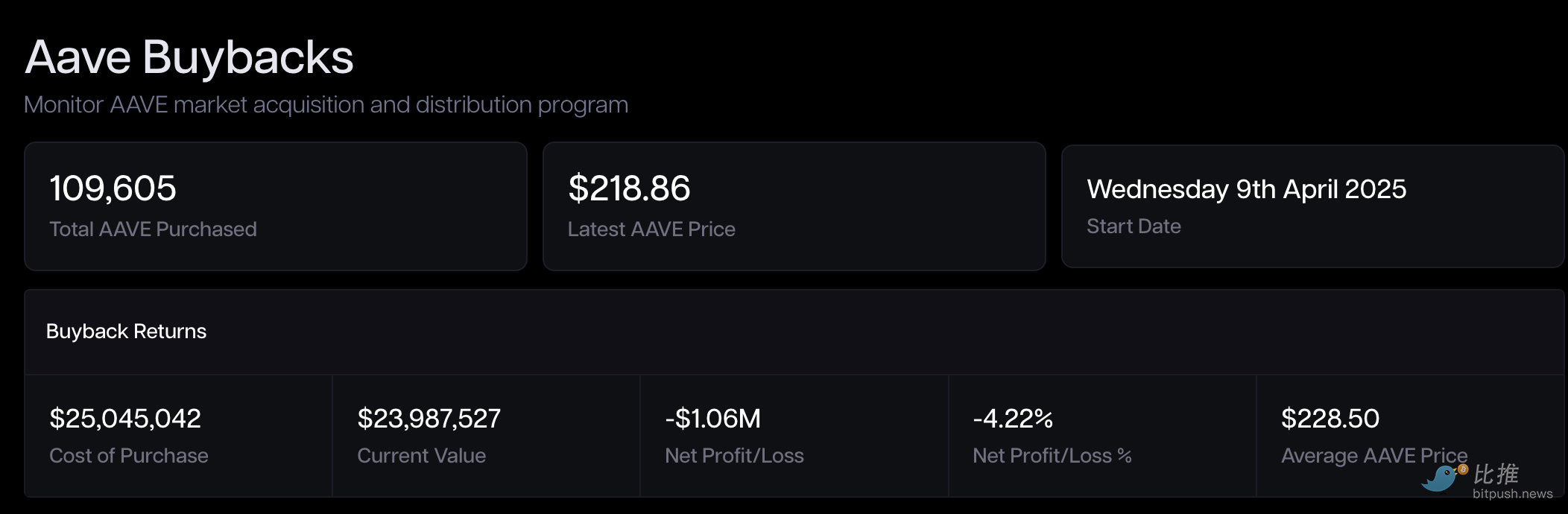

Aave (AAVE) is one of the leading projects that launched a systemic buyback program relatively early.

Starting in April 2025, Aave DAO will use protocol revenue to repurchase approximately $1 million of AAVE weekly, and in October discussed making the mechanism "normalized" with an annualized budget of up to $50 million.

On the day the proposal was approved, AAVE briefly rose by 13%, but after a six-month pilot period, its book profit was negative.

In 2023, MakerDAO (MKR) launched the Smart Burn Engine, which uses DAI surplus to periodically buy back and burn MKR. In its first week of operation, MKR rebounded by 28%, and was hailed as an example of "cash flow returning to holders".

However, a year later, the market presents a paradox of "confidence recovery but valuation lag".

Despite strong fundamentals (MakerDAO continues to increase DAI reserve earnings through real-world assets RWA), the price of MKR (which fluctuated around $1,800 as of the end of October 2025) is still only one-third of the all-time high of the 2021 bull market ($6,292).

The latest proposal from the Ethereum liquidity staking protocol Ether.fi (ETHFI) is undoubtedly the most attention-grabbing "big move" recently. The DAO authorizes up to $50 million to buy back ETHFI in batches when the price drops below $3, using a Snapshot voting process, with the goal of "stabilizing the price and restoring confidence".

However, the market is also wary: if the funds mainly come from treasury reserves rather than sustainable income, this kind of "market-stabilizing buyback" will inevitably run out of steam.

PancakeSwap (CAKE) has chosen the most programmatic path. Its "Buyback & Burn" mechanism is integrated into its token model, disclosing net inflation data monthly. In April 2025, CAKE's net supply shrank by 0.61%, entering a state of sustained deflation.

But prices are still hovering around $2, well below the $44 high in 2021 – improved supply has brought stability, not a premium.

Synthetix (SNX) and GMX are also using protocol fees to buy back and burn tokens.

Synthetix added a buyback module in its 2024 update, and GMX automatically puts a portion of the transaction fees into the buyback pool.

Both saw a 30% to 40% rebound during the peak of buybacks in 2024, but when stablecoin pegs came under pressure and fees declined, they both suspended buybacks and shifted funds to risk reserves.

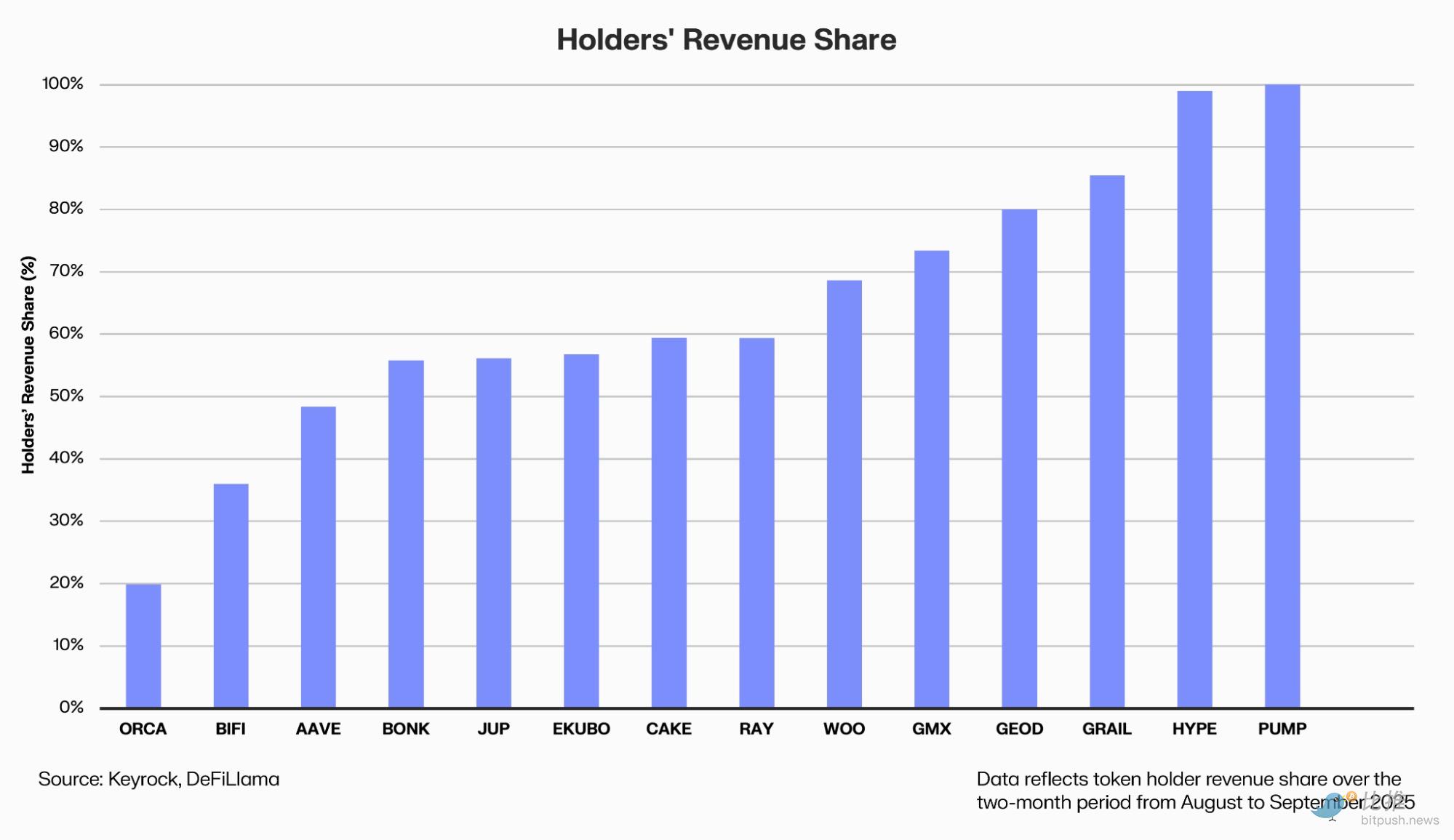

The real "exceptional winner" is the perpetual contract platform Hyperliquid (HYPE) .

It treats buybacks as part of its business narrative: a portion of the agreed revenue automatically goes into the secondary market buy pool.

According to Dune data, Hyperliquid has invested a total of $645 million in the past year, accounting for 46% of the industry, and its HYPE token has risen by 500% since its launch in November 2024.

But HYPE's success is not only due to buying pressure, but also to revenue and user growth—daily trading volume tripled in a year.

Why do buybacks often "fail"?

From the perspective of traditional financial logic, the popularity of repurchase agreements is mainly based on three points:

First, it promises to increase value share. The protocol buys back and burns tokens with real money, reducing the circulating supply and meaning each token will have a higher right to future returns.

Secondly, it conveys confidence in governance. The willingness to initiate buybacks demonstrates the protocol's profitability, financial flexibility, and governance efficiency. This is seen as a significant indicator of DeFi's shift from "cash-burning subsidies" to "operational dividends."

Furthermore, it creates expectations of scarcity. When combined with mechanisms such as lock-up and issuance reduction, buybacks can create a deflationary effect on the supply side, optimizing the token economic model.

However, a perfect theory does not equate to practical feasibility.

First, timing often backfires. Most DAOs generously invest during bull markets but reduce their funds during bear markets, creating an awkward situation of "buying high and waiting to see low," which runs counter to the original intention of value investing.

There are also concerns about the source of funding. Many projects use treasury reserves rather than continuous profits, and once revenue declines, buybacks become an unsustainable "trying to save face."

There's also the opportunity cost. Every dollar spent on buybacks means one less dollar invested in product iteration and ecosystem development. Market maker Keyrock warned in October: "Excessive buybacks may be one of the least efficient ways to allocate capital."

Even if buybacks are implemented, their effectiveness is easily diluted by continuous unlocking and new token issuance. When supply-side pressure remains, limited buybacks are like a drop in the ocean.

Messari researcher Sunny Shi pointed out:

“We have not found that the market will continue to inflate valuations due to buybacks; prices are still determined by growth and narrative.”

Furthermore, and more realistically, the current liquidity of the entire DeFi sector is still far below the peak of 2021. Both TVL (total value locked) and secondary market trading volume are at a two-year low.

In a tight funding environment, even the most generous buybacks cannot offset the structural problem of insufficient demand.

Confidence can be bought back temporarily, but only a real influx of capital and a growth cycle can enable DeFi to become self-sustaining again.

Author: OXStill

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush