While the broader market struggled in the last week of October, one altcoin bucked the trend. Aerodrome Finance's AERO Token surged more than 36% over the past week.

The rally was fueled by a series of positive developments, including a programmatic buyback program and reduced Token Issuance, along with a strategic move from Animoca Brands.

What is driving AERO Token 's rally despite market trends?

October has been a challenging month for the entire cryptocurrency market, including major assets like Bitcoin (BTC) and Ethereum (ETH), among others. Despite falling interest rates, the sector has continued to decline .

In fact, it's down nearly 5% this week alone. Most coins have seen losses over the past seven days. However, the AERO Token stands out as a notable exception.

BeInCrypto Markets data shows that the altcoin continues to rise, gaining more than 36% over the past week. The rally also helped AERO become the best-performing Token in the DEX space , according to CoinGecko .

Aerodrome Finance (AERO) price performance. Source: BeInCrypto Markets

Aerodrome Finance (AERO) price performance. Source: BeInCrypto MarketsEven today, as the overall market is down 1.4% and the DEX sector is down 7%, the Token is still bucking the trend, up 2.57%. At the time of writing, AERO is trading at $1.08.

So what caused the price increase? There were several factors, not just one.

1. AERO Buyback Program

AERO began to recover on October 23, the same day Aerodrome Finance highlighted the results of its most recent buyback . The team said that the Aerodrome Public Goods Fund bought back 560,000 AERO Token.

“All Token are locked for 4 years to ensure long-term synchronization. To date, over 150 million AERO have been purchased and locked through PGF, Flight School, and Relay,” the post reads.

The constant withdrawal of Token from circulation creates structural upward pressure on the price as long as demand persists. This also demonstrates the long-term commitment of the project.

2. Animoca Brands ' investment

Another key driver of AERO's momentum is the strategic investment from Animoca Brands, which announced on October 28 that it had acquired and locked up AERO into veAERO.

According to Animoca Brands, well-designed tokenomics and strong execution make Aerodrome a key infrastructure link in the Base ecosystem. The locked veAERO position represents long-term commitment and participation in Aerodrome’s governance and growth.

“Aerodrome is a key component of the momentum behind @base's DeFi growth, and @coinbase is making it seamless for their CEX users to trade liquidation tokens on DEXs like Aerodrome, thereby delivering more value to Aerodrome voters. With solid tokenomics for $AERO and the team's ability to execute, Aerodrome has proven its position as a key player in the @base infrastructure,” the company said .

3. Revenue and Token Issuance

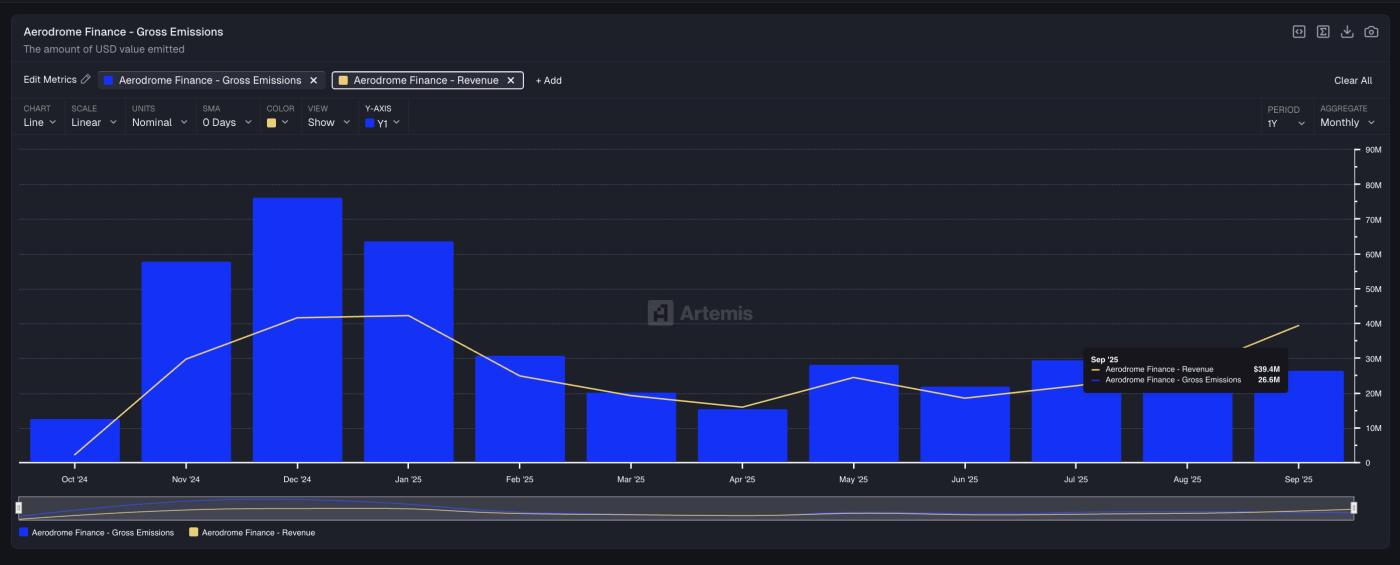

Finally, AERO’s momentum is also supported by improving protocol fundamentals. In September 2025, Aerodrome Finance reached a milestone where revenue exceeded issuance.

Artemis data shows $39.4 million in revenue and $26.6 million in issuance, creating a cumulative net worth of $12.8 million. This development allays earlier concerns about the sustainability of the issuance.

“@wagmiAlexander and the team have built a model where user fees go to locked veAERO holders and tokens burned > rewards/issuance to LPs. We are moving to a world beyond “meta-revenue” and towards revenue minus issuance for long-term sustainable growth that benefits Token holders,” Artemis commented.

AERO Revenue vs. Issue. Source: X/Artemis

AERO Revenue vs. Issue. Source: X/ArtemisGrowth continues. In its October 30, 2024 update, Aerodrome reported record performance: $1.50 returned for every $1 issued, 11% annual inflation maintained (8% net post-lock), and all-time high volume per issued dollar.

“In the face of this strength, Aero Fed will stabilize issuance, supporting long-term on-chain growth and expansion,” the team said.

With improved tokenomics, a buyback program, reduced issuance, and significant institutional backing, AERO’s momentum could continue if Aerodrome maintains revenue growth and favorable macro trends. The ability to sustain success into November 2024 will depend on these factors and the broader crypto market response.